- United Kingdom

- /

- Hospitality

- /

- LSE:IHG

InterContinental Hotels Group (LSE:IHG) Eyes Strategic M&A Amid Strong Financial Performance and Dividend Growth

Reviewed by Simply Wall St

The InterContinental Hotels Group (LSE:IHG) is navigating a period of significant growth and strategic expansion, tempered by regional challenges and financial pressures. Recent developments include a 3.2% growth in RevPAR for Q2 2024 and record-breaking room signings, contrasted by a 7% decline in RevPAR in Greater China and rising interest costs. In the discussion that follows, we will explore IHG's core advantages, critical issues, growth strategies, and potential risks to provide a comprehensive overview of the company's current business situation.

Unlock comprehensive insights into our analysis of InterContinental Hotels Group stock here.

Strengths: Core Advantages Driving Sustained Success For InterContinental Hotels Group

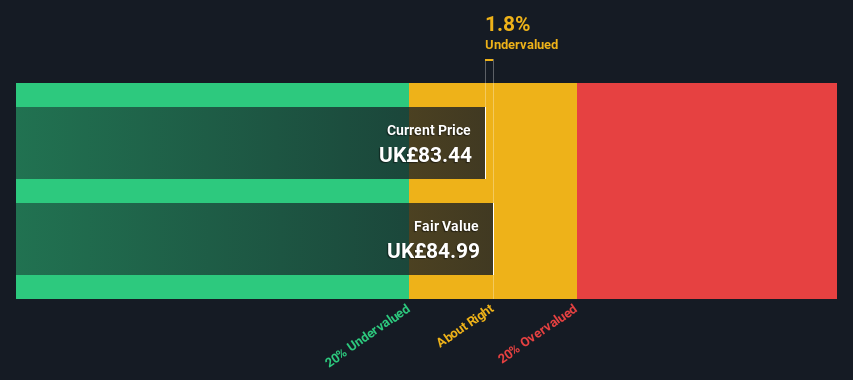

InterContinental Hotels Group (IHG) has demonstrated strong financial performance, with significant progress in key metrics for trading performance, signings, profit, and earnings. CEO Elie Maalouf highlighted a 3.2% growth in RevPAR for Q2 2024, reflecting a strong rebound in the U.S. and a 12% increase in operating profit to over $0.5 billion. The company also achieved record-breaking signings of over 57,000 rooms, up 67% from the previous year. Furthermore, IHG's fee margin expanded by 180 basis points, contributing to its financial health. The company is trading below its estimated fair value (£82.02 vs. £85.24) but is considered expensive based on its Price-To-Earnings Ratio (27.4x) compared to the peer average (25.1x) and the UK Hospitality industry average (23.6x).

To dive deeper into how InterContinental Hotels Group's valuation metrics are shaping its market position, check out our detailed analysis of InterContinental Hotels Group's Valuation.

Weaknesses: Critical Issues Affecting InterContinental Hotels Group's Performance and Areas For Growth

IHG faces challenges in Greater China, with RevPAR growth easing from 2.5% in Q1 to a reduction of 7% in Q2, as noted by CFO Michael Glover. Increased costs, including adjusted interest rising to $79 million due to higher net debt and bond interest rates, also pose a concern. The company's fee margin in China slipped to just under 56% from 58% the previous year. Additionally, IHG's earnings growth over the past year (3.2%) did not outperform the Hospitality industry's 6.9%. The company’s liabilities exceed its assets, making it difficult to calculate its Return on Equity. Despite these challenges, IHG's earnings have grown significantly by 34.2% per year over the past five years.

To gain deeper insights into InterContinental Hotels Group's historical performance, explore our detailed analysis of past performance.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

IHG is poised for growth through strategic expansions and brand development. The agreement with NOVUM Hospitality to convert 119 hotels to IHG brands will double its hotel presence in Germany, significantly enhancing its market position. The company's nine newer brands, which represent 7% of the system today but 19% of the pipeline, are accelerating growth. CFO Michael Glover expressed confidence in the medium- and long-term growth outlook for the Chinese market, despite short-term trading bumps. Additionally, IHG's earnings are forecast to grow at 10.7% per year, although this is slower than the UK market's 14.5% per year.

Threats: Key Risks and Challenges That Could Impact InterContinental Hotels Group's Success

IHG faces several external threats, including competition and market risks, as highlighted by CFO Michael Glover. The industry has experienced shifting patterns of demand mix, including an expansion of outbound leisure travel to other markets. Economic factors, such as an effective tax rate of 27%, also pose challenges. Operational risks in China are significant, with tougher comps in Q2 compared to last year. Additionally, IHG has a high level of debt and negative shareholders' equity, which could impact its financial stability. The company's revenue is expected to decline by 6.1% per year over the next three years, adding to the potential risks.

Conclusion

InterContinental Hotels Group (IHG) has shown strong financial performance with significant improvements in key metrics such as RevPAR, operating profit, and room signings, indicating a positive trajectory for the company. However, challenges in Greater China, rising costs, and a high debt level pose risks to sustained growth. The company's strategic expansions and brand development efforts, particularly in Germany and China, offer promising opportunities for future growth. Despite trading below its estimated fair value, IHG's high Price-To-Earnings Ratio compared to peers and the UK Hospitality industry suggests it is relatively expensive, which may impact investor sentiment. Overall, while IHG's strengths and opportunities provide a solid foundation for future performance, addressing its weaknesses and threats will be crucial for maintaining its competitive edge and financial stability.

Key Takeaways

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About LSE:IHG

InterContinental Hotels Group

Owns, manages, franchises, and leases hotels in the United Kingdom, the United States, and internationally.

Low with questionable track record.

Similar Companies

Market Insights

Community Narratives