- United Kingdom

- /

- Hospitality

- /

- LSE:RTN

Shareholders in Restaurant Group (LON:RTN) have lost 80%, as stock drops 16% this past week

Long term investing is the way to go, but that doesn't mean you should hold every stock forever. We really hate to see fellow investors lose their hard-earned money. Anyone who held The Restaurant Group plc (LON:RTN) for five years would be nursing their metaphorical wounds since the share price dropped 87% in that time. And it's not just long term holders hurting, because the stock is down 67% in the last year. Furthermore, it's down 26% in about a quarter. That's not much fun for holders. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Since Restaurant Group has shed UK£60m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

Before we look at the performance, you might like to know that our analysis indicates that RTN is potentially undervalued!

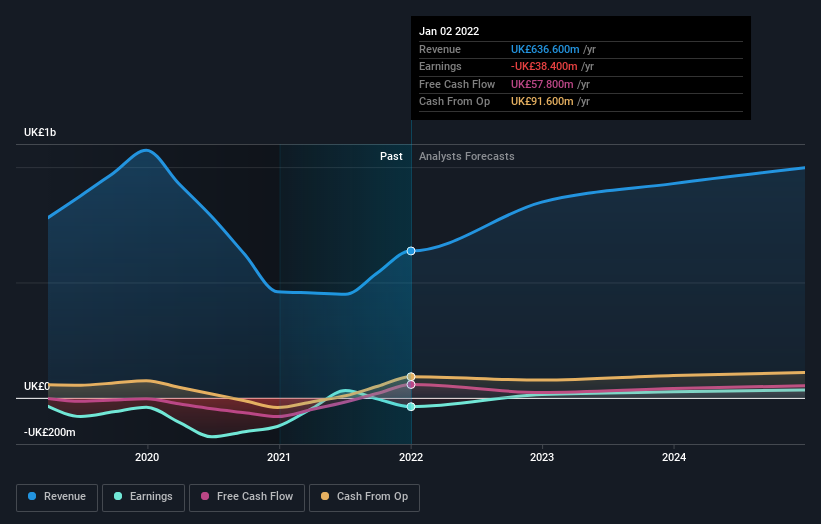

Because Restaurant Group made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over half a decade Restaurant Group reduced its trailing twelve month revenue by 3.8% for each year. That's not what investors generally want to see. The share price fall of 13% (per year, over five years) is a stern reminder that money-losing companies are expected to grow revenue. We're generally averse to companies with declining revenues, but we're not alone in that. That is not really what the successful investors we know aim for.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. This free report showing analyst forecasts should help you form a view on Restaurant Group

What About The Total Shareholder Return (TSR)?

We've already covered Restaurant Group's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Restaurant Group shareholders, and that cash payout explains why its total shareholder loss of 80%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

We regret to report that Restaurant Group shareholders are down 67% for the year. Unfortunately, that's worse than the broader market decline of 2.2%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 13% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:RTN

Restaurant Group

The Restaurant Group plc operates restaurants and pubs in the United Kingdom.

Fair value with moderate growth potential.

Market Insights

Community Narratives