- United Kingdom

- /

- Pharma

- /

- AIM:FUM

Top UK Penny Stocks To Watch In October 2025

Reviewed by Simply Wall St

The UK market has experienced some turbulence recently, with the FTSE 100 index closing lower due to weak trade data from China, highlighting ongoing global economic challenges. Despite these broader market fluctuations, penny stocks continue to attract attention for their potential value and growth opportunities. While the term might seem outdated, these smaller or newer companies can offer significant returns when supported by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.61 | £516.12M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.03 | £164M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.75 | £11.32M | ✅ 2 ⚠️ 2 View Analysis > |

| Northern Bear (AIM:NTBR) | £1.07 | £14.72M | ✅ 4 ⚠️ 2 View Analysis > |

| System1 Group (AIM:SYS1) | £2.40 | £30.45M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.54 | $313.92M | ✅ 4 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.56 | £262.74M | ✅ 4 ⚠️ 1 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.45 | £70.04M | ✅ 3 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.10 | £175.12M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.70 | £9.64M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 295 stocks from our UK Penny Stocks screener.

Let's uncover some gems from our specialized screener.

FRP Advisory Group (AIM:FRP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: FRP Advisory Group plc, with a market cap of £343.65 million, offers business advisory services to companies, lenders, investors, individuals, and other stakeholders in the United Kingdom.

Operations: The company generates revenue of £152.2 million from its specialist business advisory services in the United Kingdom.

Market Cap: £343.65M

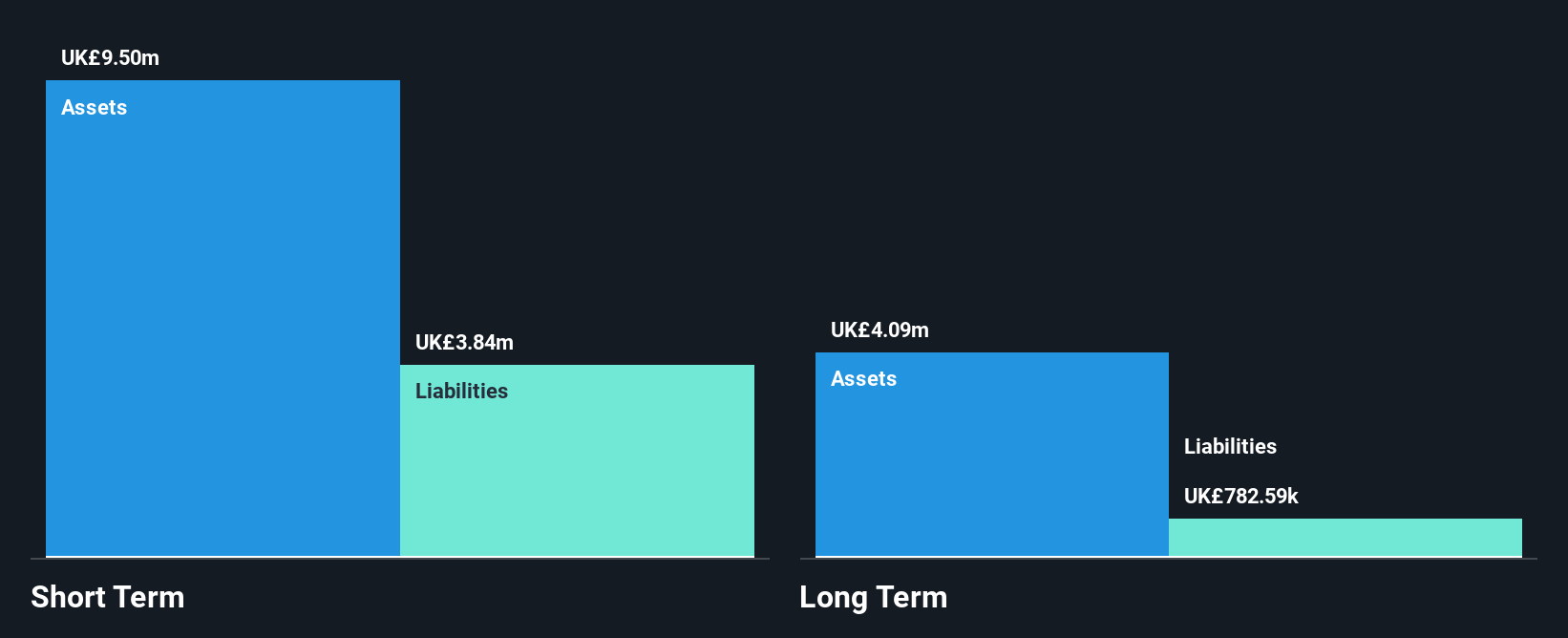

FRP Advisory Group plc, with a market cap of £343.65 million, demonstrates financial stability through its robust balance sheet where short-term assets of £119.2 million exceed both its short and long-term liabilities. The company has maintained stable weekly volatility and offers high-quality earnings, evidenced by a strong Return on Equity of 23.7%. Despite a recent slowdown in profit growth to 2.3%, FRP has shown significant earnings growth historically at 25.5% per year over five years and is forecasted to grow further at 11.59% annually, supported by well-covered interest payments and cash flow exceeding debt obligations significantly.

- Dive into the specifics of FRP Advisory Group here with our thorough balance sheet health report.

- Gain insights into FRP Advisory Group's future direction by reviewing our growth report.

Futura Medical (AIM:FUM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Futura Medical plc researches, develops, and commercializes pharmaceutical and healthcare products for sexual health, with a market cap of £7.60 million.

Operations: The company's revenue is primarily derived from the development and commercialization of MED3000, amounting to £7.93 million.

Market Cap: £7.6M

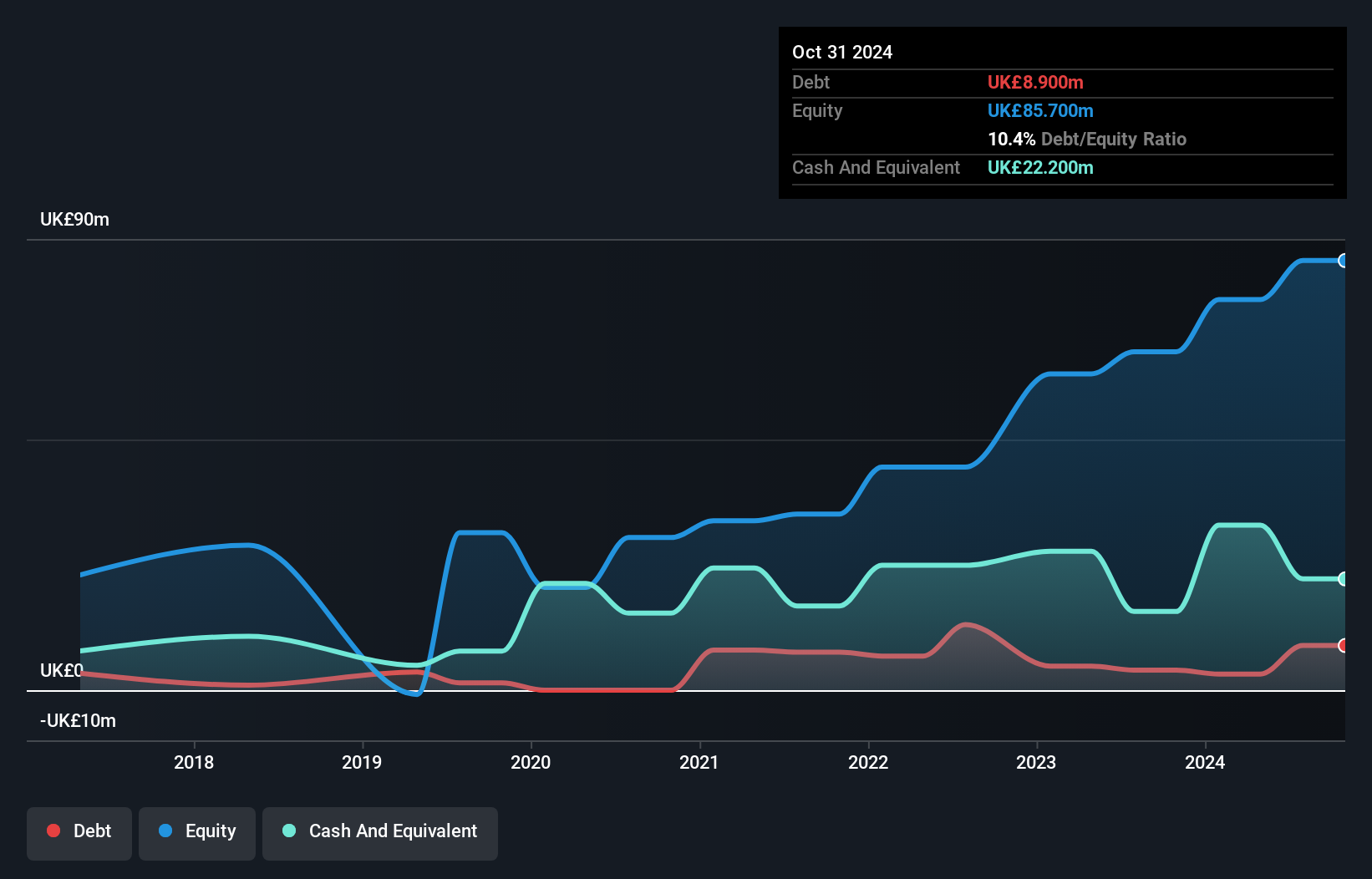

Futura Medical plc, with a market cap of £7.60 million, faces challenges as it transitions through a period of financial instability. Recent earnings reported for the half year ended June 30, 2025, showed sales of £1 million and a net loss of £6.59 million. The company's revenue guidance for the full year has been significantly lowered to between £1.3 million and £1.4 million due to slower sales across markets and delayed US patent payments. Despite being debt-free with strong short-term asset coverage over liabilities and an experienced management team, Futura remains unprofitable with high share price volatility recently observed.

- Click here and access our complete financial health analysis report to understand the dynamics of Futura Medical.

- Learn about Futura Medical's future growth trajectory here.

Playtech (LSE:PTEC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Playtech plc is a technology company that provides gambling software, services, content, and platform technologies across Italy, Mexico, the United Kingdom, the rest of Europe, Latin America, and internationally with a market cap of approximately £1.05 billion.

Operations: The company's revenue is primarily derived from its B2B segment, which generated €719.7 million, while its HAPPYBET and Sun Bingo and Other B2C segments contributed €17.1 million and €72.2 million respectively.

Market Cap: £1.05B

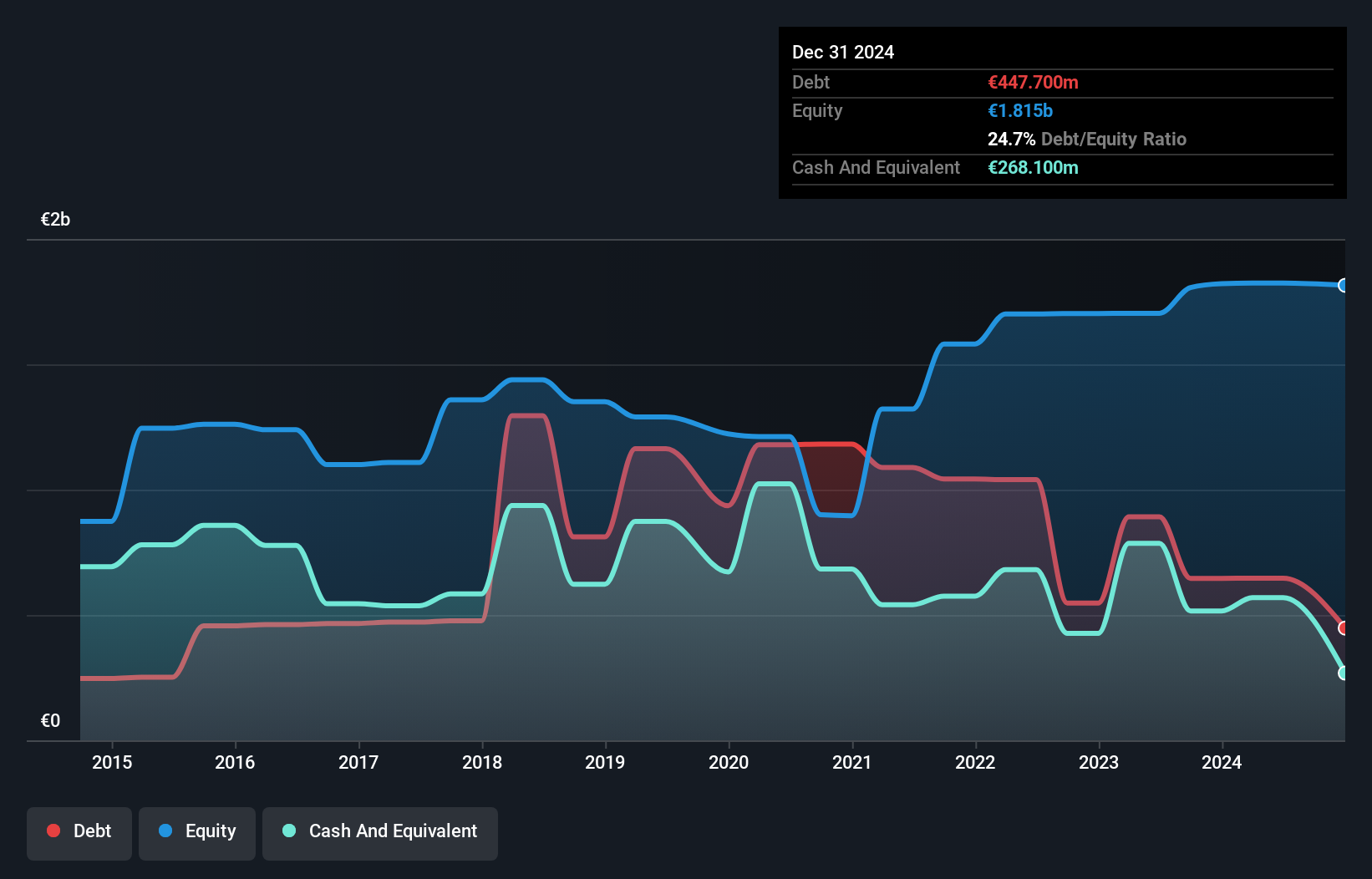

Playtech plc, with a market cap of £1.05 billion, is navigating through financial challenges as it remains unprofitable despite generating substantial revenue from its B2B segment (€719.7 million). Recent earnings show a decline in sales to €387 million for the half year ending June 30, 2025, while net income surged significantly due to one-off gains. The company is actively pursuing acquisitions and has initiated a share buyback program worth up to £43.7 million as part of its capital return strategy. Playtech's debt level is manageable with short-term assets exceeding liabilities and operating cash flow covering 76.9% of its debt obligations.

- Click here to discover the nuances of Playtech with our detailed analytical financial health report.

- Understand Playtech's earnings outlook by examining our growth report.

Where To Now?

- Explore the 295 names from our UK Penny Stocks screener here.

- Contemplating Other Strategies? AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FUM

Futura Medical

Research, develops, and commercializes pharmaceutical and healthcare products for sexual health.

Flawless balance sheet and fair value.

Market Insights

Community Narratives