- Canada

- /

- Industrial REITs

- /

- TSX:PRV.UN

Global's Undervalued Small Caps With Insider Action For October 2025

Reviewed by Simply Wall St

As global markets navigate renewed U.S.-China trade tensions and concerns over a prolonged U.S. government shutdown, small-cap stocks have faced increased volatility, reflected in the recent decline of indices like the S&P 600. In such an environment, identifying small-cap companies with strong fundamentals and insider activity can be particularly appealing to investors looking for potential opportunities amid broader market uncertainties.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Aurelia Metals | 9.2x | 1.3x | 30.88% | ★★★★★★ |

| Speedy Hire | NA | 0.3x | 27.32% | ★★★★★☆ |

| Bumitama Agri | 10.4x | 1.5x | 48.96% | ★★★★☆☆ |

| Bytes Technology Group | 17.6x | 4.5x | 12.87% | ★★★★☆☆ |

| GDI Integrated Facility Services | 18.5x | 0.3x | 2.22% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 42.75% | ★★★★☆☆ |

| BWP Trust | 10.1x | 13.2x | 13.54% | ★★★★☆☆ |

| Morguard North American Residential Real Estate Investment Trust | 6.7x | 1.8x | 21.23% | ★★★★☆☆ |

| Sagicor Financial | 7.0x | 0.4x | -71.63% | ★★★★☆☆ |

| Chinasoft International | 24.9x | 0.8x | -1366.34% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

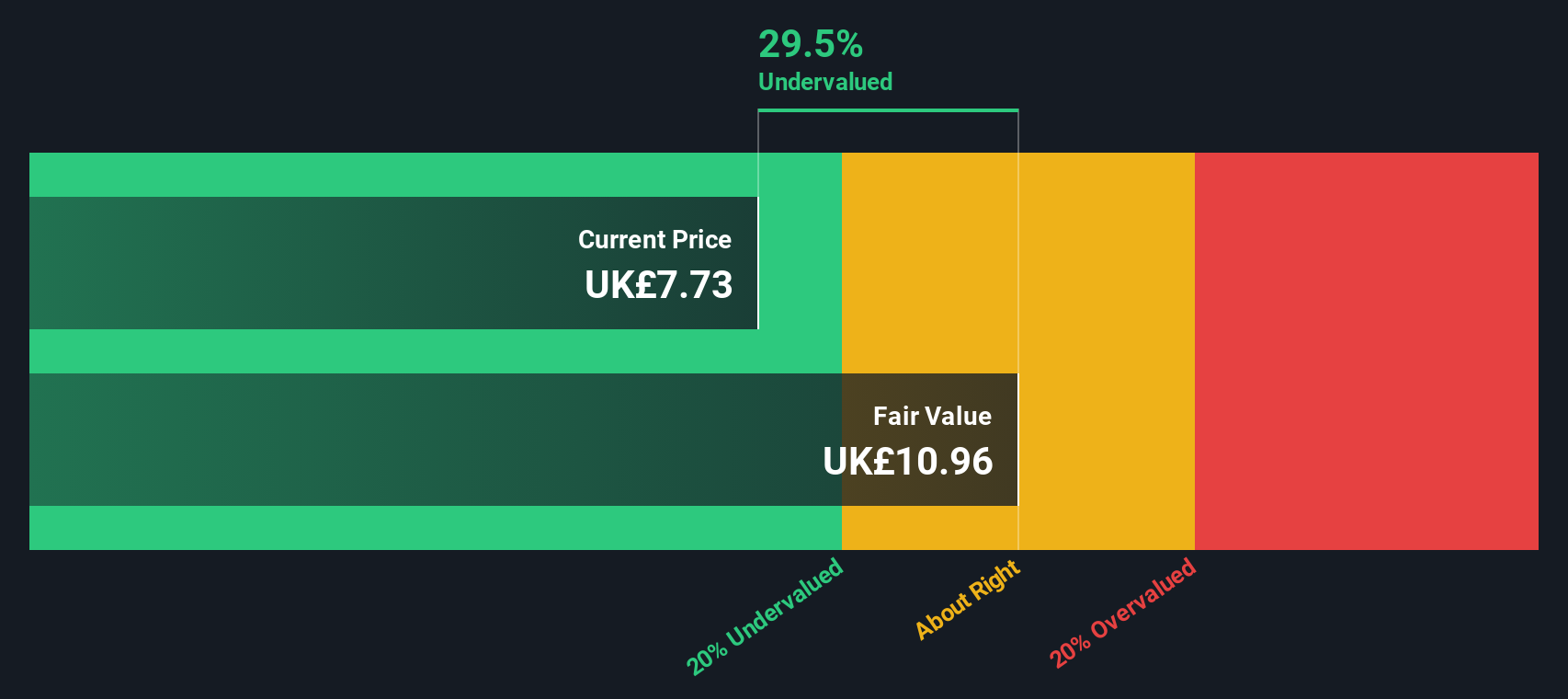

J D Wetherspoon (LSE:JDW)

Simply Wall St Value Rating: ★★★★☆☆

Overview: J D Wetherspoon operates a chain of pubs across the UK and Ireland, with a focus on offering affordable food and drinks, and has a market capitalization of approximately £0.89 billion.

Operations: The company generates revenue primarily from its pubs, with recent figures indicating a revenue of £2.13 billion. Cost of goods sold (COGS) represents a significant portion of expenses, leading to a gross profit margin of 11.96%. Operating expenses and non-operating expenses further impact profitability, resulting in a net income margin of 3.20%.

PE: 10.0x

J D Wetherspoon, known for its pub chain, recently reported a rise in sales to £2.13 billion and net income to £68 million for the year ending July 2025. Earnings per share also improved from the previous year. Despite these gains, interest payments are not well covered by earnings due to reliance on external borrowing. Insider confidence is evident with recent share purchases by executives within this period, indicating belief in potential growth despite funding challenges.

- Click here and access our complete valuation analysis report to understand the dynamics of J D Wetherspoon.

Evaluate J D Wetherspoon's historical performance by accessing our past performance report.

Ever Sunshine Services Group (SEHK:1995)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Ever Sunshine Services Group is a company that provides property management services, with a market capitalization of CN¥9.61 billion.

Operations: The company's revenue primarily comes from property management services, with recent figures reaching CN¥6.93 billion. Over time, the gross profit margin has shown variability, peaking at 31.40% in December 2020 and later declining to 18.43% by June 2025. Operating expenses have consistently included significant amounts for general and administrative expenses, which were CN¥497.08 million as of June 2025. Net income margins have also fluctuated, with a noticeable decline from a peak of approximately 13% in late 2021 to around 6% by mid-2025.

PE: 6.9x

Ever Sunshine Services Group, a company with an expected annual earnings growth of 11.17%, has seen insider confidence through Zhubo Lin's purchase of 300,000 shares valued at approximately HK$543,000. Despite relying entirely on external borrowing for funding, the company is navigating strategic changes in leadership and has announced a special dividend of HK$0.0271 per share alongside a regular interim dividend decrease to HK$0.0678 per share for the first half of 2025. Recent M&A activities include LMR Partners' commitment to acquire an 8.24% stake from CIFI Holdings at a premium price, reflecting potential market interest despite current financial challenges such as declining net income from CNY 265 million to CNY 214 million year-over-year by June-end.

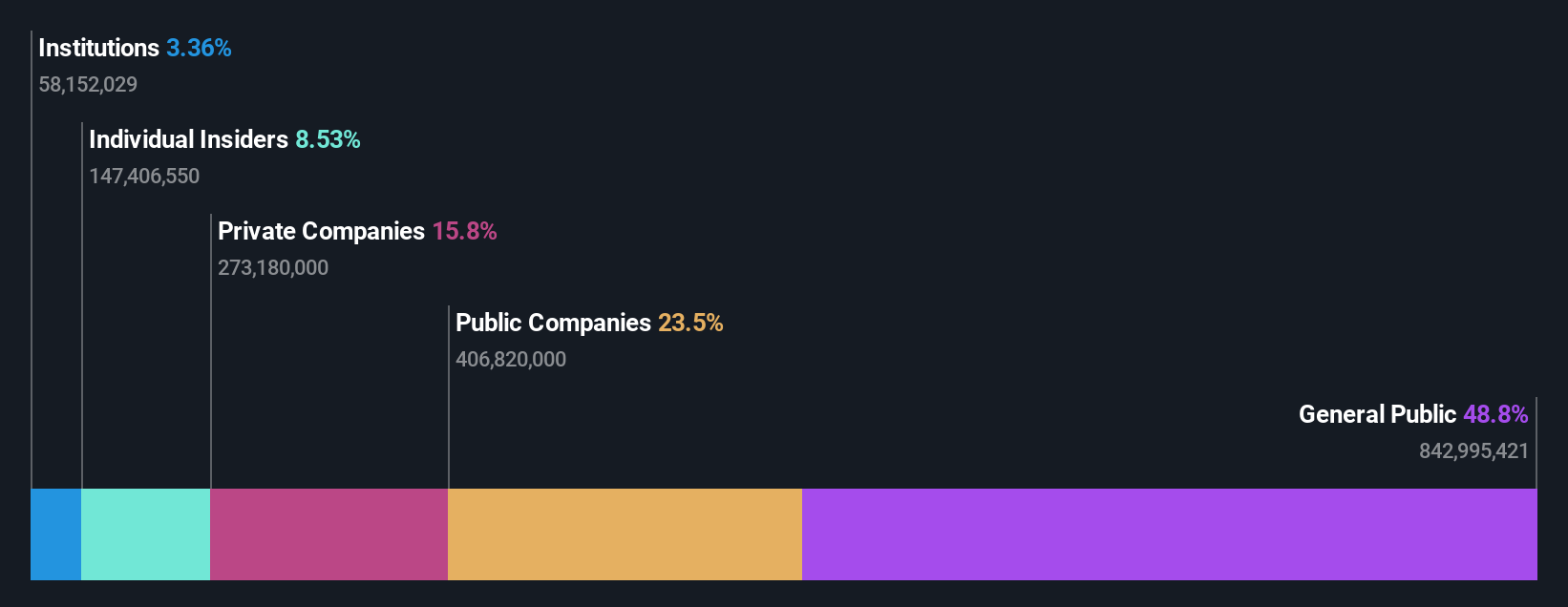

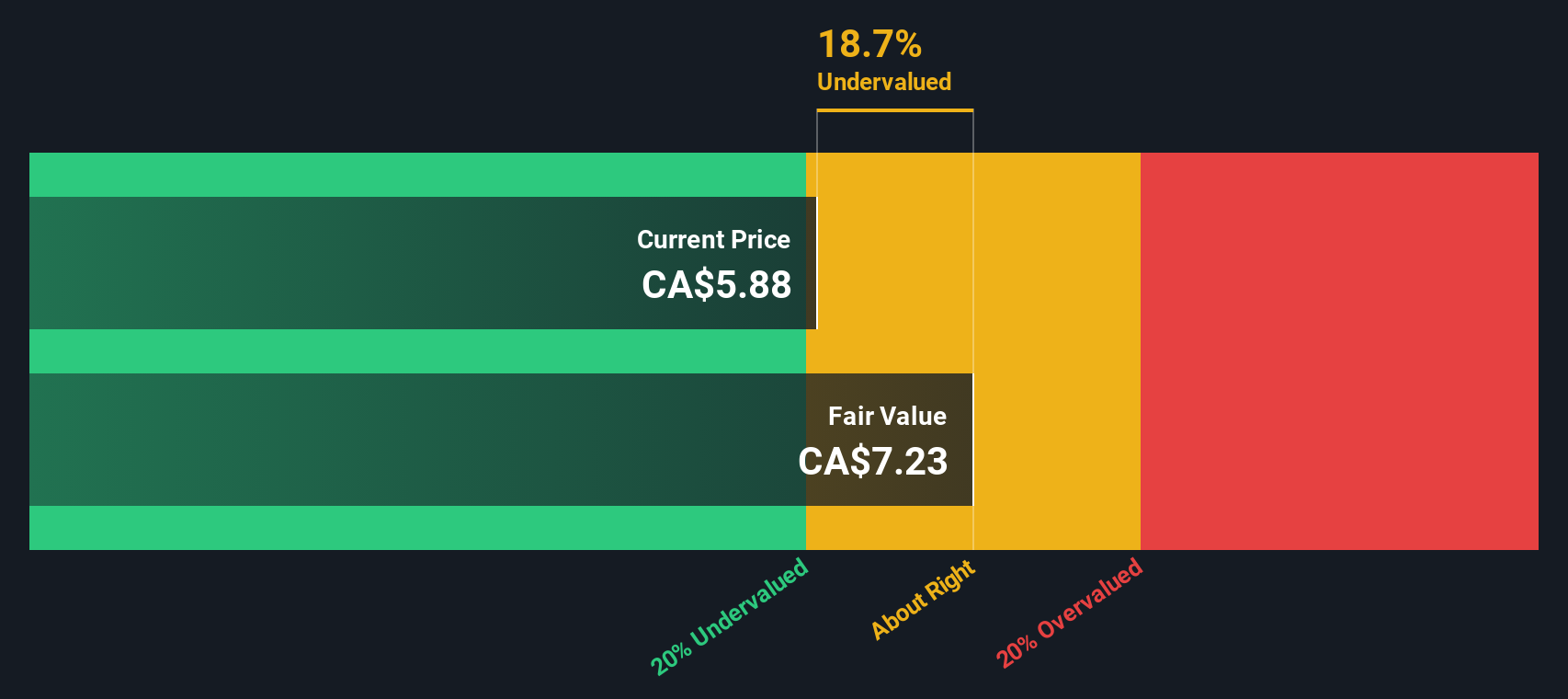

Pro Real Estate Investment Trust (TSX:PRV.UN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Pro Real Estate Investment Trust focuses on managing a diversified portfolio of office and retail properties with a market cap of CA$80.38 million.

Operations: The company generates revenue primarily from its retail and office segments, with a significant portion of adjustments contributing to the total. Over recent periods, the gross profit margin has shown fluctuations, most recently recorded at 58.42%. Operating expenses have varied across periods but remain a critical component in determining net income outcomes.

PE: 14.4x

Pro Real Estate Investment Trust, a smaller player in the real estate sector, has caught attention with insider confidence. Co-Founder Gordon Lawlor acquired 20,000 shares recently for C$108,241. This move suggests belief in the company's potential despite challenges like declining earnings over five years and reliance on external borrowing. Revenue is projected to grow by 6.64% annually, providing a glimmer of optimism amidst financial hurdles. Regular dividends affirm commitment to shareholder returns with recent payouts of C$0.0375 per unit monthly.

Key Takeaways

- Investigate our full lineup of 115 Undervalued Global Small Caps With Insider Buying right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PRV.UN

Pro Real Estate Investment Trust

PROREIT (TSX:PRV.UN) is an unincorporated open-ended real estate investment trust established pursuant to a declaration of trust under the laws of the Province of Ontario.

Proven track record average dividend payer.

Market Insights

Community Narratives