- United Kingdom

- /

- Trade Distributors

- /

- AIM:BRCK

UK Growth Companies Insiders Strongly Back

Reviewed by Simply Wall St

As the UK market grapples with the repercussions of weak trade data from China, reflected in the recent dip of both the FTSE 100 and FTSE 250, investors are keenly observing how these global economic shifts might influence domestic growth opportunities. In such a climate, companies with high insider ownership often stand out as they signal confidence from those closest to the business's operations and strategy.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Gulf Keystone Petroleum (LSE:GKP) | 12.4% | 59.2% |

| Foresight Group Holdings (LSE:FSG) | 35.1% | 26.6% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.9% | 20% |

| Audioboom Group (AIM:BOOM) | 15.7% | 59.3% |

| Judges Scientific (AIM:JDG) | 10.7% | 24.4% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 19.8% | 20.3% |

| Hochschild Mining (LSE:HOC) | 38.4% | 24.7% |

| Petrofac (LSE:PFC) | 16.6% | 117% |

| Faron Pharmaceuticals Oy (AIM:FARN) | 21.1% | 56.8% |

| Anglo Asian Mining (AIM:AAZ) | 40% | 116.2% |

Here's a peek at a few of the choices from the screener.

Brickability Group (AIM:BRCK)

Simply Wall St Growth Rating: ★★★★☆☆

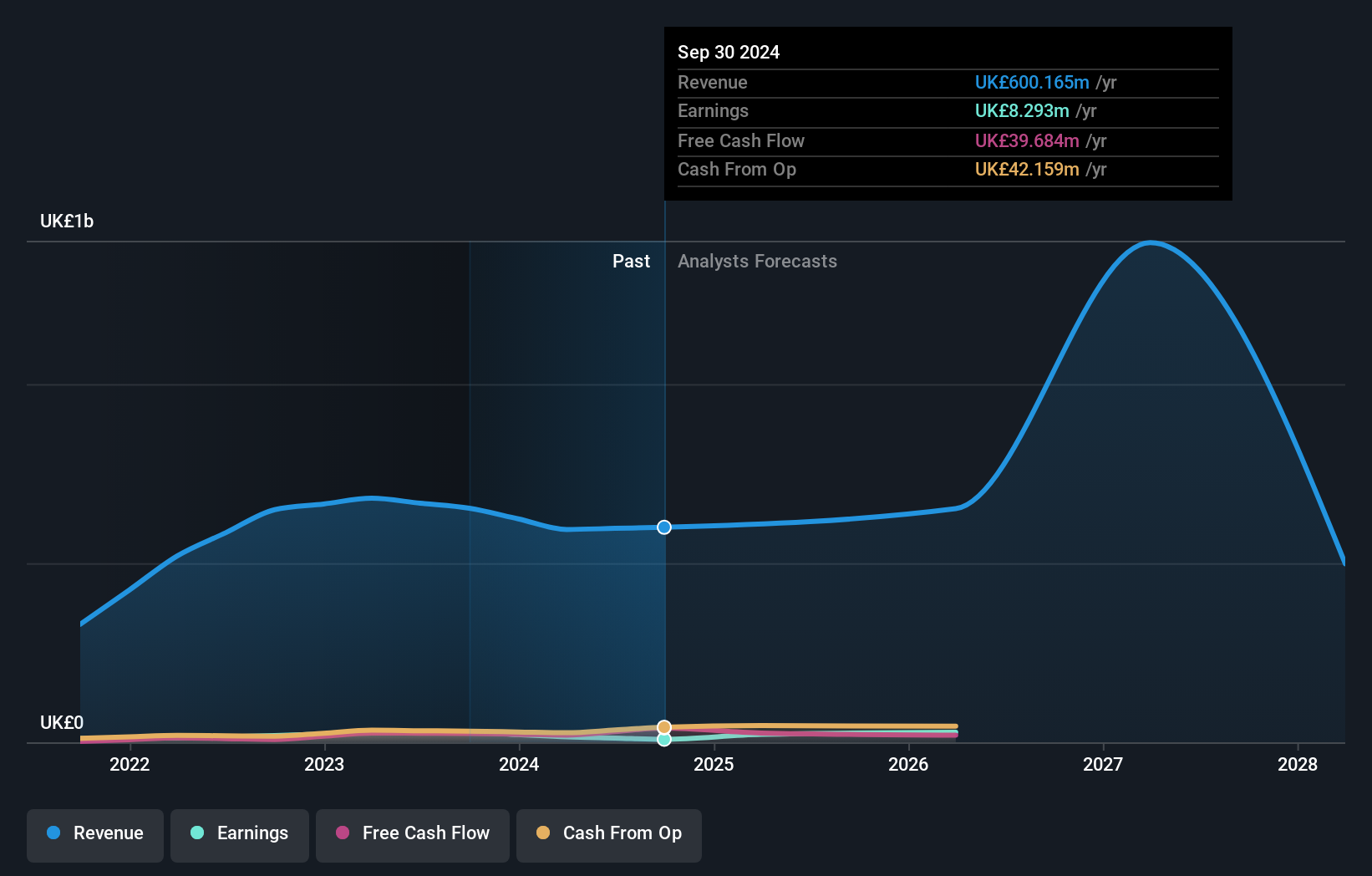

Overview: Brickability Group Plc, with a market cap of £221.41 million, supplies, distributes, and imports building products in the United Kingdom through its subsidiaries.

Operations: The company's revenue is derived from several segments, including Bricks and Building Materials (£380.56 million), Importing (£90.55 million), Contracting (£88.22 million), and Distribution (£63.21 million).

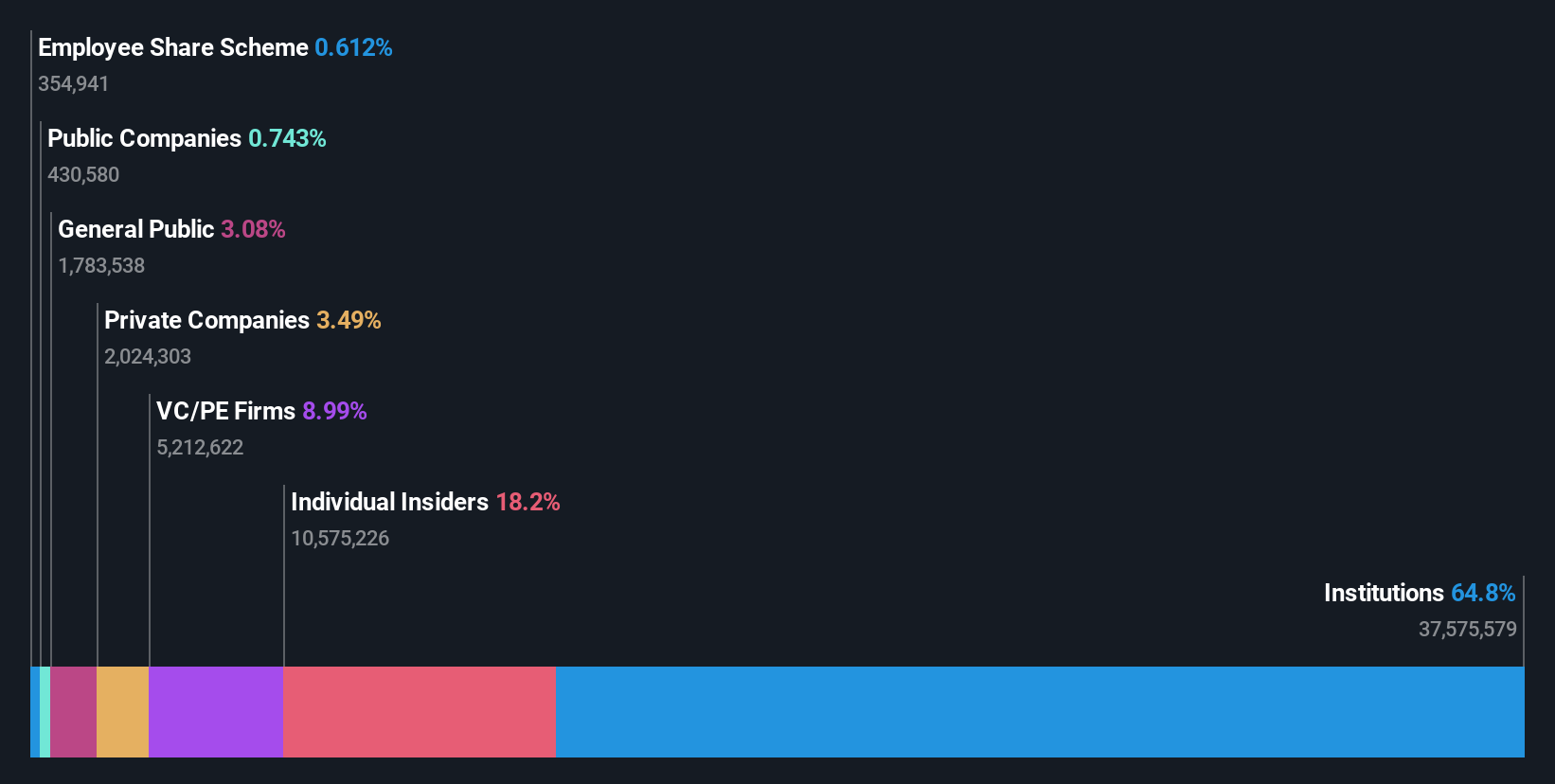

Insider Ownership: 24.6%

Earnings Growth Forecast: 39.6% p.a.

Brickability Group shows potential as a growth company with high insider ownership, despite some challenges. The company's earnings are expected to grow significantly at 39.6% annually over the next three years, outpacing the UK market. However, its return on equity is forecasted to remain low at 15.4%, and profit margins have decreased from last year. Recent guidance indicates revenue for FY2025 will be approximately £637 million, reflecting modest growth amid competitive pressures in the market.

- Click here and access our complete growth analysis report to understand the dynamics of Brickability Group.

- According our valuation report, there's an indication that Brickability Group's share price might be on the expensive side.

Mortgage Advice Bureau (Holdings) (AIM:MAB1)

Simply Wall St Growth Rating: ★★★★★☆

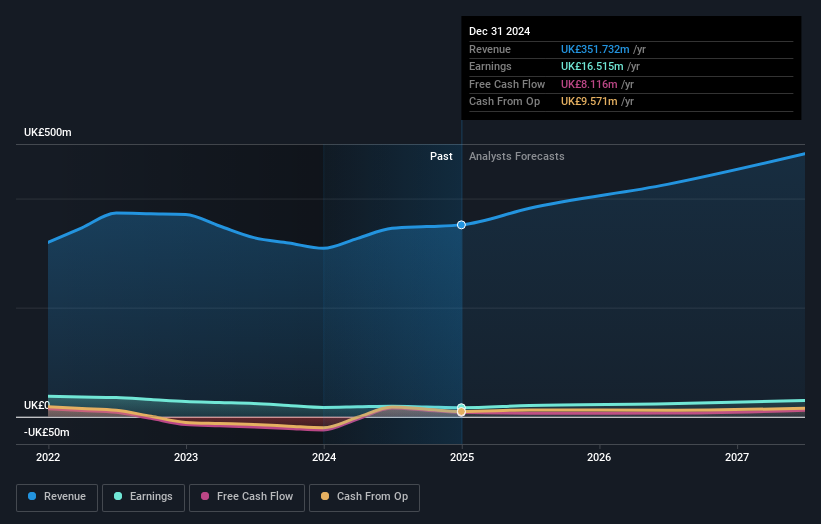

Overview: Mortgage Advice Bureau (Holdings) plc, along with its subsidiaries, offers mortgage advice services in the United Kingdom and has a market cap of £490.31 million.

Operations: The company's revenue segment is comprised of the provision of financial services, generating £265.27 million.

Insider Ownership: 19.8%

Earnings Growth Forecast: 20.3% p.a.

Mortgage Advice Bureau (Holdings) demonstrates strong growth potential with insider ownership aligned to its performance. The company reported a net income of £16.08 million for 2024, up from £12.46 million the previous year, and earnings per share increased accordingly. Earnings are forecasted to grow significantly at over 20% annually, surpassing the UK market average. Insiders have shown confidence by purchasing shares recently, although not in substantial volumes, while revenue is expected to grow steadily at 10.7% per year.

- Click to explore a detailed breakdown of our findings in Mortgage Advice Bureau (Holdings)'s earnings growth report.

- Our valuation report here indicates Mortgage Advice Bureau (Holdings) may be overvalued.

MJ Gleeson (LSE:GLE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: MJ Gleeson plc operates in the United Kingdom, focusing on house building and land promotion and sales, with a market cap of £299.18 million.

Operations: The company's revenue is derived from two segments: Gleeson Land, contributing £8.40 million, and Gleeson Homes, generating £343.33 million.

Insider Ownership: 11.2%

Earnings Growth Forecast: 20.2% p.a.

MJ Gleeson shows promising growth with high insider ownership, as insiders have been net buyers recently. The company's earnings are projected to grow significantly at 20.2% annually, outpacing the UK market average of 14.1%. While revenue growth is expected at a slower pace of 12.4% per year, it still exceeds the market's 3.9%. Analysts anticipate a stock price increase of 30.2%, although Return on Equity remains low at an estimated 7.8%.

- Click here to discover the nuances of MJ Gleeson with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of MJ Gleeson shares in the market.

Make It Happen

- Navigate through the entire inventory of 63 Fast Growing UK Companies With High Insider Ownership here.

- Seeking Other Investments? Outshine the giants: these 28 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Brickability Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:BRCK

Brickability Group

Supplies, distributes, and imports building products in the United Kingdom.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives