- United Kingdom

- /

- Capital Markets

- /

- AIM:NUM

Does Numis Corporation Plc's (LON:NUM) CEO Pay Reflect Performance?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

In 2016 Alex Ham was appointed CEO of Numis Corporation Plc (LON:NUM). This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. Then we'll look at a snap shot of the business growth. And finally - as a second measure of performance - we will look at the returns shareholders have received over the last few years. The aim of all this is to consider the appropriateness of CEO pay levels.

See our latest analysis for Numis

How Does Alex Ham's Compensation Compare With Similar Sized Companies?

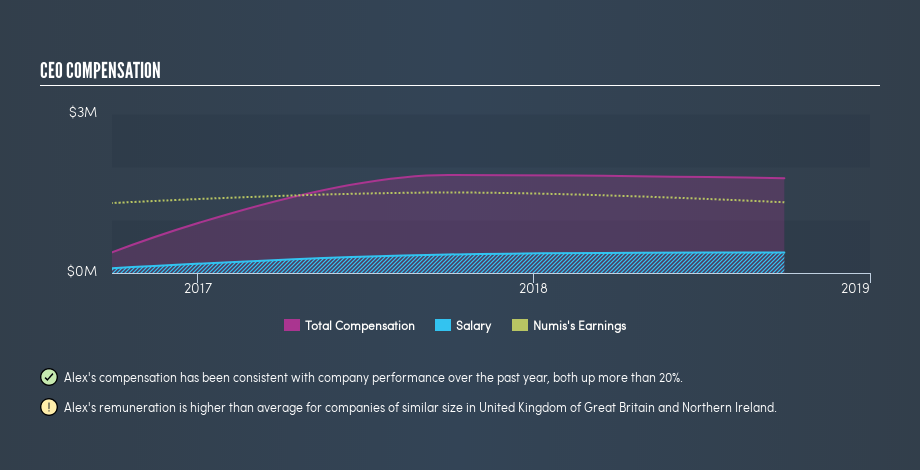

According to our data, Numis Corporation Plc has a market capitalization of UK£267m, and pays its CEO total annual compensation worth UK£1.8m. (This figure is for the year to September 2018). While this analysis focuses on total compensation, it's worth noting the salary is lower, valued at UK£388k. We looked at a group of companies with market capitalizations from UK£159m to UK£637m, and the median CEO total compensation was UK£682k.

As you can see, Alex Ham is paid more than the median CEO pay at companies of a similar size, in the same market. However, this does not necessarily mean Numis Corporation Plc is paying too much. A closer look at the performance of the underlying business will give us a better idea about whether the pay is particularly generous.

You can see a visual representation of the CEO compensation at Numis, below.

Is Numis Corporation Plc Growing?

Over the last three years, Numis Corporation Plc has not seen its earnings per share change much, though there is a positive trend. It saw its revenue drop -24% over the last year.

I would argue that the lack of revenue growth in the last year is less than ideal, but it is good to see modest EPS growth. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching.

Has Numis Corporation Plc Been A Good Investment?

Most shareholders would probably be pleased with Numis Corporation Plc for providing a total return of 51% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

We compared the total CEO remuneration paid by Numis Corporation Plc, and compared it to remuneration at a group of similar sized companies. As discussed above, we discovered that the company pays more than the median of that group.

Over the last three years returns to investors have been great, though we might have liked stronger business growth. As a result of the juicy return to investors, the CEO remuneration may well be quite reasonable. If you think CEO compensation levels are interesting you will probably really like this free visualization of insider trading at Numis.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About AIM:NUM

Numis

Numis Corporation Plc, through its subsidiaries, provides various investment banking services in the United Kingdom, the United States, and Ireland.

Flawless balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)