- United Kingdom

- /

- Consumer Durables

- /

- LSE:CRN

3 Noteworthy UK Penny Stocks With Under £2B Market Cap

Reviewed by Simply Wall St

The UK stock market has faced challenges recently, with the FTSE 100 and FTSE 250 indices experiencing declines amid concerns over weak trade data from China. In such a climate, investors may turn their attention to penny stocks, which despite their somewhat outdated name, continue to represent smaller or newer companies that can offer intriguing value propositions. By focusing on those with robust financials and a clear growth trajectory, investors might uncover promising opportunities among these often-overlooked stocks.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.948 | £149.54M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.05 | £772.37M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.62 | £69.04M | ★★★★☆☆ |

| Luceco (LSE:LUCE) | £1.284 | £198.03M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.355 | £172.56M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.935 | £391.36M | ★★★★☆☆ |

| Foresight Group Holdings (LSE:FSG) | £4.11 | £470.86M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.21 | £103.38M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £2.47 | £315.6M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.437 | $254.04M | ★★★★★★ |

Click here to see the full list of 469 stocks from our UK Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Concurrent Technologies (AIM:CNC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Concurrent Technologies Plc designs, develops, manufactures, and markets single board computers for system integrators and original equipment manufacturers globally, with a market cap of £117.96 million.

Operations: The company generates revenue of £36.32 million from the design, manufacture, and supply of high-end embedded computer products.

Market Cap: £117.96M

Concurrent Technologies Plc, with a market cap of £117.96 million and revenues of £36.32 million, has shown significant earnings growth of 222.6% over the past year, outpacing the tech industry average. The company is debt-free and has strong short-term asset coverage for liabilities, reflecting financial stability. Recent developments include securing a $3.33 million order from a US defense contractor for VME standard computer boards and launching Hermod II, an advanced Ethernet switch designed for harsh environments in defense sectors. Additionally, Concurrent secured a $3.72 million contract in Asia for rugged systems in next-generation armored vehicles, highlighting its strategic expansion efforts globally.

- Navigate through the intricacies of Concurrent Technologies with our comprehensive balance sheet health report here.

- Gain insights into Concurrent Technologies' outlook and expected performance with our report on the company's earnings estimates.

Cairn Homes (LSE:CRN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cairn Homes plc is a holding company that operates as a home and community builder in Ireland, with a market cap of £1.21 billion.

Operations: The company generates its revenue primarily from building and property development, totaling €813.40 million.

Market Cap: £1.21B

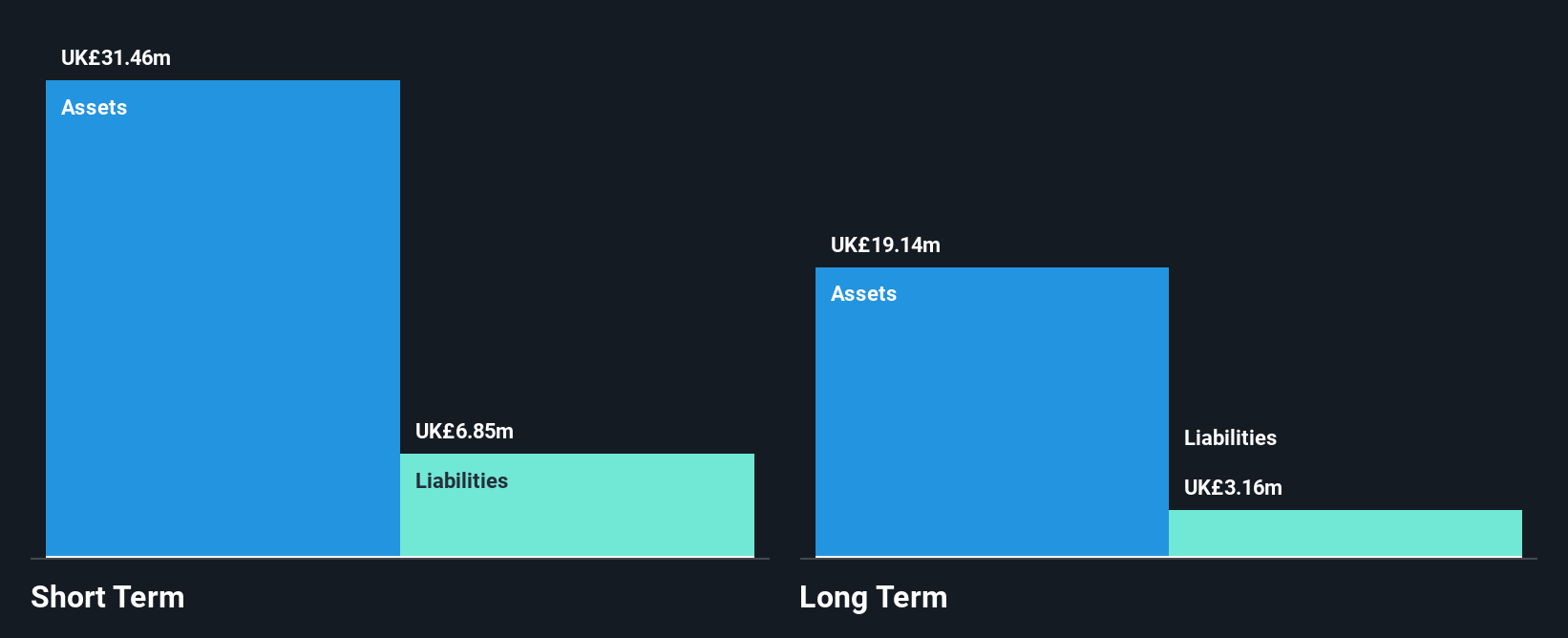

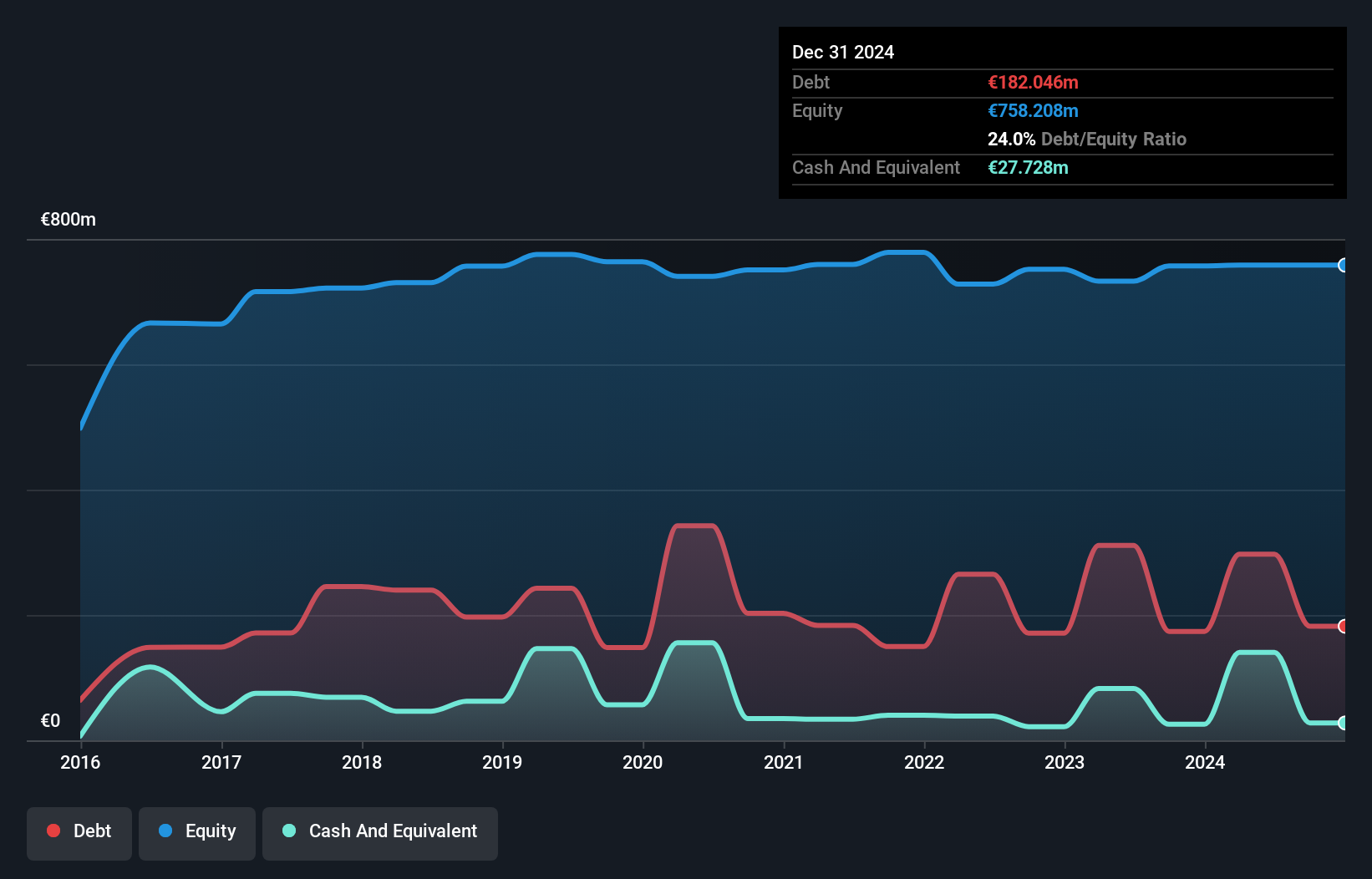

Cairn Homes plc, with a market cap of £1.21 billion and revenue of €813.40 million, demonstrates financial robustness with short-term assets exceeding both short and long-term liabilities significantly. The company's debt management is commendable, with operating cash flow covering 63.1% of its debt and interest payments well covered by EBIT at 9.5 times coverage. Despite a low Return on Equity at 14.7%, earnings have grown impressively by 49.5% over the past year, surpassing industry averages, though insider selling has been significant recently. Recent board changes aim to support future growth as Cairn navigates an unstable dividend track record.

- Jump into the full analysis health report here for a deeper understanding of Cairn Homes.

- Understand Cairn Homes' earnings outlook by examining our growth report.

Mollyroe (OFEX:MOY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Mollyroe Plc is involved in investing in commercial and residential properties, with a market capitalization of £8.06 million.

Operations: Mollyroe Plc has not reported any specific revenue segments.

Market Cap: £8.06M

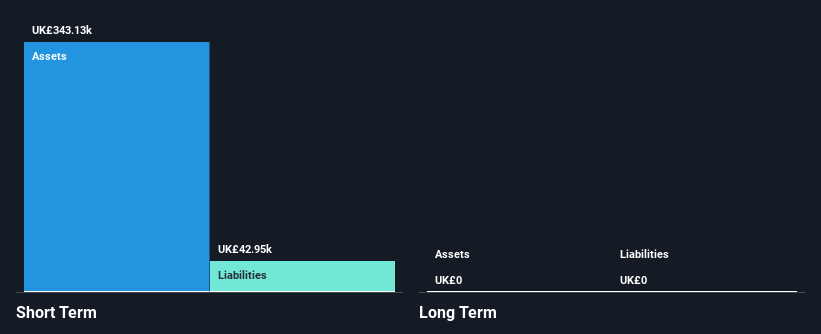

Mollyroe Plc, with a market capitalization of £8.06 million, is currently pre-revenue and unprofitable. The company has no debt, alleviating concerns over interest payments and long-term liabilities. However, its share price has been highly volatile over the past three months, with weekly volatility increasing significantly in the past year. While short-term assets of £343.1K comfortably cover short-term liabilities of £42.9K, shareholders have experienced dilution as shares outstanding grew by 2.2% last year. Insufficient data exists to assess management or board experience accurately due to limited tenure information available.

- Click here to discover the nuances of Mollyroe with our detailed analytical financial health report.

- Understand Mollyroe's track record by examining our performance history report.

Seize The Opportunity

- Unlock our comprehensive list of 469 UK Penny Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CRN

Cairn Homes

A holding company, operates as a home and community builder in Ireland.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives