Lyndon Davies has been the CEO of Hornby PLC (LON:HRN) since 2017, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also assess whether Hornby pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

View our latest analysis for Hornby

Comparing Hornby PLC's CEO Compensation With the industry

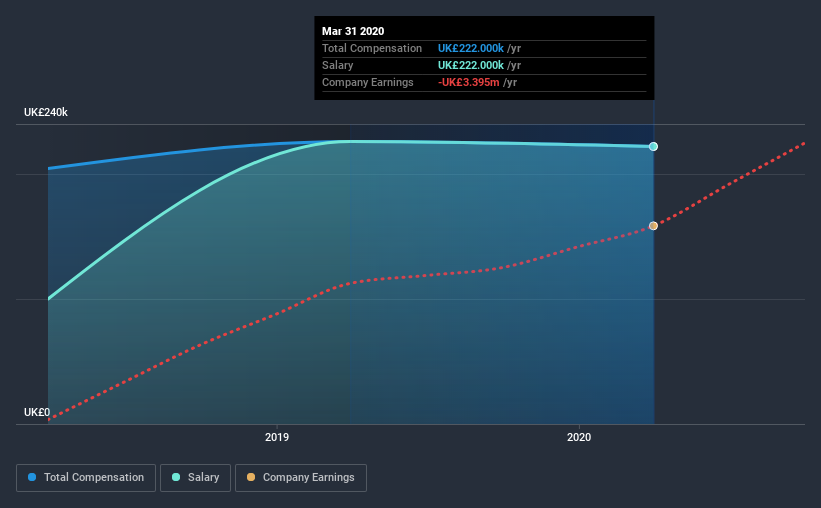

Our data indicates that Hornby PLC has a market capitalization of UK£116m, and total annual CEO compensation was reported as UK£222k for the year to March 2020. That's mostly flat as compared to the prior year's compensation. It is worth noting that the CEO compensation consists entirely of the salary, worth UK£222k.

On comparing similar companies from the same industry with market caps ranging from UK£74m to UK£295m, we found that the median CEO total compensation was UK£197k. From this we gather that Lyndon Davies is paid around the median for CEOs in the industry. Furthermore, Lyndon Davies directly owns UK£553k worth of shares in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | UK£222k | UK£226k | 100% |

| Other | - | - | - |

| Total Compensation | UK£222k | UK£226k | 100% |

Speaking on an industry level, nearly 83% of total compensation represents salary, while the remainder of 17% is other remuneration. At the company level, Hornby pays Lyndon Davies solely through a salary, preferring to go down a conventional route. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Hornby PLC's Growth Numbers

Hornby PLC has seen its earnings per share (EPS) increase by 68% a year over the past three years. It achieved revenue growth of 24% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. This sort of respectable year-on-year revenue growth is often seen at a healthy, growing business. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Hornby PLC Been A Good Investment?

Boasting a total shareholder return of 162% over three years, Hornby PLC has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

Hornby rewards its CEO solely through a salary, ignoring non-salary benefits completely. As we noted earlier, Hornby pays its CEO in line with similar-sized companies belonging to the same industry. The company is growing EPS and total shareholder returns have been pleasing. Although the pay is close to the industry median, overall performance is excellent, so we don't think the CEO is paid too generously. Also, such solid returns might lead to shareholders warming to the idea of a bump in pay.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 2 warning signs for Hornby that you should be aware of before investing.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade Hornby, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Hornby, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hornby might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:HRN

Hornby

Through its subsidiaries, designs, develops, sources, and distributes hobby and interactive products in the United Kingdom, the United States, Spain, Italy, and rest of Europe.

Slight with imperfect balance sheet.

Market Insights

Community Narratives