- United Kingdom

- /

- Consumer Durables

- /

- LSE:TW.

Taylor Wimpey (LSE:TW.) Valuation in Focus After Recent Share Price Rebound

Reviewed by Kshitija Bhandaru

See our latest analysis for Taylor Wimpey.

Taylor Wimpey’s 2.6% 1-month share price return may be catching the spotlight, but it comes after a tough stretch. Its year-to-date performance is still down, and the total shareholder return over the past year is a sobering -29.5%. While near-term momentum looks tentative, long-term investors who held on have still seen gains over three and five years as the housing market ebbs and flows.

If you’re eyeing opportunities beyond housebuilders, it could be the perfect time to expand your strategy and discover fast growing stocks with high insider ownership.

But after a rough year, with shares still trading well below analyst price targets, is Taylor Wimpey now looking undervalued? Or has the market fully accounted for its future prospects and growth risks?

Most Popular Narrative: 23.9% Undervalued

With Taylor Wimpey's fair value placed at £1.32, well above its latest closing price of £1.00, the market may be underestimating the company's long-term earnings power relative to analyst expectations. The most widely followed narrative suggests that operational strengths and regulatory catalysts set the stage for higher valuations if assumptions prove accurate.

Easing regulatory hurdles and a robust balance sheet enable expansion, increased completions, and sustainable shareholder returns with minimal additional capital needs. Ongoing safety costs, affordability barriers, market competition, planning delays, and mounting build inflation all threaten margins, revenue growth, and long-term earnings.

Curious how analyst expectations stack up against market reality? Shocking growth projections in revenue, profits, and future operating margins drive this valuation. The backbone of this fair value isn't just hope; it's built on ambitious financial targets and long-term industry trends. Want to uncover which numbers spark this optimism? The answer is one click away.

Result: Fair Value of £1.32 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent affordability challenges and unexpected build cost inflation could quickly undermine even optimistic forecasts. This may limit Taylor Wimpey’s recovery potential.

Find out about the key risks to this Taylor Wimpey narrative.

Another View: Is the Market Price Too High?

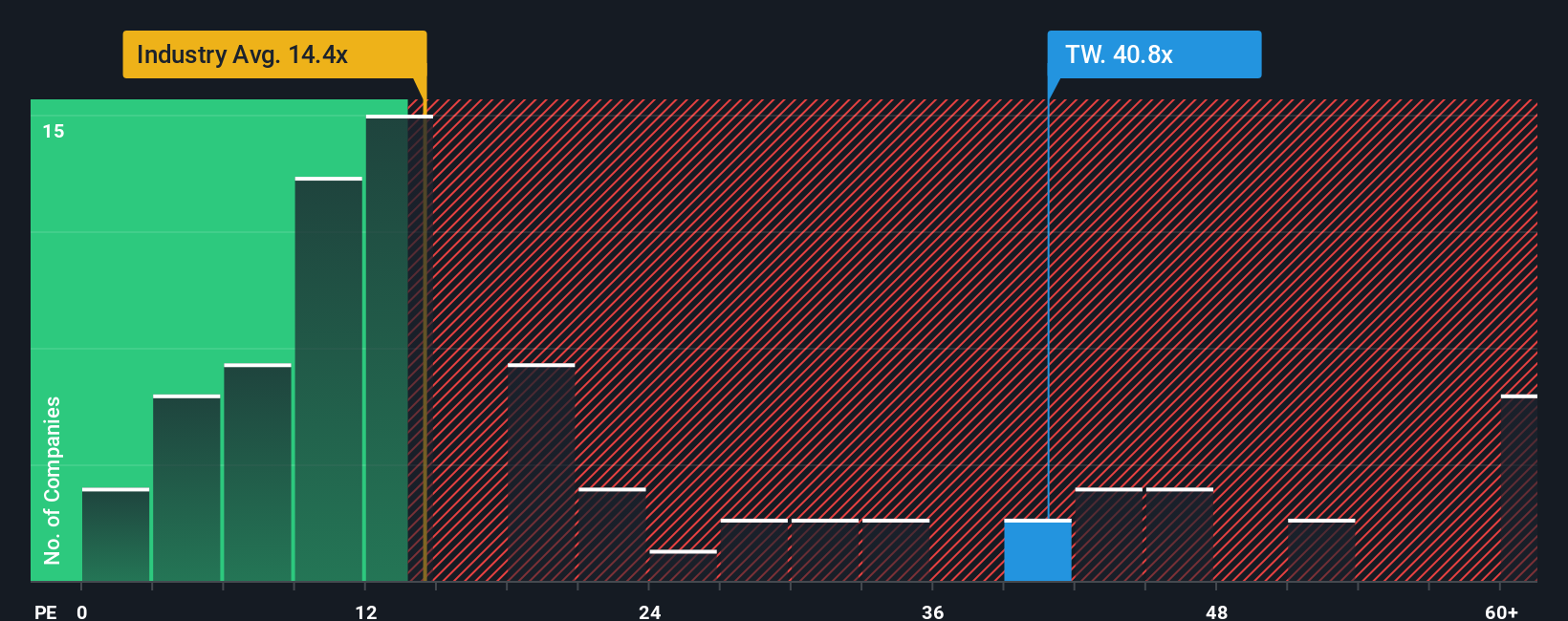

While the analyst narrative points to undervaluation, a closer look at the price-to-earnings ratio paints a different picture. Taylor Wimpey trades at 41.9 times earnings, which is more expensive than both its peer group average of 18 and the European industry average of 14.4. The fair ratio, calculated at 32.8, suggests the market may have priced in more optimism than is justified by fundamentals. Is there a risk the share price could still fall to meet more grounded expectations?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Taylor Wimpey Narrative

Prefer to dig into the numbers and form your own view? In just a few minutes, you can piece together your personal take. Do it your way.

A great starting point for your Taylor Wimpey research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why settle for the obvious when there are standout opportunities waiting? Level up your strategy with these focused stock shortlists that could put you ahead of the herd.

- Tap into robust income streams by checking out these 19 dividend stocks with yields > 3% offering attractive yields above 3%.

- Spot the potential game-changers in tech by investigating these 24 AI penny stocks, which includes companies at the forefront of artificial intelligence breakthroughs.

- Seize undervalued opportunities right now through these 893 undervalued stocks based on cash flows, based on strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taylor Wimpey might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:TW.

Taylor Wimpey

Operates as a homebuilder company in the United Kingdom and Spain.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives