- United Kingdom

- /

- Chemicals

- /

- AIM:ITX

Spotlight On UK Penny Stocks For December 2024

Reviewed by Simply Wall St

The United Kingdom's stock market has recently experienced fluctuations, with the FTSE 100 index closing lower following weak trade data from China, highlighting global economic interdependencies. Amidst these broader market movements, investors often seek opportunities in various segments, including penny stocks—an investment area that continues to intrigue due to its potential for growth at lower price points. Despite being an older term, penny stocks can still represent smaller or newer companies with solid fundamentals and strong balance sheets that might offer both stability and upside potential in today's market landscape.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.105 | £793.09M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.48 | £66.37M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.12 | £95.58M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.825 | £182.42M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.302 | £200.81M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.38 | £175.75M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £4.30 | £427.66M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.436 | $253.46M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £1.07 | £81.04M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £4.18 | £480.53M | ★★★★★★ |

Click here to see the full list of 468 stocks from our UK Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Itaconix (AIM:ITX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Itaconix plc develops plant-based polymers for home and personal care applications in North America and Europe, with a market cap of £17.94 million.

Operations: The company's revenue is derived from two main segments: Formulation Solutions, contributing $1.51 million, and Performance Ingredients, generating $5.10 million.

Market Cap: £17.94M

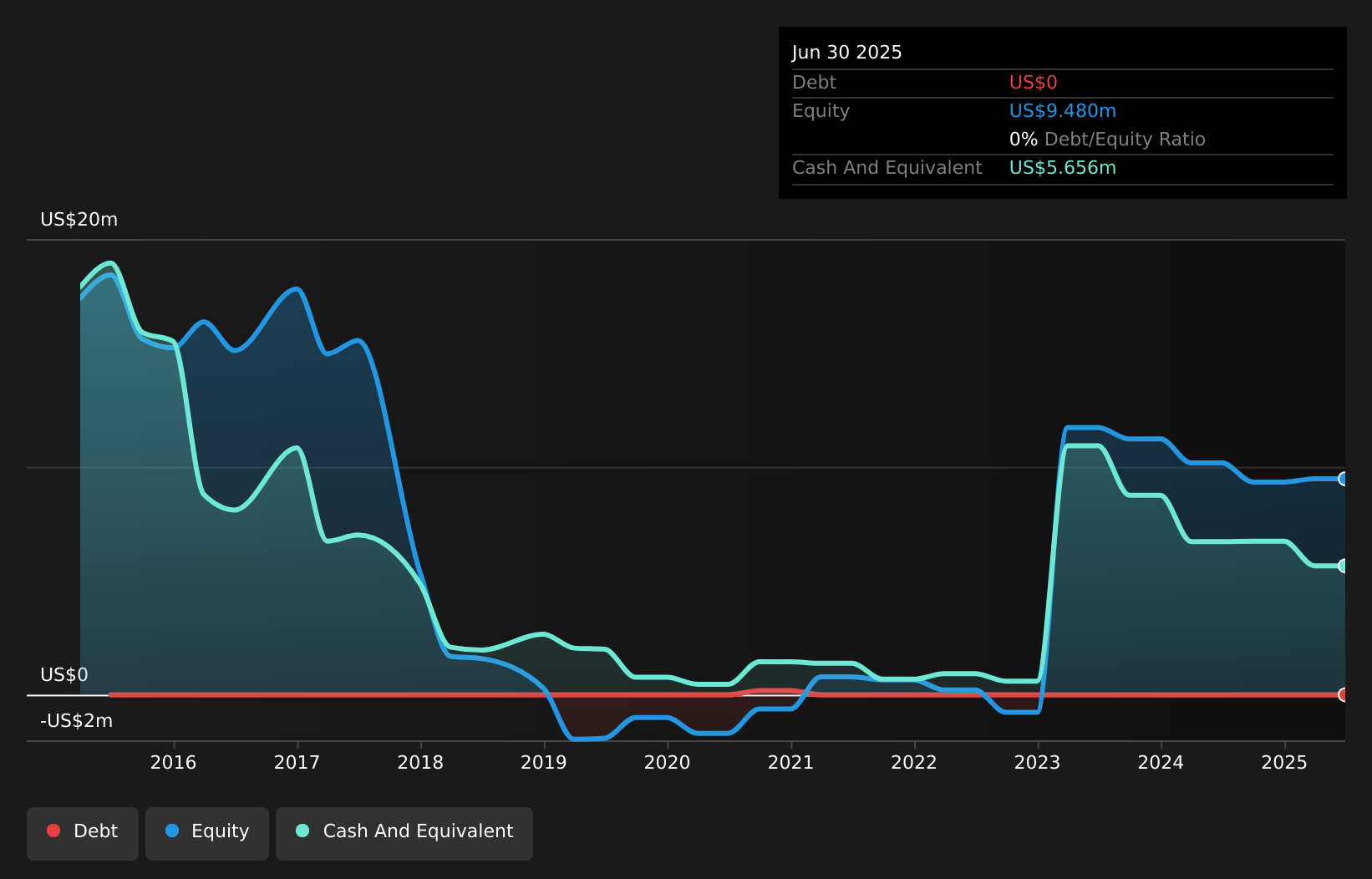

Itaconix plc, with a market cap of £17.94 million, is focusing on expanding its plant-based polymer offerings through strategic initiatives like the SPARX program, aiming to introduce safer and more sustainable products in collaboration with industry partners. Despite being unprofitable and having a negative return on equity of -18.4%, Itaconix has no debt and maintains sufficient cash runway for over a year based on current free cash flow. The company’s revenue is primarily generated from Performance Ingredients (US$5.10 million) and Formulation Solutions (US$1.51 million), with forecasted revenue growth of 31.53% annually.

- Get an in-depth perspective on Itaconix's performance by reading our balance sheet health report here.

- Explore Itaconix's analyst forecasts in our growth report.

Jarvis Securities (AIM:JIM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jarvis Securities plc, operating through its subsidiary Jarvis Investment Management Limited, offers stock broking services to retail and institutional clients in the United Kingdom with a market cap of £22.37 million.

Operations: The company generates revenue of £12.20 million from its financial services operations.

Market Cap: £22.37M

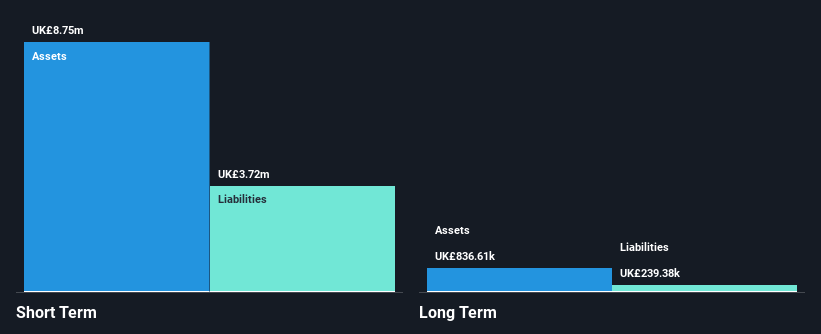

Jarvis Securities plc, with a market cap of £22.37 million, operates without debt and maintains strong short-term financial health, with assets of £8.8 million surpassing both short and long-term liabilities. Despite a high return on equity at 55.1%, the company faces challenges like declining profit margins from 39.4% to 25.4% and negative earnings growth over the past year (-42.4%). A significant one-off loss of £1.5 million has impacted recent results, yet the board continues to affirm dividends, recently declaring an interim dividend of 1 pence per share payable in December 2024.

- Click to explore a detailed breakdown of our findings in Jarvis Securities' financial health report.

- Review our historical performance report to gain insights into Jarvis Securities' track record.

Staffline Group (AIM:STAF)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Staffline Group plc, along with its subsidiaries, offers recruitment and outsourced human resource services as well as skills and employment training in the UK and Republic of Ireland, with a market cap of £32.71 million.

Operations: The company generates revenue through three main segments: PeoplePlus (£66 million), Recruitment GB (£814.8 million), and Recruitment Ireland (£107.6 million).

Market Cap: £32.71M

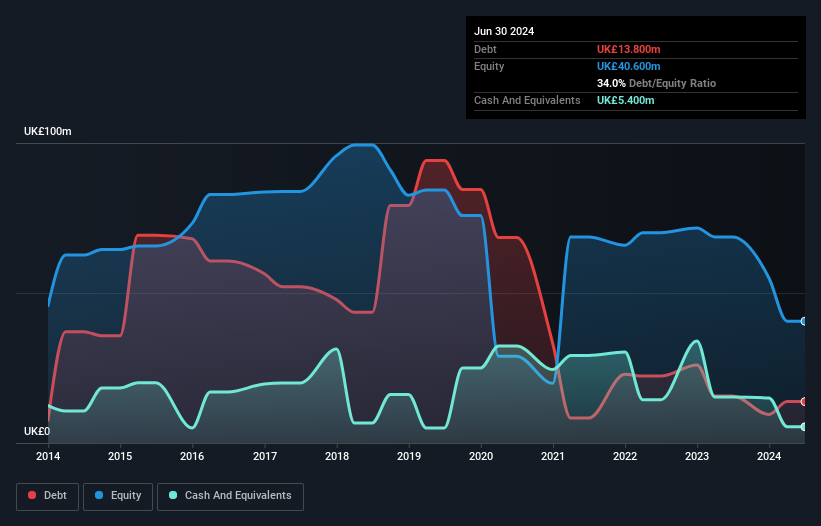

Staffline Group plc, with a market cap of £32.71 million, operates in the recruitment and human resource services sector. Despite being unprofitable, it has reduced its losses at 45.6% annually over five years and maintains a satisfactory net debt to equity ratio of 20.7%. While short-term assets (£147.4M) do not fully cover short-term liabilities (£158.3M), they exceed long-term liabilities (£4.6M). The company benefits from an experienced management team and board, each with average tenures around four years, and possesses sufficient cash runway for more than three years despite shrinking free cash flow.

- Click here to discover the nuances of Staffline Group with our detailed analytical financial health report.

- Examine Staffline Group's earnings growth report to understand how analysts expect it to perform.

Turning Ideas Into Actions

- Get an in-depth perspective on all 468 UK Penny Stocks by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:ITX

Itaconix

Engages in the development of plant-based polymers for home and personal care applications in North America and Europe.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives