- United Kingdom

- /

- Software

- /

- AIM:CNS

Corero Network Security Leads 3 UK Penny Stocks To Consider

Reviewed by Simply Wall St

In the last week, the UK market has been flat, but over the past 12 months, it has risen by 11%, with earnings expected to grow by 14% per annum over the next few years. Despite being an outdated term, penny stocks remain relevant for investors seeking opportunities in smaller or newer companies that offer a mix of value and growth potential. By focusing on those with strong financials, these stocks can present under-the-radar opportunities for long-term success.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Tristel (AIM:TSTL) | £3.95 | £184.64M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.115 | £768.58M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.355 | £407.27M | ★★★★☆☆ |

| Supreme (AIM:SUP) | £1.555 | £180.75M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.325 | £324.93M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.50 | £191.03M | ★★★★★☆ |

| Luceco (LSE:LUCE) | £1.596 | £235.97M | ★★★★★☆ |

| Ultimate Products (LSE:ULTP) | £1.41 | £119.17M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £0.86 | £70.81M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.457 | $261.6M | ★★★★★★ |

Click here to see the full list of 466 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Corero Network Security (AIM:CNS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Corero Network Security plc offers distributed denial of service (DDoS) protection solutions globally and has a market cap of £137.77 million.

Operations: The company generated $23.99 million in revenue from its distributed denial of service protection solutions worldwide.

Market Cap: £137.77M

Corero Network Security, with a market cap of £137.77 million, has seen significant growth in its distributed denial of service protection solutions, generating $23.99 million in revenue globally. The company became profitable this year and maintains a debt-free balance sheet, enhancing financial stability. Recent developments include securing $6 million in new orders for Q3 2024 and expanding into strategic markets like the Middle East and Latin America through innovative SmartWall ONE solutions. Despite a low return on equity at 4.6%, Corero's robust order book and strategic partnerships indicate continued momentum in customer acquisition and retention.

- Unlock comprehensive insights into our analysis of Corero Network Security stock in this financial health report.

- Review our growth performance report to gain insights into Corero Network Security's future.

Impax Asset Management Group (AIM:IPX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Impax Asset Management Group Plc is a publicly owned investment manager with a market cap of £519.53 million.

Operations: Impax Asset Management Group's revenue segment, Impax LN, generated £176.56 million.

Market Cap: £519.53M

Impax Asset Management Group, with a market cap of £519.53 million, presents a compelling profile for investors interested in penny stocks. The company is debt-free and has shown significant earnings growth over the past five years at 26.9% annually, though recent performance has been negative. Its high return on equity of 34.5% indicates strong profitability despite declining net profit margins from last year. Trading at 60.7% below fair value estimates suggests potential undervaluation relative to peers and industry standards. Recent board changes bring experienced leadership with Simon O'Regan as Chair, potentially influencing future strategic directions positively.

- Get an in-depth perspective on Impax Asset Management Group's performance by reading our balance sheet health report here.

- Learn about Impax Asset Management Group's future growth trajectory here.

Integrated Diagnostics Holdings (LSE:IDHC)

Simply Wall St Financial Health Rating: ★★★★★★

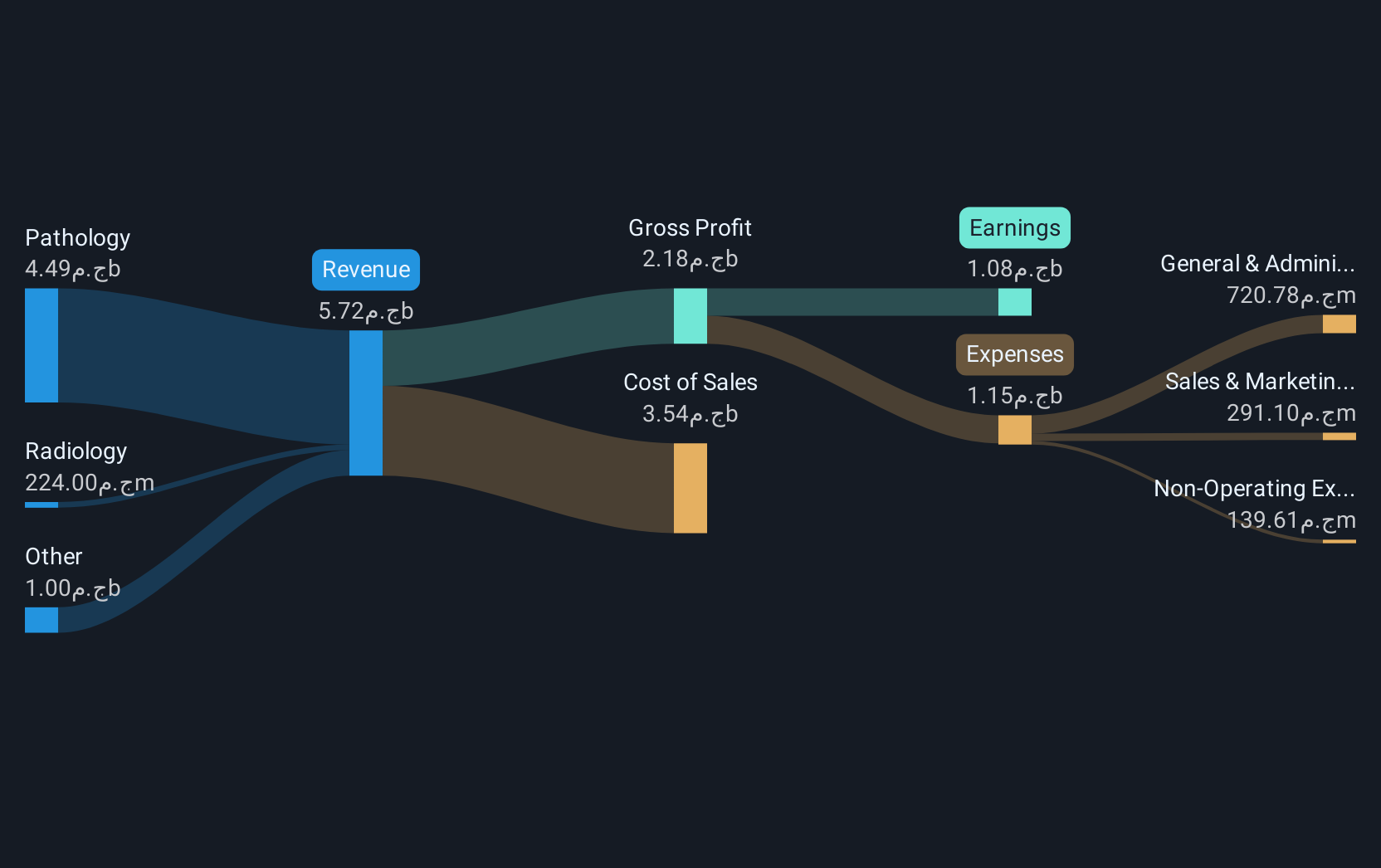

Overview: Integrated Diagnostics Holdings plc is a consumer healthcare company that offers a range of medical diagnostics services to patients, with a market cap of $261.60 million.

Operations: The company generates revenue from various regions, with EGP 3.97 billion coming from Egypt, EGP 699.61 million from Jordan, and EGP 77.09 million from Nigeria.

Market Cap: $261.6M

Integrated Diagnostics Holdings plc, with a market cap of $261.60 million, has demonstrated strong financial performance with earnings growth of 138.6% over the past year, exceeding industry averages. The company maintains high-quality earnings and a robust return on equity at 20.8%. Its debt levels are well-managed, supported by cash flow coverage of 891.8%, and its short-term assets exceed both short- and long-term liabilities. Recent developments include a voluntary delisting from the Egyptian Exchange while maintaining its listing on the London Stock Exchange, alongside an active share buyback program aimed at enhancing shareholder value amidst stable yet high volatility in share price movements.

- Navigate through the intricacies of Integrated Diagnostics Holdings with our comprehensive balance sheet health report here.

- Explore Integrated Diagnostics Holdings' analyst forecasts in our growth report.

Make It Happen

- Navigate through the entire inventory of 466 UK Penny Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CNS

Corero Network Security

Provides distributed denial of service (DDoS) protection solutions worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives