- United Kingdom

- /

- Media

- /

- AIM:SYS1

UK Penny Stocks To Watch In July 2025

Reviewed by Simply Wall St

The UK stock market has recently been impacted by weak trade data from China, leading to declines in the FTSE 100 and FTSE 250 indices. Despite these challenges, investors continue to explore opportunities within various sectors. Penny stocks, often associated with smaller or newer companies, present unique opportunities for growth at lower price points when they are backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| FRP Advisory Group (AIM:FRP) | £1.215 | £301.38M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £4.25 | £343.35M | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.395 | £42.74M | ✅ 5 ⚠️ 2 View Analysis > |

| System1 Group (AIM:SYS1) | £4.20 | £53.29M | ✅ 3 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £3.07 | £316.1M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.46 | £124.43M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.23 | £196.23M | ✅ 4 ⚠️ 1 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.82 | £11.29M | ✅ 3 ⚠️ 4 View Analysis > |

| Braemar (LSE:BMS) | £2.21 | £68.28M | ✅ 3 ⚠️ 4 View Analysis > |

| ME Group International (LSE:MEGP) | £2.15 | £811.87M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 293 stocks from our UK Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Eagle Eye Solutions Group (AIM:EYE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Eagle Eye Solutions Group PLC offers marketing technology software as a service solutions across various regions including the United Kingdom, France, the United States, Canada, Australia, Europe, and the Asia Pacific with a market cap of £68.99 million.

Operations: No specific revenue segments are reported for Eagle Eye Solutions Group.

Market Cap: £68.99M

Eagle Eye Solutions Group PLC has demonstrated financial resilience, becoming profitable recently and maintaining a strong balance sheet with more cash than debt. It offers good value with a price-to-earnings ratio of 8.8x, below the UK market average. However, its share price has been highly volatile over the past three months. The company announced a £1 million share buyback program to enhance shareholder value and mitigate future dilution from staff share schemes. Despite losing a significant contract worth £9-10 million annually, Eagle Eye's experienced board and management team continue to navigate these challenges effectively.

- Jump into the full analysis health report here for a deeper understanding of Eagle Eye Solutions Group.

- Assess Eagle Eye Solutions Group's future earnings estimates with our detailed growth reports.

RWS Holdings (AIM:RWS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: RWS Holdings plc offers technology-enabled language, content, and intellectual property services across the UK, Continental Europe, the US, and internationally with a market cap of £314.31 million.

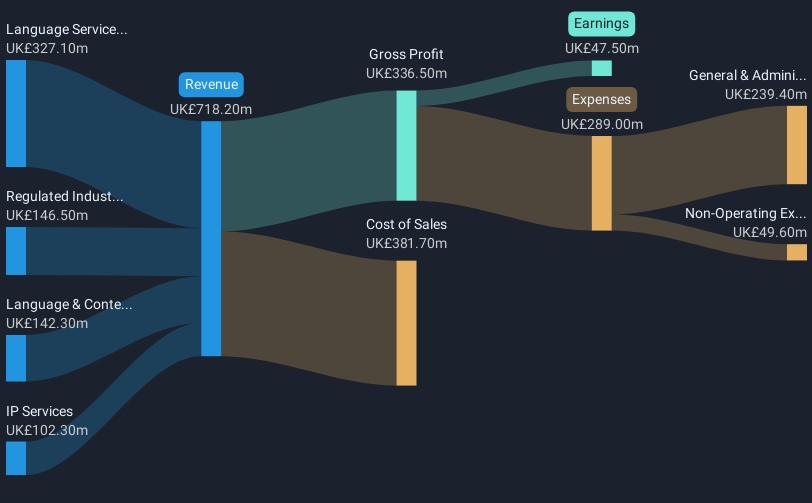

Operations: The company generates revenue through four main segments: IP Services (£98.2 million), Language Services (£329 million), Regulated Industries (£140.3 million), and Language & Content Technology (£144.7 million).

