- United Kingdom

- /

- Trade Distributors

- /

- AIM:BRCK

UK Growth Companies With High Insider Ownership For July 2024

Reviewed by Simply Wall St

As the FTSE 100 shows signs of extending gains amidst a complex global backdrop marked by geopolitical tensions and policy uncertainties, investors are keenly observing market movements. In such an environment, growth companies with high insider ownership in the UK could offer an appealing blend of entrepreneurial commitment and potential resilience.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Plant Health Care (AIM:PHC) | 36.8% | 121.3% |

| Petrofac (LSE:PFC) | 16.6% | 120.1% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.1% | 74.6% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 23.5% |

| Helios Underwriting (AIM:HUW) | 23.1% | 14.7% |

| LSL Property Services (LSE:LSL) | 10.8% | 33.3% |

| Velocity Composites (AIM:VEL) | 27.8% | 173.3% |

| B90 Holdings (AIM:B90) | 24.4% | 142.7% |

| Judges Scientific (AIM:JDG) | 11.5% | 25.3% |

| Hochschild Mining (LSE:HOC) | 38.4% | 42.6% |

We're going to check out a few of the best picks from our screener tool.

Brickability Group (AIM:BRCK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Brickability Group Plc operates in the United Kingdom, where it supplies, distributes, and imports building products, with a market capitalization of approximately £232.29 million.

Operations: The company operates primarily in the distribution and importation of building products within the UK.

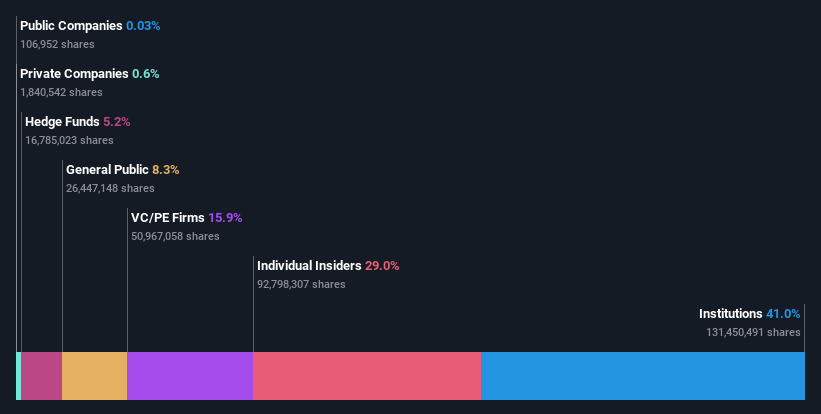

Insider Ownership: 29.3%

Earnings Growth Forecast: 34.6% p.a.

Brickability Group has demonstrated a strong insider buying trend over the past three months, signaling confidence from within despite recent financial setbacks. The company's earnings are projected to grow at 34.6% annually over the next three years, outpacing the UK market average of 12.6%. However, revenue growth is more modest at 7.9% per year, still above the market's 3.5%. Challenges include a year-over-year decline in profit margins and unstable dividends, with a notable decrease in net income and sales reported for FY2024.

- Navigate through the intricacies of Brickability Group with our comprehensive analyst estimates report here.

- Our valuation report here indicates Brickability Group may be undervalued.

RWS Holdings (AIM:RWS)

Simply Wall St Growth Rating: ★★★★☆☆

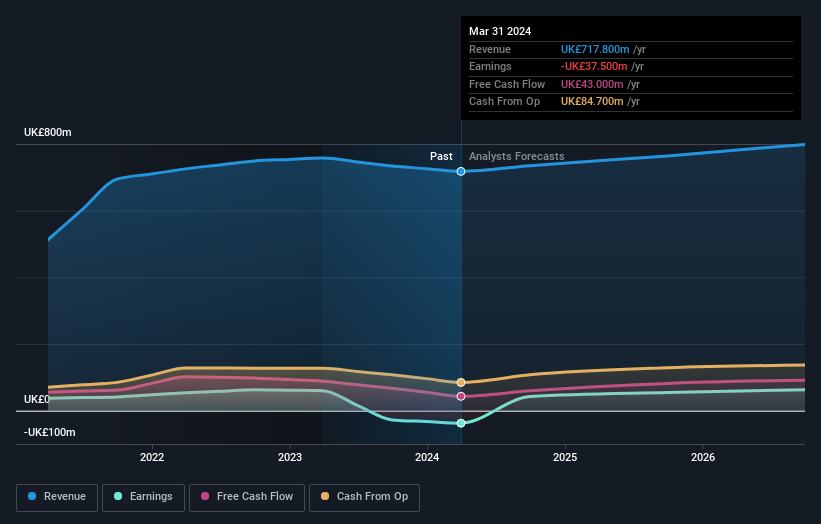

Overview: RWS Holdings plc specializes in technology-enabled language, content, and intellectual property services with a market capitalization of approximately £0.67 billion.

Operations: The company's revenue is derived from several key areas: IP Services generating £105.10 million, Language Services contributing £325.40 million, Regulated Industry at £149.40 million, and Language & Content Technology bringing in £137.90 million.

Insider Ownership: 24.6%

Earnings Growth Forecast: 67.4% p.a.

RWS Holdings, a UK-based growth company with significant insider ownership, is poised for profitability within three years, surpassing average market growth expectations. Recent product launches like Trados Studio 2024 and enhancements in Tridion Docs emphasize innovation, particularly in AI-driven solutions. However, the company faces challenges such as a highly volatile share price and dividends that are not well covered by earnings or free cash flows. Despite these issues, analysts predict a substantial potential rise in stock price.

- Click here and access our complete growth analysis report to understand the dynamics of RWS Holdings.

- Our expertly prepared valuation report RWS Holdings implies its share price may be lower than expected.

Evoke (LSE:EVOK)

Simply Wall St Growth Rating: ★★★★★☆

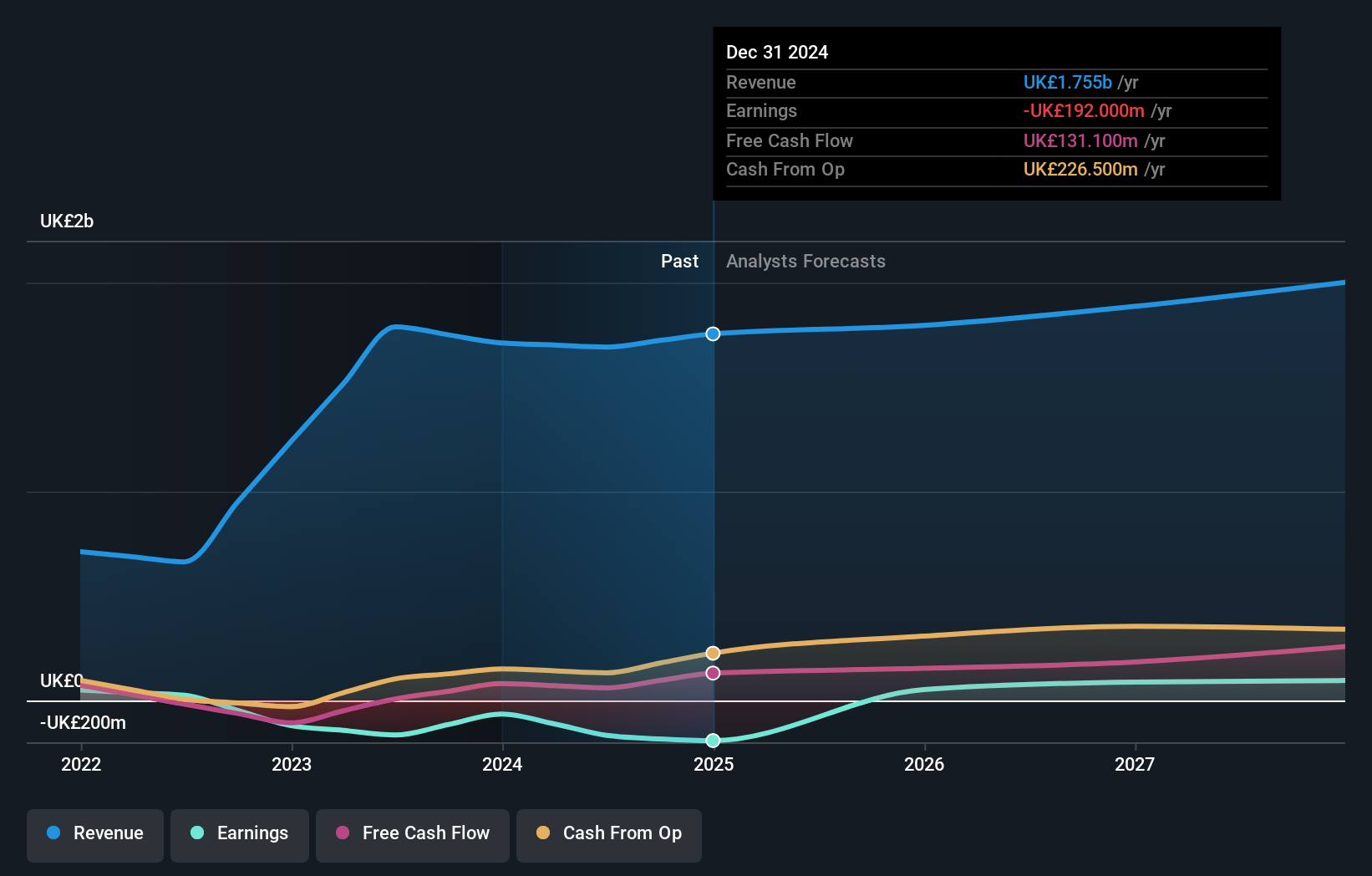

Overview: Evoke plc operates an online betting and gaming business across the UK, Ireland, Italy, Spain, and other international markets with a market capitalization of approximately £387.61 million.

Operations: The company generates revenue through three primary segments: Retail (£535 million), UK & Ireland Online (£658.50 million), and International (£517.40 million).

Insider Ownership: 20.1%

Earnings Growth Forecast: 79.1% p.a.

Evoke plc, recently renamed from 888 Holdings, is on track to outperform the UK market with its revenue growth forecast at 5.1% annually and an anticipated profitability within three years. Despite trading at a significant discount to fair value, concerns exist as interest payments are poorly covered by earnings. The company's return on equity is expected to be very high in three years, showcasing potential for substantial financial improvement amidst stable insider ownership following recent executive changes and corporate restructuring.

- Dive into the specifics of Evoke here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential undervaluation of Evoke shares in the market.

Summing It All Up

- Take a closer look at our Fast Growing UK Companies With High Insider Ownership list of 62 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Brickability Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:BRCK

Brickability Group

Supplies, distributes, and imports building products in the United Kingdom.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives