- United Kingdom

- /

- Consumer Durables

- /

- AIM:SPR

AdvancedAdvT And 2 Other Promising Penny Stocks On The UK Exchange

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index experiencing a downturn influenced by weak trade data from China. In times of fluctuating global markets, investors often seek opportunities in smaller or less-established companies that can offer unique value propositions. Penny stocks, despite being an older term, continue to represent such opportunities when they are backed by solid financials and potential for growth.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.968 | £152.69M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.085 | £785.66M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.46 | £185.93M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.58 | £68.28M | ★★★★☆☆ |

| Luceco (LSE:LUCE) | £1.274 | £196.49M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.715 | £369.48M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.44 | $255.78M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.96 | £453.67M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £2.52 | £321.99M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.0875 | £92.91M | ★★★★★★ |

Click here to see the full list of 465 stocks from our UK Penny Stocks screener.

Let's uncover some gems from our specialized screener.

AdvancedAdvT (AIM:ADVT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: AdvancedAdvT Limited offers software solutions across Europe, the United Kingdom, North America, and internationally with a market cap of £203.13 million.

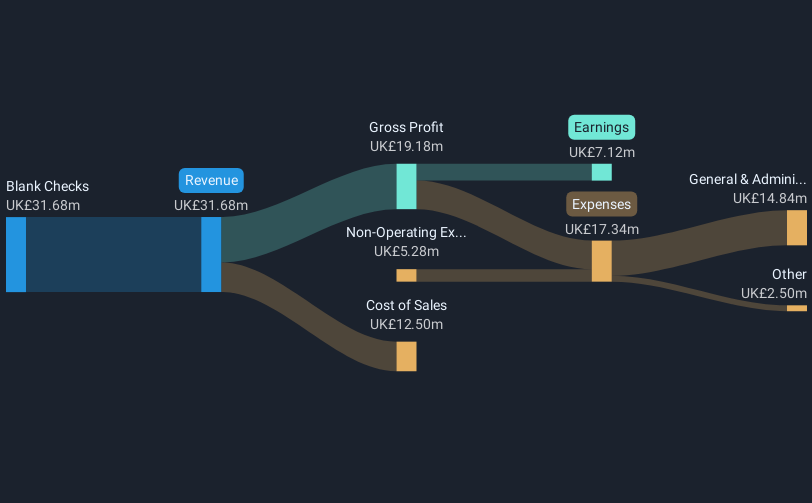

Operations: The company's revenue is primarily generated from its Blank Checks segment, totaling £31.68 million.

Market Cap: £203.13M

AdvancedAdvT Limited, with a market cap of £203.13 million, has recently demonstrated significant financial improvement. Reporting half-year sales of £19.87 million and net income of £7.85 million, the company shows notable growth compared to the previous year. Despite a low return on equity at 5.5%, AdvancedAdvT is debt-free and maintains strong short-term asset coverage over liabilities (£89.3M vs £16.3M). The board's experience averages 3.8 years, contributing to stable management oversight amid this transition to profitability after five years without debt accumulation or shareholder dilution concerns.

- Click to explore a detailed breakdown of our findings in AdvancedAdvT's financial health report.

- Learn about AdvancedAdvT's historical performance here.

Springfield Properties (AIM:SPR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Springfield Properties Plc, with a market cap of £115.79 million, operates in the United Kingdom's house building industry through its subsidiaries.

Operations: The company generates revenue from its Housing Building Activity segment, which amounts to £266.53 million.

Market Cap: £115.79M

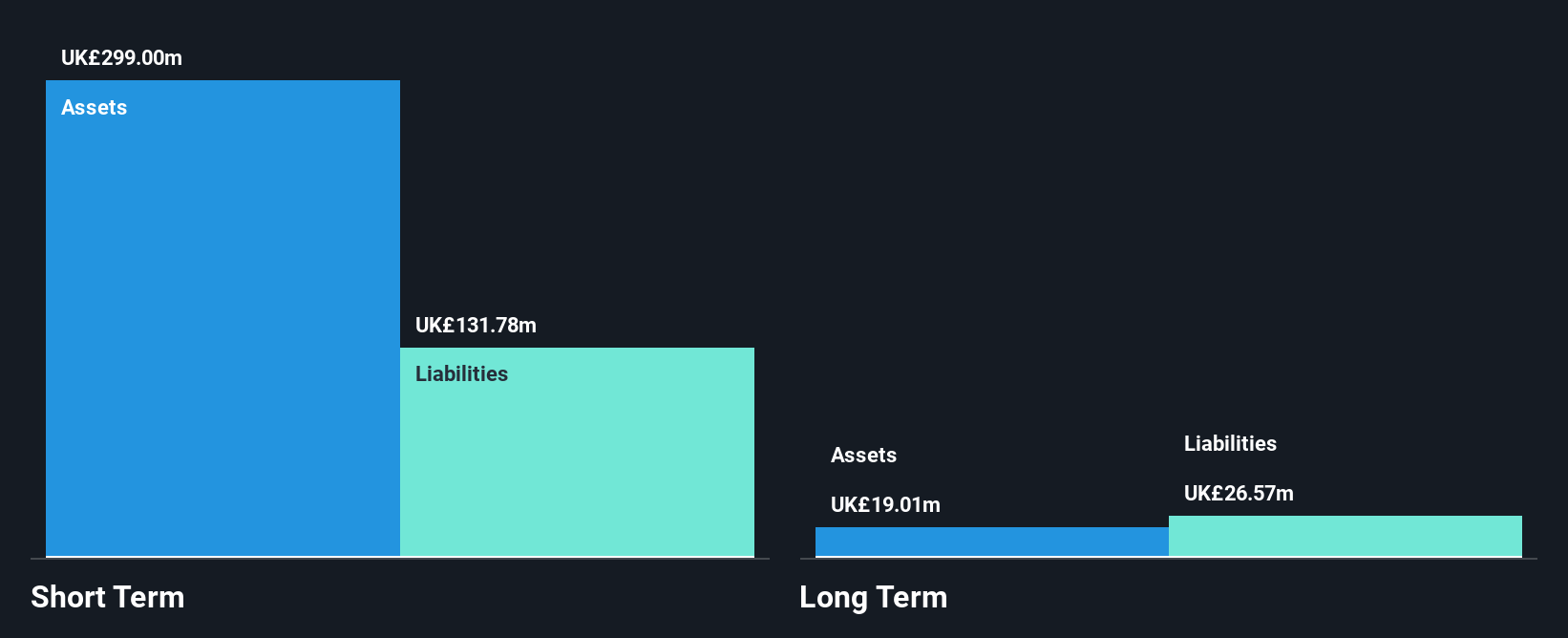

Springfield Properties Plc, with a market cap of £115.79 million, operates in the UK's house building sector and generates revenue of £266.53 million from its Housing Building Activity segment. The company has experienced negative earnings growth over the past year and five years but is forecasted to grow earnings by 18.94% annually. Its financial stability is supported by short-term assets (£285.6M) exceeding both short-term (£116.7M) and long-term liabilities (£30.3M). While debt levels are satisfactory with a net debt to equity ratio of 25.2%, interest coverage remains weak at 2.4x EBIT, indicating potential risk areas for investors to monitor closely.

- Take a closer look at Springfield Properties' potential here in our financial health report.

- Learn about Springfield Properties' future growth trajectory here.

Hostelworld Group (LSE:HSW)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hostelworld Group plc operates as an online travel agent specializing in the hostel market globally, with a market cap of £168.77 million.

Operations: The company generates €93.86 million in revenue from providing software and data processing services.

Market Cap: £168.77M

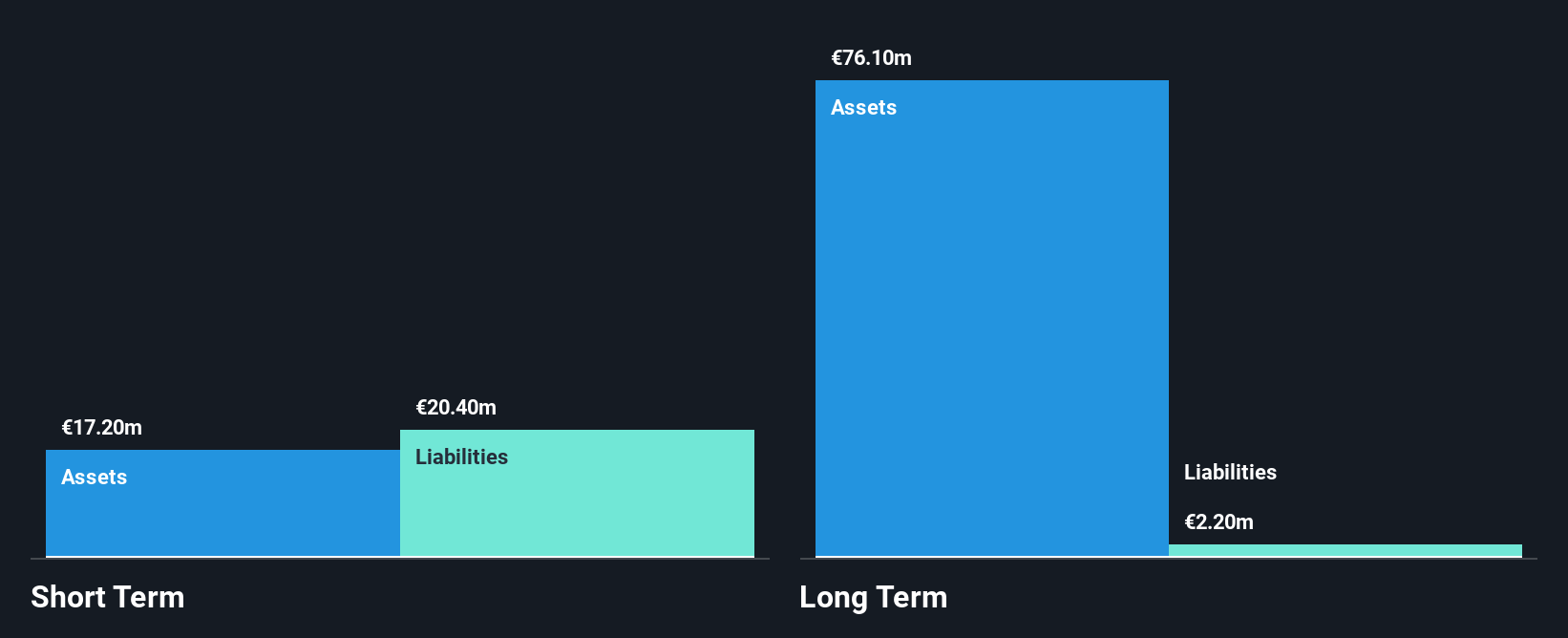

Hostelworld Group plc, with a market cap of £168.77 million, has demonstrated stability in its weekly volatility over the past year and is debt-free. The company has recently become profitable, showing high-quality earnings and a strong return on equity at 24.2%. Despite trading at 56.2% below estimated fair value and analysts expecting a significant price increase, short-term liabilities (€23.1M) surpass short-term assets (€10M), indicating potential liquidity concerns. Its experienced board and management team contribute to its operational strength, while long-term liabilities are well-covered by existing assets (€10M).

- Get an in-depth perspective on Hostelworld Group's performance by reading our balance sheet health report here.

- Gain insights into Hostelworld Group's outlook and expected performance with our report on the company's earnings estimates.

Next Steps

- Dive into all 465 of the UK Penny Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:SPR

Springfield Properties

Engages in the house building business in the United Kingdom.

Excellent balance sheet and fair value.