- United Kingdom

- /

- Metals and Mining

- /

- AIM:PAF

UK Stocks That May Be Trading Below Their Estimated Value In October 2025

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China, impacting companies heavily reliant on Chinese demand. As global economic pressures persist, identifying stocks that may be trading below their estimated value can offer potential opportunities for investors looking to navigate these uncertain conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SigmaRoc (AIM:SRC) | £1.164 | £2.31 | 49.6% |

| Pinewood Technologies Group (LSE:PINE) | £3.975 | £7.87 | 49.5% |

| Pan African Resources (AIM:PAF) | £0.941 | £1.86 | 49.4% |

| On the Beach Group (LSE:OTB) | £2.235 | £4.40 | 49.2% |

| Likewise Group (AIM:LIKE) | £0.275 | £0.53 | 47.9% |

| Gooch & Housego (AIM:GHH) | £5.88 | £11.28 | 47.9% |

| Fevertree Drinks (AIM:FEVR) | £7.87 | £15.37 | 48.8% |

| Begbies Traynor Group (AIM:BEG) | £1.14 | £2.22 | 48.6% |

| AOTI (AIM:AOTI) | £0.40 | £0.78 | 48.9% |

| Advanced Medical Solutions Group (AIM:AMS) | £2.28 | £4.40 | 48.2% |

Here we highlight a subset of our preferred stocks from the screener.

Pan African Resources (AIM:PAF)

Overview: Pan African Resources PLC is involved in the mining, extraction, production, and sale of gold in South Africa, with a market cap of £1.91 billion.

Operations: The company's revenue is primarily derived from its operations at Barberton Mines ($242.19 million), Evander Mines ($206.17 million), MTR Projects ($87.34 million), Tennant Mines ($3.87 million), and Agricultural ESG Projects ($0.46 million).

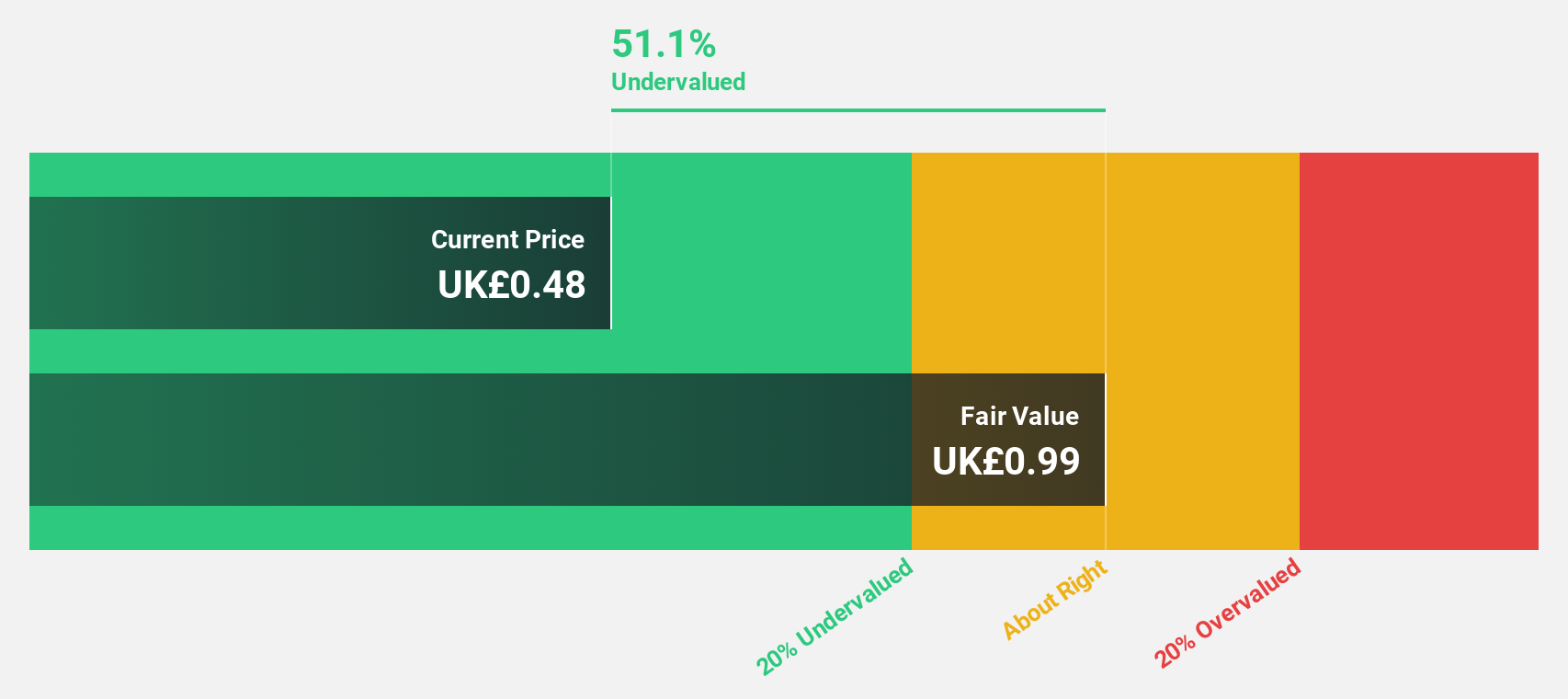

Estimated Discount To Fair Value: 49.4%

Pan African Resources appears undervalued, trading at £0.94 against a fair value estimate of £1.86, suggesting it is 49.4% below estimated fair value. The company forecasts strong revenue growth of 22.7% annually, outpacing the UK market's 4.2%. Earnings are expected to grow significantly at 25.1% per year over the next three years, exceeding the market's 14.3%. Recent results show increased gold production and improved earnings performance, supporting future growth potential.

- According our earnings growth report, there's an indication that Pan African Resources might be ready to expand.

- Get an in-depth perspective on Pan African Resources' balance sheet by reading our health report here.

ACG Metals (LSE:ACG)

Overview: ACG Metals Limited is involved in the production of copper in Europe and has a market capitalization of £227.42 million.

Operations: ACG Metals Limited generates its revenue from the production of copper in Europe.

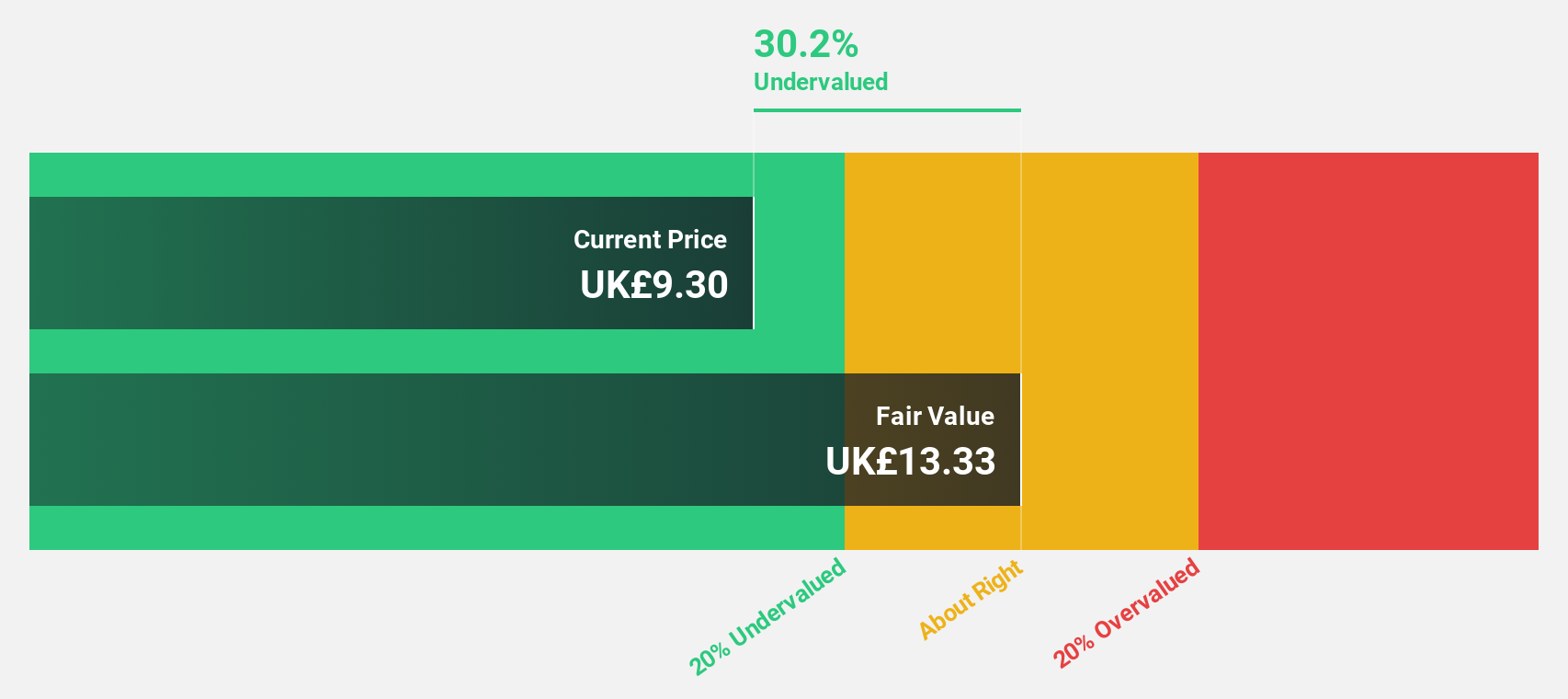

Estimated Discount To Fair Value: 15.5%

ACG Metals is trading at £10.5, slightly below its estimated fair value of £12.43, indicating some undervaluation based on cash flows. Despite a high debt level, the company benefits from expected revenue growth of 20.3% annually and significant earnings growth of 37.7% per year over three years, outpacing the UK market's averages. Recent amendments to royalty agreements should enhance cash flow by reducing costs and eliminating certain payment obligations at the Gediktepe mine transition stage.

- Our growth report here indicates ACG Metals may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of ACG Metals stock in this financial health report.

Dr. Martens (LSE:DOCS)

Overview: Dr. Martens plc is involved in the design, development, procurement, marketing, sale, and distribution of footwear with a market cap of approximately £859.13 million.

Operations: The company's revenue primarily comes from its footwear segment, which generated £787.60 million.

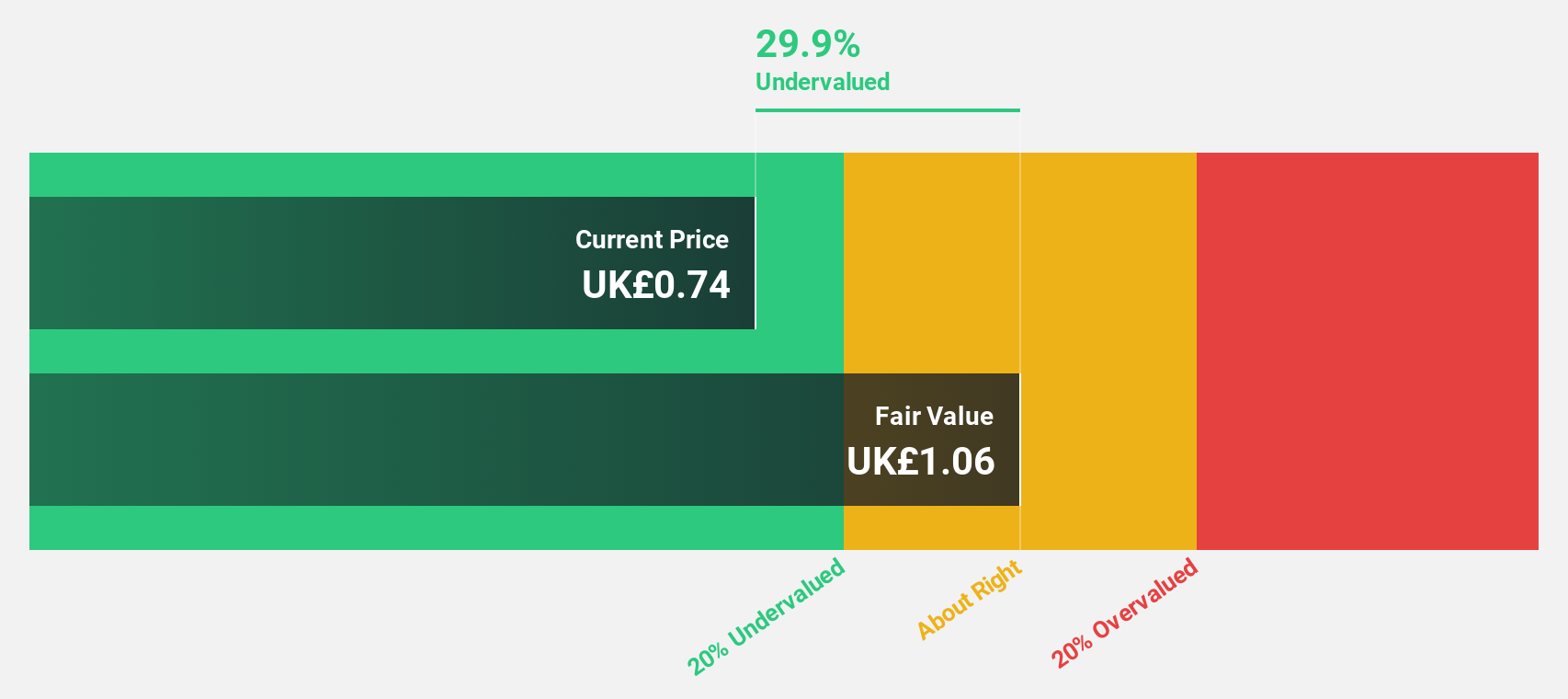

Estimated Discount To Fair Value: 21.2%

Dr. Martens is trading at £0.89, below its estimated fair value of £1.13, suggesting undervaluation based on cash flows. Despite a low net profit margin and unsustainable dividend coverage, earnings are forecast to grow significantly at 46.81% annually over the next three years, surpassing UK market averages. Recent strategic partnerships in the UAE and Latin America aim to expand market reach through capital-light models, potentially enhancing future revenue streams without heavy investment burdens.

- Upon reviewing our latest growth report, Dr. Martens' projected financial performance appears quite optimistic.

- Click here to discover the nuances of Dr. Martens with our detailed financial health report.

Seize The Opportunity

- Gain an insight into the universe of 53 Undervalued UK Stocks Based On Cash Flows by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:PAF

Pan African Resources

Engages in the mining, extraction, production, and sale of gold in South Africa.

Exceptional growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives