3 European Undervalued Small Caps With Insider Buying To Consider

Reviewed by Simply Wall St

In recent weeks, the European market has shown mixed performance, with Germany's DAX and Italy's FTSE MIB gaining while France's CAC 40 and the UK's FTSE 100 experienced slight declines. Amidst these fluctuations, small-cap stocks in Europe present intriguing opportunities for investors seeking to navigate a dynamic economic landscape. Identifying promising small-cap stocks often involves looking at companies with solid fundamentals and insider confidence, especially in markets where economic indicators suggest potential shifts in growth trajectories.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Norcros | 13.7x | 0.7x | 41.21% | ★★★★★☆ |

| Tokmanni Group Oyj | 12.1x | 0.2x | 42.67% | ★★★★★☆ |

| Eastnine | 11.9x | 7.5x | 48.83% | ★★★★★☆ |

| Senior | 24.9x | 0.8x | 27.00% | ★★★★★☆ |

| A.G. BARR | 14.5x | 1.6x | 48.06% | ★★★★☆☆ |

| Tristel | 29.5x | 4.2x | 20.23% | ★★★☆☆☆ |

| Gooch & Housego | 47.5x | 1.1x | 21.30% | ★★★☆☆☆ |

| Kendrion | 29.1x | 0.7x | 42.37% | ★★★☆☆☆ |

| CVS Group | 46.6x | 1.3x | 25.32% | ★★★☆☆☆ |

| Linc | NA | NA | 0.43% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

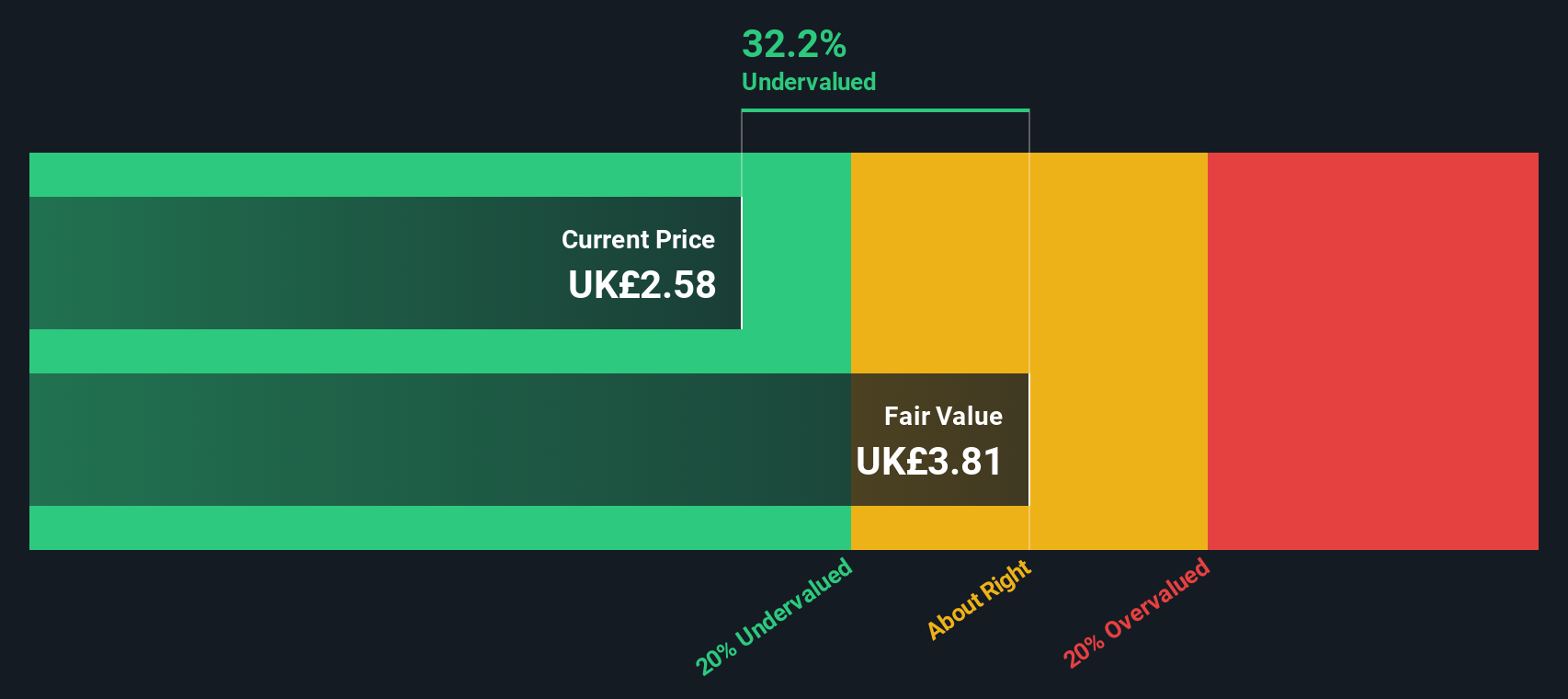

Domino's Pizza Group (LSE:DOM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Domino's Pizza Group operates as a leading pizza delivery company with various revenue streams including sales to franchisees, corporate stores income, and national advertising and ecommerce income, with a market cap of approximately £2.5 billion.

Operations: Sales to franchisees contribute significantly to revenue, alongside income from corporate stores and national advertising and ecommerce. The gross profit margin has shown fluctuations, reaching 47.18% in June 2025. Operating expenses have steadily increased over time, with general and administrative expenses being a major component.

PE: 8.5x

Domino's Pizza Group, a European small cap, presents an intriguing opportunity for investors seeking undervalued stocks. Despite recent executive shake-ups and a challenging year marked by a halved share price, insider confidence is reflected in key appointments like Annie Murphy and interim CEO Nicola Frampton. The company's ambitious strategy aims to capitalize on its growing UK market share. However, high debt levels and reliance on external borrowing present risks that should be considered alongside growth prospects.

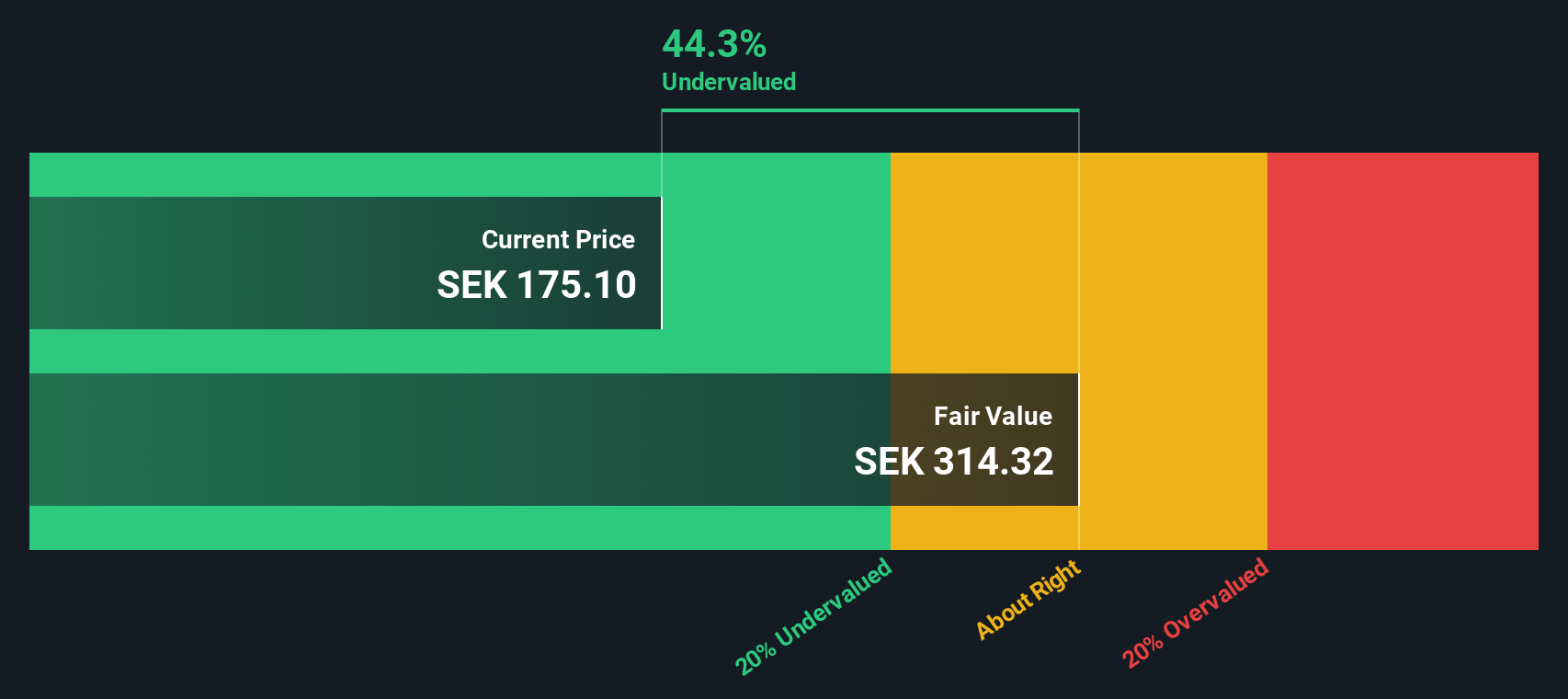

Hemnet Group (OM:HEM)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Hemnet Group operates as an internet information provider, focusing on real estate listings and related services, with a market capitalization of SEK 10.78 billion.

Operations: Hemnet Group's primary revenue stream comes from its operations as an Internet Information Provider, with recent revenues reaching SEK 1.54 billion. The company has shown a notable trend in its gross profit margin, which increased to 86.96% by the end of September 2025. Operating expenses and non-operating expenses are significant components of their cost structure, impacting net income margins that have reached up to 34.95%.

PE: 32.2x

Hemnet Group, a key player in Europe's property portal sector, demonstrates potential as an undervalued stock. Despite a slight dip in Q3 2025 earnings with sales at SEK 366.7 million and net income of SEK 132.4 million, insider confidence is evident from Anders Nilsson's purchase of 5,000 shares for approximately SEK 1.2 million. Furthermore, the company completed a buyback of 812,500 shares worth SEK 223.2 million by September end. Earnings are projected to grow by over 20% annually despite reliance on external borrowing for funding.

- Take a closer look at Hemnet Group's potential here in our valuation report.

Gain insights into Hemnet Group's past trends and performance with our Past report.

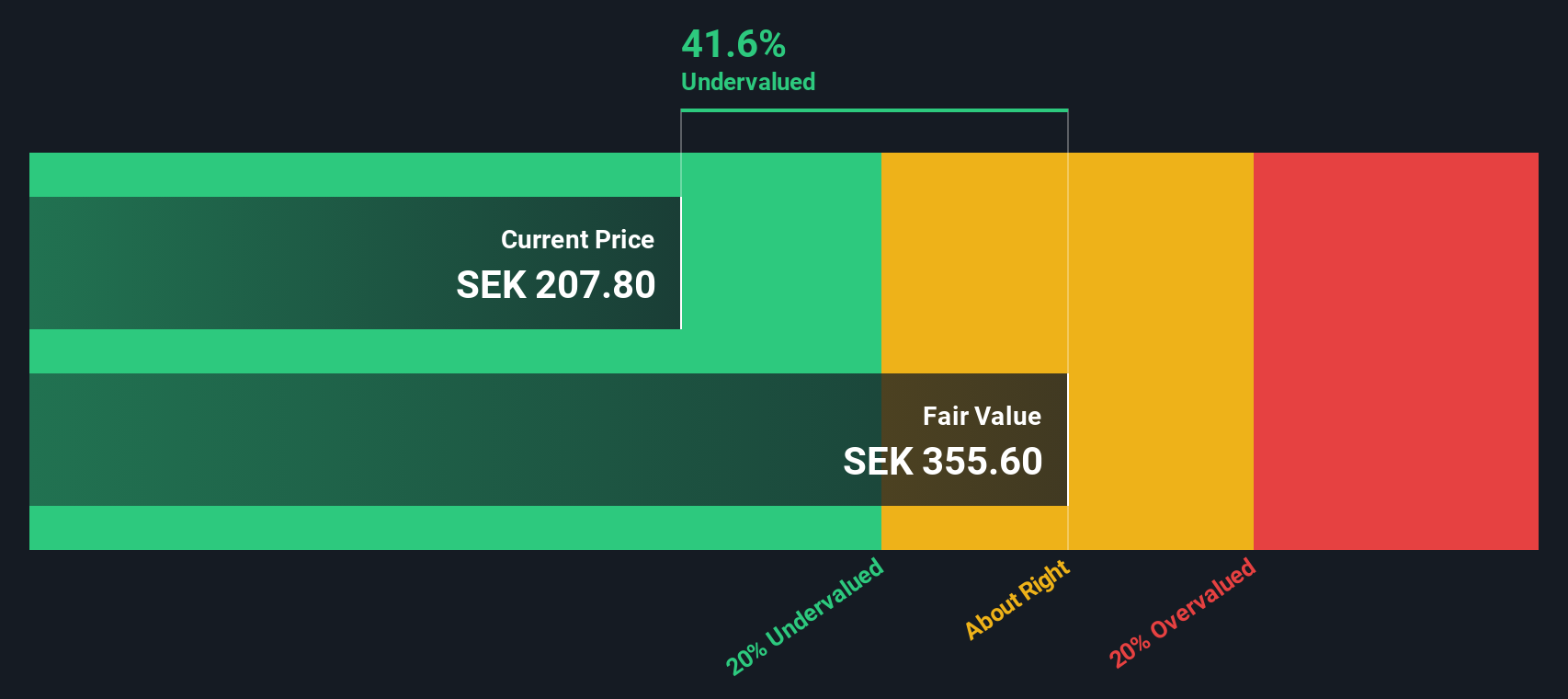

Inwido (OM:INWI)

Simply Wall St Value Rating: ★★★★★★

Overview: Inwido is a company that specializes in the design, manufacture, and sale of windows and doors across various regions including Scandinavia, Eastern Europe, and Western Europe with a market cap of SEK 8.75 billion.

Operations: Inwido generates revenue primarily from its operations in Scandinavia, Eastern Europe, Western Europe, and E-Commerce. Over recent periods, the company's gross profit margin has shown variability, reaching 25.86% as of September 2025. Operating expenses include significant allocations to sales and marketing as well as general and administrative functions.

PE: 17.2x

Inwido, a European player in the window and door industry, is positioning itself for growth through strategic acquisitions. Despite a dip in Q3 2025 sales to SEK 2.22 billion from SEK 2.27 billion last year, they are pursuing mergers and acquisitions to offset limited organic growth prospects. Their commitment is evident as they target a compound annual growth rate of 15% by 2030, with significant contributions expected from M&A activities. This proactive approach reflects insider confidence in potential future value creation within the company’s market segment.

- Dive into the specifics of Inwido here with our thorough valuation report.

Evaluate Inwido's historical performance by accessing our past performance report.

Key Takeaways

- Embark on your investment journey to our 77 Undervalued European Small Caps With Insider Buying selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:INWI

Inwido

Through its subsidiaries, engages in development, manufacture, and sale of windows and doors in Sweden.

Very undervalued with flawless balance sheet and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)