- United Kingdom

- /

- Consumer Durables

- /

- AIM:IGR

IG Design Group (LON:IGR shareholders incur further losses as stock declines 16% this week, taking five-year losses to 87%

We're definitely into long term investing, but some companies are simply bad investments over any time frame. We don't wish catastrophic capital loss on anyone. For example, we sympathize with anyone who was caught holding IG Design Group plc (LON:IGR) during the five years that saw its share price drop a whopping 88%. We also note that the stock has performed poorly over the last year, with the share price down 70%. Even worse, it's down 25% in about a month, which isn't fun at all. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Since IG Design Group has shed UK£11m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

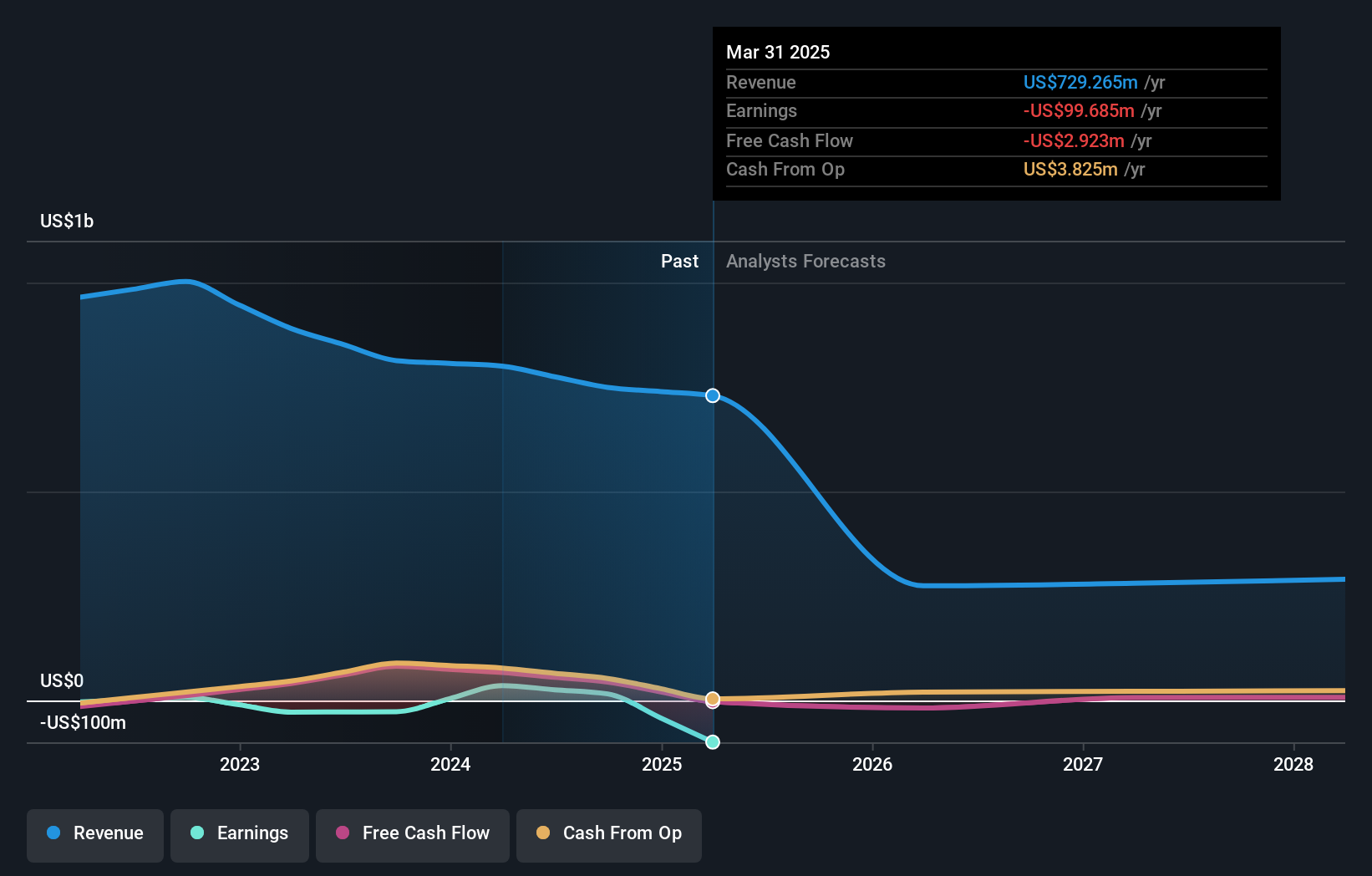

Given that IG Design Group didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last five years IG Design Group saw its revenue shrink by 0.3% per year. While far from catastrophic that is not good. The share price fall of 13% (per year, over five years) is a stern reminder that money-losing companies are expected to grow revenue. It takes a certain kind of mental fortitude (or recklessness) to buy shares in a company that loses money and doesn't grow revenue. That is not really what the successful investors we know aim for.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at IG Design Group's financial health with this free report on its balance sheet.

A Different Perspective

Investors in IG Design Group had a tough year, with a total loss of 70%, against a market gain of about 11%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 13% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that IG Design Group is showing 3 warning signs in our investment analysis , and 2 of those are a bit unpleasant...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:IGR

IG Design Group

Engages in the design, production, and distribution of gift packaging, arty, goods not for resale, craft, stationery, and homeware consumable products in the Americas, the United Kingdom, Netherlands, and internationally.

Fair value with mediocre balance sheet.

Market Insights

Community Narratives