- United Kingdom

- /

- Metals and Mining

- /

- AIM:ALL

3 UK Penny Stocks With Market Caps Under £90M

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index experiencing a downturn due to weak trade data from China, highlighting global economic uncertainties. In such conditions, investors often turn their attention to smaller companies that may offer unique opportunities for growth. Penny stocks, though an older term, still represent a segment of the market where smaller or newer companies can provide both affordability and potential upside when supported by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Tristel (AIM:TSTL) | £3.50 | £173.92M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.865 | £459.28M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.28 | £323.7M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.135 | £800.61M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.235 | £409.76M | ★★★★☆☆ |

| Supreme (AIM:SUP) | £1.41 | £163.26M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.42 | £121.65M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.414 | £216.54M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.49 | £190.39M | ★★★★★☆ |

| Serabi Gold (AIM:SRB) | £0.915 | £67.71M | ★★★★★★ |

Click here to see the full list of 476 stocks from our UK Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Atlantic Lithium (AIM:ALL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Atlantic Lithium Limited is involved in the exploration and development of mineral properties in Australia, Ivory Coast, and Ghana with a market cap of £78.22 million.

Operations: The company generates revenue of A$0.72 million from its exploration activities for base and precious metals.

Market Cap: £78.22M

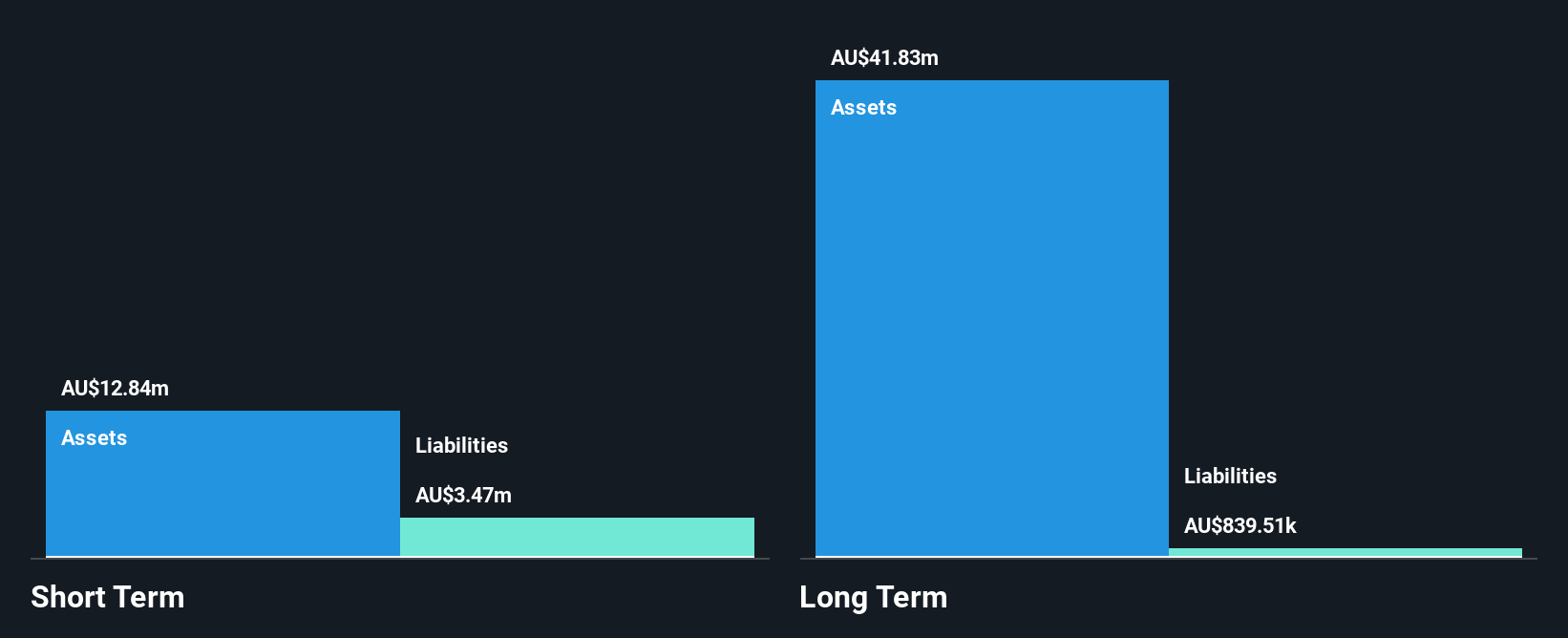

Atlantic Lithium Limited, with a market cap of £78.22 million, is a pre-revenue company focused on mineral exploration in Australia and Africa. Recent developments include securing key permits for its Ewoyaa Lithium Project in Ghana, marking significant progress towards construction commencement. However, the company remains unprofitable with net losses widening to A$12.65 million for the year ending June 2024. Despite having no debt and short-term assets exceeding liabilities, shareholder dilution occurred following a recent A$10 million equity offering to bolster its cash runway beyond the current four months based on free cash flow estimates.

- Unlock comprehensive insights into our analysis of Atlantic Lithium stock in this financial health report.

- Assess Atlantic Lithium's future earnings estimates with our detailed growth reports.

Staffline Group (AIM:STAF)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Staffline Group plc offers recruitment, outsourced human resource services, and skills and employment training in the UK and Ireland, with a market cap of £37.19 million.

Operations: The company's revenue is derived from three segments: PeoplePlus contributing £66 million, Recruitment GB generating £814.8 million, and Recruitment Ireland providing £107.6 million.

Market Cap: £37.19M

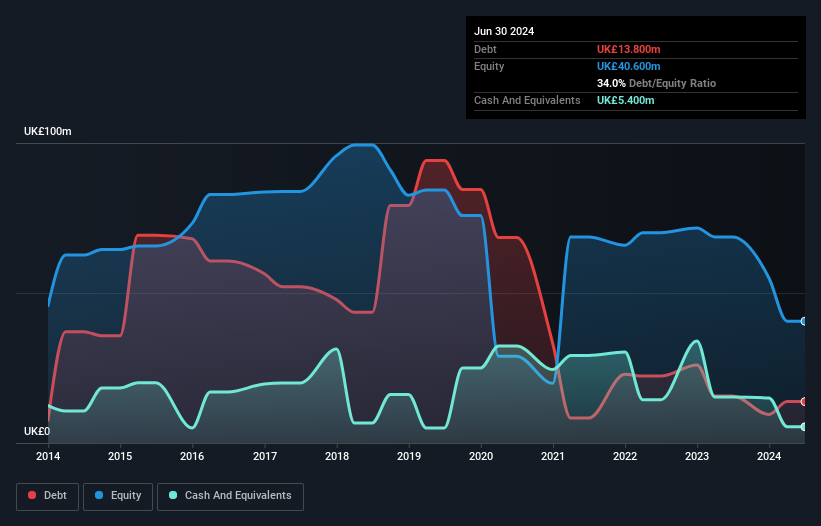

Staffline Group plc, with a market cap of £37.19 million, operates in recruitment and HR services across the UK and Ireland. Despite being unprofitable, it has reduced its debt to equity ratio significantly over five years to 34% and maintains a satisfactory net debt to equity ratio of 20.7%. Short-term assets (£147.4M) fall short of covering short-term liabilities (£158.3M), yet the company boasts a cash runway exceeding three years due to positive free cash flow. Recent earnings showed increased sales at £480.2 million but also widened net losses of £12.3 million for the half year ending June 2024.

- Click here to discover the nuances of Staffline Group with our detailed analytical financial health report.

- Gain insights into Staffline Group's future direction by reviewing our growth report.

Tribal Group (AIM:TRB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tribal Group plc, with a market cap of £88.83 million, provides software and services to education institutions worldwide through its subsidiaries.

Operations: The company generates revenue through its Education Services segment, which accounts for £17.24 million, and its Student Information Systems (SIS) segment, contributing £70.08 million.

Market Cap: £88.83M

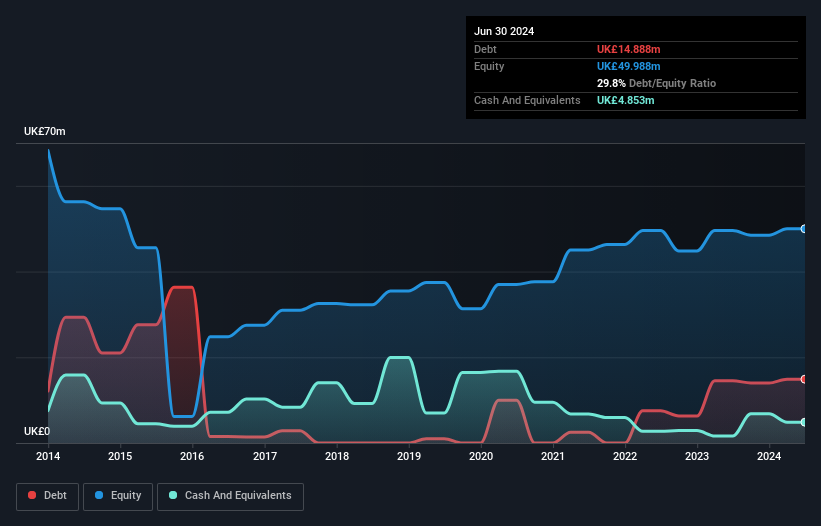

Tribal Group plc, with a market cap of £88.83 million, has shown stable weekly volatility over the past year and maintains a satisfactory net debt to equity ratio of 20.1%. The company's revenue for the half-year ending June 2024 was £44.94 million, but net income declined to £1.35 million from £4.72 million previously, impacted by a significant one-off loss of £4 million. Despite negative earnings growth last year and low return on equity at 3.9%, earnings are forecasted to grow substantially annually by 35.84%. Short-term assets do not cover short-term liabilities; however, long-term liabilities are well covered by short-term assets (£22.8M).

- Click to explore a detailed breakdown of our findings in Tribal Group's financial health report.

- Learn about Tribal Group's future growth trajectory here.

Taking Advantage

- Navigate through the entire inventory of 476 UK Penny Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:ALL

Atlantic Lithium

Engages in the exploration and development of mineral properties in Australia, Ivory Coast, and Ghana.

Flawless balance sheet moderate.

Similar Companies

Market Insights

Community Narratives