- United Kingdom

- /

- Professional Services

- /

- LSE:STEM

Top UK Dividend Stocks To Watch In August 2024

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index has recently experienced a downturn, largely influenced by weak trade data from China and faltering commodity prices. As the market navigates these global economic challenges, investors may find stability in dividend stocks, which can provide consistent income even in uncertain times.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| James Latham (AIM:LTHM) | 5.94% | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | 7.49% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 3.56% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 3.16% | ★★★★★☆ |

| Man Group (LSE:EMG) | 5.53% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.30% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 5.55% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.68% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.84% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.43% | ★★★★★☆ |

Click here to see the full list of 58 stocks from our Top UK Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

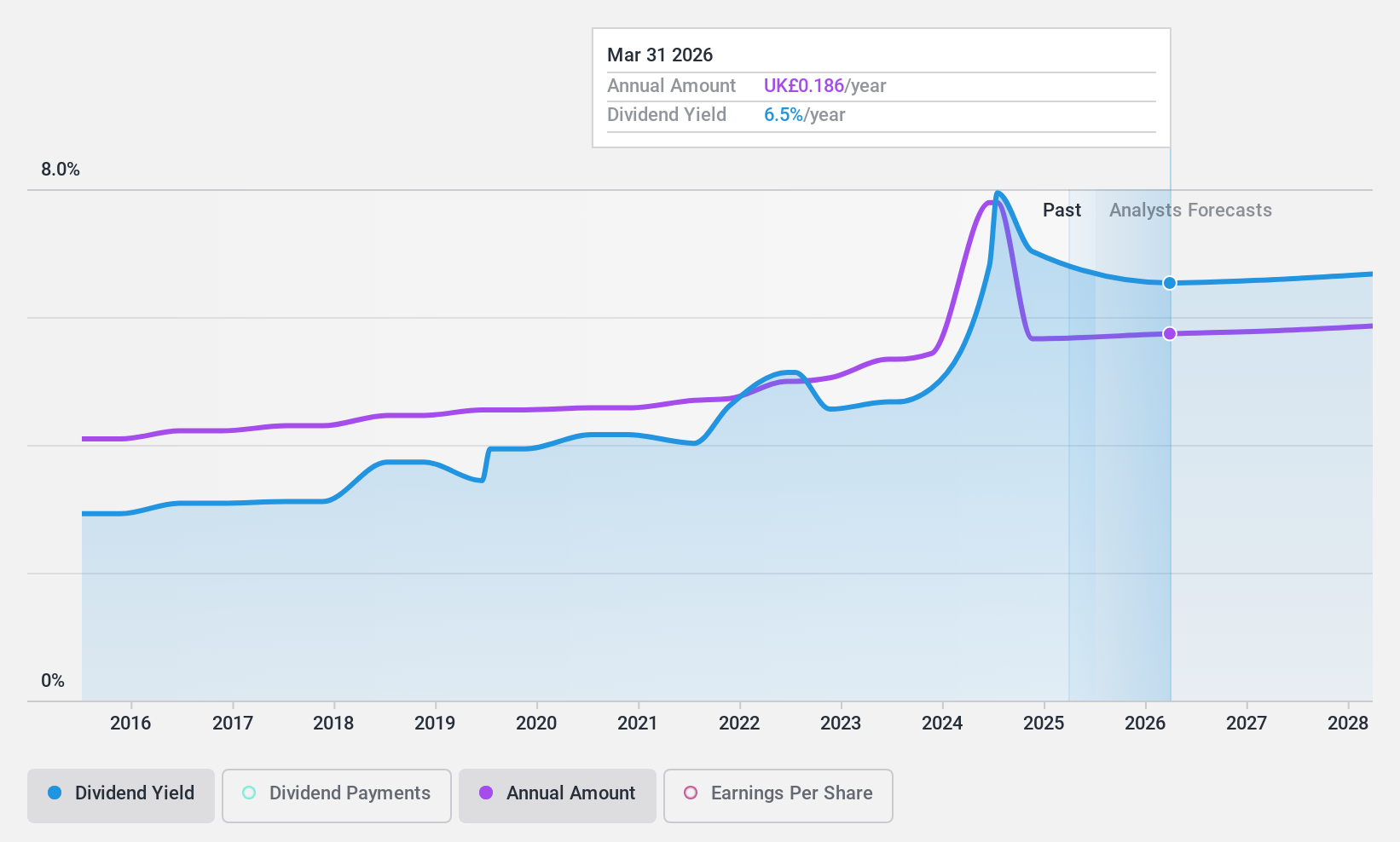

Castings (LSE:CGS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Castings P.L.C. is involved in iron casting and machining operations across various regions including the United Kingdom, Europe, and the Americas, with a market cap of £135.59 million.

Operations: Castings P.L.C.'s revenue primarily comes from Foundry Operations (£250.98 million) and Machining Operations (£37.65 million).

Dividend Yield: 8.1%

Castings P.L.C. has demonstrated reliable and growing dividend payments over the past decade, with a recent increase of 5.6% in total dividends for the year to 18.32 pence per share. Despite a favorable payout ratio of 47.6%, the dividend is not well covered by free cash flows, posing sustainability concerns. Recent events include a special dividend of 7 pence per share and strong financial performance with sales reaching £224.41 million and net income at £16.72 million for FY2024.

- Dive into the specifics of Castings here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Castings shares in the market.

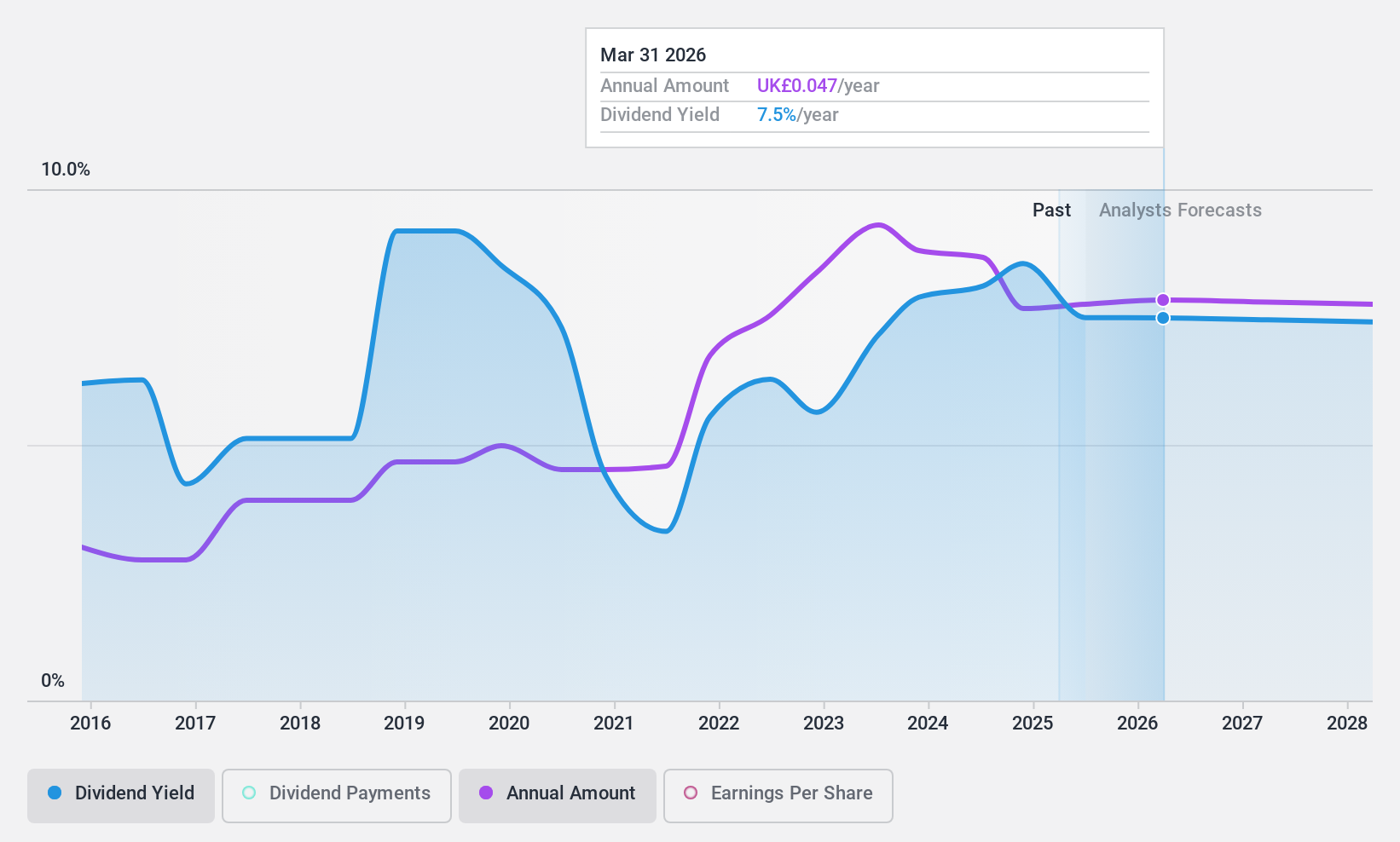

Record (LSE:REC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Record plc, with a market cap of £124.65 million, provides currency and derivative management services through its subsidiaries in the United Kingdom, North America, Continental Europe, Australia, and internationally.

Operations: Record plc generates £45.38 million from its currency and derivative management services across various regions including the United Kingdom, North America, Continental Europe, Australia, and internationally.

Dividend Yield: 8%

Record plc offers a high dividend yield of 8.02%, placing it in the top 25% of UK dividend payers. However, its dividends are not well covered by earnings, with a payout ratio of 95%. Despite this, dividends have been stable and growing over the past decade. Recent announcements include a final ordinary dividend of 2.45 pence per share and a special dividend of 0.6 pence, reflecting continued commitment to shareholder returns despite mixed earnings results for FY2024.

- Delve into the full analysis dividend report here for a deeper understanding of Record.

- Our expertly prepared valuation report Record implies its share price may be lower than expected.

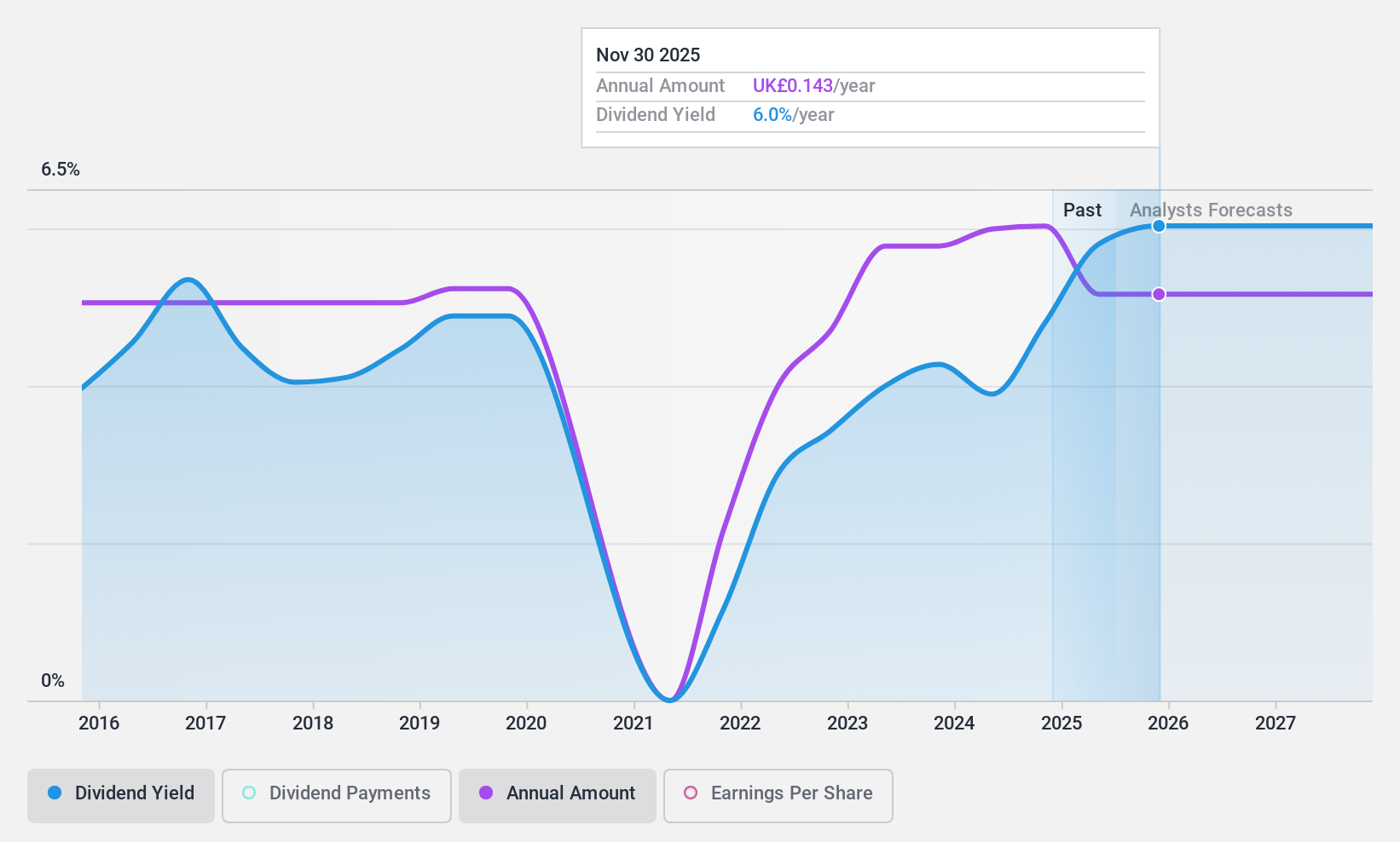

SThree (LSE:STEM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SThree plc offers specialist recruitment services in the STEM fields across various countries including the UK, US, and several European nations, with a market cap of £543.71 million.

Operations: SThree plc's revenue segments are as follows: USA (£318.74 million), DACH (£490.18 million), Rest of Europe (£384.35 million), Middle East & Asia (£42.03 million), and Netherlands (including Spain) (£366.06 million).

Dividend Yield: 4.1%

SThree's dividend payments are well covered by earnings (payout ratio: 39.2%) and free cash flow (cash payout ratio: 42.2%). Despite having a low dividend yield of 4.07%, the company has increased its dividends over the past decade, although they have been volatile at times. Recent earnings showed stable net income growth, with an interim dividend increase to 5.1 pence per share for H1 2024, reflecting cautious optimism in shareholder returns amidst fluctuating sales figures (£763.4 million).

- Click here and access our complete dividend analysis report to understand the dynamics of SThree.

- According our valuation report, there's an indication that SThree's share price might be on the cheaper side.

Summing It All Up

- Unlock our comprehensive list of 58 Top UK Dividend Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:STEM

SThree

Provides specialist recruitment services in the sciences, technology, engineering, and mathematics markets in the United Kingdom, Austria, Germany, Switzerland, Netherlands, Spain, Belgium, France, the United States, Dubai, Japan.

Outstanding track record with flawless balance sheet and pays a dividend.