- United Kingdom

- /

- Consumer Durables

- /

- LSE:GLE

UK Penny Stocks To Consider In October 2025

Reviewed by Simply Wall St

Amidst a backdrop of global economic uncertainty, the UK's FTSE 100 index has recently faced challenges due to weak trade data from China, highlighting the interconnectedness of international markets. For investors looking beyond well-known names, penny stocks—often representing smaller or newer companies—continue to offer intriguing opportunities despite being considered a niche area. These stocks can provide a blend of value and growth potential, especially when backed by strong financials, making them appealing for those seeking hidden gems with long-term promise.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.55 | £509.4M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.04 | £164.81M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.76 | £11.47M | ✅ 2 ⚠️ 2 View Analysis > |

| Northern Bear (AIM:NTBR) | £1.07 | £14.72M | ✅ 4 ⚠️ 2 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.5375 | $312.46M | ✅ 4 ⚠️ 2 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.355 | £120.64M | ✅ 4 ⚠️ 1 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.48 | £71.49M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.115 | £177.51M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.70 | £9.64M | ✅ 3 ⚠️ 4 View Analysis > |

| Braemar (LSE:BMS) | £2.40 | £73.12M | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 296 stocks from our UK Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Cora Gold (AIM:CORA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cora Gold Limited, with a market cap of £48.48 million, explores and develops mineral projects in West Africa through its subsidiaries.

Operations: Currently, there are no revenue segments reported for this company.

Market Cap: £48.48M

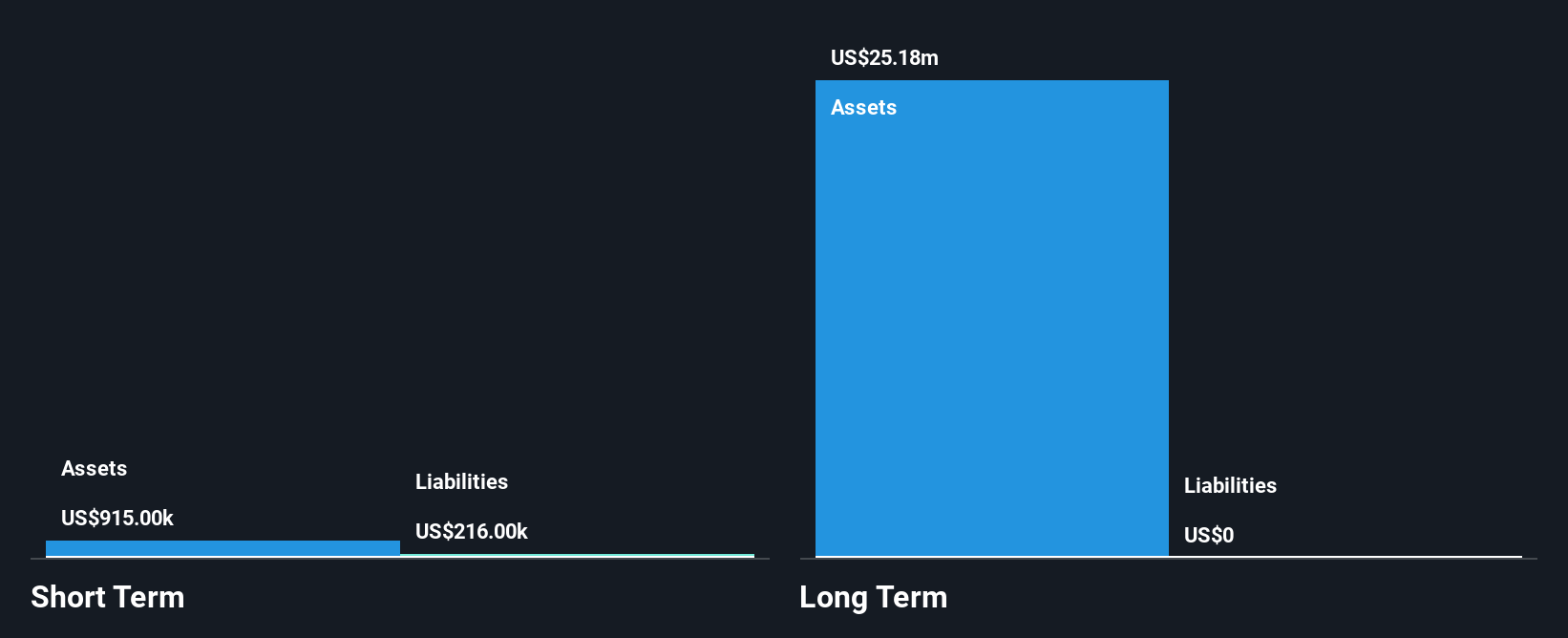

Cora Gold Limited, with a market cap of £48.48 million, is pre-revenue and operates in the volatile penny stock segment. The company has no debt and its short-term assets significantly exceed liabilities. Recent exploration at the Madina Foulbe Project in Senegal indicates promising gold mineralization potential, while updated reserves at the Sanankoro Gold Project in Mali show a 26% increase to 531 koz of gold. Despite these developments, Cora remains unprofitable with increasing losses over five years and less than one year of cash runway. The management team is experienced, offering some stability amid share price volatility.

- Take a closer look at Cora Gold's potential here in our financial health report.

- Review our growth performance report to gain insights into Cora Gold's future.

Steppe Cement (AIM:STCM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Steppe Cement Ltd. is an investment holding company involved in the production and sale of cement and clinkers in Kazakhstan, with a market cap of £40.52 million.

Operations: The company generates revenue of $91.50 million from its operations in the production and sale of cement.

Market Cap: £40.52M

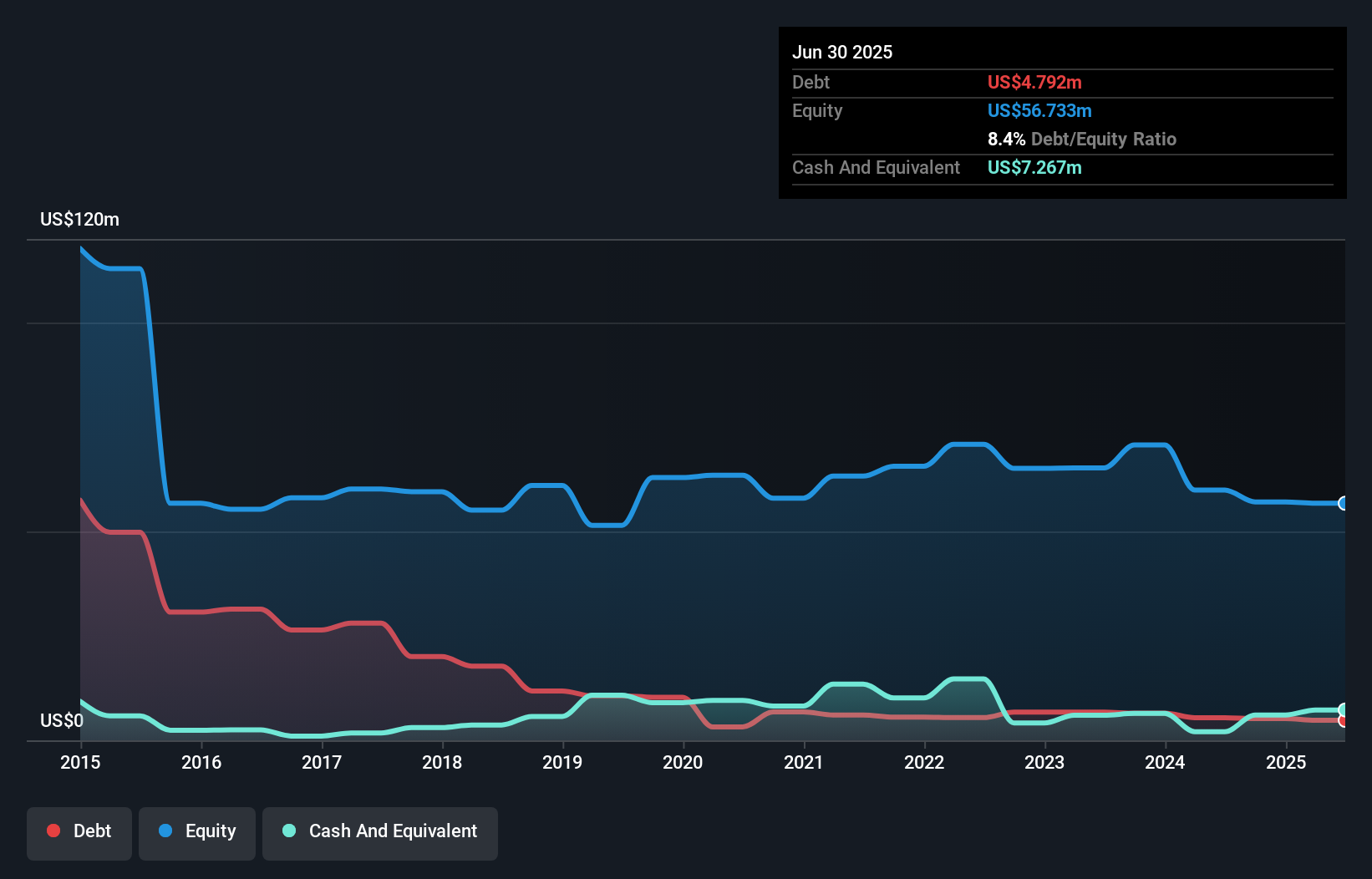

Steppe Cement Ltd., with a market cap of £40.52 million, operates in the penny stock segment and has shown significant improvement in its financial performance. Recent earnings for the half year ended June 30, 2025, reported sales of US$40.95 million and a reduced net loss of US$0.476 million compared to last year. The company benefits from high-quality earnings and improved profit margins of 4.4%. Its debt is well covered by operating cash flow, and it holds more cash than total debt, indicating strong financial management despite low return on equity at 7.1%.

- Navigate through the intricacies of Steppe Cement with our comprehensive balance sheet health report here.

- Learn about Steppe Cement's historical performance here.

MJ Gleeson (LSE:GLE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: MJ Gleeson plc operates in the United Kingdom, focusing on house building and land promotion and sales, with a market cap of £209.78 million.

Operations: The company generates revenue through two primary segments: Gleeson Homes, which accounts for £348.25 million, and Gleeson Land, contributing £17.57 million.

Market Cap: £209.78M

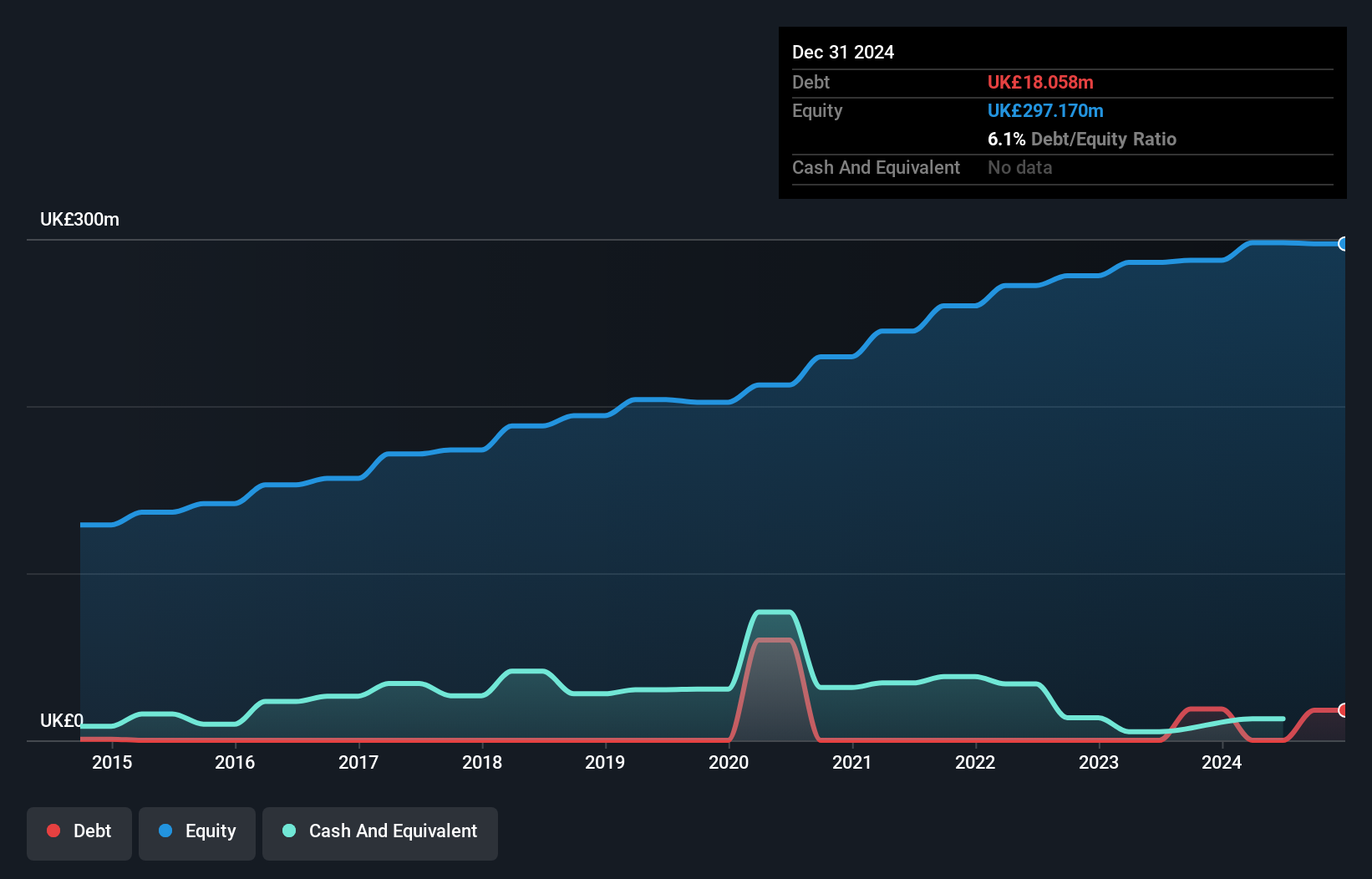

MJ Gleeson plc, with a market cap of £209.78 million, operates in the housing sector and has shown mixed performance indicators. The company reported annual sales of £365.82 million, but net income declined to £15.82 million from the previous year. Despite negative earnings growth over the past year, its earnings are forecasted to grow by 19.55% annually. Short-term assets significantly exceed liabilities, providing financial stability; however, operating cash flow remains negative and does not adequately cover debt obligations or dividends. The stock trades slightly below estimated fair value with analysts predicting a potential price rise of 48.9%.

- Jump into the full analysis health report here for a deeper understanding of MJ Gleeson.

- Assess MJ Gleeson's future earnings estimates with our detailed growth reports.

Key Takeaways

- Navigate through the entire inventory of 296 UK Penny Stocks here.

- Searching for a Fresh Perspective? Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GLE

MJ Gleeson

Engages in house building, and land promotion and sale businesses in the United Kingdom.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives