- United Kingdom

- /

- Biotech

- /

- LSE:GNS

Exploring 3 Undervalued Small Caps In United Kingdom With Insider Action

Reviewed by Simply Wall St

The United Kingdom's stock market has recently experienced turbulence, with the FTSE 100 and FTSE 250 indices closing lower amid concerns over weak trade data from China, highlighting global economic uncertainties. In this challenging environment, small-cap stocks in the UK may present unique opportunities for investors seeking value, particularly those exhibiting insider activity that could signal confidence in their potential despite broader market headwinds.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Senior | 18.1x | 0.6x | 37.60% | ★★★★★★ |

| Bytes Technology Group | 21.7x | 5.5x | 13.18% | ★★★★★☆ |

| NWF Group | 8.1x | 0.1x | 39.24% | ★★★★★☆ |

| John Wood Group | NA | 0.2x | 39.93% | ★★★★★☆ |

| Genus | 175.9x | 2.1x | 5.98% | ★★★★★☆ |

| J D Wetherspoon | 16.0x | 0.4x | 5.93% | ★★★★★☆ |

| Headlam Group | NA | 0.2x | 27.48% | ★★★★★☆ |

| Marlowe | NA | 0.7x | 41.86% | ★★★★☆☆ |

| Optima Health | NA | 1.3x | 37.42% | ★★★★☆☆ |

| Robert Walters | 43.8x | 0.3x | 39.56% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Dr. Martens (LSE:DOCS)

Simply Wall St Value Rating: ★★★★★★

Overview: Dr. Martens is a renowned British footwear brand known for its iconic boots and shoes, with a market capitalization of approximately £2.47 billion.

Operations: Revenue primarily stems from the footwear segment, with recent figures showing £877.10 million. The gross profit margin has shown a notable upward trend, reaching 65.58%. Operating expenses are significant, with general and administrative costs being a major component at £377.70 million.

PE: 7.9x

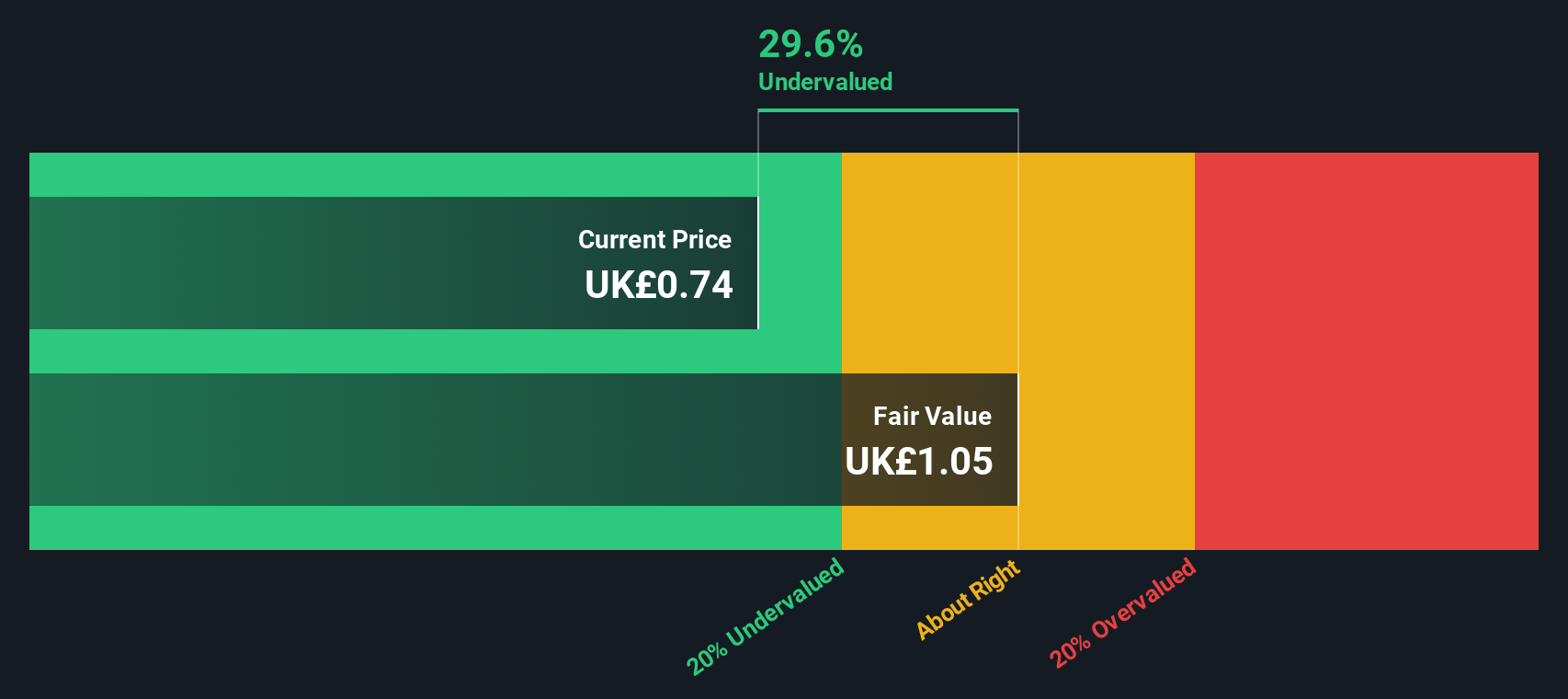

Dr. Martens, a notable player in the UK market, has seen its share price fluctuate significantly over the past three months. Despite carrying a high debt load and relying solely on external borrowing, the company is projected to grow earnings by 5.68% annually. Profit margins have decreased from 12.9% to 7.9%, yet insider confidence is evident with recent share purchases this year, suggesting belief in future potential amidst current challenges.

- Dive into the specifics of Dr. Martens here with our thorough valuation report.

Assess Dr. Martens' past performance with our detailed historical performance reports.

Genus (LSE:GNS)

Simply Wall St Value Rating: ★★★★★☆

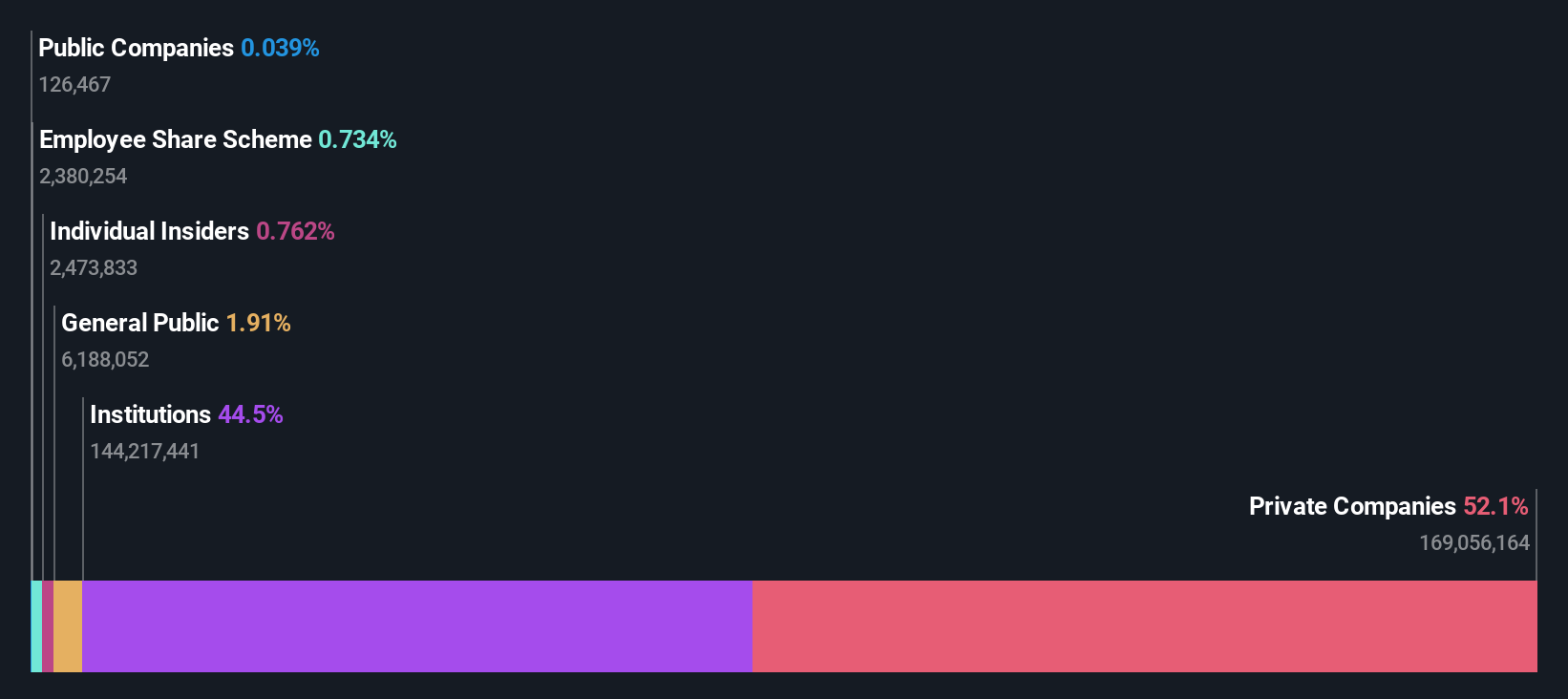

Overview: Genus is a biotechnology company specializing in animal genetics, with operations focused on providing advanced breeding services and products for livestock, and has a market cap of approximately £1.80 billion.

Operations: Genus generates revenue primarily from its Genus ABS and Genus PIC segments, with the latter contributing slightly more. The company's gross profit margin has fluctuated over recent periods, reaching a high of 53.78% in December 2019 before settling at 38.17% in June 2024. Key expenses include research and development, which has consistently been significant, indicating an ongoing investment focus in this area.

PE: 175.9x

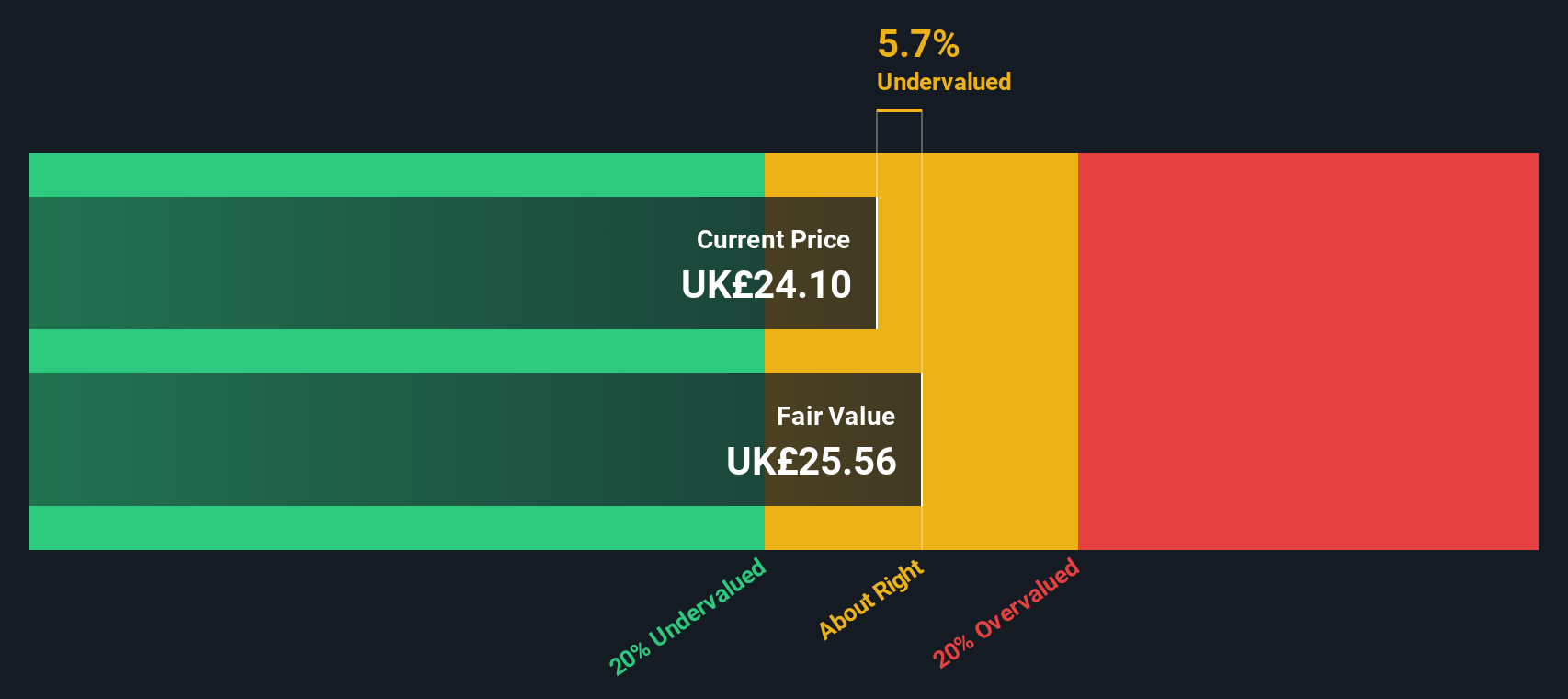

Genus, a small company in the UK, recently reported a decline in net income to £7.9 million for the year ending June 2024, down from £33.3 million previously. Despite this, insider confidence is evident with recent share purchases by key individuals within the firm. The company's earnings are expected to grow at 37% annually, offering potential upside despite current margin pressures and reliance on external borrowing for funding. CFO Alison Henriksen's planned retirement in July 2025 may impact strategic continuity but provides an opportunity for fresh leadership insights moving forward.

- Click here to discover the nuances of Genus with our detailed analytical valuation report.

Understand Genus' track record by examining our Past report.

Harworth Group (LSE:HWG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Harworth Group is a real estate investment and development company focused on the regeneration of land and property for residential, commercial, and industrial uses, with a market cap of approximately £0.47 billion.

Operations: The company generates revenue primarily from the sale of development properties, with additional income from property activities and income generation. Over recent periods, there has been a notable trend in the gross profit margin fluctuating between 11.43% and 54.39%, indicating variability in cost management or pricing strategies relative to revenue. Operating expenses have consistently increased over time, impacting overall profitability.

PE: 12.0x

Harworth Group, recently added to the FTSE 250 and FTSE 350 indices as of September 17, 2024, showcases a mixed bag of opportunities and challenges. Their impressive half-year sales growth to £41.31 million from £18.24 million last year reflects potential for future expansion. However, reliance on external borrowing indicates higher risk funding strategies. Insider confidence is evident with Alastair Lyons purchasing 50,000 shares for approximately £80K in recent months, suggesting belief in the company's prospects despite risks associated with one-off earnings impacts and forecasts predicting a promising annual earnings growth of around 26%.

Seize The Opportunity

- Click here to access our complete index of 28 Undervalued UK Small Caps With Insider Buying.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GNS

Genus

Operates as an animal genetics company in North America, Latin America, the United Kingdom, rest of Europe, the Middle East, Russia, Africa, and Asia.

Reasonable growth potential and slightly overvalued.