- United Kingdom

- /

- Hospitality

- /

- LSE:PTEC

3 UK Growth Companies With Up To 38% Insider Ownership

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid weak trade data from China, highlighting the interconnectedness of global economies. In such uncertain times, identifying growth companies with substantial insider ownership can be appealing to investors as it often signals confidence in the company's long-term potential and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Gulf Keystone Petroleum (LSE:GKP) | 12.4% | 59.2% |

| Foresight Group Holdings (LSE:FSG) | 35.1% | 26.6% |

| QinetiQ Group (LSE:QQ.) | 13.1% | 30.1% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.9% | 20% |

| Audioboom Group (AIM:BOOM) | 15.7% | 59.3% |

| Judges Scientific (AIM:JDG) | 11.2% | 24.4% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 20.6% | 20.3% |

| Hochschild Mining (LSE:HOC) | 38.4% | 24.7% |

| Faron Pharmaceuticals Oy (AIM:FARN) | 21.1% | 56.8% |

| Anglo Asian Mining (AIM:AAZ) | 40% | 116.2% |

Here we highlight a subset of our preferred stocks from the screener.

PensionBee Group (LSE:PBEE)

Simply Wall St Growth Rating: ★★★★☆☆

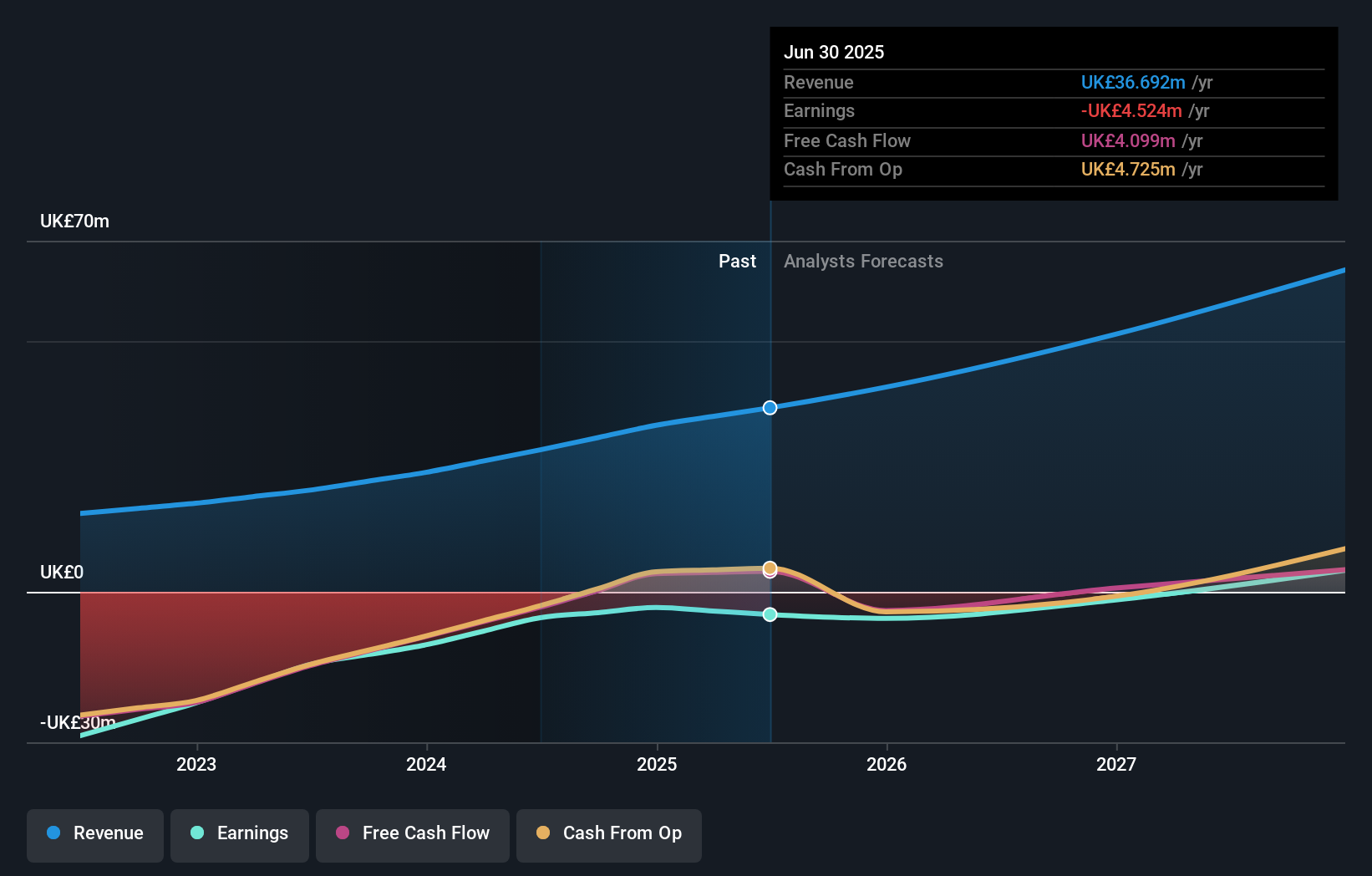

Overview: PensionBee Group plc offers online retirement saving services in the United Kingdom and the United States, with a market cap of £370.21 million.

Operations: The company generates revenue of £33.20 million from its Internet Information Providers segment.

Insider Ownership: 38.4%

PensionBee Group is experiencing robust growth, with earnings projected to rise 57.06% annually and revenue expected to grow at 18.6% per year, surpassing the UK market average. Analysts agree on a potential stock price increase of 29.4%. Despite a low forecasted return on equity of 3.9%, the company is set to become profitable within three years. Recent product innovations, like its retirement savings calculator for Americans, enhance its growth prospects by expanding user engagement and financial planning capabilities.

- Navigate through the intricacies of PensionBee Group with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report PensionBee Group implies its share price may be too high.

Playtech (LSE:PTEC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Playtech plc is a technology company that provides gambling software, services, content, and platform technologies globally, with a market cap of approximately £1.09 billion.

Operations: Playtech's revenue is primarily derived from its Gaming B2B segment (€754.30 million), along with contributions from B2C activities such as HAPPYBET (€18.90 million) and Sun Bingo and other B2C ventures (€78.90 million).

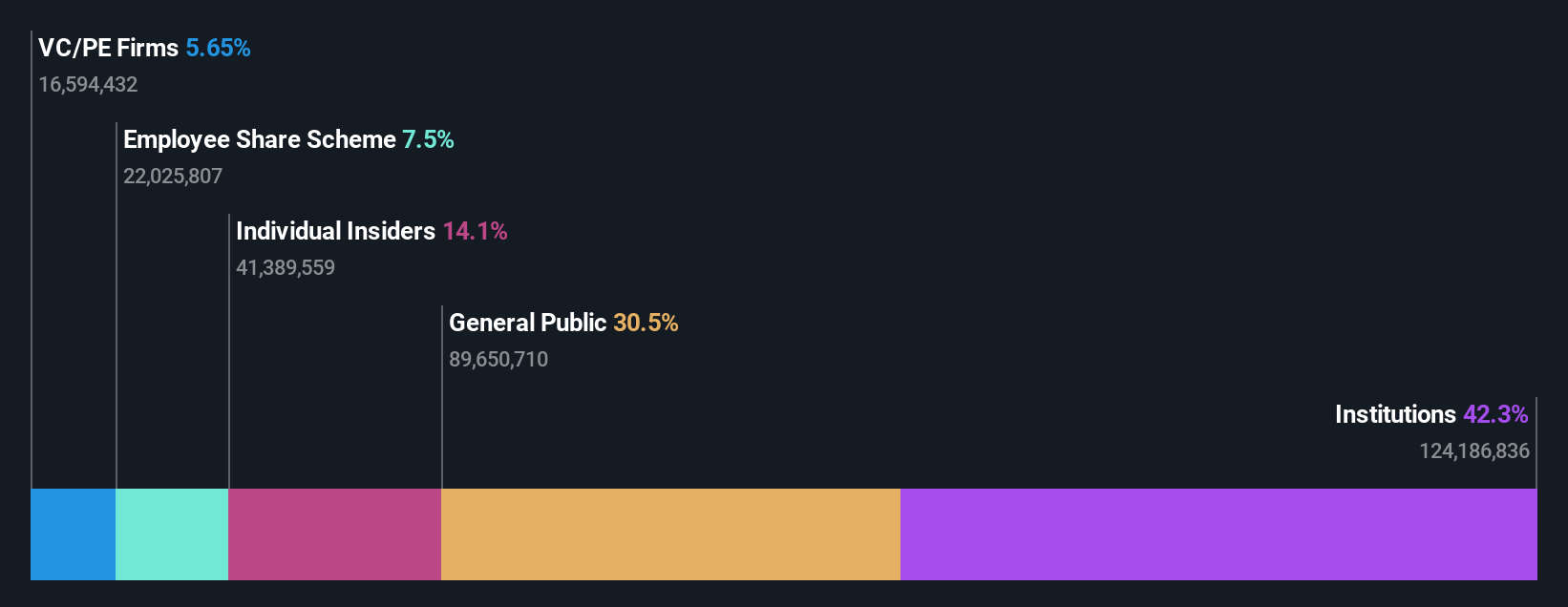

Insider Ownership: 13.4%

Playtech has completed the sale of Snaitech, using proceeds to redeem €150 million in senior secured notes. Despite a net loss of €23.9 million for 2024, earnings are forecasted to grow 65.39% annually, with profitability expected within three years. Although revenue growth is modest at 4.3% per year, it surpasses the UK market average and trades below estimated fair value by 7.4%. The company announced a special dividend of up to €1.8 billion post-sale completion.

- Get an in-depth perspective on Playtech's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Playtech's current price could be inflated.

QinetiQ Group (LSE:QQ.)

Simply Wall St Growth Rating: ★★★★★☆

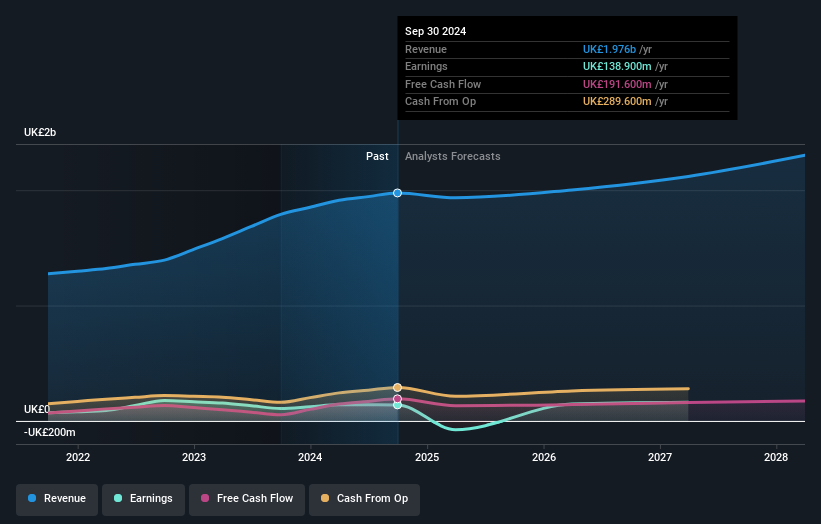

Overview: QinetiQ Group plc is a science and engineering company serving the defense, security, and infrastructure sectors across the UK, US, Australia, and other international markets with a market cap of £2.37 billion.

Operations: QinetiQ Group's revenue is primarily derived from its EMEA Services segment, which accounts for £1.48 billion, and its Global Solutions segment, contributing £495.40 million.

Insider Ownership: 13.1%

QinetiQ Group, with high insider ownership, is forecasted to see significant earnings growth of 30.1% annually over the next three years, outpacing the UK market's 13.9%. Despite recent share price volatility, it's trading at a substantial discount to its estimated fair value. Revenue growth is modest at 3.9% per year but still exceeds the UK market average. Recent leadership changes include Dina Knight assuming Chair of the Remuneration Committee from Susan Searle.

- Click to explore a detailed breakdown of our findings in QinetiQ Group's earnings growth report.

- Our valuation report here indicates QinetiQ Group may be undervalued.

Summing It All Up

- Unlock more gems! Our Fast Growing UK Companies With High Insider Ownership screener has unearthed 60 more companies for you to explore.Click here to unveil our expertly curated list of 63 Fast Growing UK Companies With High Insider Ownership.

- Ready For A Different Approach? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:PTEC

Playtech

A technology company, operates as a gambling software, services, content, and platform technologies provider worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives