- United Kingdom

- /

- Oil and Gas

- /

- AIM:PMG

Parkmead Group Leads 3 UK Penny Stocks To Consider

Reviewed by Simply Wall St

The UK market has been grappling with challenges as the FTSE 100 index recently closed lower, influenced by weak trade data from China and its impact on commodity-linked companies. In such fluctuating conditions, identifying stocks that combine financial strength with growth potential becomes crucial for investors. Penny stocks, despite being a somewhat outdated term, still represent an intriguing investment area where smaller or newer companies can offer significant opportunities when backed by robust fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.215 | £834.53M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.33 | £169.38M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £4.18 | £415.73M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.48 | £66.37M | ★★★★☆☆ |

| Serabi Gold (AIM:SRB) | £0.89 | £67.4M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.23 | £104.97M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.292 | £199.26M | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | £3.215 | £411.4M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.404 | $234.86M | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.40 | £209.85M | ★★★★★★ |

Click here to see the full list of 464 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Parkmead Group (AIM:PMG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: The Parkmead Group plc is an independent oil and gas company involved in the exploration and production of oil and gas properties across Europe, North America, and internationally, with a market cap of £16.39 million.

Operations: No specific revenue segments have been reported for the company.

Market Cap: £16.39M

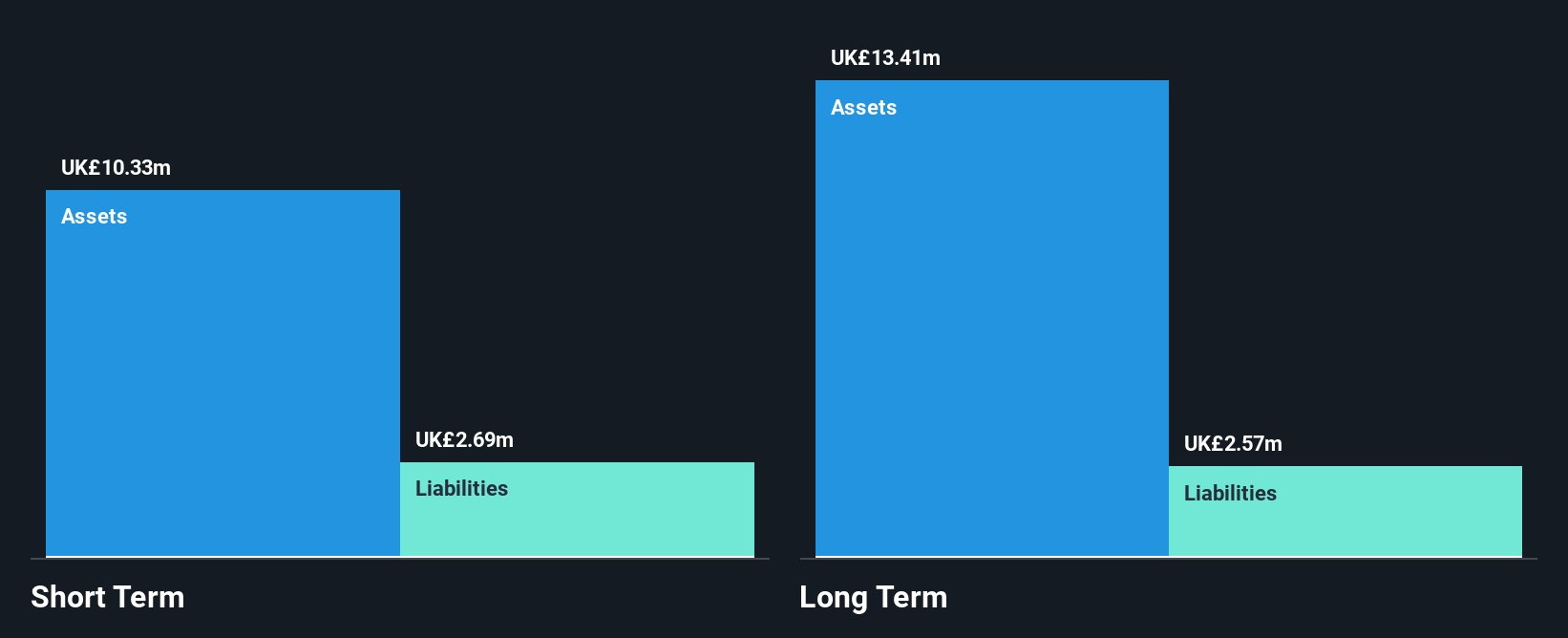

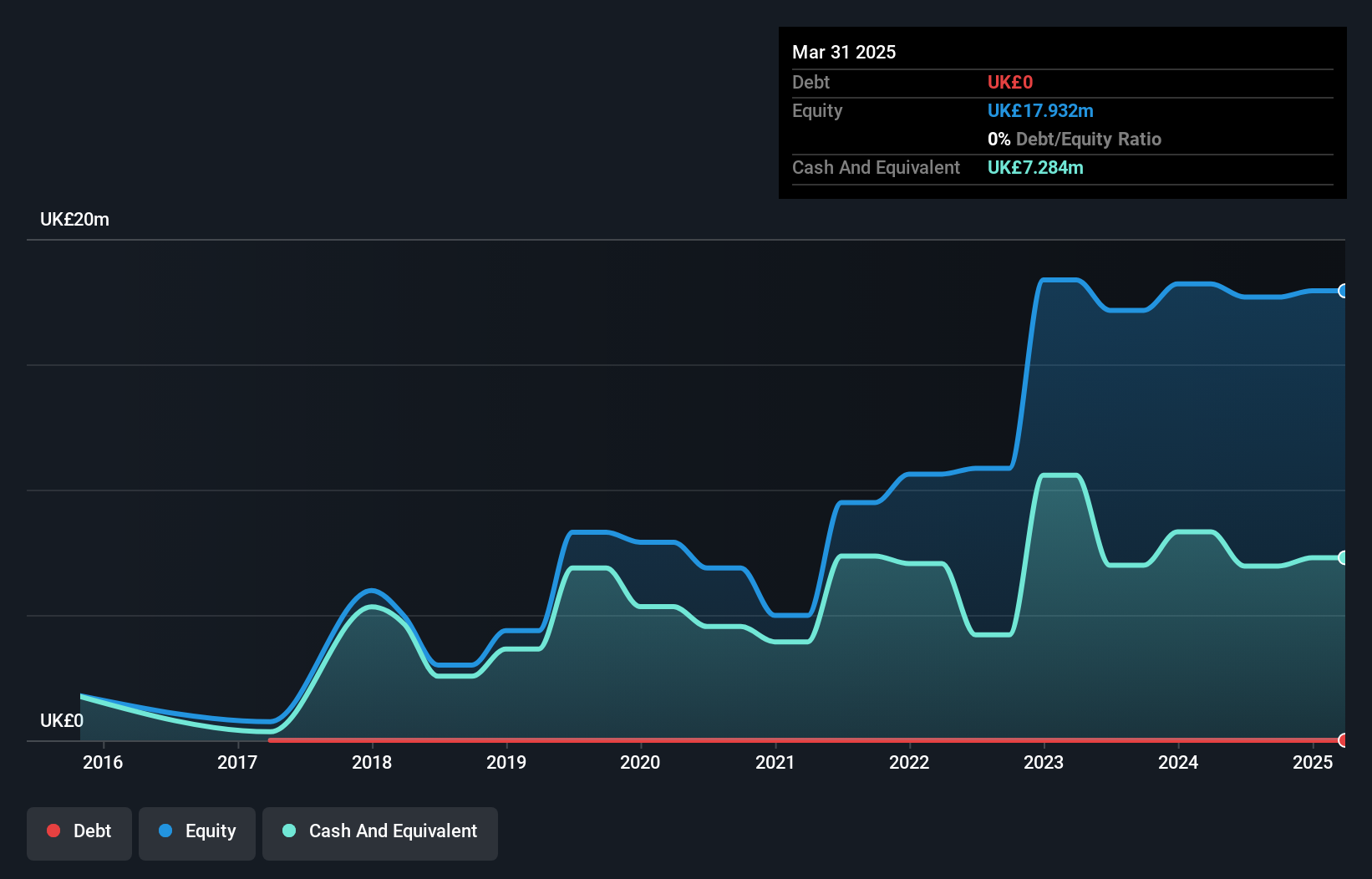

The Parkmead Group has transitioned to profitability, reporting a net income of £4.94 million for the year ending June 2024, a significant turnaround from the previous year's loss. Despite volatile share prices and reduced sales (£5.72 million from £14.77 million), its financial stability is underscored by short-term assets exceeding liabilities and robust debt coverage by operating cash flow (339.7%). With a low price-to-earnings ratio (3.3x) compared to the UK market and seasoned management, Parkmead is strategically positioned for potential acquisitions in renewable energy and international exploration sectors, aiming to enhance shareholder value further.

- Navigate through the intricacies of Parkmead Group with our comprehensive balance sheet health report here.

- Gain insights into Parkmead Group's historical outcomes by reviewing our past performance report.

Sosandar (AIM:SOS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sosandar Plc is a company that manufactures and distributes clothing products through internet and mail order in the United Kingdom and internationally, with a market cap of £22.59 million.

Operations: Sosandar generates its revenue through the manufacture and distribution of clothing products via online and mail order channels both domestically in the UK and internationally.

Market Cap: £22.59M

Sosandar Plc has shown resilience despite declining sales, reporting a half-year revenue of £16.19 million and reducing its net loss to £0.659 million from the previous year. The company benefits from strong brand partnerships, exemplified by a new licensing agreement with NEXT for a homeware range, which requires no capital expenditure and aims to leverage Sosandar's brand equity. Financially stable with short-term assets of £23 million exceeding liabilities and no debt burden, Sosandar remains focused on growth through strategic store expansions in high-footfall locations like Cardiff's St David’s centre while maintaining high-quality earnings amidst industry challenges.

- Get an in-depth perspective on Sosandar's performance by reading our balance sheet health report here.

- Examine Sosandar's earnings growth report to understand how analysts expect it to perform.

Volex (AIM:VLX)

Simply Wall St Financial Health Rating: ★★★★☆☆

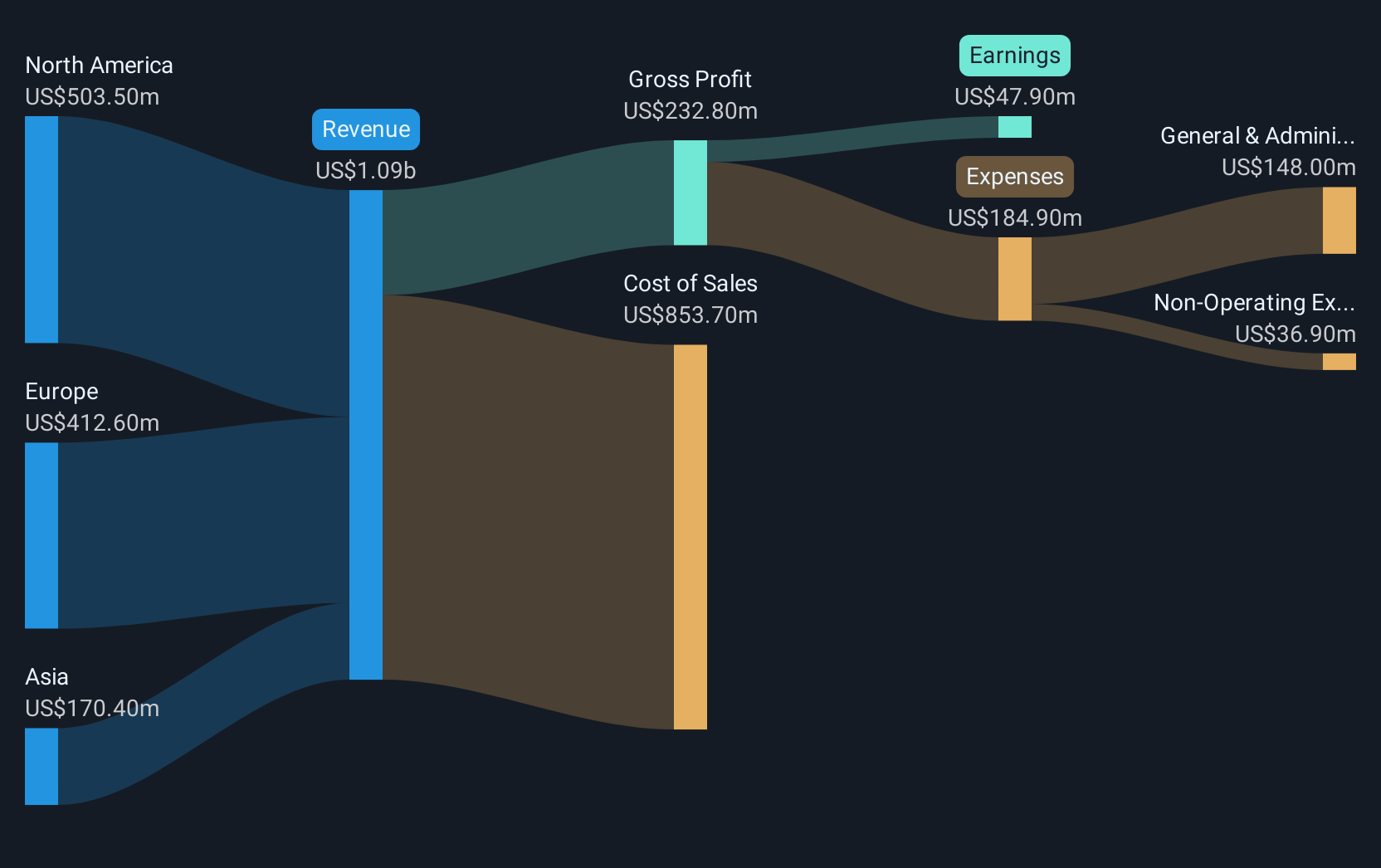

Overview: Volex plc manufactures and sells power and data cables across North America, Europe, and Asia with a market cap of £524.72 million.

Operations: The company's revenue is segmented as follows: $197.3 million from Asia, $421.2 million from Europe, and $415 million from North America.

Market Cap: £524.72M

Volex plc, with a market cap of £524.72 million, has shown solid financial performance, reporting a half-year revenue increase to US$518.2 million from US$397.5 million the previous year and net income growth to US$19.3 million. The company's earnings have grown at 22.1% over the past year, surpassing industry averages, and its short-term assets exceed both short and long-term liabilities by significant margins. Despite high debt levels with a net debt to equity ratio of 42.9%, interest payments are well covered by EBIT (3.8x). Recent M&A proposals for TT Electronics were rejected but highlight strategic ambitions for diversification and growth in new markets like aerospace and defence.

- Take a closer look at Volex's potential here in our financial health report.

- Evaluate Volex's prospects by accessing our earnings growth report.

Seize The Opportunity

- Dive into all 464 of the UK Penny Stocks we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:PMG

Parkmead Group

An independent oil and gas company, engages in the exploration and production of oil and gas properties in Europe.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives