- United Kingdom

- /

- Pharma

- /

- AIM:FUM

UK Penny Stocks: 3 Promising Picks With Over £40M Market Cap

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index slipping due to weak trade data from China, highlighting global economic uncertainties. Despite these broader market fluctuations, investors can still find promising opportunities in smaller companies that offer potential for growth. Penny stocks, though an older term, remain a relevant investment area when backed by strong financials; they can provide hidden value and growth prospects often overlooked by larger firms.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.94 | £149.81M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.965 | £478.61M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.08 | £329.61M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.38 | £336.16M | ★★★★☆☆ |

| Foresight Group Holdings (LSE:FSG) | £4.05 | £460.22M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.285 | £861.02M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.23 | £159.09M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £4.70 | £89.64M | ★★★★☆☆ |

| Van Elle Holdings (AIM:VANL) | £0.38 | £41.12M | ★★★★★★ |

| QinetiQ Group (LSE:QQ.) | £3.684 | £2.05B | ★★★★★☆ |

Click here to see the full list of 443 stocks from our UK Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Futura Medical (AIM:FUM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Futura Medical plc researches, develops, and sells pharmaceutical and healthcare products for sexual health, with a market cap of £43.72 million.

Operations: The company generates revenue of £8.40 million from the development and commercialisation of MED3000, a pharmaceutical product for sexual health.

Market Cap: £43.72M

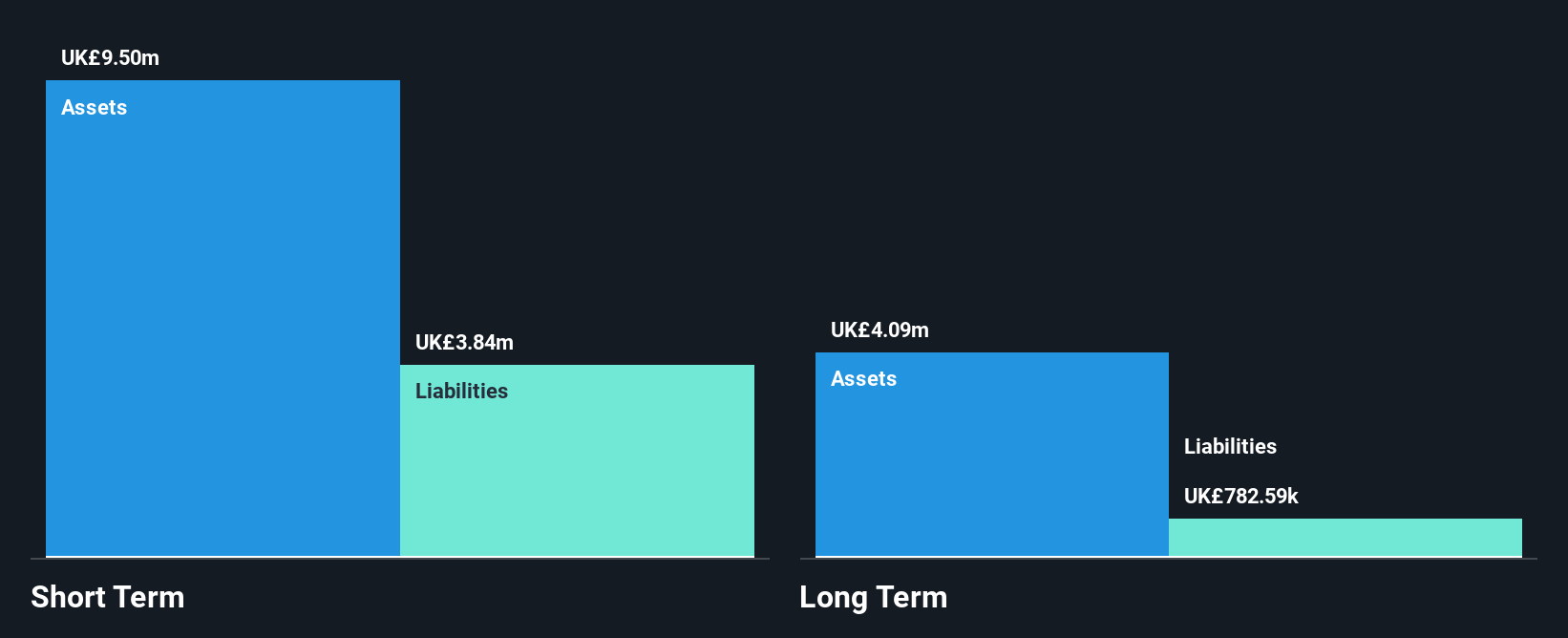

Futura Medical, with a market cap of £43.72 million, is navigating the challenges common to penny stocks. Despite being unprofitable, it has reduced losses by 6.8% annually over five years and remains debt-free with short-term assets covering liabilities. The company recently announced positive results from its WSD4000 study for sexual dysfunction treatment in women, indicating potential for future growth. However, it faces high share price volatility and limited cash runway under a year. Analysts expect significant stock price appreciation and earnings growth despite current unprofitability and negative return on equity at -48.05%.

- Navigate through the intricacies of Futura Medical with our comprehensive balance sheet health report here.

- Learn about Futura Medical's future growth trajectory here.

Nexteq (AIM:NXQ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nexteq plc is a business-to-business technology design and supply chain partner for industrial equipment manufacturers across North America, Europe, Asia, Australia, the rest of the United Kingdom, and internationally with a market cap of £43.40 million.

Operations: The company generates revenue through its Quixant segment, contributing $65.87 million, and its Densitron segment, which accounts for $40.42 million.

Market Cap: £43.4M

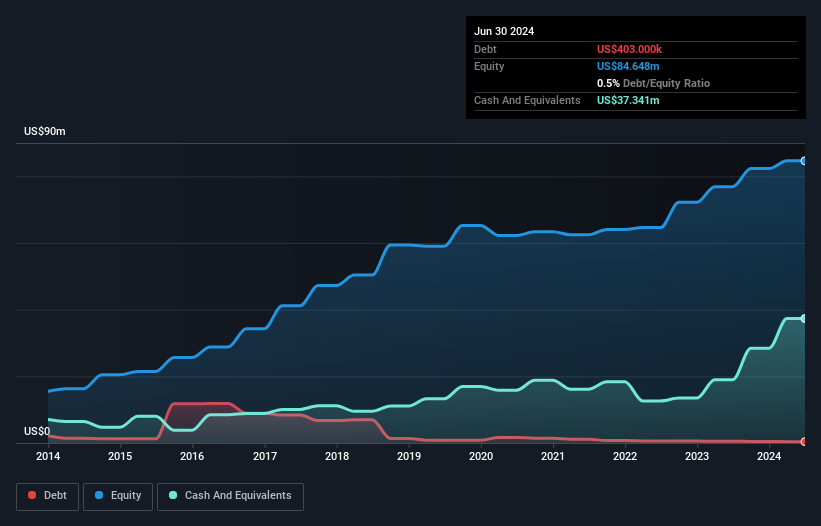

Nexteq plc, with a market cap of £43.40 million, presents a mixed picture typical of penny stocks. The company has strong revenue streams from its Quixant and Densitron segments, totaling over US$106 million. Despite stable weekly volatility and no recent shareholder dilution, Nexteq faces challenges such as declining earnings growth and an inexperienced management team with a 0.5-year tenure average. While short-term assets significantly exceed liabilities and debt is well covered by cash flow, the forecasted decline in earnings by 106% annually over the next three years raises concerns about future profitability prospects.

- Get an in-depth perspective on Nexteq's performance by reading our balance sheet health report here.

- Gain insights into Nexteq's future direction by reviewing our growth report.

Focusrite (AIM:TUNE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Focusrite plc develops, manufactures, and markets professional audio and electronic music products globally, with a market cap of £109.33 million.

Operations: Focusrite's revenue is primarily derived from its Focusrite segment (£60.28 million), with additional contributions from Martin Audio (£47.71 million), ADAM Audio (£22.61 million), Novation (£16.26 million), Sequential (£9.71 million), and Sonnox (£1.97 million).

Market Cap: £109.33M

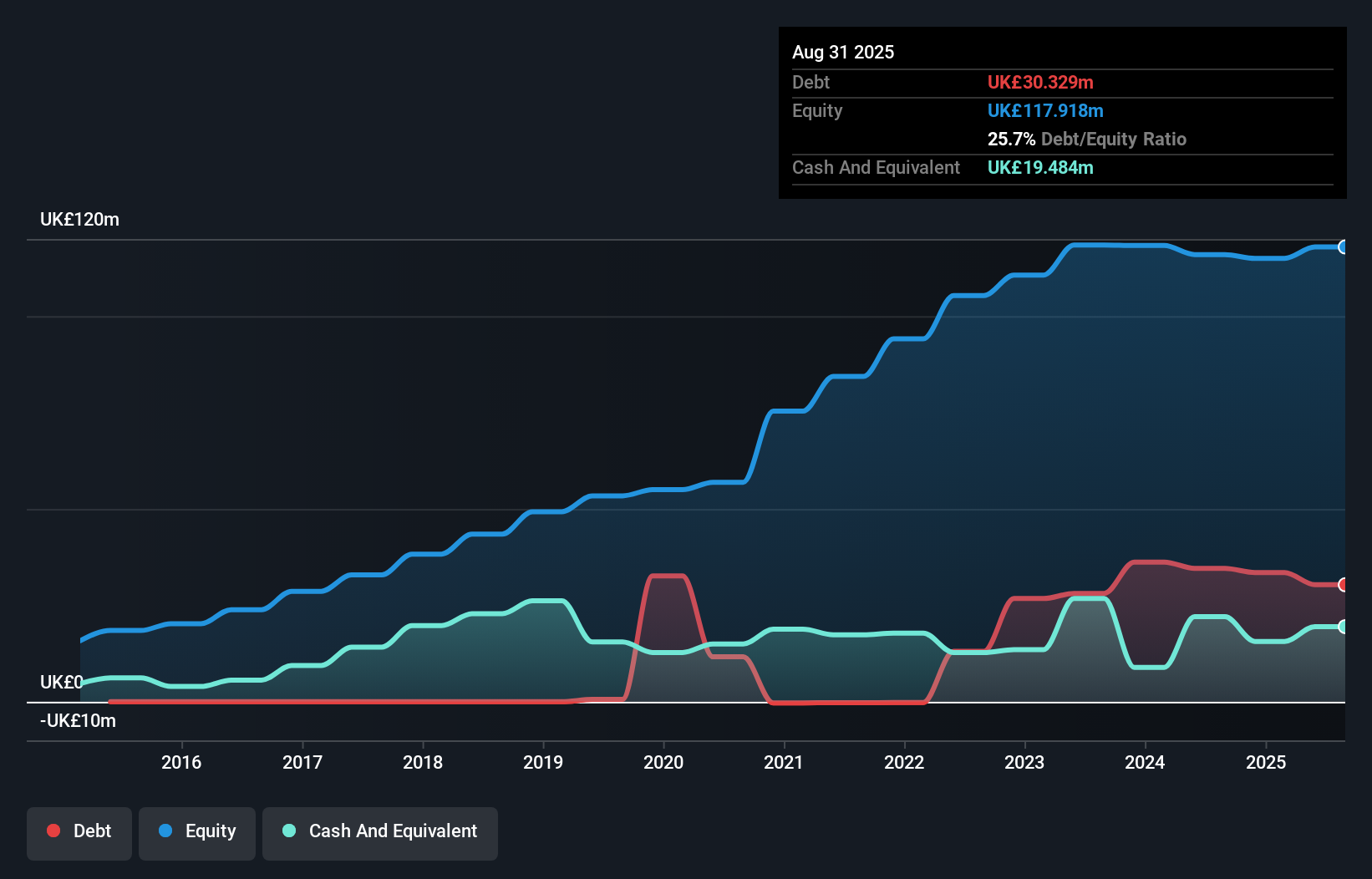

Focusrite plc, with a market cap of £109.33 million, displays characteristics common to penny stocks. The company has robust revenue streams across its segments, yet recent financial results reveal challenges. Sales decreased from £178.47 million to £158.52 million year-over-year, and net income dropped significantly from £17.8 million to £2.61 million due to a large one-off loss impacting earnings quality. Despite this, Focusrite maintains strong short-term asset coverage over liabilities and satisfactory debt levels relative to equity (10.8%). Analysts anticipate substantial stock price appreciation by 121%, though low profit margins (1.6%) and dividend sustainability concerns persist amidst experienced management oversight.

- Click to explore a detailed breakdown of our findings in Focusrite's financial health report.

- Explore Focusrite's analyst forecasts in our growth report.

Summing It All Up

- Unlock our comprehensive list of 443 UK Penny Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FUM

Futura Medical

Research, develops, and sells pharmaceutical and healthcare products for sexual health.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives