- United Kingdom

- /

- Consumer Durables

- /

- LSE:TW.

Assessing Taylor Wimpey Shares After Latest UK Housing Market Confidence Boost

Reviewed by Bailey Pemberton

Wondering whether Taylor Wimpey is a smart move right now? You’re not alone; the stock’s recent twists and turns have left many investors scratching their heads. On one hand, the share price has taken a 15.1% hit since the start of the year and is still down a sharp 27.7% over the past 12 months. Yet, the story isn’t all gloom. Looking at a longer timeframe, Taylor Wimpey is still up 43.8% over the past three years, and 28.7% if you consider the five-year picture. This highlights the contrast between short-term volatility and long-term resilience.

This mixed performance in the market comes as the property sector navigates changing interest rates and evolving demand trends. While there has not been a single dramatic catalyst in recent weeks, broader confidence in the UK housing market seems to be slowly rebuilding, contributing to the 6.2% increase in the last month alone. Investors are clearly weighing fresh risks alongside renewed optimism, which makes understanding the company’s valuation especially important.

When we put Taylor Wimpey through six different valuation checks, it comes up undervalued in three of them, giving it a valuation score of 3. That result places it in the middle of the pack, which might be intriguing enough to warrant a closer look. In the next section, I will break down these valuation methods one by one, and also explore whether there is a smarter way to get a true sense of the company’s value.

Why Taylor Wimpey is lagging behind its peers

Approach 1: Taylor Wimpey Discounted Cash Flow (DCF) Analysis

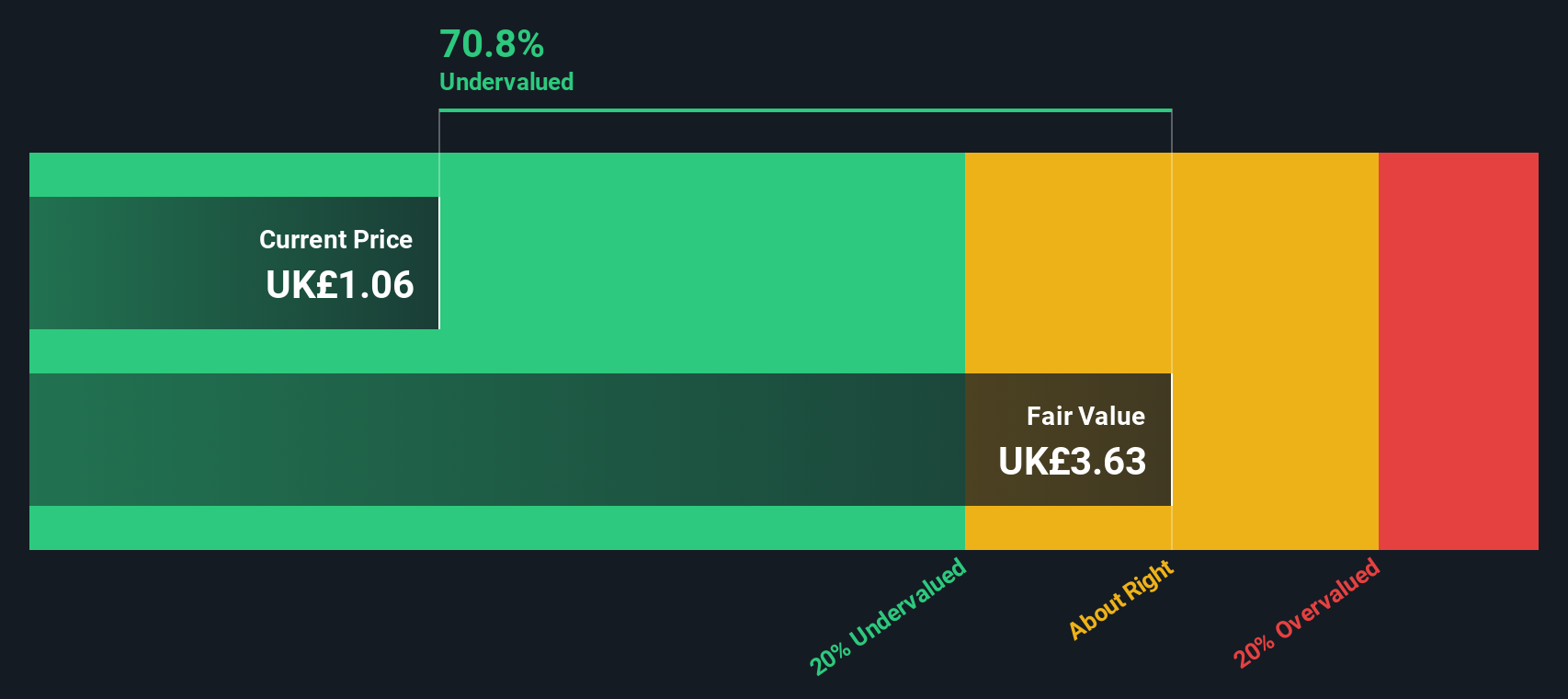

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting future cash flows and then discounting those future flows back to today’s value. In Taylor Wimpey’s case, this means looking at what the business is expected to generate in cash over the coming years and determining what that stream is worth right now in £.

The company’s most recent Free Cash Flow (FCF) stands at £65.1 million. Analysts provide forecasts for up to five years, after which additional projections are extrapolated. For example, Taylor Wimpey’s projected FCF in 2029 is £568.5 million. By 2035, estimates suggest FCF could surpass £1 billion. Such long-range numbers should be viewed as directional rather than certain. These future figures are discounted to reflect their present value, using the 2 Stage Free Cash Flow to Equity method for this analysis.

The resulting intrinsic value per share from this DCF process is £3.66. Compared with Taylor Wimpey’s current share price, the analysis implies the stock is trading at a 71.6% discount to its estimated fair value. In summary, this model points toward the shares being undervalued at current levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Taylor Wimpey is undervalued by 71.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Taylor Wimpey Price vs Earnings

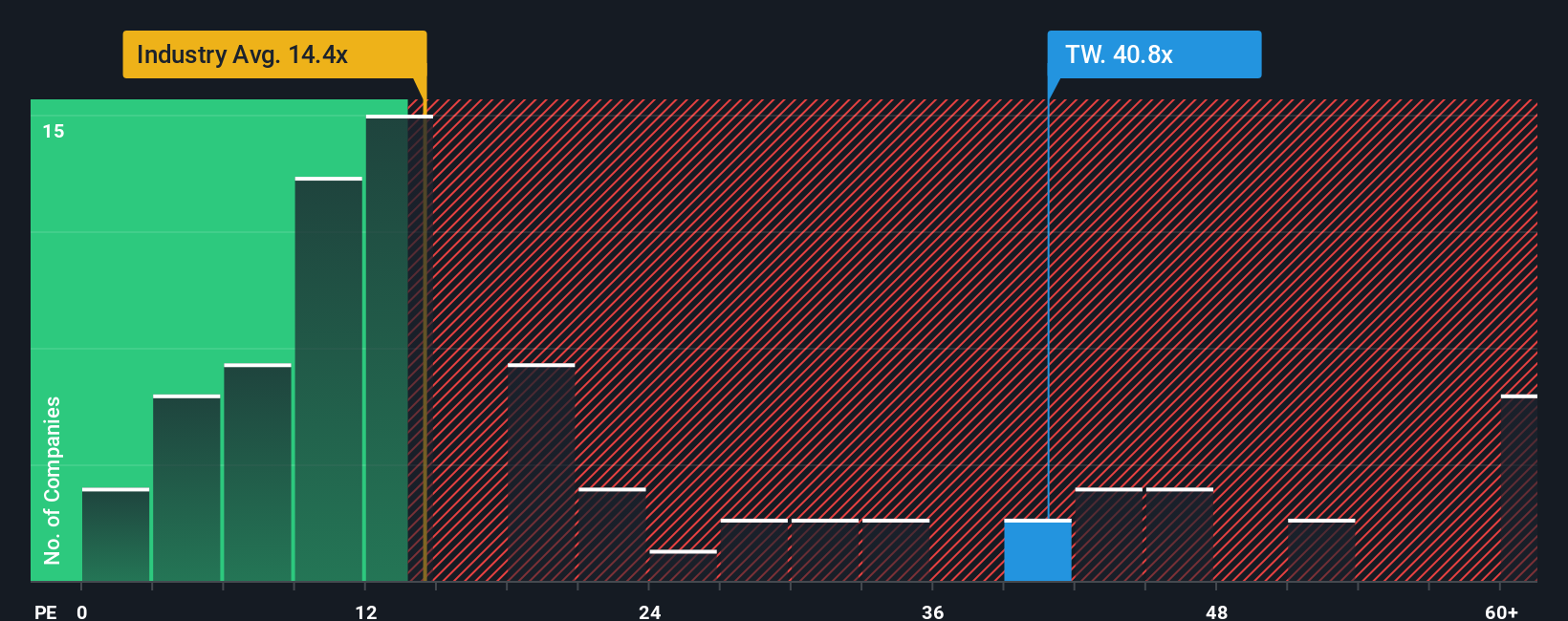

The Price-to-Earnings (PE) ratio is often the preferred valuation multiple for profitable companies because it links a company’s share price directly to its earnings, allowing investors to gauge how much they are paying for each pound of profit. Typically, higher expected growth rates and lower perceived risks will justify a higher PE ratio. Companies facing an uncertain outlook or earnings headwinds tend to trade at lower multiples.

Taylor Wimpey is currently trading at a PE ratio of 43.35x, which is well above the Consumer Durables industry average of 15.83x and the average for its direct peers at 18.40x. At first glance, this elevated PE might signal that investors expect robust earnings growth or see the company as lower risk relative to its rivals. However, comparing multiples like this can be misleading. Differences in growth prospects, profit margins, and company size can lead to wide variations in what is considered a “normal” PE for each company.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio for Taylor Wimpey is calculated at 32.91x. Unlike a straight industry or peer average, this proprietary metric accounts for factors such as the company’s earnings growth, risk profile, profit margins, industry, and market capitalization. It provides a more customized benchmark for what Taylor Wimpey’s PE ratio should be, given its specific strengths and risks.

Since Taylor Wimpey’s current PE of 43.35x is materially higher than its Fair Ratio (32.91x), this suggests the stock may be overvalued based on earnings. Investors could be paying a premium that is not fully justified by the underlying fundamentals right now.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Taylor Wimpey Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives—a smarter tool for making investment decisions that looks beyond just ratios and models. A Narrative is simply your story or perspective about a company, where you connect your own assumptions about Taylor Wimpey’s future revenues, margins and risks to a tailored fair value estimate, making the numbers more personal and meaningful. Narratives link the company’s story to a financial forecast, and then to a clear fair value, making it easy to see if you believe shares are a bargain or priced for perfection.

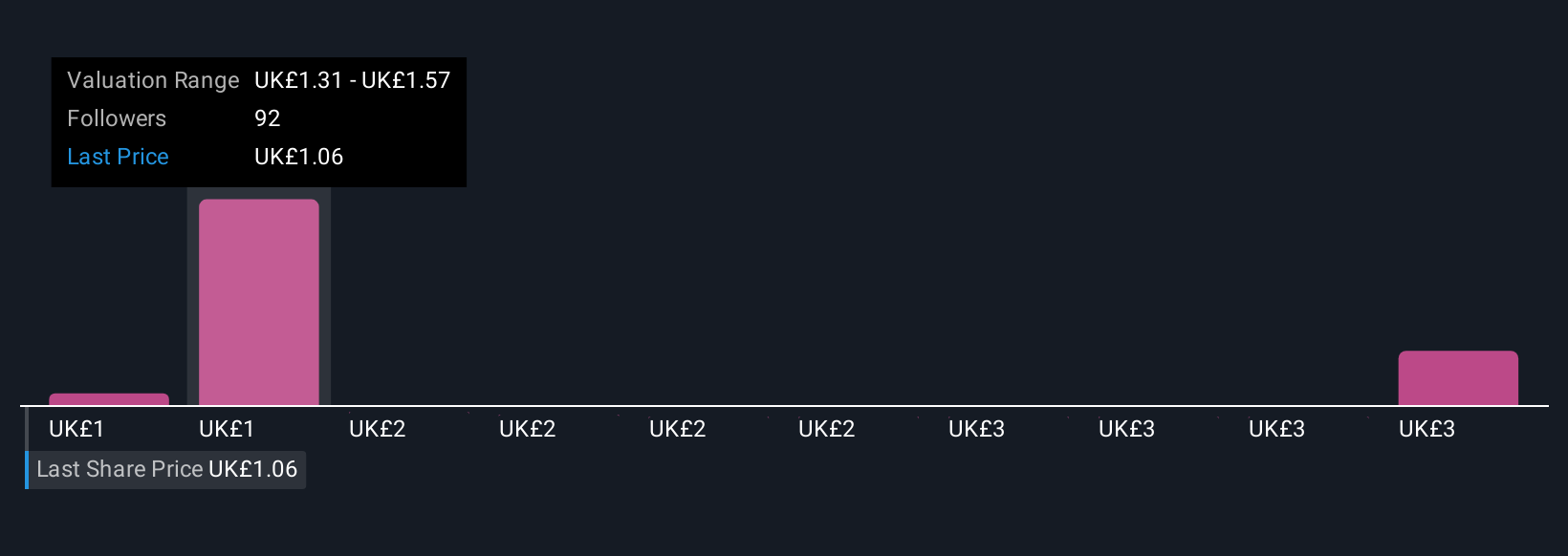

This tool is available right in the Simply Wall St Community page, used by millions of investors to discuss and compare their views. With Narratives, you can easily compare the fair value that results from your assumptions with the current share price to spot new opportunities or avoid potential pitfalls. They update dynamically as new earnings, news, or regulatory changes arrive. For example, some investors currently see Taylor Wimpey’s fair value as low as £1.05, while others are more optimistic, valuing shares as high as £1.72. The Narrative approach makes it clear whose story aligns with today’s price, helping you decide if now is the right time to invest, hold, or move on.

Do you think there's more to the story for Taylor Wimpey? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taylor Wimpey might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:TW.

Taylor Wimpey

Operates as a homebuilder company in the United Kingdom and Spain.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives