- United Kingdom

- /

- Energy Services

- /

- LSE:HTG

Discover UK Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

As the FTSE 100 and FTSE 250 indices face downward pressure due to weak trade data from China, investors are looking for alternative opportunities in the UK market. Penny stocks, often associated with smaller or newer companies, offer a unique opportunity for growth at lower price points. Despite being considered a somewhat outdated term, these stocks can still present significant potential when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.245 | £845.83M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.335 | £431.14M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.57 | £68.08M | ★★★★☆☆ |

| Serabi Gold (AIM:SRB) | £0.99 | £74.98M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.20 | £102.41M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.30 | £200.5M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.38 | £175.75M | ★★★★★☆ |

| Tristel (AIM:TSTL) | £4.20 | £200.31M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.4125 | $239.8M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.48 | £365.3M | ★★★★★★ |

Click here to see the full list of 465 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Cirata (AIM:CRTA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cirata plc, along with its subsidiaries, develops and provides collaboration software across North America, Europe, China, and internationally with a market cap of £33.28 million.

Operations: The company generates revenue primarily from the development and sale of licenses for software, along with related maintenance and support services, totaling $7.14 million.

Market Cap: £33.28M

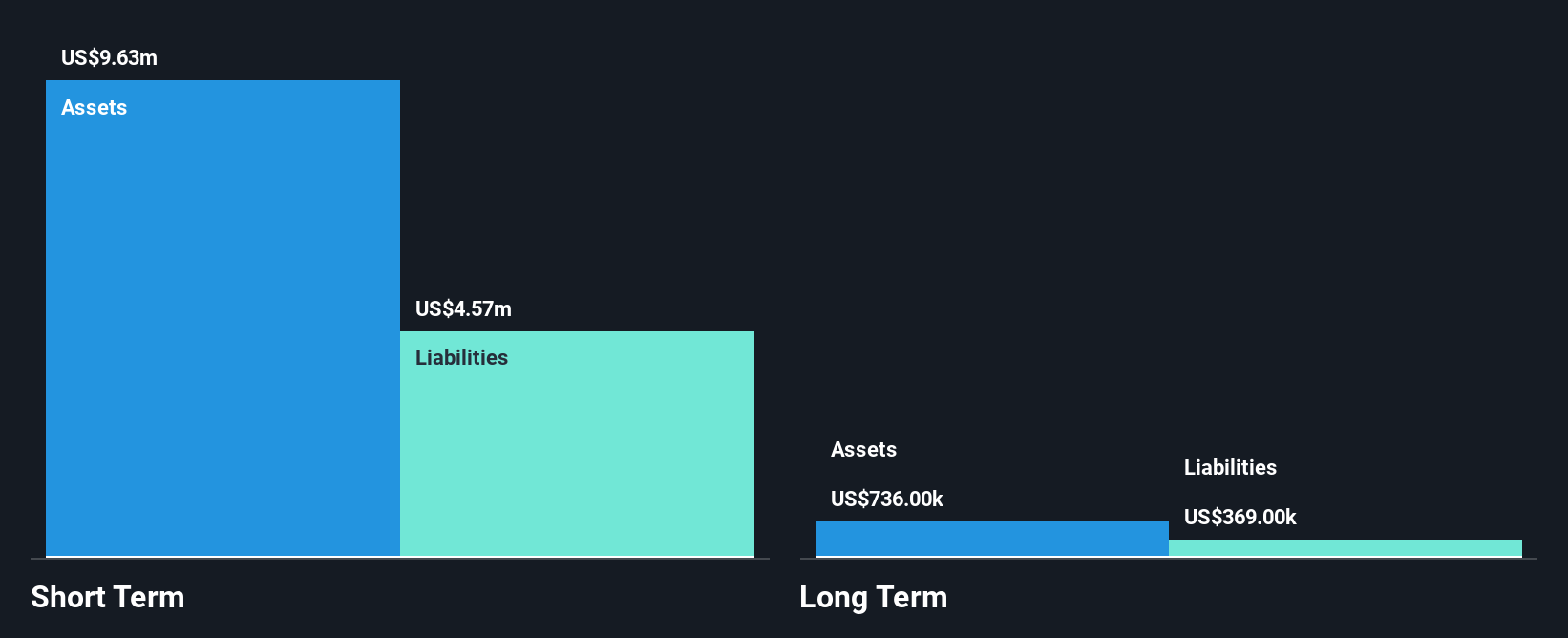

Cirata plc, with a market cap of £33.28 million, has been actively expanding its cloud migration services through strategic partnerships, notably with TD SYNNEX and IBM. Despite generating US$7.14 million in revenue from software licenses and support services, the company remains unprofitable and is not expected to achieve profitability in the near term. Recent management changes include new board appointments and a transition in CFO roles aimed at stabilizing operations during challenging times. While Cirata's share price has been volatile and shareholders experienced dilution, its short-term assets comfortably cover liabilities, providing some financial stability amidst ongoing challenges.

- Navigate through the intricacies of Cirata with our comprehensive balance sheet health report here.

- Gain insights into Cirata's outlook and expected performance with our report on the company's earnings estimates.

Cairn Homes (LSE:CRN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cairn Homes plc is a holding company that operates as a home and community builder in Ireland, with a market cap of £1.10 billion.

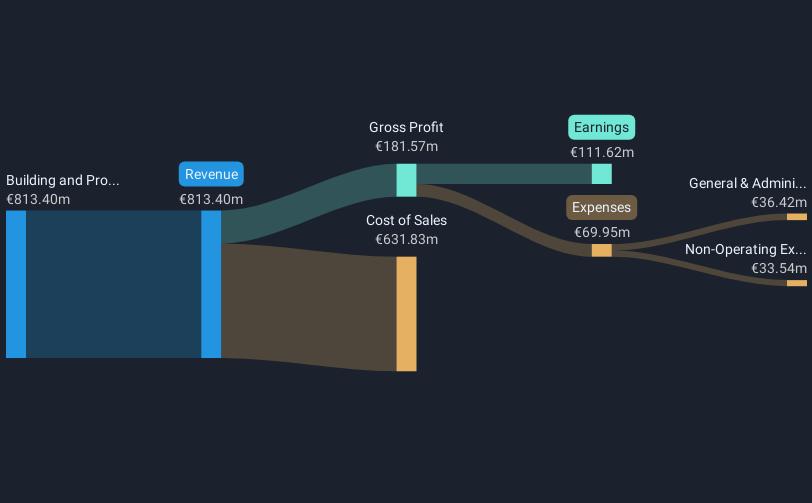

Operations: The company generates revenue of €813.40 million from its building and property development operations.

Market Cap: £1.1B

Cairn Homes plc, with a market cap of £1.10 billion, has demonstrated robust financial performance, reporting significant earnings growth of 49.5% over the past year and maintaining high-quality earnings. The company’s debt is well covered by operating cash flow, and its short-term assets exceed both short- and long-term liabilities, indicating strong financial health. Recent strategic moves include substantial share buybacks totaling €70 million and board restructuring with the appointment of Orla O’Connor to enhance governance. Despite an unstable dividend history, Cairn Homes continues to trade at good value compared to peers in its industry.

- Click to explore a detailed breakdown of our findings in Cairn Homes' financial health report.

- Learn about Cairn Homes' future growth trajectory here.

Hunting (LSE:HTG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hunting PLC, with a market cap of £484 million, manufactures components, technology systems, and precision parts globally through its subsidiaries.

Operations: The company's revenue is derived from several segments, including Asia Pacific ($150.3 million), Hunting Titan ($247.6 million), Subsea Technologies ($134.8 million), and Europe, Middle East and Africa (EMEA) ($88.4 million).

Market Cap: £483.96M

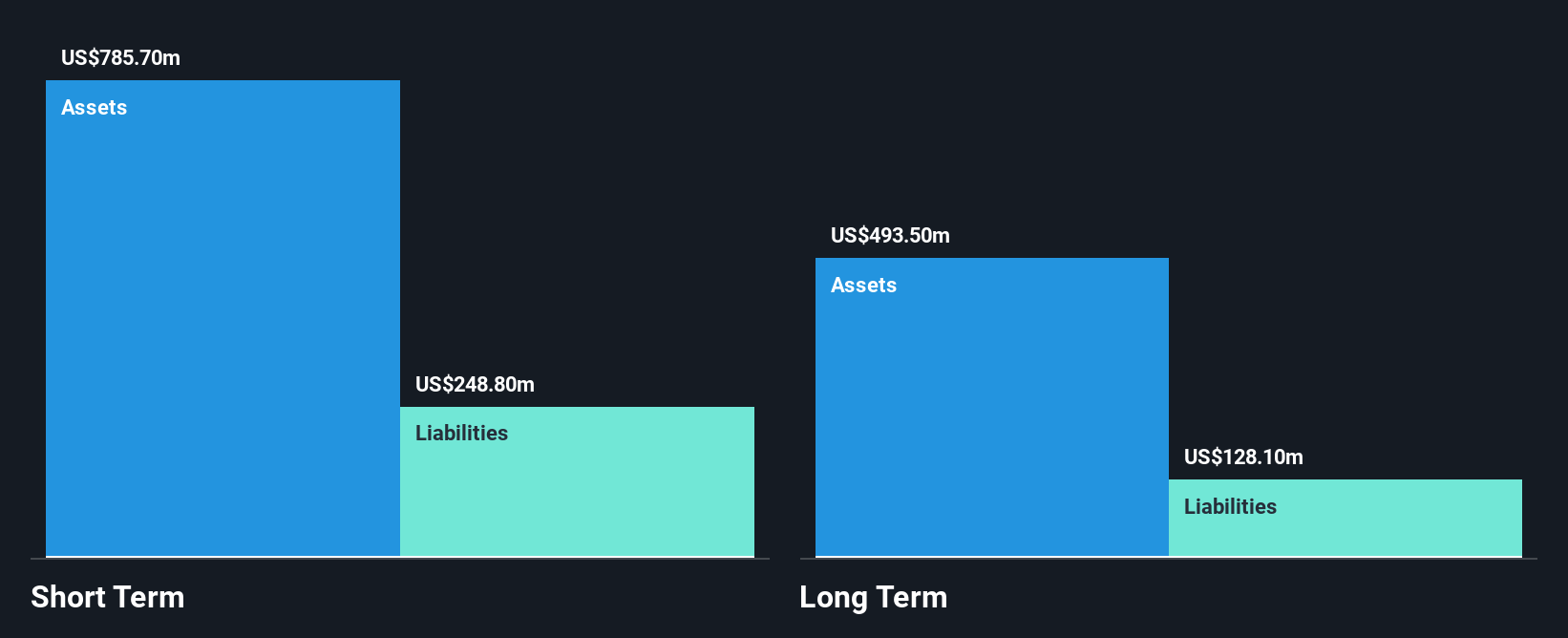

Hunting PLC, with a market cap of £484 million, presents a mixed picture for investors interested in penny stocks. The company is trading at 63.1% below its estimated fair value and has not experienced shareholder dilution over the past year. Despite low return on equity at 13.8%, Hunting's interest payments are well covered by EBIT, and both short- and long-term liabilities are adequately managed by its assets. Recent strategic alliances, particularly with CRA Tubulars B.V., aim to expand their Titanium Composite Tubing technology across Europe, potentially enhancing revenue streams in energy transition markets like carbon capture and storage.

- Click here to discover the nuances of Hunting with our detailed analytical financial health report.

- Assess Hunting's future earnings estimates with our detailed growth reports.

Next Steps

- Click this link to deep-dive into the 465 companies within our UK Penny Stocks screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hunting might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HTG

Hunting

Manufactures components, technology systems, and precision parts worldwide.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives