- United Kingdom

- /

- Consumer Durables

- /

- LSE:CRN

Shareholders May Be More Conservative With Cairn Homes plc's (LON:CRN) CEO Compensation For Now

Key Insights

- Cairn Homes will host its Annual General Meeting on 10th of May

- Salary of €425.0k is part of CEO Michael Stanley's total remuneration

- The overall pay is 116% above the industry average

- Over the past three years, Cairn Homes' EPS grew by 98% and over the past three years, the total shareholder return was 71%

Under the guidance of CEO Michael Stanley, Cairn Homes plc (LON:CRN) has performed reasonably well recently. As shareholders go into the upcoming AGM on 10th of May, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders may still be hesitant of being overly generous with CEO compensation.

Check out our latest analysis for Cairn Homes

Comparing Cairn Homes plc's CEO Compensation With The Industry

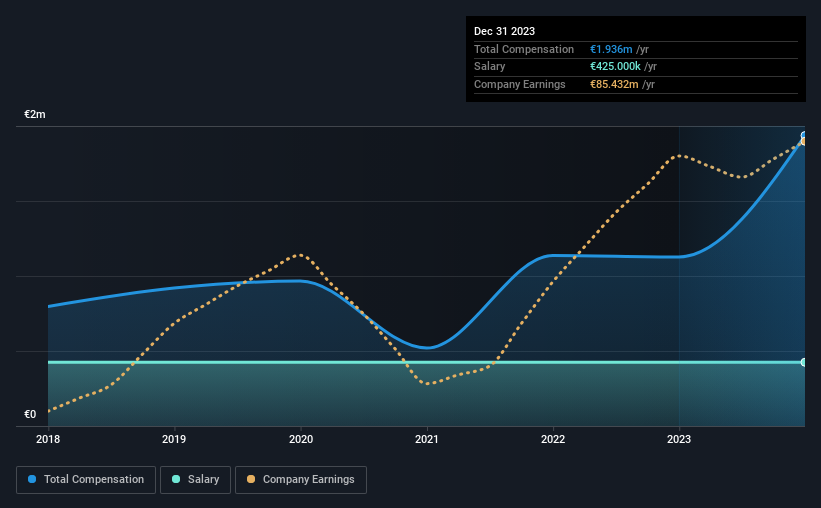

At the time of writing, our data shows that Cairn Homes plc has a market capitalization of UK£910m, and reported total annual CEO compensation of €1.9m for the year to December 2023. We note that's an increase of 72% above last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at €425k.

On examining similar-sized companies in the British Consumer Durables industry with market capitalizations between UK£319m and UK£1.3b, we discovered that the median CEO total compensation of that group was €896k. This suggests that Michael Stanley is paid more than the median for the industry. What's more, Michael Stanley holds UK£31m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | €425k | €425k | 22% |

| Other | €1.5m | €702k | 78% |

| Total Compensation | €1.9m | €1.1m | 100% |

Talking in terms of the industry, salary represented approximately 46% of total compensation out of all the companies we analyzed, while other remuneration made up 54% of the pie. Cairn Homes pays a modest slice of remuneration through salary, as compared to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Cairn Homes plc's Growth

Cairn Homes plc has seen its earnings per share (EPS) increase by 98% a year over the past three years. In the last year, its revenue is up 8.0%.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's nice to see revenue heading northwards, as this is consistent with healthy business conditions. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Cairn Homes plc Been A Good Investment?

Boasting a total shareholder return of 71% over three years, Cairn Homes plc has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. However, if the board proposes to increase the compensation, some shareholders might have questions given that the CEO is already being paid higher than the industry.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 2 warning signs for Cairn Homes that investors should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:CRN

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026