Market Cap: £314.31M

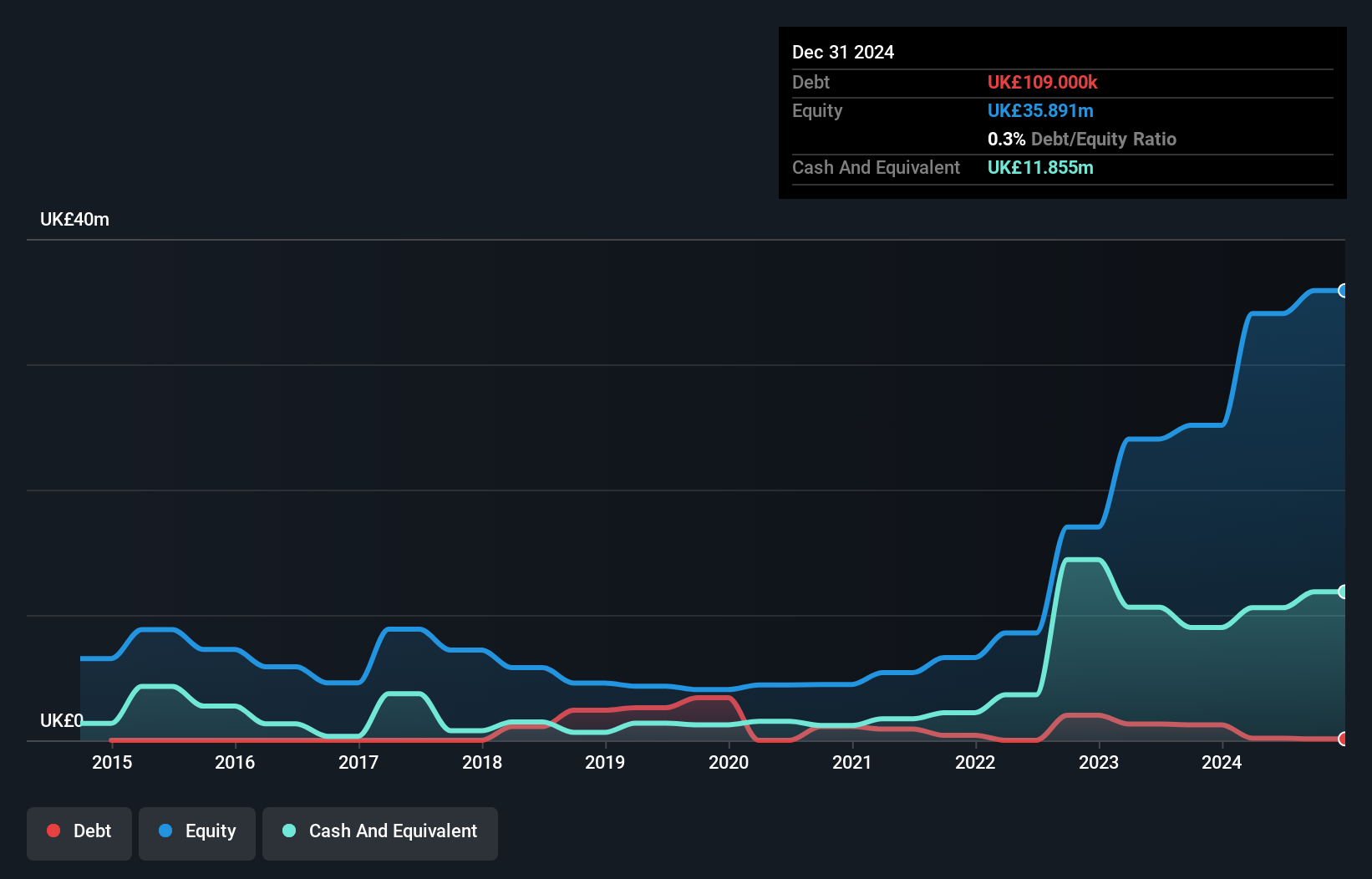

RWS Holdings has recently turned profitable, though a significant one-off loss of £31.5 million affected its financial results for the year ending March 2025. Despite this, the company's debt is well-managed with operating cash flow covering 77.8% of it, and interest payments are comfortably covered by EBIT at 11.6 times. RWS's recent partnership with AGCO Corporation highlights its innovative linguistic AI solution, Evolve, which enhances global customer support through advanced translation technologies. However, earnings for the first half of 2025 showed a net loss of £11.3 million on sales of £344.3 million compared to last year's performance.

- Click to explore a detailed breakdown of our findings in RWS Holdings' financial health report.

- Gain insights into RWS Holdings' outlook and expected performance with our report on the company's earnings estimates.

System1 Group (AIM:SYS1)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: System1 Group PLC, with a market cap of £53.29 million, offers market research data and insight services across the United Kingdom, the United States, Latin America, Europe, and the Asia Pacific.

Operations: The company generates revenue through its "Data" segment (£28.12 million), "Improve Your" data-led consultancy (£6.44 million), and other consultancy services (£2.87 million).

Market Cap: £53.29M

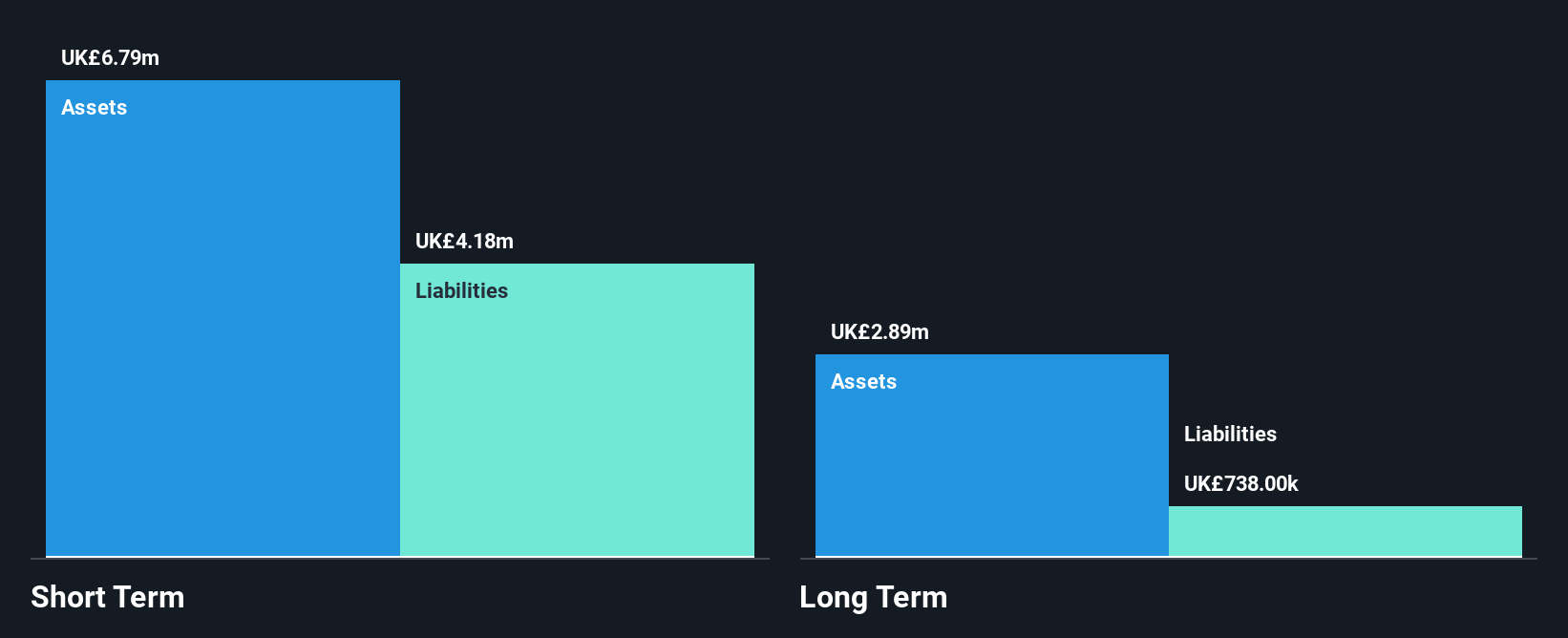

System1 Group PLC, with a market cap of £53.29 million, has demonstrated significant financial growth, becoming profitable over the past five years with earnings increasing by 42.1% annually. The company is debt-free and its short-term assets exceed liabilities by £12 million, indicating solid financial health. Recent full-year results show revenue of £37.43 million and net income doubling to £4.47 million from the previous year. Despite a slight decline in Q1 2026 revenue to £8.8 million, System1 forecasts a 15% annual revenue growth for 2026 while proposing both ordinary and special dividends of 5.5 pence per share for shareholders' approval at their upcoming AGM.

- Dive into the specifics of System1 Group here with our thorough balance sheet health report.

- Learn about System1 Group's future growth trajectory here.

Seize The Opportunity

- Unlock more gems! Our UK Penny Stocks screener has unearthed 290 more companies for you to explore.Click here to unveil our expertly curated list of 293 UK Penny Stocks.

- Want To Explore Some Alternatives? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:SYS1

System1 Group

Provides market research data and insight services in the United Kingdom, the United States, Latin America, rest of Europe, and the Asia Pacific.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives