- United Kingdom

- /

- Diversified Financial

- /

- AIM:ORCH

Even With A 33% Surge, Cautious Investors Are Not Rewarding Orchard Funding Group plc's (LON:ORCH) Performance Completely

Orchard Funding Group plc (LON:ORCH) shareholders have had their patience rewarded with a 33% share price jump in the last month. The annual gain comes to 145% following the latest surge, making investors sit up and take notice.

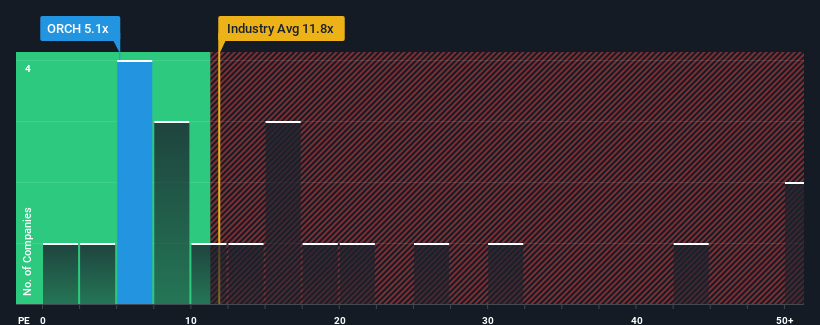

Although its price has surged higher, Orchard Funding Group may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 5.1x, since almost half of all companies in the United Kingdom have P/E ratios greater than 16x and even P/E's higher than 27x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Orchard Funding Group could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Orchard Funding Group

How Is Orchard Funding Group's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as depressed as Orchard Funding Group's is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 7.8%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 88% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Shifting to the future, estimates from the lone analyst covering the company suggest earnings should grow by 78% over the next year. With the market only predicted to deliver 18%, the company is positioned for a stronger earnings result.

In light of this, it's peculiar that Orchard Funding Group's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Orchard Funding Group's recent share price jump still sees its P/E sitting firmly flat on the ground. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Orchard Funding Group's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Orchard Funding Group (1 is potentially serious) you should be aware of.

You might be able to find a better investment than Orchard Funding Group. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:ORCH

Orchard Funding Group

Through its subsidiaries, offers insurance premium finance, professional fee funding, finance, and secured property lending services in the United Kingdom.

Undervalued with solid track record.

Market Insights

Community Narratives