- United Kingdom

- /

- Hospitality

- /

- LSE:MAB

The five-year loss for Mitchells & Butlers (LON:MAB) shareholders likely driven by its shrinking earnings

Ideally, your overall portfolio should beat the market average. But in any portfolio, there will be mixed results between individual stocks. So we wouldn't blame long term Mitchells & Butlers plc (LON:MAB) shareholders for doubting their decision to hold, with the stock down 47% over a half decade. The falls have accelerated recently, with the share price down 19% in the last three months. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

On a more encouraging note the company has added UK£48m to its market cap in just the last 7 days, so let's see if we can determine what's driven the five-year loss for shareholders.

See our latest analysis for Mitchells & Butlers

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Mitchells & Butlers became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics might give us a better handle on how its value is changing over time.

Revenue is actually up 12% over the time period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

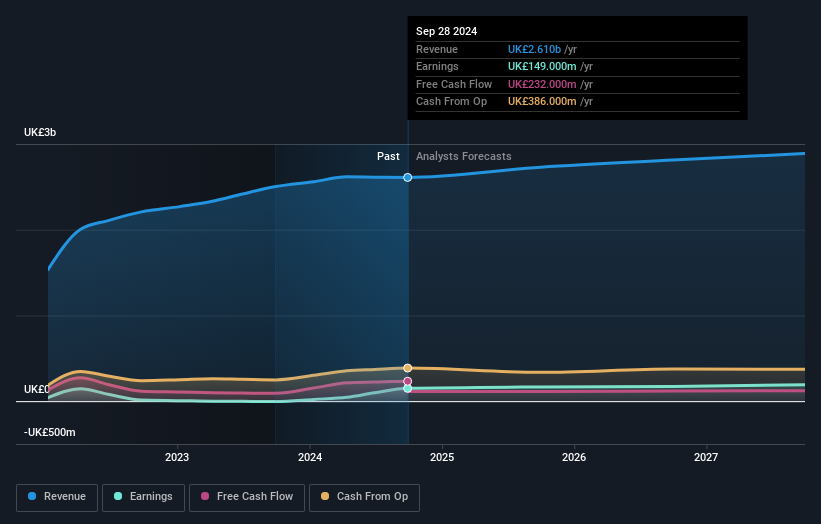

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It is of course excellent to see how Mitchells & Butlers has grown profits over the years, but the future is more important for shareholders. This free interactive report on Mitchells & Butlers' balance sheet strength is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Mitchells & Butlers' total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Its history of dividend payouts mean that Mitchells & Butlers' TSR, which was a 41% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

Mitchells & Butlers shareholders are down 5.8% for the year, but the market itself is up 7.0%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 7% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. Before spending more time on Mitchells & Butlers it might be wise to click here to see if insiders have been buying or selling shares.

But note: Mitchells & Butlers may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:MAB

Mitchells & Butlers

Engages in the management of pubs, bars, and restaurants in the United Kingdom and Germany.

Good value with acceptable track record.

Similar Companies

Market Insights

Community Narratives