- United Kingdom

- /

- Media

- /

- AIM:PEBB

3 UK Penny Stocks Under £80M Market Cap

Reviewed by Simply Wall St

Over the last 7 days, the UK market has remained flat, but it has seen an 8.5% rise over the past year with earnings expected to grow by 15% annually in the coming years. In light of these conditions, identifying stocks with strong financials is crucial, particularly when considering penny stocks—an investment area that continues to hold potential despite being somewhat outdated in terminology. These smaller or newer companies can offer unique opportunities for growth and value, and we'll explore three such stocks that demonstrate financial robustness and long-term promise.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.16 | £806.27M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.53 | £67.32M | ★★★★☆☆ |

| Solid State (AIM:SOLI) | £1.235 | £68.45M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £1.015 | £78.01M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.65 | £183.61M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.125 | £98.14M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.28 | £200.5M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.38 | £174.47M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £4.46 | £443.08M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.416 | $249.68M | ★★★★★★ |

Click here to see the full list of 470 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

AssetCo (AIM:ASTO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: AssetCo plc focuses on acquiring, managing, and operating asset and wealth management activities with a market cap of £42.03 million.

Operations: The company generates revenue from its Active Equities segment, amounting to £13.95 million.

Market Cap: £42.03M

AssetCo plc, with a market cap of £42.03 million, focuses on asset and wealth management activities. Despite being unprofitable and experiencing increased losses over the past five years, the company has no debt, alleviating concerns about interest payments or cash flow coverage. Its short-term assets of £16.9 million comfortably cover both its short-term (£6.1 million) and long-term liabilities (£2.2 million). The board is experienced with an average tenure of 3.9 years; however, the management team is relatively new with a 1.9-year average tenure. Earnings are forecast to grow significantly by 98.81% per year according to consensus estimates.

- Dive into the specifics of AssetCo here with our thorough balance sheet health report.

- Explore AssetCo's analyst forecasts in our growth report.

Brave Bison Group (AIM:BBSN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Brave Bison Group plc offers digital advertising and technology services across the United Kingdom, Europe, the Asia-Pacific, and internationally with a market cap of £28.74 million.

Operations: The company generates revenue of £34.38 million from monetising online video content.

Market Cap: £28.74M

Brave Bison Group plc, with a market cap of £28.74 million, has demonstrated robust financial health and growth in the digital advertising sector. The company's short-term assets (£14.3M) exceed both its short-term (£8.6M) and long-term liabilities (£2.5M), indicating strong liquidity. It has achieved profitability over the past five years, with earnings growing significantly by 481.8% last year, far outpacing industry averages. Despite this impressive growth, earnings are forecast to decline by an average of 35.7% annually over the next three years, suggesting potential volatility ahead for investors to consider carefully in their strategies.

- Jump into the full analysis health report here for a deeper understanding of Brave Bison Group.

- Gain insights into Brave Bison Group's outlook and expected performance with our report on the company's earnings estimates.

Pebble Group (AIM:PEBB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The Pebble Group plc provides digital commerce, products, and related services to the promotional merchandise industry across the UK, Continental Europe, the US, and internationally with a market cap of £74.44 million.

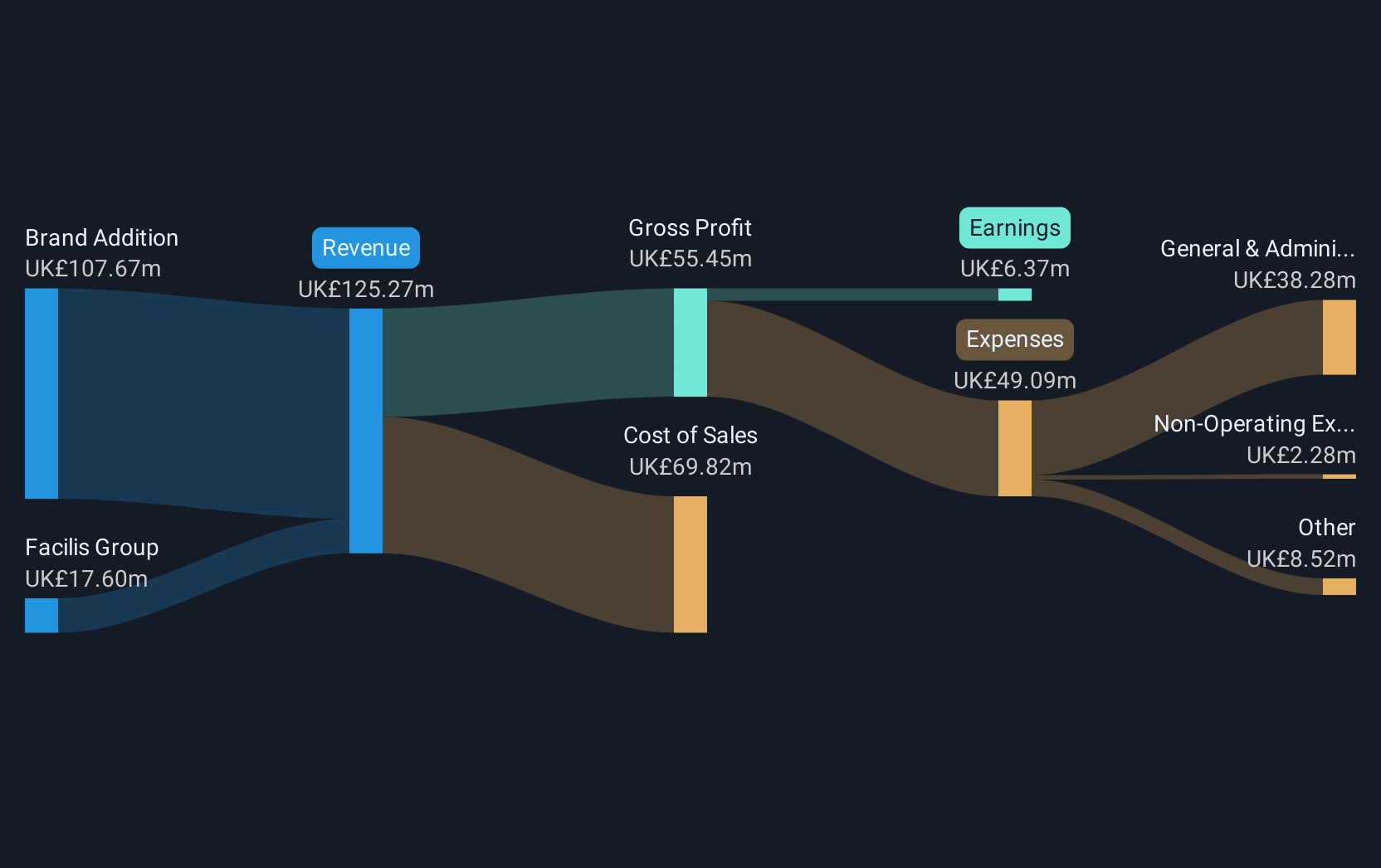

Operations: The company's revenue is derived from two segments: Facilis Group, contributing £17.63 million, and Brand Addition, generating £103.98 million.

