- United Kingdom

- /

- Food and Staples Retail

- /

- AIM:CBOX

Discover UK Penny Stocks For February 2025

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index declining due to weak trade data from China, highlighting the interconnectedness of global economies. Despite these broader market fluctuations, investors often find value in exploring smaller or newer companies. Penny stocks, while an outdated term, remain a relevant investment area for those seeking growth opportunities and financial resilience in less prominent sectors.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.96 | £152.99M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.855 | £468.01M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £3.95 | £319.11M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.95 | £448.86M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.09 | £307.32M | ★★★★☆☆ |

| ME Group International (LSE:MEGP) | £2.185 | £823.34M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.25 | £160.52M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £4.23 | £80.67M | ★★★★☆☆ |

| Van Elle Holdings (AIM:VANL) | £0.38 | £41.12M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £0.866 | £73.51M | ★★★★★★ |

Click here to see the full list of 442 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Cake Box Holdings (AIM:CBOX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cake Box Holdings Plc, with a market cap of £82 million, operates in the United Kingdom retailing fresh cream celebration cakes through its subsidiaries.

Operations: The company generates revenue through its food processing segment, which amounts to £38.62 million.

Market Cap: £82M

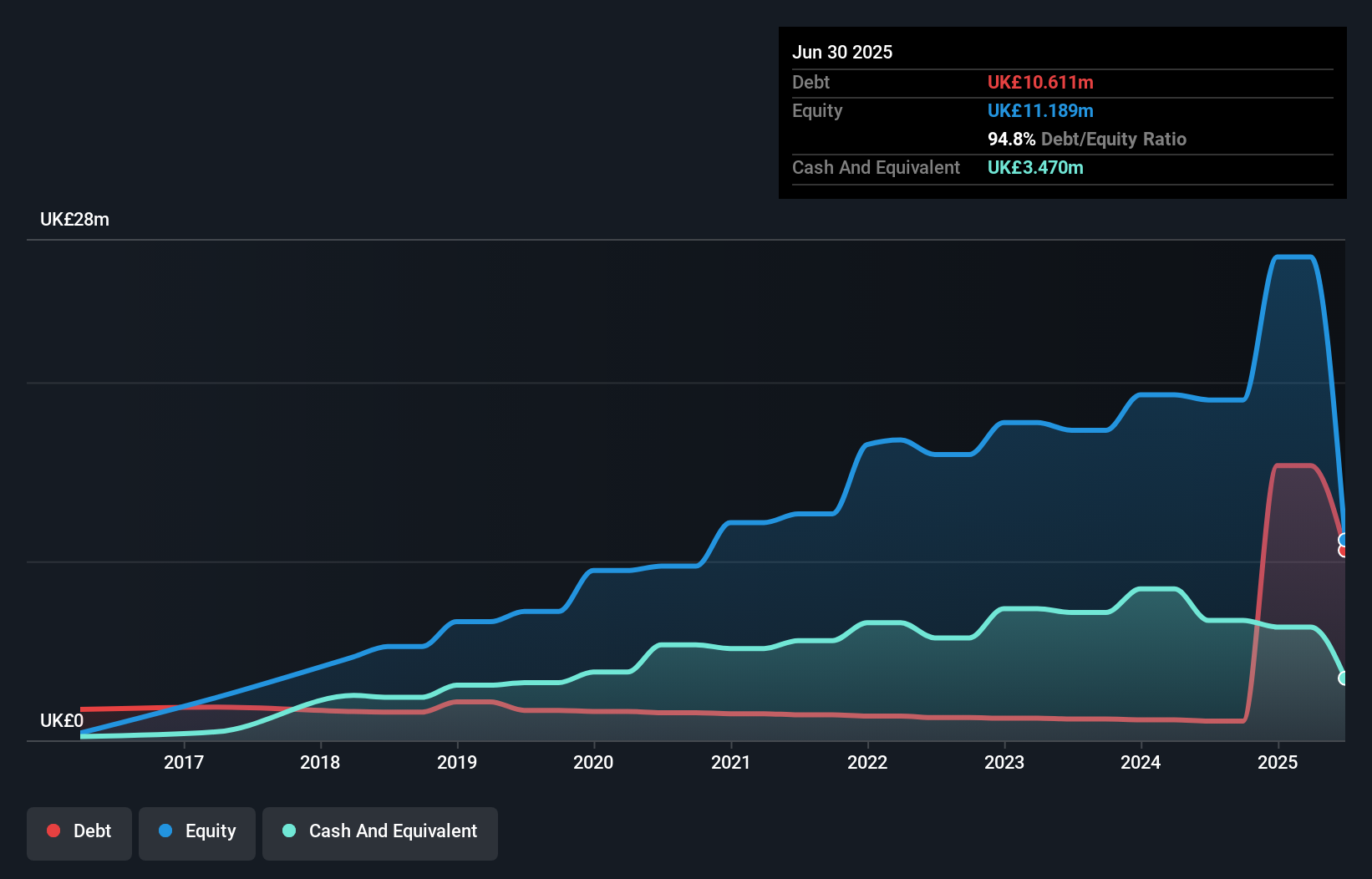

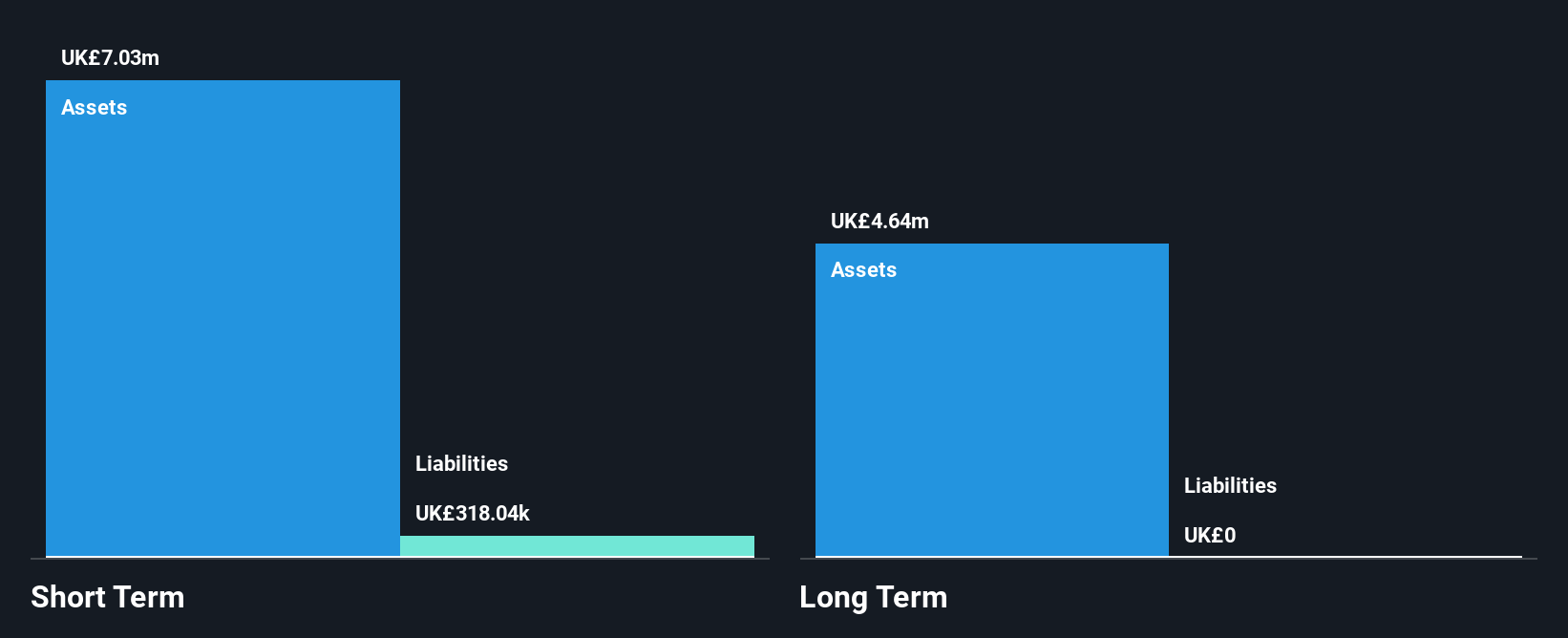

Cake Box Holdings Plc, with a market cap of £82 million, is noteworthy for its stable financial foundation in the penny stock arena. The company has demonstrated high-quality past earnings and has reduced its debt to equity ratio significantly over five years. Its management and board are seasoned, with average tenures suggesting stability. While earnings growth (9.3%) lags behind industry standards, Cake Box maintains a strong return on equity at 26% and covers short-term liabilities effectively with assets (£13.6M). Recent board appointments may further strengthen governance as the company continues to navigate competitive market conditions.

- Dive into the specifics of Cake Box Holdings here with our thorough balance sheet health report.

- Understand Cake Box Holdings' earnings outlook by examining our growth report.

Empire Metals (AIM:EEE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Empire Metals Limited is involved in the exploration and development of properties in the United Kingdom, Australia, and Austria with a market cap of £60.28 million.

Operations: Empire Metals Limited does not have any reported revenue segments.

Market Cap: £60.28M

Empire Metals Limited, with a market cap of £60.28 million, remains pre-revenue as it focuses on exploration activities in Australia and beyond. Recent developments include the initiation of a significant drilling campaign at their Pitfield Project targeting high-grade titanium mineralisation zones. This effort aims to expedite the development of a Mineral Resource Estimate by collecting extensive metallurgical samples for testing. The addition of Phillip Brumit to the board brings valuable mining industry expertise that could benefit project execution. Despite its unprofitable status and volatile share price, Empire Metals is debt-free with sufficient cash runway for short-term operations.

- Take a closer look at Empire Metals' potential here in our financial health report.

- Gain insights into Empire Metals' past trends and performance with our report on the company's historical track record.

Irish Continental Group (LSE:ICGC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Irish Continental Group plc operates as a maritime transport company with a market cap of £750.49 million.

Operations: The company generates revenue through its Ferries segment, which accounts for €430.1 million, and its Container and Terminal operations, contributing €195.8 million.

Market Cap: £750.49M

Irish Continental Group plc, with a market cap of £750.49 million, shows resilience as a penny stock through its robust revenue streams from Ferries (€430.1 million) and Container operations (€195.8 million). The company has effectively reduced its debt to equity ratio from 76% to 53.5% over five years, with operating cash flow covering 80.7% of its debt. While short-term liabilities exceed assets, the company's Return on Equity is high at 22.3%, and it trades below fair value estimates by 15.8%. Despite an unstable dividend track record, ICGC's seasoned management supports stable operations amidst industry challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of Irish Continental Group.

- Gain insights into Irish Continental Group's outlook and expected performance with our report on the company's earnings estimates.

Summing It All Up

- Discover the full array of 442 UK Penny Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CBOX

Cake Box Holdings

Engages in the retail of fresh cream celebration cakes in the United Kingdom.

Outstanding track record and good value.

Market Insights

Community Narratives