- United Kingdom

- /

- Renewable Energy

- /

- AIM:GOOD

Spotlight On 3 UK Penny Stocks With At Least £0 Market Cap

Reviewed by Simply Wall St

The United Kingdom's stock market has been facing challenges, with the FTSE 100 and FTSE 250 indices recently declining due to weak trade data from China, which has impacted companies tied to its economic performance. In such a climate, investors often seek opportunities in smaller or newer companies that can offer value despite broader market pressures. Penny stocks—though an older term—remain relevant for those interested in exploring investments with potential for growth and stability. This article highlights three UK penny stocks that exhibit financial strength and could present intriguing prospects for investors looking beyond the major indices.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Ultimate Products (LSE:ULTP) | £0.64 | £54.25M | ✅ 4 ⚠️ 4 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.62 | £270.86M | ✅ 4 ⚠️ 1 View Analysis > |

| Next 15 Group (AIM:NFG) | £2.51 | £249.63M | ✅ 4 ⚠️ 5 View Analysis > |

| Central Asia Metals (AIM:CAML) | £1.47 | £255.74M | ✅ 4 ⚠️ 2 View Analysis > |

| Warpaint London (AIM:W7L) | £3.40 | £274.68M | ✅ 5 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.14 | £355.76M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £3.70 | £356.67M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £0.988 | £157.57M | ✅ 4 ⚠️ 2 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £3.774 | £2.09B | ✅ 5 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.33 | £35.71M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 391 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Active Energy Group (AIM:AEG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Active Energy Group Plc currently does not have significant operations and has a market cap of £388,471.

Operations: Active Energy Group Plc does not report any revenue segments.

Market Cap: £388.47k

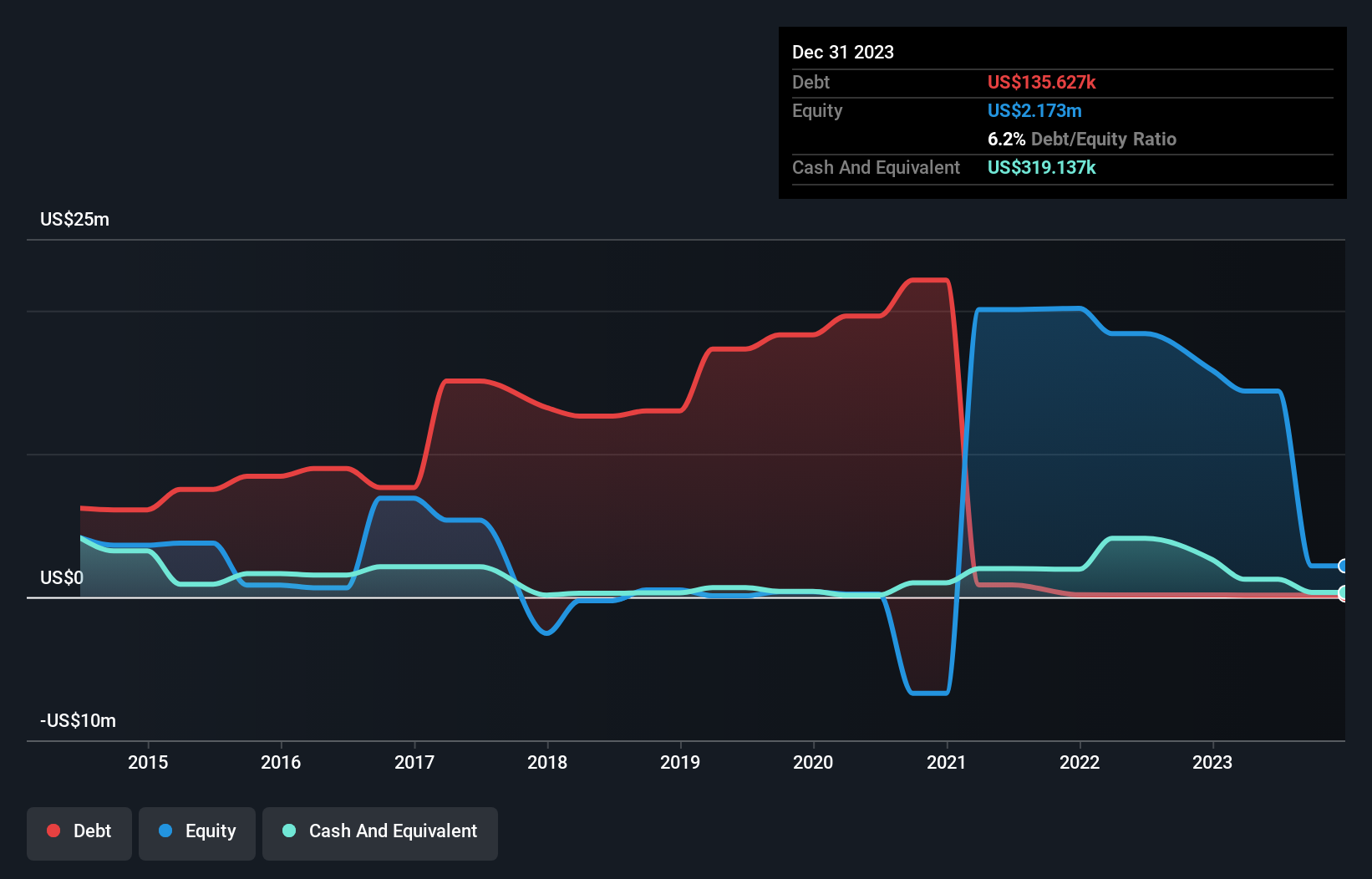

Active Energy Group Plc, with a market cap of £388,471, is a pre-revenue company facing significant challenges typical of penny stocks. The company has undergone substantial executive and board changes recently, including the resignation of its CEO Michael Rowan. Despite reducing its debt to equity ratio from very high levels to 6.2% over five years and having more cash than total debt, Active Energy remains unprofitable with no significant revenue streams. Its share price has been highly volatile over the past three months, reflecting uncertainty in its operations and future prospects.

- Jump into the full analysis health report here for a deeper understanding of Active Energy Group.

- Gain insights into Active Energy Group's historical outcomes by reviewing our past performance report.

Good Energy Group (AIM:GOOD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Good Energy Group PLC, with a market cap of £90.03 million, operates in the United Kingdom by purchasing, generating, and selling electricity from renewable sources through its subsidiaries.

Operations: The company generates revenue of £180.07 million from its operations in the United Kingdom.

Market Cap: £90.03M

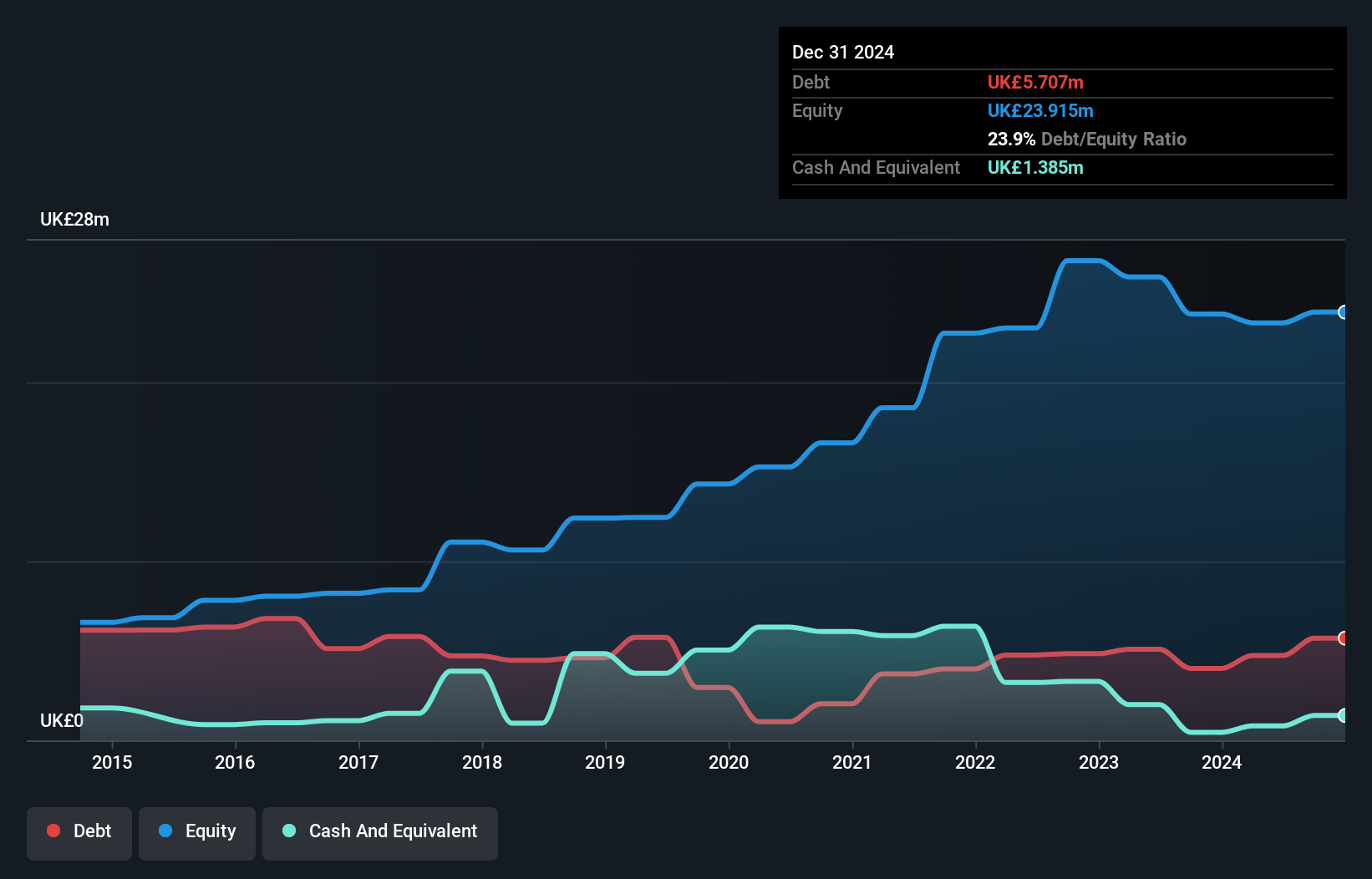

Good Energy Group PLC, with a market cap of £90.03 million, demonstrates characteristics appealing to penny stock investors. Despite a decline in sales from £254.7 million to £180.07 million, the company improved its net income to £4.75 million and increased earnings per share over the past year, indicating resilience amidst challenges. The company's debt is well managed with more cash than total debt and reduced debt-to-equity ratio significantly over five years. Good Energy's experienced management team and board further bolster investor confidence while recent shareholder approval of amendments suggests strategic adaptability for future growth opportunities.

- Get an in-depth perspective on Good Energy Group's performance by reading our balance sheet health report here.

- Gain insights into Good Energy Group's outlook and expected performance with our report on the company's earnings estimates.

Tandem Group (AIM:TND)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tandem Group plc designs, develops, distributes, and retails sports, leisure, and mobility products in the United Kingdom with a market cap of £9.71 million.

Operations: The company's revenue is segmented into Golf (£2.55 million), Home & Garden (£2.33 million), Toys, Sports and Leisure (£12.36 million), and Bicycles, Including Electric (£7.38 million).

Market Cap: £9.71M

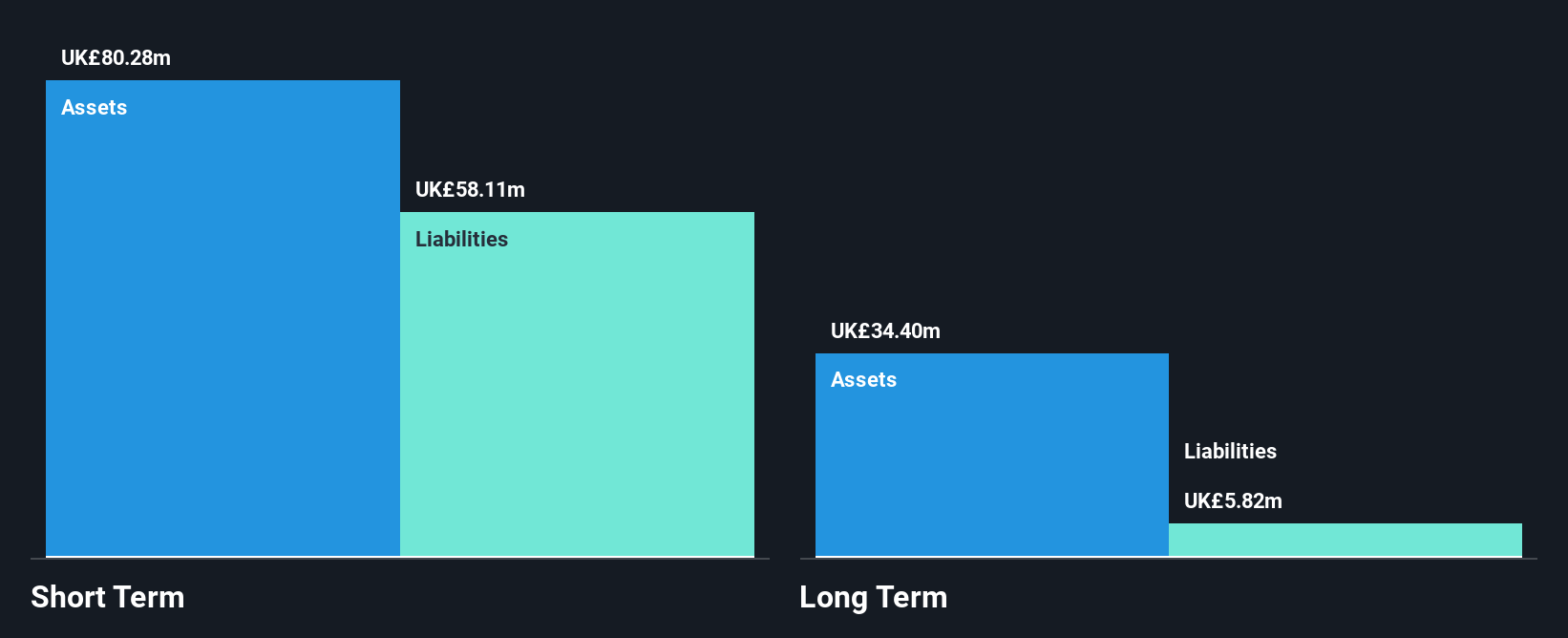

Tandem Group, with a market cap of £9.71 million, presents both opportunities and challenges for penny stock investors. Despite reporting a net loss of £0.06 million for 2024, the company showed resilience with an 11% increase in revenue to £24.62 million year-on-year, driven by strong performance in its Toys, Sports and Leisure segment (£12.36 million). Short-term assets exceed liabilities, providing some financial stability; however, the company remains unprofitable with negative operating cash flow. Recent leadership changes could signal strategic shifts as Tandem aims for improved profitability in 2025 amidst ongoing market pressures.

- Unlock comprehensive insights into our analysis of Tandem Group stock in this financial health report.

- Review our historical performance report to gain insights into Tandem Group's track record.

Next Steps

- Embark on your investment journey to our 391 UK Penny Stocks selection here.

- Want To Explore Some Alternatives? This technology could replace computers: discover the 21 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:GOOD

Good Energy Group

Through its subsidiaries, engages in the purchase, generation, and sale of electricity from renewable sources in the United Kingdom.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives