- United Kingdom

- /

- Specialty Stores

- /

- LSE:CARD

3 European Undervalued Small Caps With Recent Insider Activity

Reviewed by Simply Wall St

Amid recent fluctuations in global markets, European equities have faced headwinds with the pan-European STOXX Europe 600 Index declining by 1.10% as political turmoil and international trade tensions weighed on investor sentiment. Despite these challenges, small-cap stocks in Europe continue to present intriguing opportunities for investors, particularly when there is notable insider activity which can sometimes signal confidence from those closest to the company’s operations.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Cairn Homes | 12.1x | 1.5x | 30.60% | ★★★★★★ |

| Bytes Technology Group | 16.2x | 3.9x | 22.16% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 28.23% | ★★★★★☆ |

| J D Wetherspoon | 10.1x | 0.3x | 1.30% | ★★★★☆☆ |

| Senior | 24.6x | 0.8x | 26.03% | ★★★★☆☆ |

| Fastighets AB Trianon | 13.5x | 4.4x | -205.83% | ★★★★☆☆ |

| Pexip Holding | 35.3x | 5.2x | 41.88% | ★★★☆☆☆ |

| Nyab | 20.9x | 0.9x | 38.80% | ★★★☆☆☆ |

| Oxford Instruments | 40.2x | 2.1x | 17.20% | ★★★☆☆☆ |

| Social Housing REIT | NA | 6.9x | 35.40% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

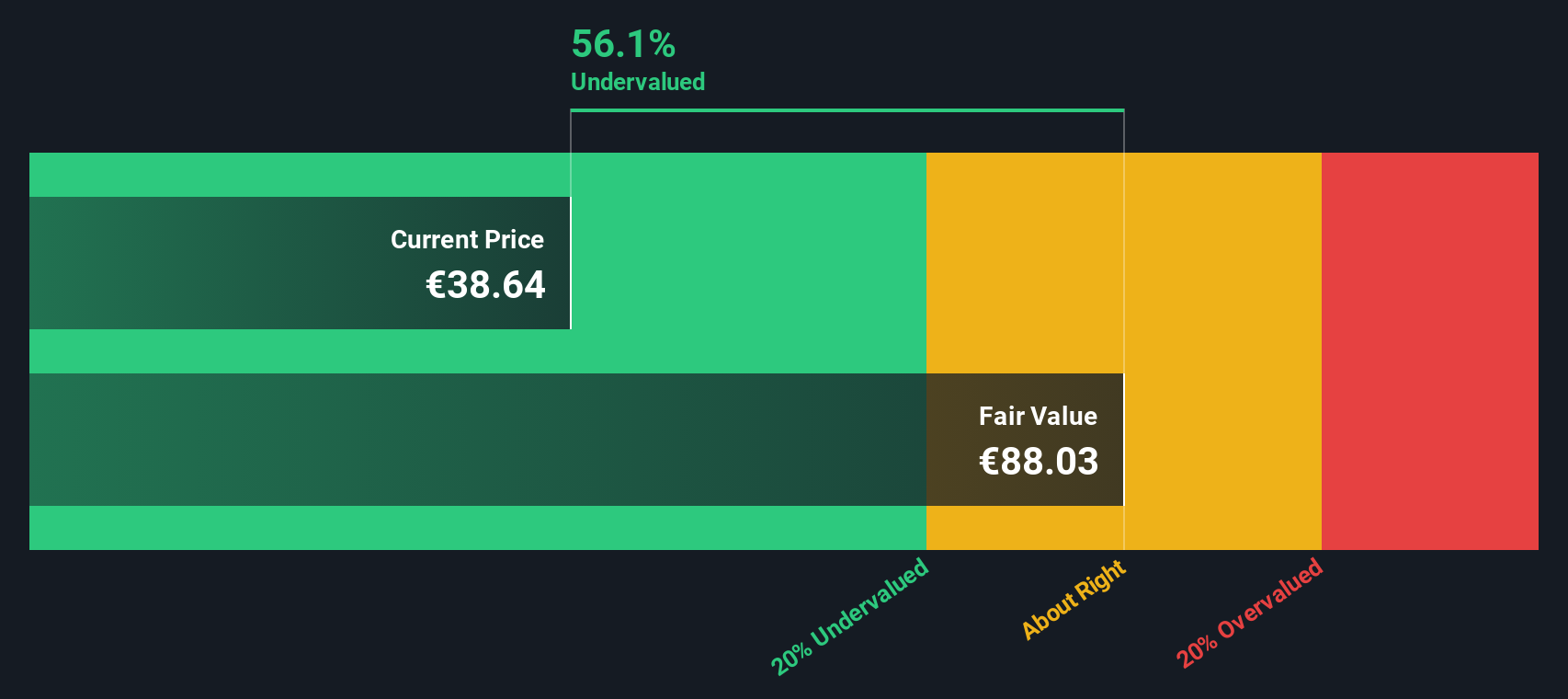

Qt Group Oyj (HLSE:QTCOM)

Simply Wall St Value Rating: ★★★★★★

Overview: Qt Group Oyj is a technology company specializing in software development tools, with a market capitalization of approximately €1.29 billion.

Operations: The company generates revenue primarily from its software development tools, with recent figures showing €209.12 million in revenue. Over the years, the gross profit margin has shown a notable increase, reaching 51.24% by the end of 2024. Operating expenses have consistently included costs such as depreciation and amortization and sales & marketing expenses, contributing to overall financial performance.

PE: 25.3x

Qt Group Oyj, a European stock with potential for growth, has recently attracted attention due to its collaboration with Suzuki Group on the e VITARA's digital cockpit. This partnership highlights Qt's strength in cross-platform HMI tools. Despite a decrease in net income to €6.74 million for Q2 2025, the company maintains strong insider confidence through share purchases from January to September 2025. With earnings projected to grow annually by 22%, Qt shows promise amidst its volatile share price and reliance on external funding sources.

- Delve into the full analysis valuation report here for a deeper understanding of Qt Group Oyj.

Assess Qt Group Oyj's past performance with our detailed historical performance reports.

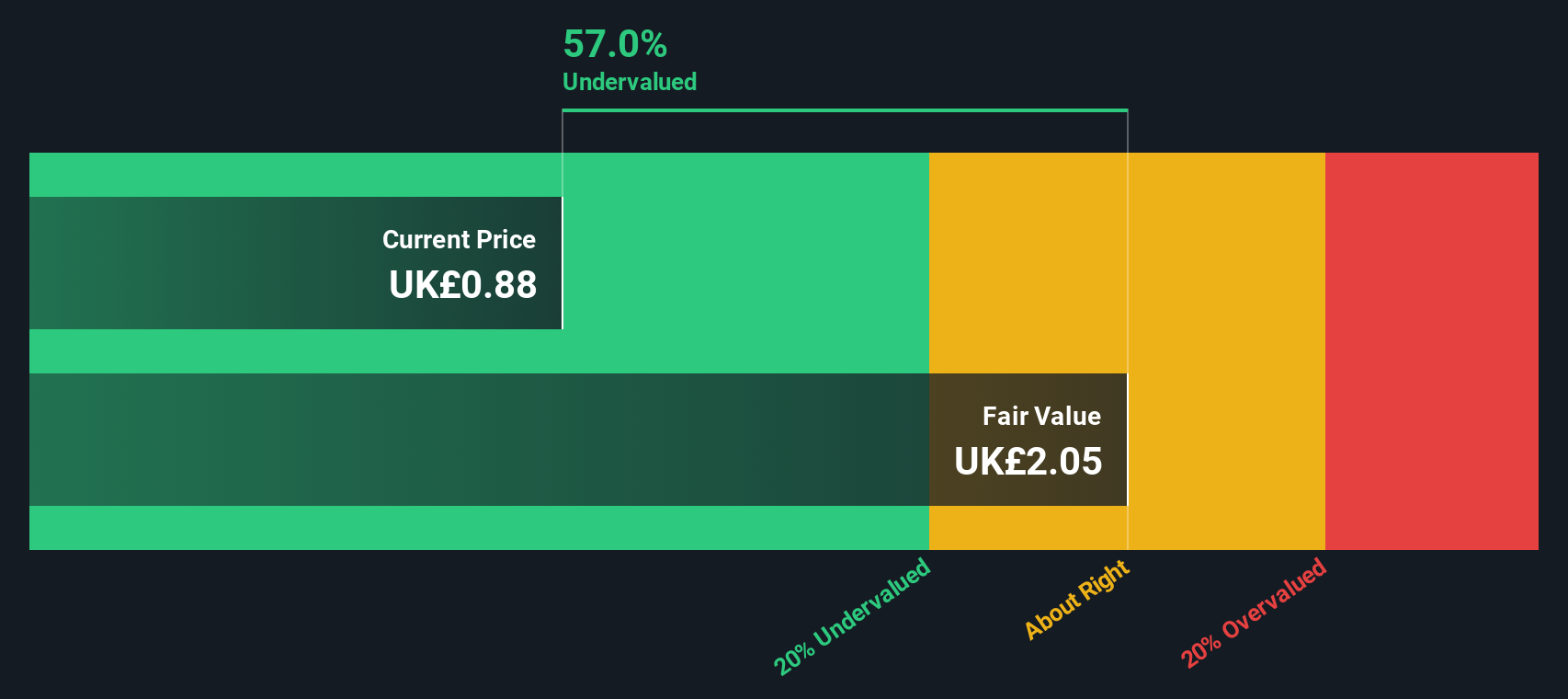

Card Factory (LSE:CARD)

Simply Wall St Value Rating: ★★★★★☆

Overview: Card Factory operates as a retailer specializing in greeting cards, gifts, and celebration essentials with a market capitalization of £0.54 billion.

Operations: The company's primary revenue streams are from Cardfactory Stores (£513.20 million) and Partnerships (£32.10 million). Over the years, its net income margin has shown fluctuations, reaching 0.1067% in July 2023 before declining to 0.0771% by October 2025. Operating expenses have consistently increased, impacting profitability with a notable rise to £114.9 million by October 2025.

PE: 7.9x

Card Factory, a small player in Europe's retail sector, shows potential for growth despite mixed financial results. Recent earnings revealed sales of £247.6 million for the half year ended July 2025, up from £233.8 million the previous year, though net income dropped to £5.6 million from £10.5 million. The company proposed an interim dividend increase to 1.3 pence per share, reflecting confidence in future performance despite reliance on external borrowing for funding and insider confidence shown through recent share purchases suggests optimism about its trajectory amidst forecasted annual earnings growth of nearly 13%.

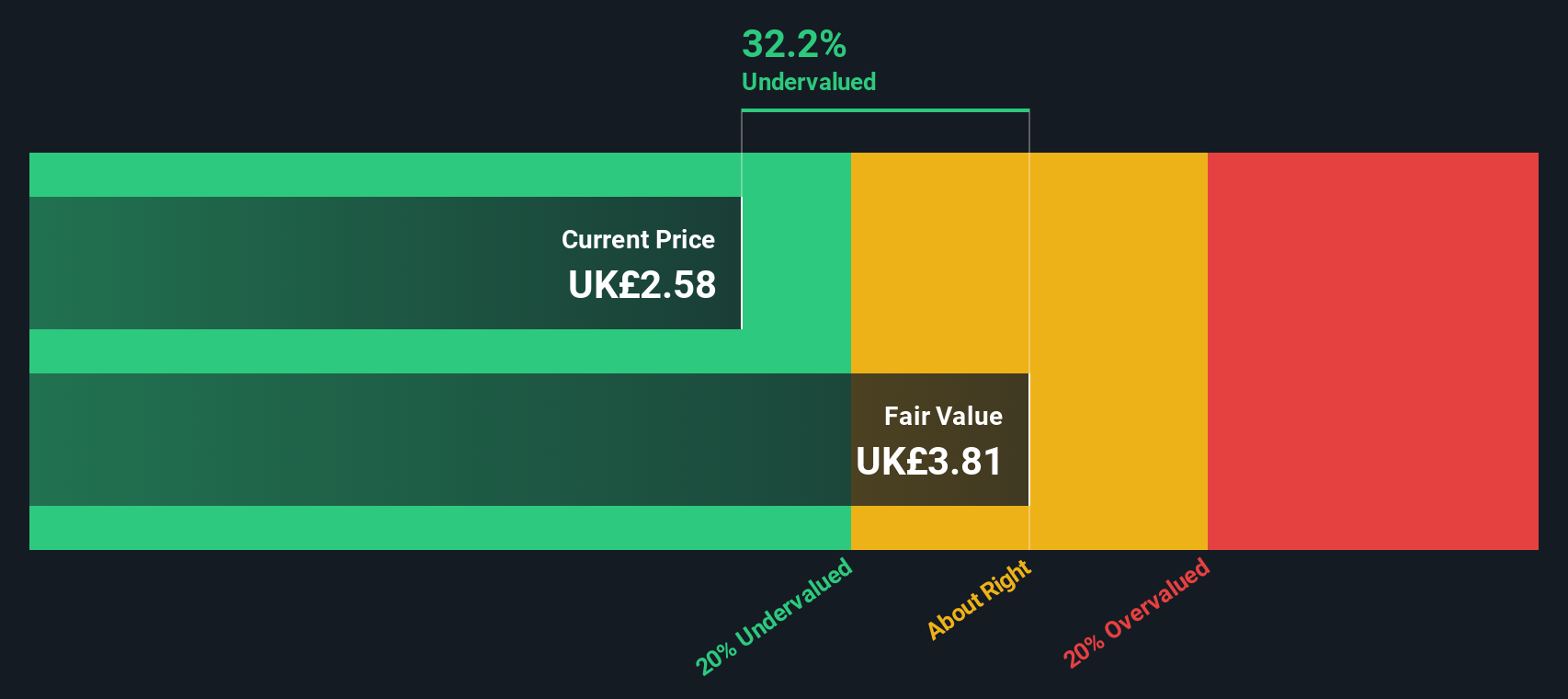

Domino's Pizza Group (LSE:DOM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Domino's Pizza Group operates as a leading pizza delivery and carryout chain, primarily generating income through sales to franchisees, corporate stores, and national advertising, with a market capitalization of £1.16 billion.

Operations: The primary revenue streams include sales to franchisees and corporate stores income, with additional contributions from national advertising and ecommerce. Over recent periods, the gross profit margin has shown an upward trend, reaching 47.18% in June 2025. Operating expenses are a significant cost component, consistently rising alongside revenue growth.

PE: 9.2x

Domino's Pizza Group, a smaller player in the European market, is capturing attention with its strategic moves and innovation. Their recent launch of CHICK 'N' DIP aims to tap into the growing casual dining sector, leveraging existing infrastructure for minimal investment. Despite a high debt level and reliance on external borrowing, earnings are projected to grow annually by 5.03%. Insider confidence is reflected in share purchases earlier this year. The company announced a £20 million buyback program amidst calls from activist investors for larger capital returns and strategic shifts.

Next Steps

- Embark on your investment journey to our 53 Undervalued European Small Caps With Insider Buying selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CARD

Card Factory

Operates as a specialist retailer of cards, gifts, and celebration essentials in the United Kingdom, South Africa, Republic of Ireland, the United States, and internationally.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives