- United Kingdom

- /

- Food and Staples Retail

- /

- LSE:SBRY

Top 3 UK Dividend Stocks To Consider

Reviewed by Simply Wall St

In recent trading sessions, the UK's FTSE 100 index has faced downward pressure, primarily influenced by weak trade data from China and its impact on global markets. As the economic landscape remains uncertain, investors often turn to dividend stocks for their potential to provide a steady income stream even in volatile conditions. In this article, we explore three UK dividend stocks that may offer attractive yields amid these challenging market dynamics.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| WPP (LSE:WPP) | 9.36% | ★★★★★★ |

| Treatt (LSE:TET) | 3.36% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 6.03% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.76% | ★★★★★☆ |

| Man Group (LSE:EMG) | 7.30% | ★★★★★☆ |

| Keller Group (LSE:KLR) | 3.54% | ★★★★★☆ |

| IG Group Holdings (LSE:IGG) | 4.31% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 4.07% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 7.01% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 4.70% | ★★★★★☆ |

Click here to see the full list of 57 stocks from our Top UK Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

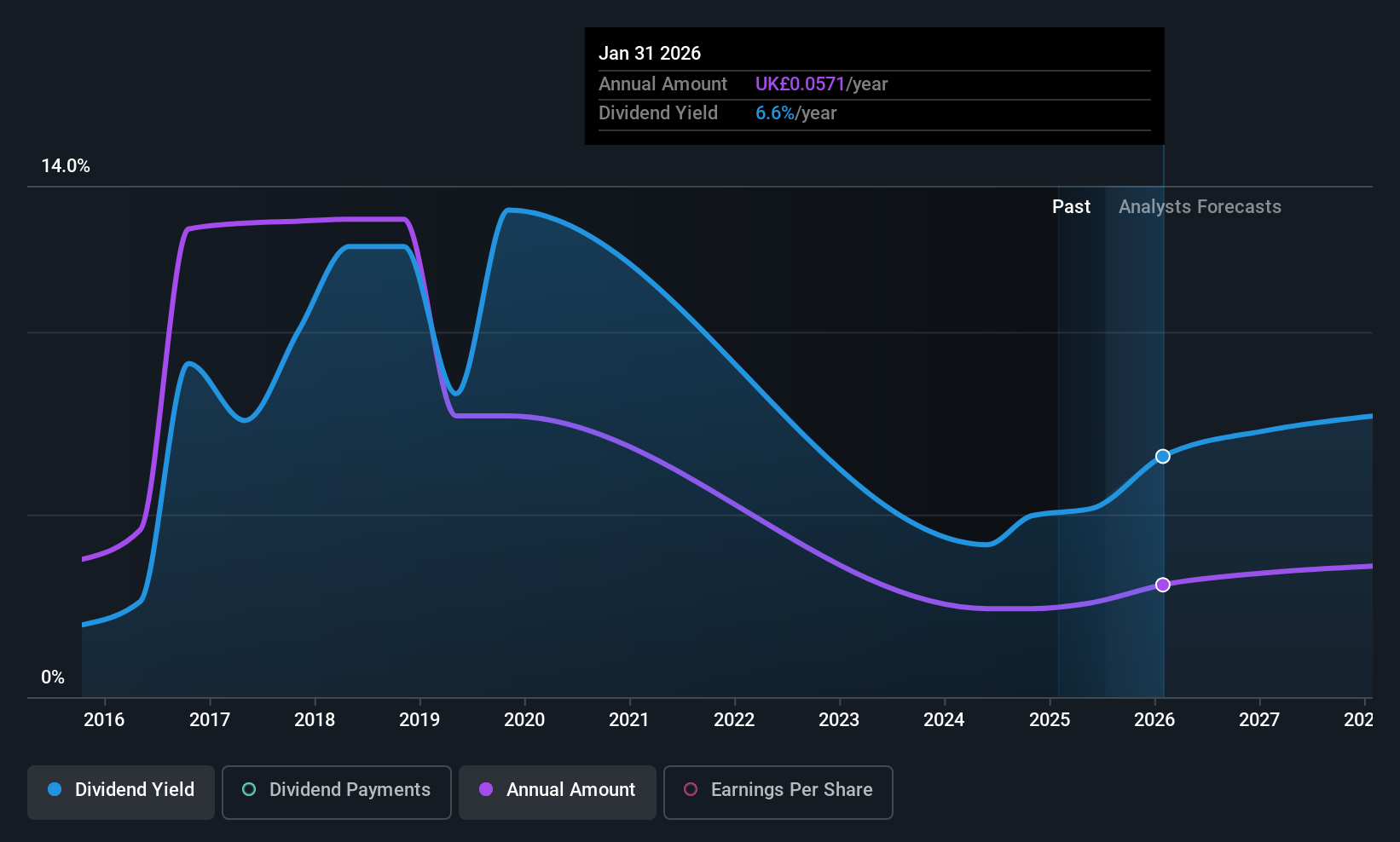

Card Factory (LSE:CARD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Card Factory plc is a specialist retailer of cards, gifts, and celebration essentials with operations in the United Kingdom, South Africa, Republic of Ireland, the United States, and internationally; it has a market cap of £307.68 million.

Operations: Card Factory plc generates revenue through its segments, including Cardfactory Stores (£506.80 million), Partnerships (£22.20 million), and Cardfactory Online, which includes Getting Personal (£13.20 million).

Dividend Yield: 5.5%

Card Factory's dividend, proposed at 3.6 pence per share, is well-covered by both earnings and cash flows, with payout ratios of 34.8% and 23.8%, respectively. Despite trading at a significant discount to its estimated fair value, the stock's dividend yield slightly lags behind top-tier UK payers. However, the company's dividends have been volatile over the past decade despite recent increases in payments. The upcoming AGM will confirm this year's final dividend payment on June 27th.

- Click to explore a detailed breakdown of our findings in Card Factory's dividend report.

- Our comprehensive valuation report raises the possibility that Card Factory is priced lower than what may be justified by its financials.

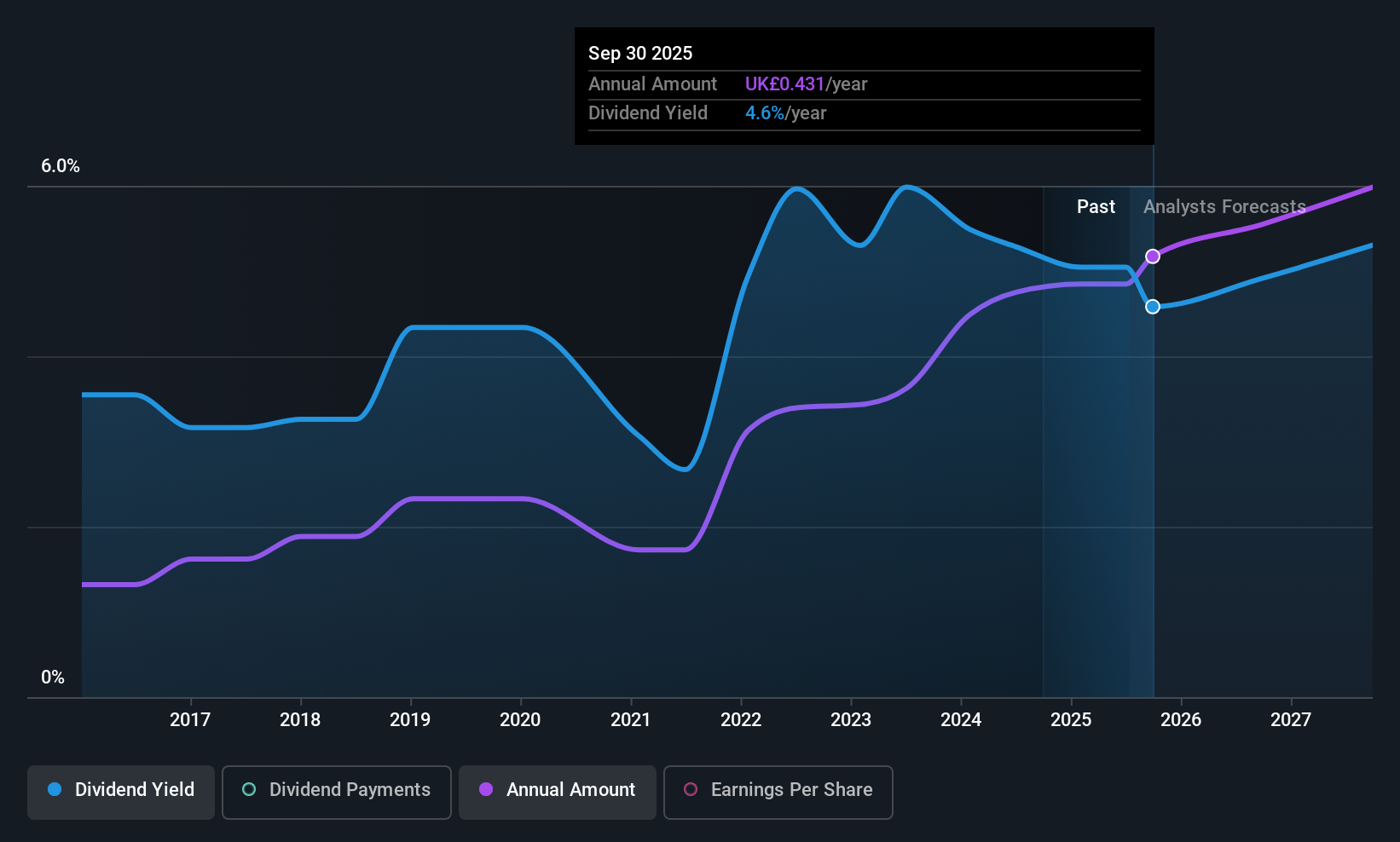

Paragon Banking Group (LSE:PAG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Paragon Banking Group PLC offers financial products and services in the United Kingdom, with a market cap of £1.82 billion.

Operations: Paragon Banking Group PLC generates revenue through its Mortgage Lending segment (£278.30 million) and Commercial Lending segment (£106.80 million) in the UK.

Dividend Yield: 4.3%

Paragon Banking Group's interim dividend of £0.136 per share, payable on July 25, 2025, is well-supported by a low payout ratio of 40.6% and cash flow coverage at 17.8%. Despite recent growth in payments, the dividend history has been volatile over the past decade. The company trades below estimated fair value and has initiated a buyback program for up to 20.5 million shares, enhancing shareholder returns amidst steady earnings growth reported for H1 2025.

- Click here and access our complete dividend analysis report to understand the dynamics of Paragon Banking Group.

- In light of our recent valuation report, it seems possible that Paragon Banking Group is trading behind its estimated value.

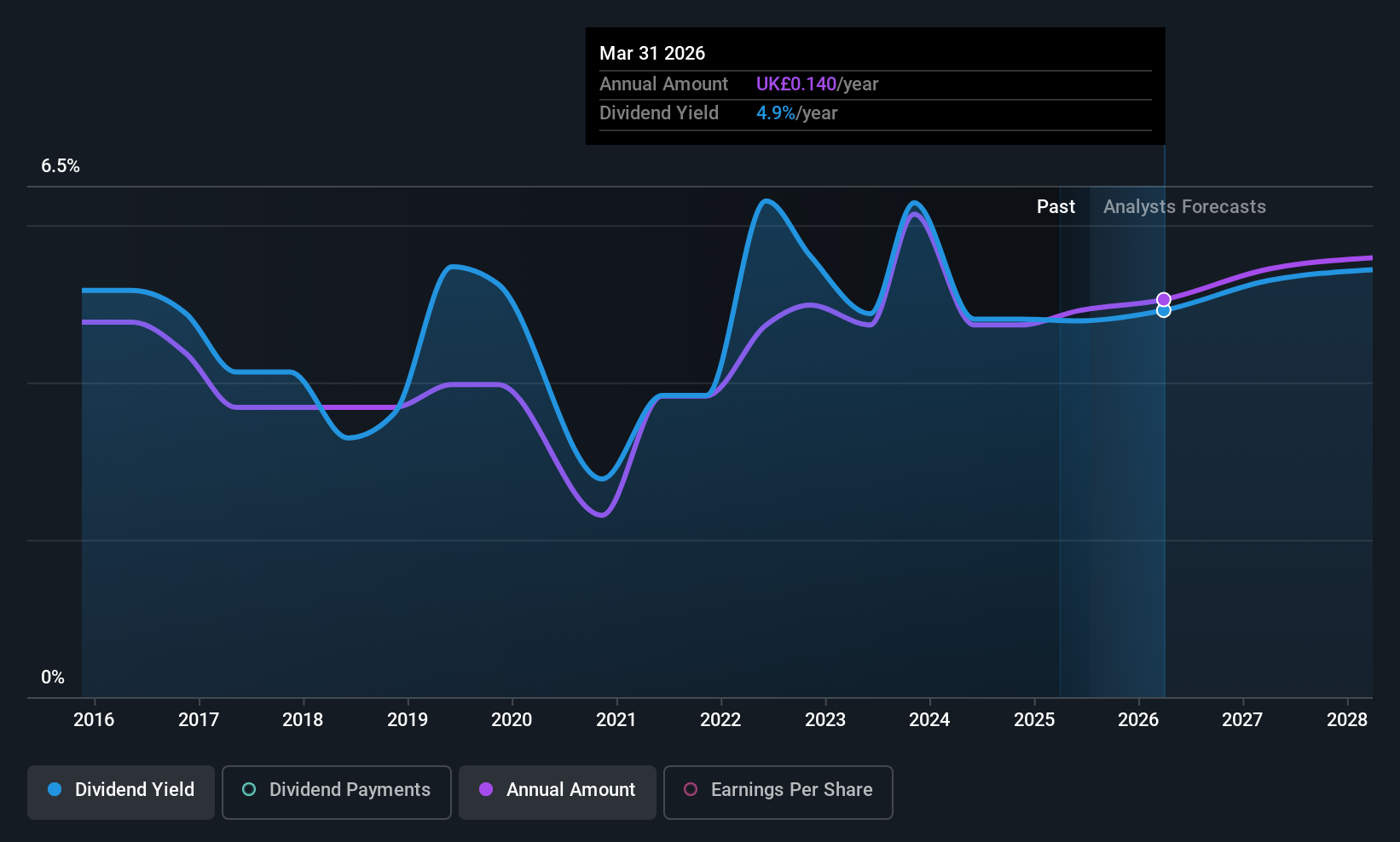

J Sainsbury (LSE:SBRY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: J Sainsbury plc operates in the United Kingdom, focusing on food, general merchandise and clothing retailing, as well as financial services, with a market cap of approximately £6.33 billion.

Operations: J Sainsbury plc generates revenue primarily from its retail segment, amounting to £32.63 billion, and also from financial services, which contribute £182 million.

Dividend Yield: 4.9%

J Sainsbury's recent dividend increase to 9.7 pence per share reflects a commitment to progressive payouts, supported by a sustainable payout ratio of 75.5% and cash flow coverage at 27.5%. Despite past volatility in dividends, the company plans a special dividend from bank disposal proceeds alongside an ongoing buyback program worth £200 million. Sales growth and stable earnings guidance further bolster its position, though insider selling raises potential concerns for investors.

- Take a closer look at J Sainsbury's potential here in our dividend report.

- According our valuation report, there's an indication that J Sainsbury's share price might be on the cheaper side.

Turning Ideas Into Actions

- Navigate through the entire inventory of 57 Top UK Dividend Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SBRY

J Sainsbury

Engages in the food, general merchandise and clothing retailing, and financial services activities in the United Kingdom.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives