- United Kingdom

- /

- Software

- /

- AIM:QTX

Discover 3 UK Penny Stocks With Market Caps As Low As £70M

Reviewed by Simply Wall St

The UK market has recently experienced some turbulence, with the FTSE 100 and FTSE 250 indices closing lower amid concerns over weak trade data from China. In such uncertain times, investors often look beyond blue-chip stocks to explore opportunities in smaller companies. Penny stocks, though an older term, continue to represent a segment of the market where smaller or newer companies can offer potential value. This article explores three UK penny stocks that demonstrate strong financial foundations and growth potential, providing intriguing options for those interested in exploring this investment area.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| FRP Advisory Group (AIM:FRP) | £1.42 | £348.23M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.14 | £806.26M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.915 | £473.73M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.29 | £426.67M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.42 | £121.23M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.57 | £183.08M | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.08 | £194.41M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.398 | £215.61M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.48 | £188.48M | ★★★★★☆ |

| Character Group (AIM:CCT) | £2.74 | £51.44M | ★★★★★★ |

Click here to see the full list of 474 stocks from our UK Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Quartix Technologies (AIM:QTX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Quartix Technologies plc designs, develops, markets, and delivers vehicle telematics services across the United Kingdom, France, the United States, and European Territories with a market cap of £77.43 million.

Operations: The company's revenue is generated from various regions, with £18.36 million from the United Kingdom, £7.50 million from France, £3.26 million from the United States of America, and £2.24 million from New European Territories.

Market Cap: £77.43M

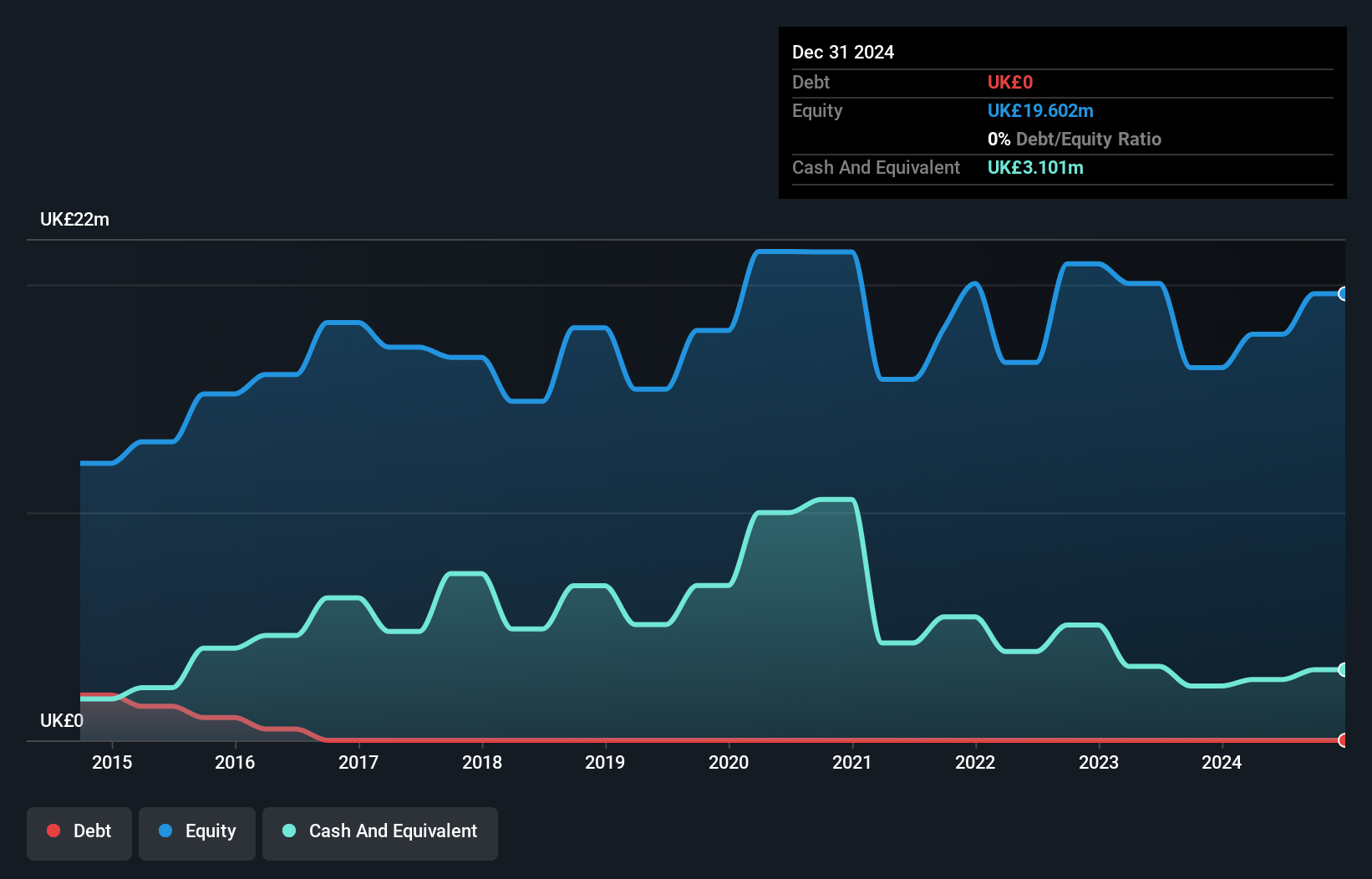

Quartix Technologies, with a market cap of £77.43 million, operates in vehicle telematics across multiple regions. Despite being unprofitable and experiencing increasing losses over the past five years, Quartix remains debt-free, alleviating concerns about interest coverage and debt levels. The company’s short-term assets exceed both its short-term and long-term liabilities, indicating solid financial footing in terms of liquidity. Trading at a significant discount to its estimated fair value offers potential upside if profitability improves. However, challenges include a relatively inexperienced board and management team with an average tenure of 2.3 years for managers and 1 year for directors.

- Click here to discover the nuances of Quartix Technologies with our detailed analytical financial health report.

- Explore Quartix Technologies' analyst forecasts in our growth report.

Springfield Properties (AIM:SPR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Springfield Properties Plc, along with its subsidiaries, operates in the house building industry in the United Kingdom and has a market cap of £122.91 million.

Operations: The company generates revenue from its Housing Building Activity segment, amounting to £266.53 million.

Market Cap: £122.91M

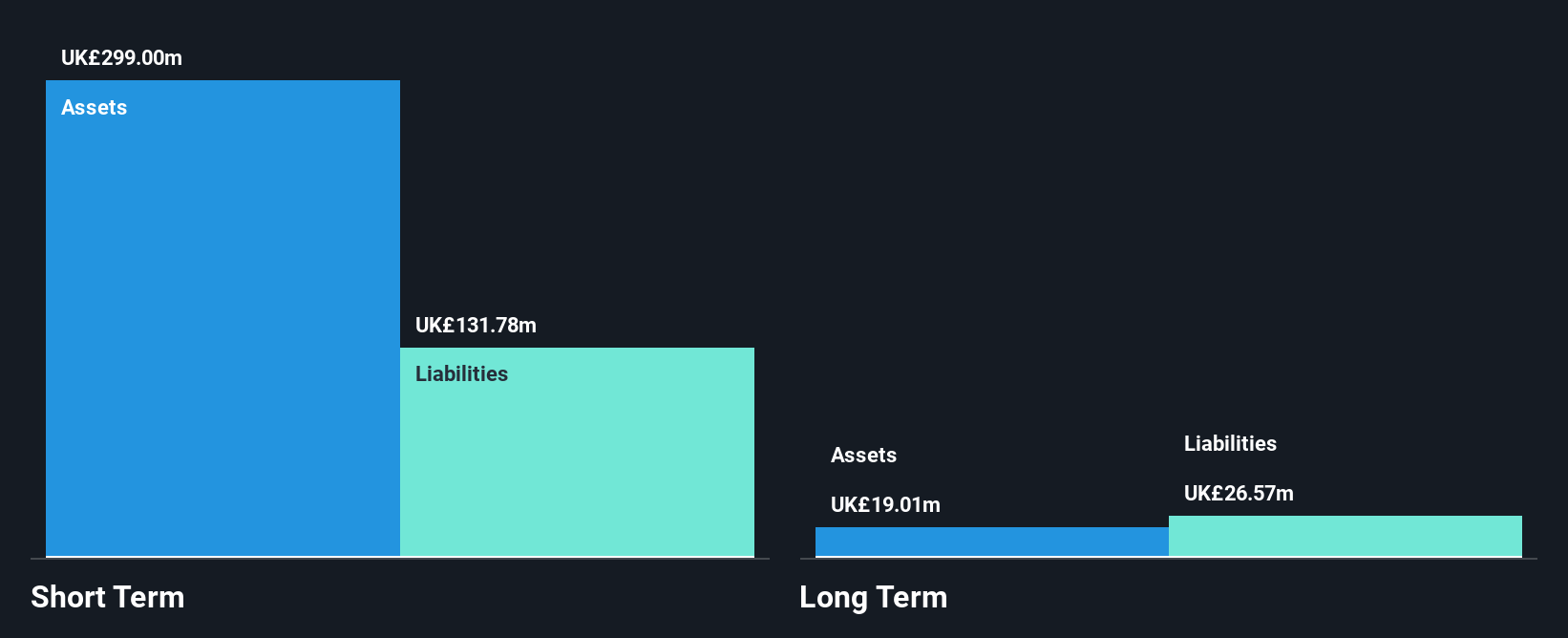

Springfield Properties, with a market cap of £122.91 million, faces challenges in the house building sector as evidenced by declining sales and net income over the past year. Despite this, it maintains a strong liquidity position with short-term assets exceeding both short and long-term liabilities. The company's debt is well-managed relative to its cash flow, though interest coverage remains a concern at 2.4 times EBIT. Earnings are forecasted to grow annually by 19.56%, suggesting potential recovery prospects. Recent financial results showed decreased earnings per share but an upcoming dividend indicates confidence in future performance improvements amidst current volatility concerns.

- Click here and access our complete financial health analysis report to understand the dynamics of Springfield Properties.

- Assess Springfield Properties' future earnings estimates with our detailed growth reports.

Henry Boot (LSE:BOOT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Henry Boot PLC operates in the United Kingdom, focusing on property investment and development, land promotion, and construction activities, with a market cap of £316.73 million.

Operations: The company generates revenue through its segments of Property Investment and Development (£170.56 million), Construction (£87.90 million), and Land Promotion (£28.37 million).

Market Cap: £316.73M

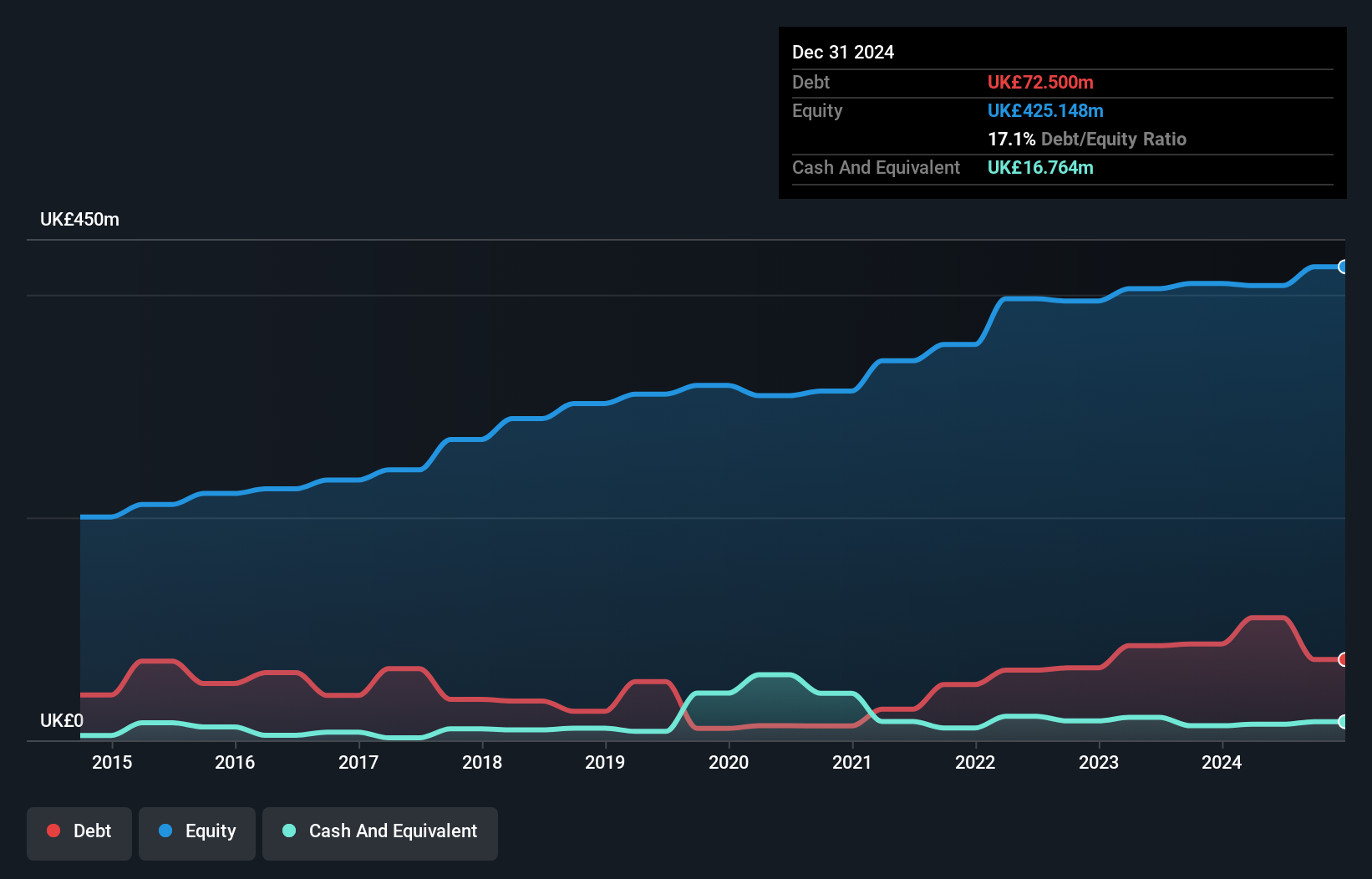

Henry Boot PLC, with a market cap of £316.73 million, has faced recent earnings challenges, reporting a significant decline in sales and net income for the first half of 2024 compared to the previous year. Despite this, the company maintains strong liquidity with short-term assets surpassing both short and long-term liabilities. The interim dividend increase reflects confidence in future prospects despite lower profit margins and negative earnings growth over the past year. Recent expansion efforts at Airport Business Park Southend highlight strategic development initiatives, potentially enhancing revenue streams through industrial and logistics projects while maintaining satisfactory debt levels relative to equity.

- Take a closer look at Henry Boot's potential here in our financial health report.

- Gain insights into Henry Boot's future direction by reviewing our growth report.

Where To Now?

- Unlock more gems! Our UK Penny Stocks screener has unearthed 471 more companies for you to explore.Click here to unveil our expertly curated list of 474 UK Penny Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quartix Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:QTX

Quartix Technologies

Engages in the design, development, marketing, and delivery of vehicle telematics services in the United Kingdom, France, the United States, and the European Territories.

Flawless balance sheet with reasonable growth potential.