- United Kingdom

- /

- Luxury

- /

- LSE:BRBY

The one-year shareholder returns and company earnings persist lower as Burberry Group (LON:BRBY) stock falls a further 5.8% in past week

Investing in stocks comes with the risk that the share price will fall. And there's no doubt that Burberry Group plc (LON:BRBY) stock has had a really bad year. The share price has slid 70% in that time. To make matters worse, the returns over three years have also been really disappointing (the share price is 66% lower than three years ago). Shareholders have had an even rougher run lately, with the share price down 36% in the last 90 days.

Since Burberry Group has shed UK£156m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

View our latest analysis for Burberry Group

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

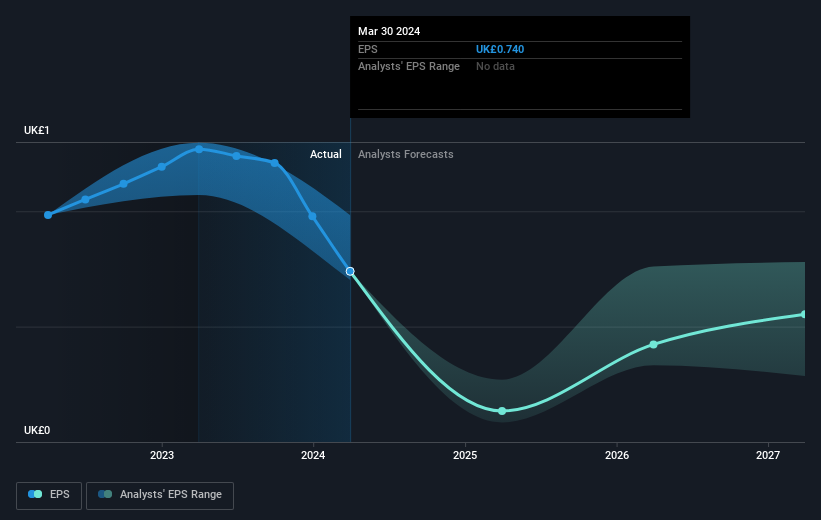

Unhappily, Burberry Group had to report a 42% decline in EPS over the last year. This reduction in EPS is not as bad as the 70% share price fall. Unsurprisingly, given the lack of EPS growth, the market seems to be more cautious about the stock. The P/E ratio of 8.62 also points to the negative market sentiment.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. Dive deeper into the earnings by checking this interactive graph of Burberry Group's earnings, revenue and cash flow.

A Different Perspective

Burberry Group shareholders are down 68% for the year (even including dividends), but the market itself is up 14%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 11% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 3 warning signs for Burberry Group that you should be aware of.

Burberry Group is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Burberry Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:BRBY

Burberry Group

Engages in manufacturing, retail, and wholesale of luxury goods under the Burberry brand in the Asia Pacific, Europe, the Middle East, India, Africa, and the Americas.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives