- United Kingdom

- /

- Capital Markets

- /

- OFEX:HRIP

Develop North And 2 More Penny Stocks On UK Radar

Reviewed by Simply Wall St

In the last week, the UK market has been flat, though it is up 6.1% over the past year with earnings forecasted to grow by 15% annually. In such a market, identifying stocks with strong financials can be key to uncovering potential growth opportunities. While penny stocks may seem like a throwback term, they continue to represent smaller or newer companies that can offer significant value when backed by solid fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.225 | £838.3M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.67 | £365M | ★★★★☆☆ |

| Supreme (AIM:SUP) | £1.55 | £180.75M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.44 | £355.43M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £0.875 | £66.27M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.22 | £104.15M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.316 | £202.97M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.46 | £185.93M | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | £3.39 | £433.8M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.3885 | $225.85M | ★★★★★★ |

Click here to see the full list of 463 stocks from our UK Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Develop North (LSE:DVNO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Develop North PLC is an investment company that offers a portfolio of fixed rate loans mainly secured by land and property in the United Kingdom, with a market cap of £19.48 million.

Operations: The company's revenue is primarily derived from its financial services segment, specifically commercial activities, amounting to £1.45 million.

Market Cap: £19.48M

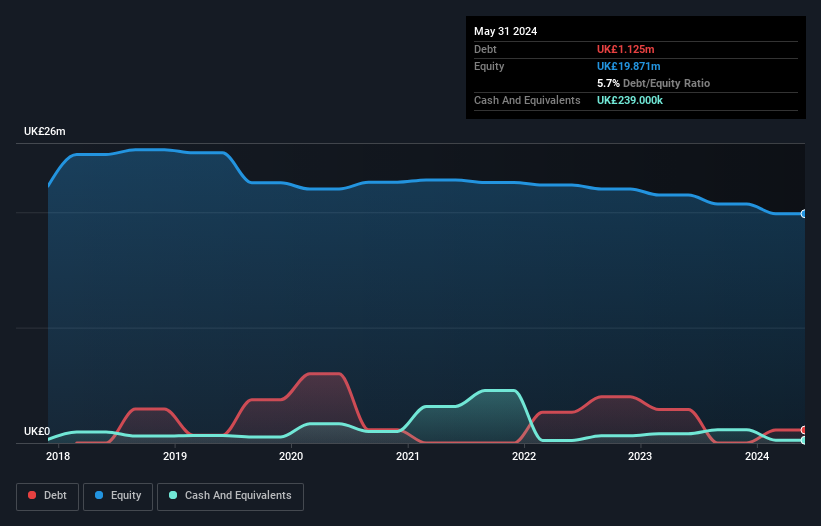

Develop North PLC, with a market cap of £19.48 million, has shown significant earnings growth of 334.8% over the past year, surpassing its five-year average growth rate of 28.5% annually. Despite this impressive growth and high-quality earnings, the company does not have meaningful revenue (£1M), suggesting it may be pre-revenue. Its net profit margins have improved to 59.6%, and its debt is well covered by operating cash flow (65.5%). The board is experienced with an average tenure of 7.5 years, though dividends are not well covered by free cash flows at present levels (5.13%).

- Click here and access our complete financial health analysis report to understand the dynamics of Develop North.

- Evaluate Develop North's historical performance by accessing our past performance report.

Hot Rocks Investments (OFEX:HRIP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hot Rocks Investments plc focuses on investing in companies or assets within the natural resources sector and has a market cap of £390,604.

Operations: Hot Rocks Investments plc has not reported any specific revenue segments.

Market Cap: £390.6k

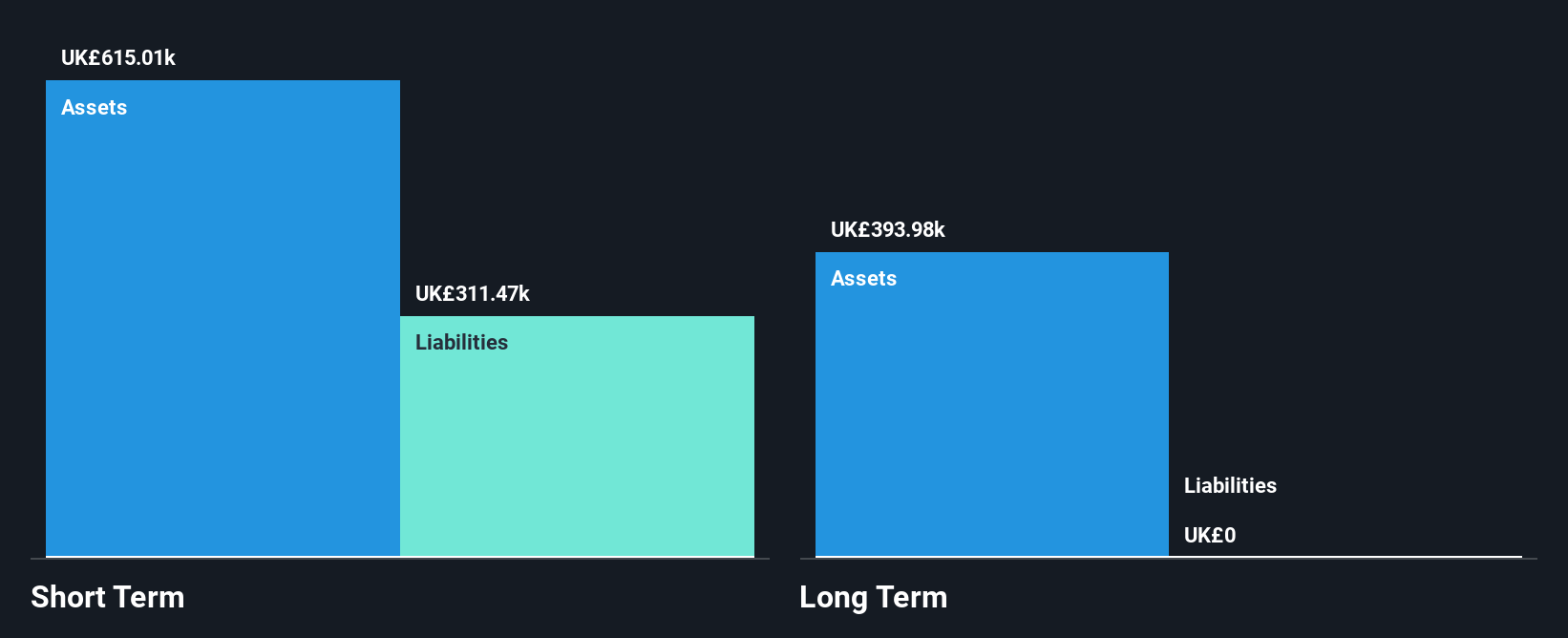

Hot Rocks Investments plc, with a market cap of £390,604, focuses on the natural resources sector and is pre-revenue. The company recently became profitable despite having no significant revenue streams. Its financial results were impacted by a large one-off gain of £114.7K in the last 12 months ending March 31, 2024. The stock has been highly volatile over the past three months but remains debt-free with short-term assets exceeding liabilities (£341.9K vs £294.0K). With a low price-to-earnings ratio of 8.3x compared to the UK market average, it may present value considerations for investors interested in penny stocks.

- Click to explore a detailed breakdown of our findings in Hot Rocks Investments' financial health report.

- Gain insights into Hot Rocks Investments' historical outcomes by reviewing our past performance report.

Newbury Racecourse (OFEX:NYR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Newbury Racecourse plc, with a market cap of £16.24 million, operates in the United Kingdom focusing on racing, hospitality, and related food and beverage retail activities through its subsidiaries.

Operations: The company's revenue is generated from several segments, including £0.87 million from Lodge, £2.12 million from Nursery, £17.16 million from Trading, and £0.06 million from Property activities.

Market Cap: £16.24M

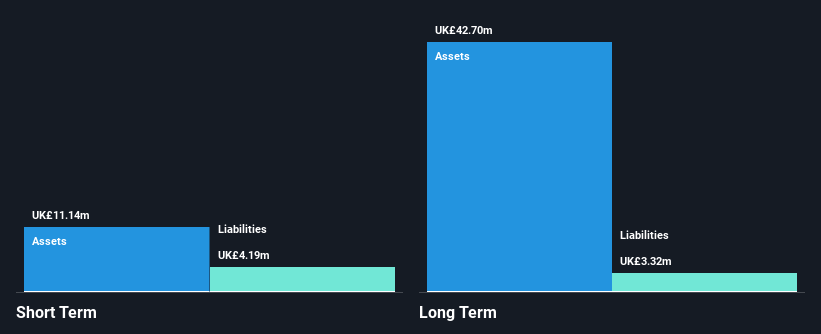

Newbury Racecourse plc, with a market cap of £16.24 million, reported half-year sales of £9.28 million, up from £8.03 million the previous year, and reduced its net loss to £0.286 million from £0.518 million. The company is debt-free and has seen stable weekly volatility at 3%. Its short-term assets (£11.1M) comfortably cover both short-term (£4.2M) and long-term liabilities (£3.3M). Despite a low return on equity (2.1%) and an inexperienced management team (1.2 years average tenure), its price-to-earnings ratio of 17.1x suggests potential value against industry averages.

- Navigate through the intricacies of Newbury Racecourse with our comprehensive balance sheet health report here.

- Understand Newbury Racecourse's track record by examining our performance history report.

Taking Advantage

- Gain an insight into the universe of 463 UK Penny Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hot Rocks Investments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OFEX:HRIP

Hot Rocks Investments

Invests in companies or assets in the natural resources sector.

Mediocre balance sheet low.