Market Cap: £74.44M

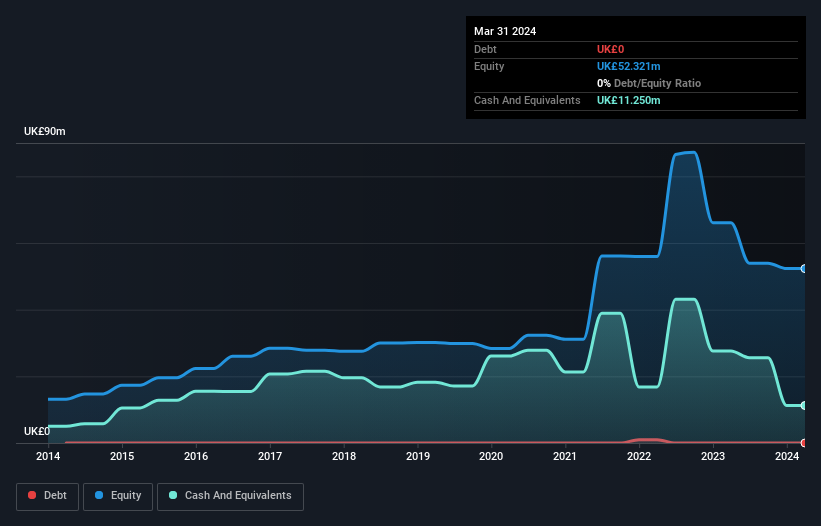

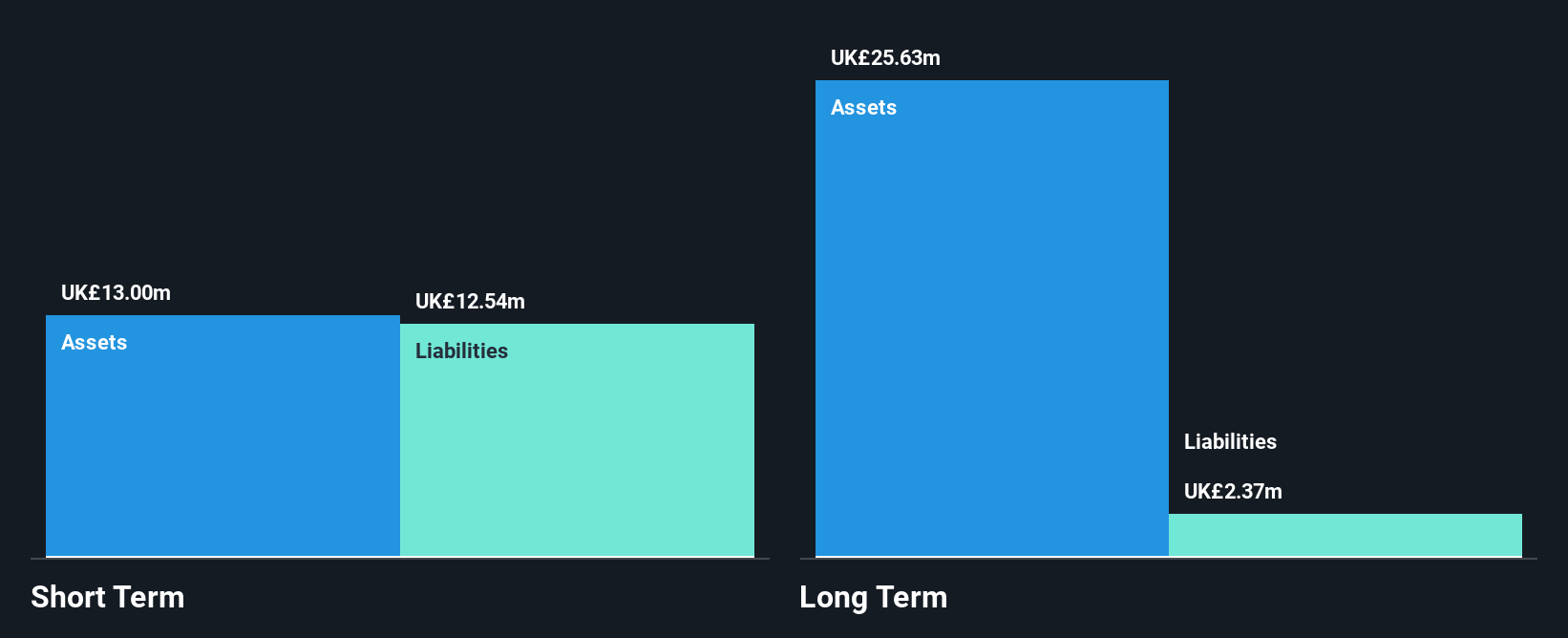

Pebble Group plc, with a market cap of £74.44 million, operates in the promotional merchandise industry and shows strong financial stability with short-term assets (£53.2M) exceeding both short-term (£27.4M) and long-term liabilities (£7.6M). The company has no debt, enhancing its financial flexibility, although recent earnings growth has been negative at -26%. Despite this setback, Pebble Group is trading at a significant discount to its estimated fair value and has achieved profitability over the past five years with high-quality earnings. However, its current net profit margin of 4.7% is lower than last year's 5.7%.

- Click to explore a detailed breakdown of our findings in Pebble Group's financial health report.

- Assess Pebble Group's future earnings estimates with our detailed growth reports.

Taking Advantage

- Click this link to deep-dive into the 470 companies within our UK Penny Stocks screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:PEBB

Pebble Group

Sells digital commerce, products, and related services to the promotional merchandise industry in the United Kingdom, Continental Europe, the United States, and internationally.

Very undervalued with flawless balance sheet.