- United Kingdom

- /

- Capital Markets

- /

- LSE:IHP

ITM Power And 2 Other UK Penny Stocks To Watch

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices slipping due to weak trade data from China, highlighting global economic interdependencies. In such a climate, investors often seek opportunities that offer growth potential at lower price points. Penny stocks, despite being considered an outdated term, continue to attract attention for their affordability and potential for significant returns when backed by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Warpaint London (AIM:W7L) | £3.575 | £288.81M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.54 | £402.66M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £2.93 | £291.41M | ★★★★☆☆ |

| Begbies Traynor Group (AIM:BEG) | £0.936 | £149.17M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.21 | £405.83M | ★★★★★★ |

| Van Elle Holdings (AIM:VANL) | £0.34 | £36.79M | ★★★★★★ |

| City of London Investment Group (LSE:CLIG) | £3.32 | £163.62M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £0.794 | £67.31M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.08 | £148.39M | ★★★★★☆ |

| Luceco (LSE:LUCE) | £1.39 | £214.38M | ★★★★★☆ |

Click here to see the full list of 443 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

ITM Power (AIM:ITM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ITM Power Plc designs and manufactures proton exchange membrane (PEM) electrolysers, operating in the United Kingdom, Germany, Australia, the rest of Europe, and the United States with a market cap of £169.78 million.

Operations: The company's revenue is primarily derived from its Electric Equipment segment, totaling £23.16 million.

Market Cap: £169.78M

ITM Power's recent contract to supply four NEPTUNE V units for a 20MW green hydrogen project in Norway highlights its strategic positioning within the renewable energy sector. Despite being unprofitable, ITM maintains a robust balance sheet with short-term assets significantly exceeding liabilities and no debt over the past five years. Revenue is forecasted to grow substantially, although losses have increased historically. The company's cash runway appears sufficient for over three years under current conditions. While share price volatility remains high, ITM's management team is experienced, though its board lacks tenure depth at an average of 2.7 years.

- Navigate through the intricacies of ITM Power with our comprehensive balance sheet health report here.

- Evaluate ITM Power's prospects by accessing our earnings growth report.

Software Circle (AIM:SFT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Software Circle plc, along with its subsidiaries, is involved in licensing various software across the United Kingdom, Ireland, Europe, and internationally with a market cap of £117.02 million.

Operations: The company generates revenue through its key segments: Graphics & Ecommerce (£9.53 million), Health & Social Care (£2.89 million), Professional & Financial Services (£2.09 million), and Property (£1.58 million).

Market Cap: £117.02M

Software Circle plc, with a market cap of £117.02 million, has recently turned profitable and boasts a stable financial position. The company generates revenue from diverse segments, including Graphics & Ecommerce (£9.53 million) and Health & Social Care (£2.89 million). Its debt is well-covered by operating cash flow, and it holds more cash than total debt. However, the financial results were significantly impacted by a one-off gain of £2M in the past year. While trading slightly below estimated fair value, its Return on Equity remains low at 2%. The board's experience averages 5.2 years in tenure.

- Unlock comprehensive insights into our analysis of Software Circle stock in this financial health report.

- Review our historical performance report to gain insights into Software Circle's track record.

IntegraFin Holdings (LSE:IHP)

Simply Wall St Financial Health Rating: ★★★★★★

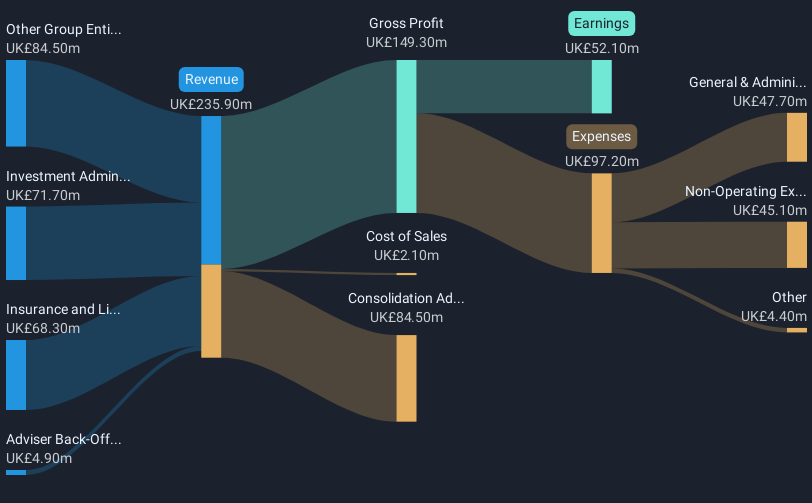

Overview: IntegraFin Holdings plc, with a market cap of £1.06 billion, offers software and services tailored for UK financial advisers and their clients in the United Kingdom and Isle of Man.

Operations: The company's revenue is primarily derived from its Investment Administration Services (£71.7 million), Insurance and Life Assurance Business (£68.3 million), and Adviser Back-Office Technology (£4.9 million).

Market Cap: £1.06B

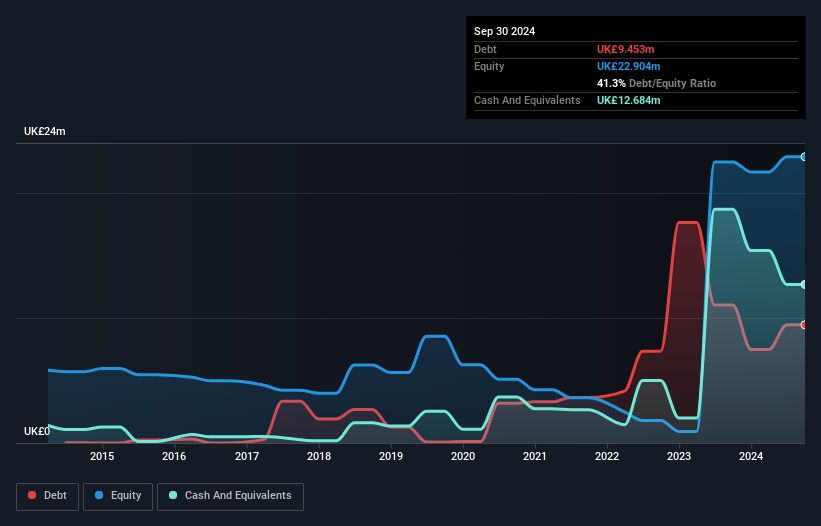

IntegraFin Holdings plc, with a market cap of £1.06 billion, demonstrates solid financial health and stability. The company is debt-free and boasts high-quality earnings, with net income rising to £52.1 million for the year ended September 30, 2024. Its short-term assets significantly exceed liabilities (£29.1 billion vs £28.9 billion), ensuring robust liquidity management. Despite a slightly unstable dividend track record, the recent increase in dividends to 10.4 pence per share indicates confidence in future cash flows. Additionally, management's seasoned experience and strategic board appointments further strengthen its governance framework amidst modest earnings growth forecasts of 9.7% annually.

- Take a closer look at IntegraFin Holdings' potential here in our financial health report.

- Understand IntegraFin Holdings' earnings outlook by examining our growth report.

Where To Now?

- Explore the 443 names from our UK Penny Stocks screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:IHP

IntegraFin Holdings

Provides software and services for clients and UK financial advisers in the United Kingdom and Isle of Man.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives