- United Kingdom

- /

- Capital Markets

- /

- AIM:IPX

UK Penny Stocks To Watch In October 2025

Reviewed by Simply Wall St

As the FTSE 100 and FTSE 250 indices face downward pressure due to weak trade data from China, investors are increasingly looking for opportunities beyond traditional blue-chip stocks. Penny stocks, though an older term, still represent a viable investment area by highlighting smaller or newer companies that can offer hidden value. By focusing on those with solid financials and potential for growth, investors can uncover promising opportunities in the UK market.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.61 | £516.12M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.03 | £164M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.75 | £11.32M | ✅ 2 ⚠️ 2 View Analysis > |

| Northern Bear (AIM:NTBR) | £1.07 | £14.72M | ✅ 4 ⚠️ 2 View Analysis > |

| System1 Group (AIM:SYS1) | £2.40 | £30.45M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.54 | $313.92M | ✅ 4 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.56 | £262.74M | ✅ 4 ⚠️ 1 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.45 | £70.04M | ✅ 3 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.10 | £175.12M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.70 | £9.64M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 295 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Impax Asset Management Group (AIM:IPX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Impax Asset Management Group Plc is a publicly owned investment manager with a market cap of £232.08 million.

Operations: The company generates revenue of £160.42 million from its investment management activities.

Market Cap: £232.08M

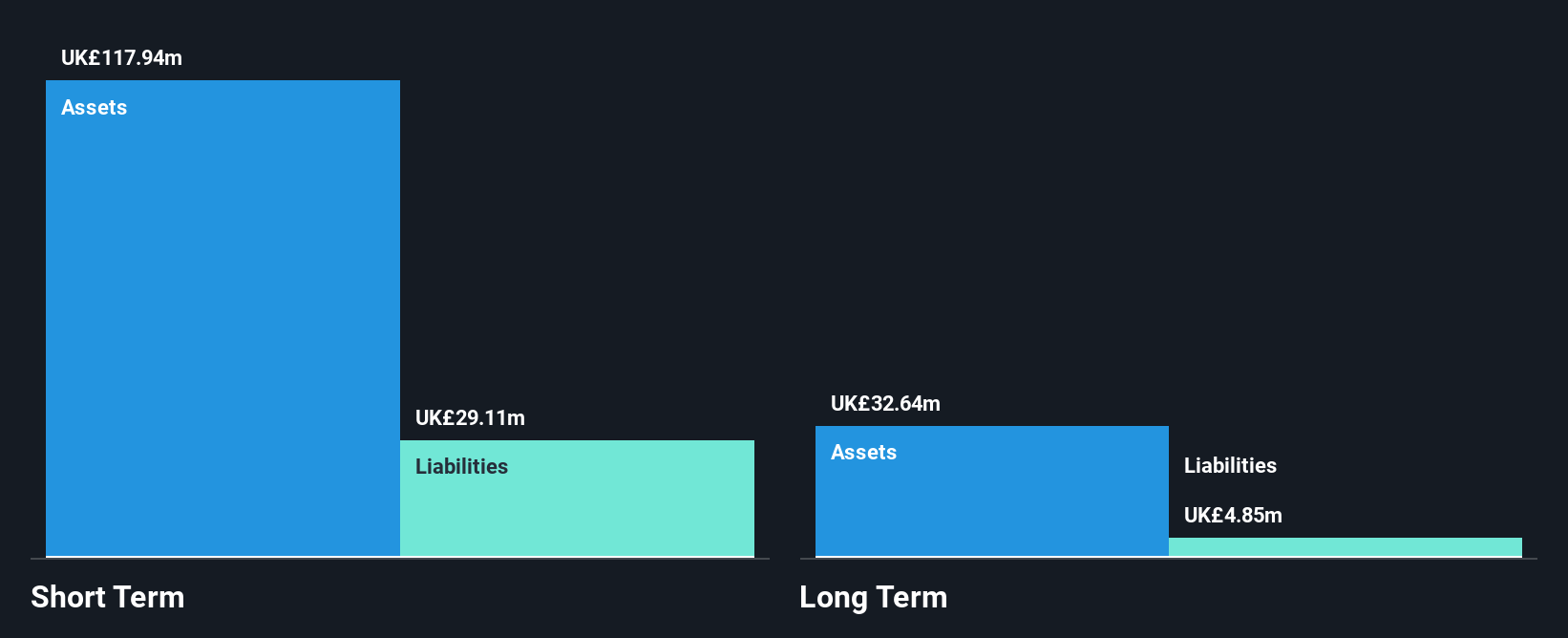

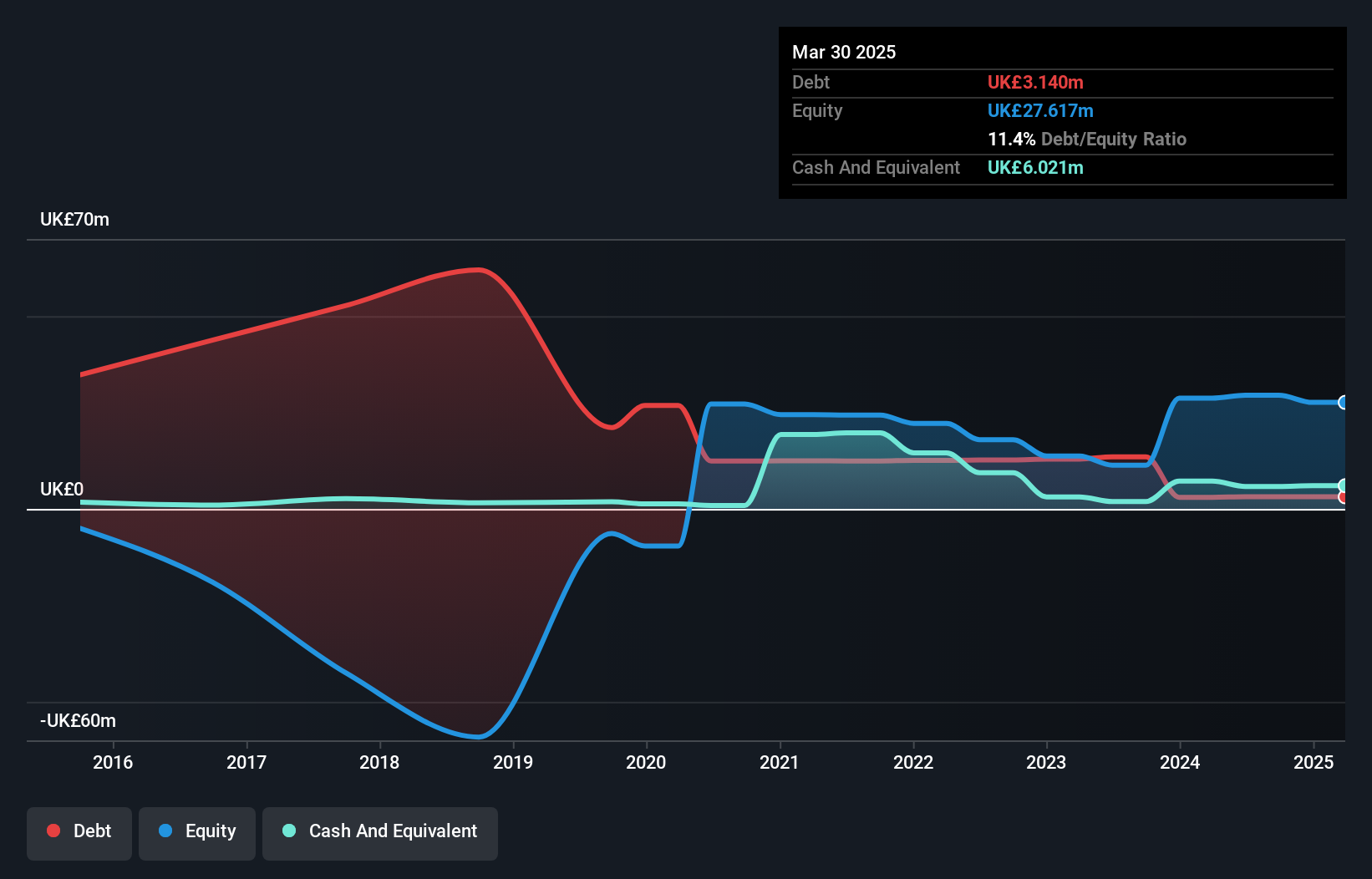

Impax Asset Management Group, with a market cap of £232.08 million, presents an intriguing profile for penny stock investors. Despite recent challenges like being dropped from the S&P Global BMI Index, the company maintains strong fundamentals: it is debt-free and trades at 73.4% below its estimated fair value. Its short-term assets (£117.9M) comfortably cover both short-term (£29.1M) and long-term liabilities (£4.9M). However, earnings have declined by 24.3% over the past year and are forecast to decline further by 7.7% annually over the next three years, impacting its high dividend sustainability (14.51%).

- Take a closer look at Impax Asset Management Group's potential here in our financial health report.

- Review our growth performance report to gain insights into Impax Asset Management Group's future.

Various Eateries (AIM:VARE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Various Eateries PLC, along with its subsidiaries, owns, develops, and operates restaurant and hotel sites in the United Kingdom, with a market cap of £21.01 million.

Operations: The company's revenue is primarily derived from its Restaurant Segment, which generated £47.24 million, complemented by a contribution of £4.18 million from its Hotel Segment.

Market Cap: £21.01M

Various Eateries PLC, with a market cap of £21.01 million, offers a mixed outlook for penny stock investors. The company generates revenue primarily from its restaurant segment (£47.24M) and has more cash than total debt, indicating prudent financial management. Despite being unprofitable, it has reduced losses by 24% annually over the past five years and maintains a positive free cash flow with a runway exceeding three years. However, short-term assets (£9.3M) fall short of covering both short-term (£14.1M) and long-term liabilities (£28.6M). Recent board changes include appointing Mark Julian Loughborough as Director in August 2025.

- Get an in-depth perspective on Various Eateries' performance by reading our balance sheet health report here.

- Understand Various Eateries' earnings outlook by examining our growth report.

McBride (LSE:MCB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: McBride plc, with a market cap of £217.52 million, manufactures and sells private label household and personal care products to retailers and brand owners across the United Kingdom, Europe, the Asia-Pacific region, and internationally.

Operations: The company generates revenue from various segments, including Liquids (£529.6 million), Powders (£85.5 million), Aerosols (£58.9 million), Unit Dosing (£228.9 million), and the Asia Pacific region (£23.6 million).

Market Cap: £217.52M

McBride plc, with a market cap of £217.52 million, presents a mixed picture for penny stock investors. The company's revenue streams are diversified across segments like Liquids and Unit Dosing, totaling £926.5 million in sales for the year ending June 2025. While McBride's net profit margins have stabilized at 3.6%, its high debt level remains a concern despite improved debt-to-equity ratios over five years. The company's interest payments are well-covered by EBIT, and operating cash flow adequately supports its debt obligations. However, short-term liabilities exceed short-term assets slightly, indicating potential liquidity challenges ahead.

- Unlock comprehensive insights into our analysis of McBride stock in this financial health report.

- Examine McBride's earnings growth report to understand how analysts expect it to perform.

Make It Happen

- Click this link to deep-dive into the 295 companies within our UK Penny Stocks screener.

- Looking For Alternative Opportunities? The end of cancer? These 28 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:IPX

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives