- United Kingdom

- /

- Food and Staples Retail

- /

- AIM:CBOX

Cake Box Holdings' (LON:CBOX) Sluggish Earnings Might Be Just The Beginning Of Its Problems

Cake Box Holdings Plc's (LON:CBOX) recent weak earnings report didn't cause a big stock movement. We think that investors are worried about some weaknesses underlying the earnings.

A Closer Look At Cake Box Holdings' Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

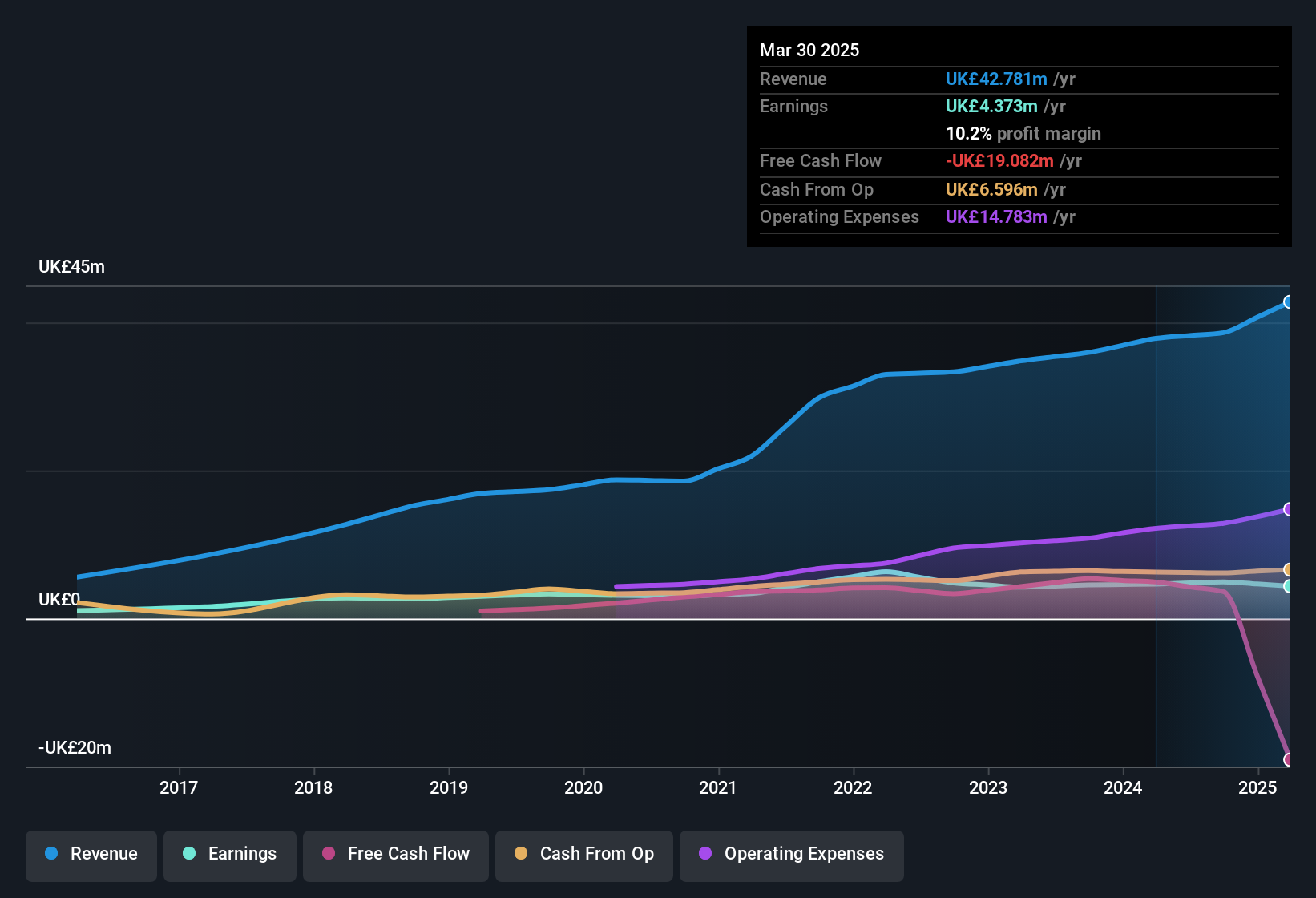

Cake Box Holdings has an accrual ratio of 0.98 for the year to March 2025. As a general rule, that bodes poorly for future profitability. To wit, the company did not generate one whit of free cashflow in that time. Over the last year it actually had negative free cash flow of UK£19m, in contrast to the aforementioned profit of UK£4.37m. It's worth noting that Cake Box Holdings generated positive FCF of UK£4.9m a year ago, so at least they've done it in the past. Having said that, there is more to consider. We must also consider the impact of unusual items on statutory profit (and thus the accrual ratio), as well as note the ramifications of the company issuing new shares. The good news for shareholders is that Cake Box Holdings' accrual ratio was much better last year, so this year's poor reading might simply be a case of a short term mismatch between profit and FCF. As a result, some shareholders may be looking for stronger cash conversion in the current year.

See our latest analysis for Cake Box Holdings

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. Cake Box Holdings expanded the number of shares on issue by 10.0% over the last year. As a result, its net income is now split between a greater number of shares. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. Check out Cake Box Holdings' historical EPS growth by clicking on this link.

A Look At The Impact Of Cake Box Holdings' Dilution On Its Earnings Per Share (EPS)

Cake Box Holdings' net profit dropped by 31% per year over the last three years. Even looking at the last year, profit was still down 6.1%. Like a sack of potatoes thrown from a delivery truck, EPS fell harder, down 6.4% in the same period. So you can see that the dilution has had a bit of an impact on shareholders.

In the long term, if Cake Box Holdings' earnings per share can increase, then the share price should too. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

How Do Unusual Items Influence Profit?

Unfortunately (in the short term) Cake Box Holdings saw its profit reduced by unusual items worth UK£920k. If this was a non-cash charge, it would have made the accrual ratio better, if cashflow had stayed strong, so it's not great to see in combination with an uninspiring accrual ratio. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And, after all, that's exactly what the accounting terminology implies. If Cake Box Holdings doesn't see those unusual expenses repeat, then all else being equal we'd expect its profit to increase over the coming year.

Our Take On Cake Box Holdings' Profit Performance

In conclusion, Cake Box Holdings' accrual ratio suggests that its statutory earnings are not backed by cash flow; but the fact unusual items actually weighed on profit may create upside if those unusual items to not recur. On top of that, the dilution means that shareholders now own less of the company. Considering all this we'd argue Cake Box Holdings' profits probably give an overly generous impression of its sustainable level of profitability. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. In terms of investment risks, we've identified 2 warning signs with Cake Box Holdings, and understanding them should be part of your investment process.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:CBOX

Cake Box Holdings

Engages in the retail of fresh cream celebration cakes in the United Kingdom.

Outstanding track record and good value.

Market Insights

Community Narratives