- United Kingdom

- /

- Food and Staples Retail

- /

- LSE:TSCO

Tesco (LSE:TSCO) Announces Leadership Changes With New CEO And Strategy Officer

Reviewed by Simply Wall St

Tesco (LSE:TSCO) recently experienced a significant leadership shuffle with Matthew Barnes stepping down, Ashwin Prasad poised to take over as UK CEO, and new executive roles being established. These leadership changes, aimed at guiding Tesco's strategy and transformation, coincided with the company's 7% share price increase over the past month. This upward movement stands out against the broader market, which recorded a 1% decline amid economic uncertainties and fluctuating bond yields. The executive transitions at Tesco likely provided a counterbalance to the broader market's negative trends, showcasing investor confidence in the company's future direction.

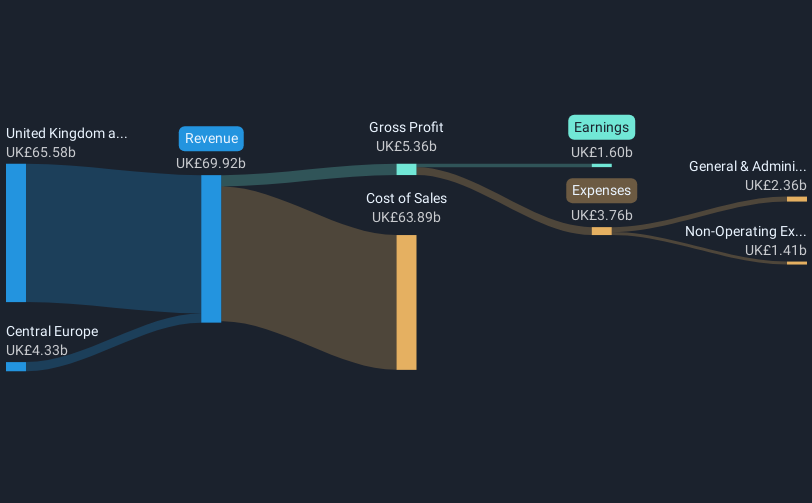

The recent leadership restructuring at Tesco, with Ashwin Prasad stepping up as UK CEO, aligns with the company's efforts to enhance its strategic direction, potentially impacting future revenue and earnings positively. The executive changes might amplify the company's focus on customer satisfaction and operational efficiency, boosting their digital investments and personalized strategies like Clubcard offers. This could influence Tesco's forecasted revenue growth of 2.3% annually and the expected increase in profit margins to 2.5% over the next three years.

Over the past five years, Tesco has delivered a total shareholder return of 104.96%, a substantial achievement highlighting the company's resilience and market standing. In the past year, the share price not only saw a 7% increase in the short term but has also outperformed the UK Consumer Retailing industry, which returned 16.1% over the same period. This performance underscores investor confidence despite broader market uncertainties.

With a current share price of £3.71, Tesco is trading slightly below the consensus analyst price target of £3.80, a differential that suggests analysts view the stock as fairly valued. The modest deviation between the share price and target may reflect confidence in the company's future growth prospects amidst the evolving retail landscape, underpinned by their continued focus on digital expansion and operational efficiencies.

Evaluate Tesco's historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Tesco, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tesco might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:TSCO

Tesco

Operates as a grocery retailer in the United Kingdom, Republic of Ireland, the Czech Republic, Slovakia, and Hungary.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives