- United Kingdom

- /

- Auto

- /

- LSE:AML

UK Growth Companies With High Insider Ownership January 2025

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid concerns over weak trade data from China and its impact on global demand. In such uncertain conditions, growth companies with high insider ownership can be appealing to investors as they often indicate strong confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Filtronic (AIM:FTC) | 28.8% | 55.7% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.2% | 93.9% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.6% | 21.5% |

| Foresight Group Holdings (LSE:FSG) | 34.2% | 23.5% |

| Facilities by ADF (AIM:ADF) | 13.1% | 190% |

| LSL Property Services (LSE:LSL) | 10.7% | 28.2% |

| Judges Scientific (AIM:JDG) | 10.6% | 29.4% |

| B90 Holdings (AIM:B90) | 24.4% | 166.8% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 19.8% | 26.4% |

| Anglo Asian Mining (AIM:AAZ) | 40% | 189.1% |

Let's take a closer look at a couple of our picks from the screened companies.

Property Franchise Group (AIM:TPFG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: The Property Franchise Group PLC manages and leases residential real estate properties in the United Kingdom, with a market cap of £256.10 million.

Operations: The company's revenue segments include £8.28 million from Financial Services and £31.64 million from Property Franchising.

Insider Ownership: 13.6%

Property Franchise Group is experiencing significant earnings growth, forecasted at 54.87% annually, outpacing the UK market's 14.4%. Revenue growth is also strong at 42.4% per year, exceeding market expectations. Despite trading significantly below estimated fair value and recent substantial insider selling, the company has not seen substantial insider buying in the past three months. Executive changes include Ben Dodds assuming CFO responsibilities from January 2025 following a transition period with David Raggett.

- Get an in-depth perspective on Property Franchise Group's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Property Franchise Group shares in the market.

Aston Martin Lagonda Global Holdings (LSE:AML)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Aston Martin Lagonda Global Holdings plc is involved in the design, development, manufacture, and marketing of luxury sports cars globally, with a market cap of £996.74 million.

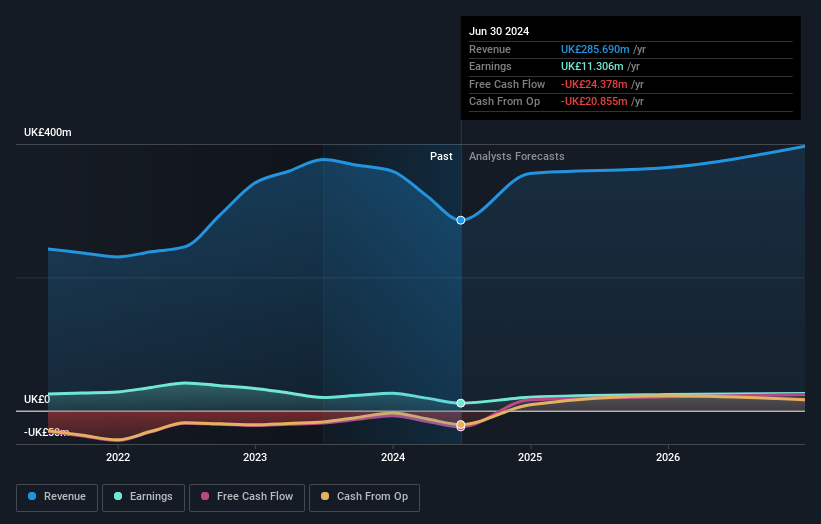

Operations: The company's revenue primarily comes from its Automotive segment, which generated £1.59 billion.

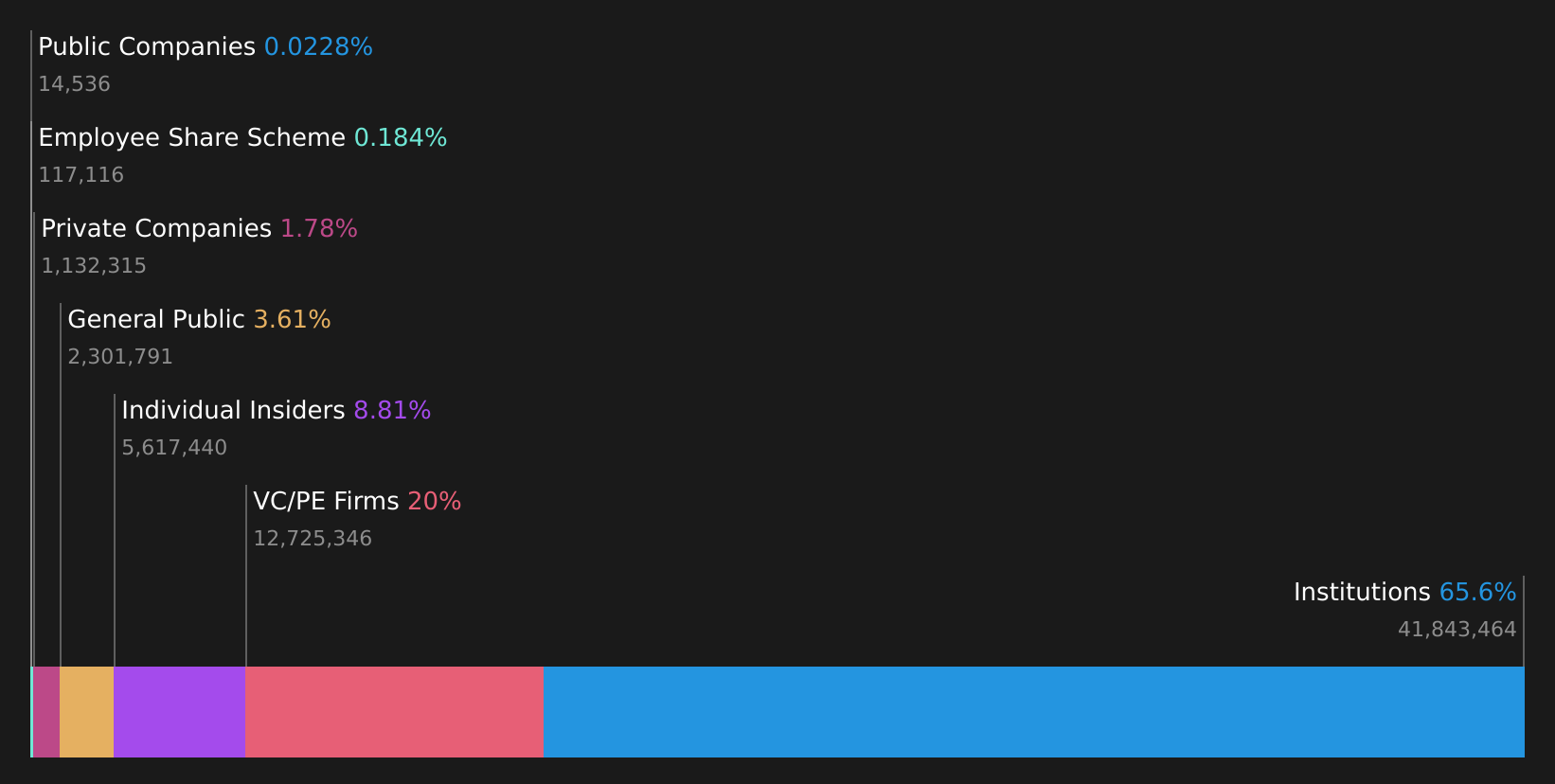

Insider Ownership: 11.3%

Aston Martin Lagonda is forecasted for impressive earnings growth of 62.68% annually, with revenue expected to grow at 12.3% per year, surpassing the UK market's average. Despite recent share dilution and a £111.25 million equity offering, the stock trades significantly below its estimated fair value. The company aims for profitability within three years but faces management changes as Robin Freestone steps down from the board in early 2025 following financial results announcements.

- Unlock comprehensive insights into our analysis of Aston Martin Lagonda Global Holdings stock in this growth report.

- Upon reviewing our latest valuation report, Aston Martin Lagonda Global Holdings' share price might be too pessimistic.

Henry Boot (LSE:BOOT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Henry Boot PLC operates in the United Kingdom, focusing on property investment and development, land promotion, and construction activities with a market cap of £307.37 million.

Operations: The company's revenue segments include £170.56 million from property investment and development, £28.37 million from land promotion, and £87.90 million from construction activities in the United Kingdom.

Insider Ownership: 27%

Henry Boot's earnings are expected to grow significantly at 25.5% annually, outpacing the UK market average. While revenue growth of 10.7% per year is anticipated, it remains below the 20% threshold for high growth but exceeds the broader market's rate. The stock trades at a notable discount to its estimated fair value, though return on equity is projected to be low at 5.8%. Dividend sustainability remains a concern due to inadequate free cash flow coverage.

- Click to explore a detailed breakdown of our findings in Henry Boot's earnings growth report.

- According our valuation report, there's an indication that Henry Boot's share price might be on the expensive side.

Summing It All Up

- Reveal the 66 hidden gems among our Fast Growing UK Companies With High Insider Ownership screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AML

Aston Martin Lagonda Global Holdings

Engages in the design, development, manufacture, and marketing of luxury sports cars in the United Kingdom, the Americas, the Middle East, Africa, rest of Europe, and the Asia Pacific.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives