- United Kingdom

- /

- Capital Markets

- /

- AIM:IPX

UK Penny Stocks To Watch In July 2025

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 index dropping due to weak trade data from China, highlighting ongoing global economic concerns. Despite these broader market fluctuations, investors often look beyond established names to explore opportunities in smaller companies. Penny stocks, though an older term, continue to capture interest for their potential growth and affordability. In this article, we explore three penny stocks that stand out for their financial strength and resilience amidst current market conditions.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| FRP Advisory Group (AIM:FRP) | £1.20 | £301.38M | ✅ 5 ⚠️ 0 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.57 | £508.81M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £4.15 | £347.39M | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.396 | £42.74M | ✅ 5 ⚠️ 2 View Analysis > |

| System1 Group (AIM:SYS1) | £4.25 | £53.93M | ✅ 3 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £3.05 | £313.01M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.255 | £198.36M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.82 | £11.29M | ✅ 3 ⚠️ 4 View Analysis > |

| Braemar (LSE:BMS) | £2.31 | £69.82M | ✅ 3 ⚠️ 4 View Analysis > |

| ME Group International (LSE:MEGP) | £2.17 | £819.53M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 296 stocks from our UK Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

accesso Technology Group (AIM:ACSO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: accesso Technology Group plc, with a market cap of £167.97 million, develops technology solutions for the attractions and leisure industry through its subsidiaries.

Operations: The company generates revenue from three main segments: Ticketing ($113.03 million), Guest Experience ($31.46 million), and Professional Services ($7.80 million).

Market Cap: £167.97M

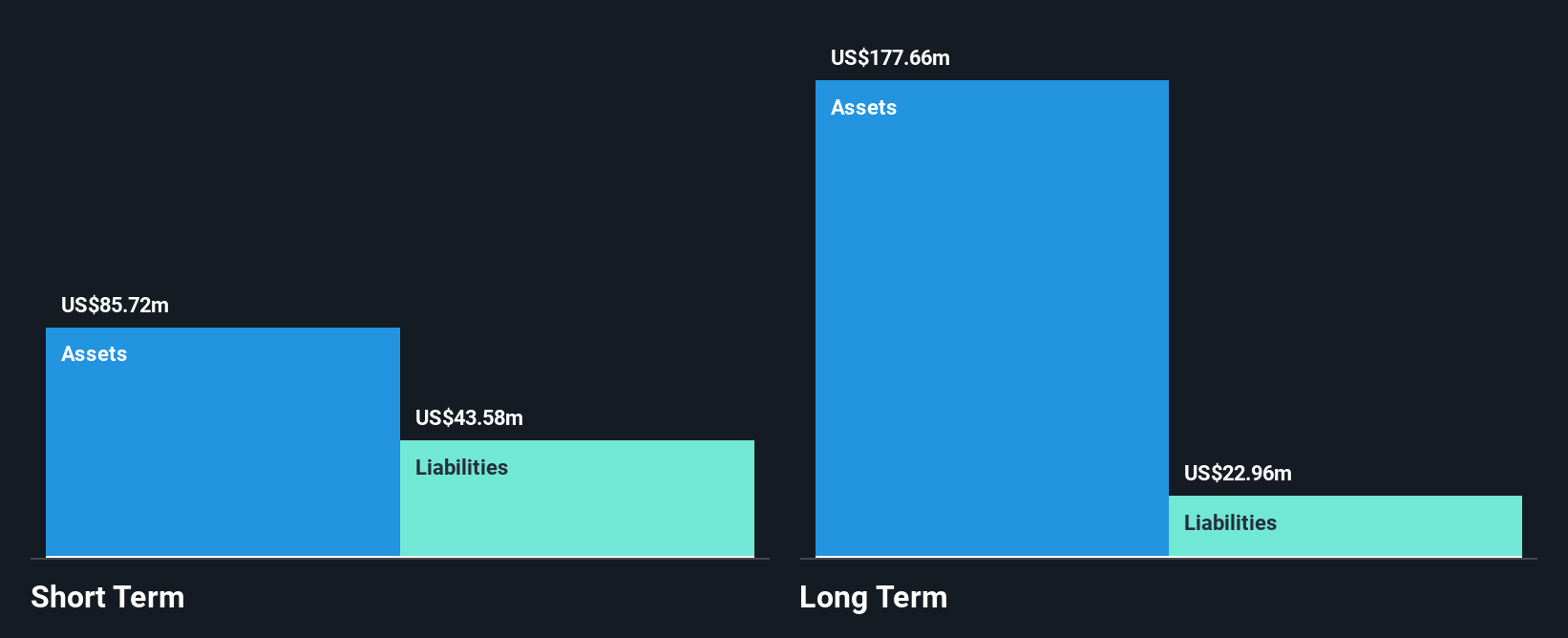

accesso Technology Group plc, with a market cap of £167.97 million, has shown consistent profitability growth over the past five years, increasing earnings by 62.9% annually. Despite recent guidance indicating lower revenue expectations for 2025, the company maintains strong financial health with short-term assets covering both short and long-term liabilities. The stock trades below its fair value estimate and is considered a good relative value compared to peers. However, the management team is relatively new with an average tenure of 1.3 years, which could present challenges in strategic execution moving forward.

- Take a closer look at accesso Technology Group's potential here in our financial health report.

- Understand accesso Technology Group's earnings outlook by examining our growth report.

Cake Box Holdings (AIM:CBOX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cake Box Holdings Plc operates in the United Kingdom, specializing in the retail of fresh cream celebration cakes, with a market cap of £81.40 million.

Operations: The company's revenue is entirely generated from its operations in the United Kingdom, amounting to £0.000001 million.

Market Cap: £81.4M

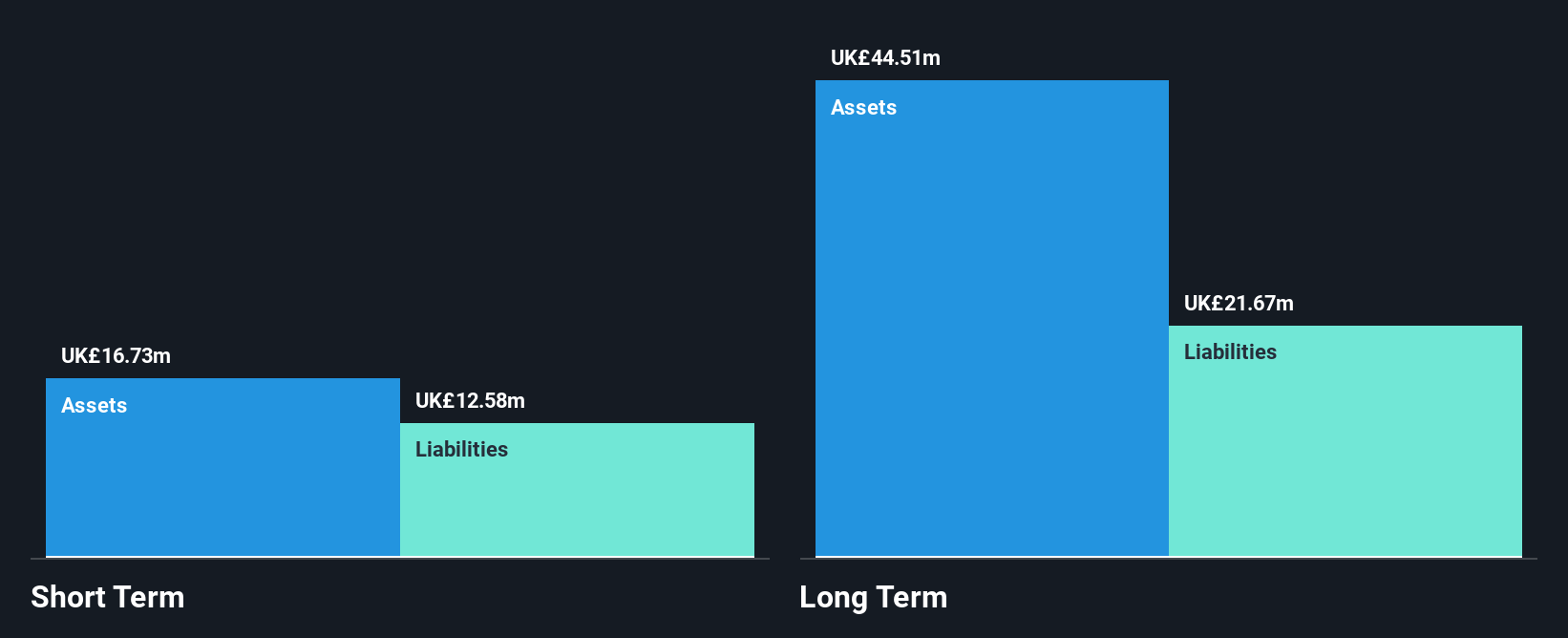

Cake Box Holdings Plc, with a market cap of £81.40 million, reported annual sales of £42.78 million and net income of £4.37 million for the year ended March 2025. The company trades at 43% below its estimated fair value and has satisfactory debt levels with interest payments well covered by EBIT. However, its short-term assets do not cover long-term liabilities, and dividend coverage remains weak despite a proposed increase to 10.2 pence per share for the year. While revenue is forecasted to grow annually by 18.1%, recent negative earnings growth poses challenges amidst a relatively inexperienced board.

- Navigate through the intricacies of Cake Box Holdings with our comprehensive balance sheet health report here.

- Examine Cake Box Holdings' earnings growth report to understand how analysts expect it to perform.

Impax Asset Management Group (AIM:IPX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Impax Asset Management Group Plc is a publicly owned investment manager with a market cap of approximately £263.66 million.

Operations: The company generates revenue primarily from its investment management services, amounting to £160.42 million.

Market Cap: £263.66M

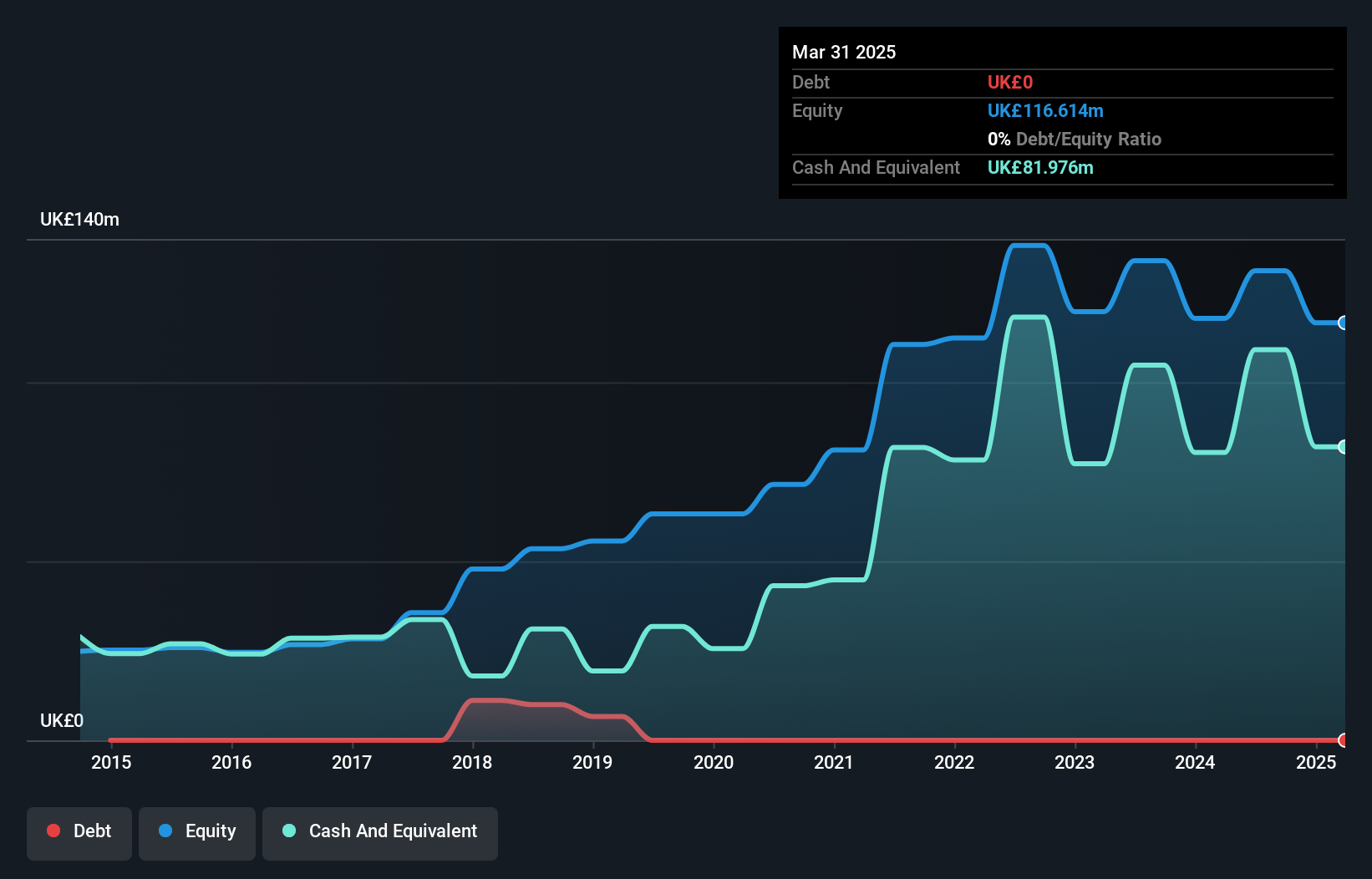

Impax Asset Management Group, with a market cap of £263.66 million and revenues of £160.42 million, is actively seeking acquisitions to bolster its investment strategy in private equity and fixed income. The company has initiated a share buyback program worth up to £10 million, aiming for capital flexibility and shareholder returns. Despite negative earnings growth over the past year, Impax's management team is seasoned with an average tenure of 14.5 years, and the firm maintains high-quality earnings without debt concerns. However, dividend coverage remains weak at 12.87%, indicating potential sustainability issues despite strong asset liability coverage.

- Unlock comprehensive insights into our analysis of Impax Asset Management Group stock in this financial health report.

- Evaluate Impax Asset Management Group's prospects by accessing our earnings growth report.

Seize The Opportunity

- Access the full spectrum of 296 UK Penny Stocks by clicking on this link.

- Looking For Alternative Opportunities? We've found 17 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:IPX

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives