- United Kingdom

- /

- Hospitality

- /

- LSE:MARS

RWS Holdings And 2 Other Undervalued Small Caps On UK With Insider Buying

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting concerns about global economic recovery. Amidst this backdrop, small-cap stocks in the UK may present unique opportunities for investors seeking value, especially those companies demonstrating resilience and potential for growth despite broader market pressures.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| NCC Group | NA | 1.4x | 36.48% | ★★★★★☆ |

| Headlam Group | NA | 0.2x | 35.45% | ★★★★★☆ |

| Sabre Insurance Group | 11.6x | 1.5x | 9.94% | ★★★★☆☆ |

| iomart Group | 27.8x | 0.7x | 25.54% | ★★★★☆☆ |

| Optima Health | NA | 1.3x | 46.65% | ★★★★☆☆ |

| Telecom Plus | 18.4x | 0.7x | 28.83% | ★★★☆☆☆ |

| Treatt | 19.5x | 1.8x | 48.53% | ★★★☆☆☆ |

| Gooch & Housego | 41.2x | 1.0x | 31.94% | ★★★☆☆☆ |

| Reach | 6.5x | 0.5x | -124.19% | ★★★☆☆☆ |

| THG | NA | 0.4x | -1156.20% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

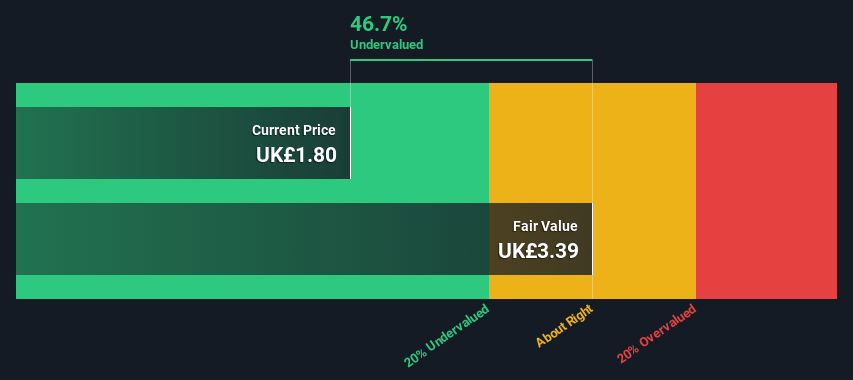

RWS Holdings (AIM:RWS)

Simply Wall St Value Rating: ★★★★★★

Overview: RWS Holdings is a company specializing in IP services, language services, regulated industry solutions, and language & content technology, with a market cap of £1.63 billion.

Operations: The company's revenue streams are primarily derived from Language Services (£327.10 million), Regulated Industry (£146.50 million), and Language & Content Technology (£142.30 million). Over recent periods, the gross profit margin has shown a trend of gradual increase, reaching 46.85% by September 2024. Operating expenses have fluctuated but remained a significant portion of costs, impacting net income margins which saw variability with recent recovery to 6.61% by September 2024 after previous negative figures in early 2024 due to high non-operating expenses.

PE: 14.1x

RWS Holdings, a smaller UK company, recently reported annual sales of £718.2 million and net income of £47.5 million for the fiscal year ending September 2024, showing improvement from a prior net loss. The company's leadership transition sees Benjamin Faes stepping in as CEO in January 2025, bringing experience in digital transformation and growth strategies. Despite recent share price volatility and reliance on external borrowing, insider confidence is evident with significant purchases within the past year.

- Delve into the full analysis valuation report here for a deeper understanding of RWS Holdings.

Examine RWS Holdings' past performance report to understand how it has performed in the past.

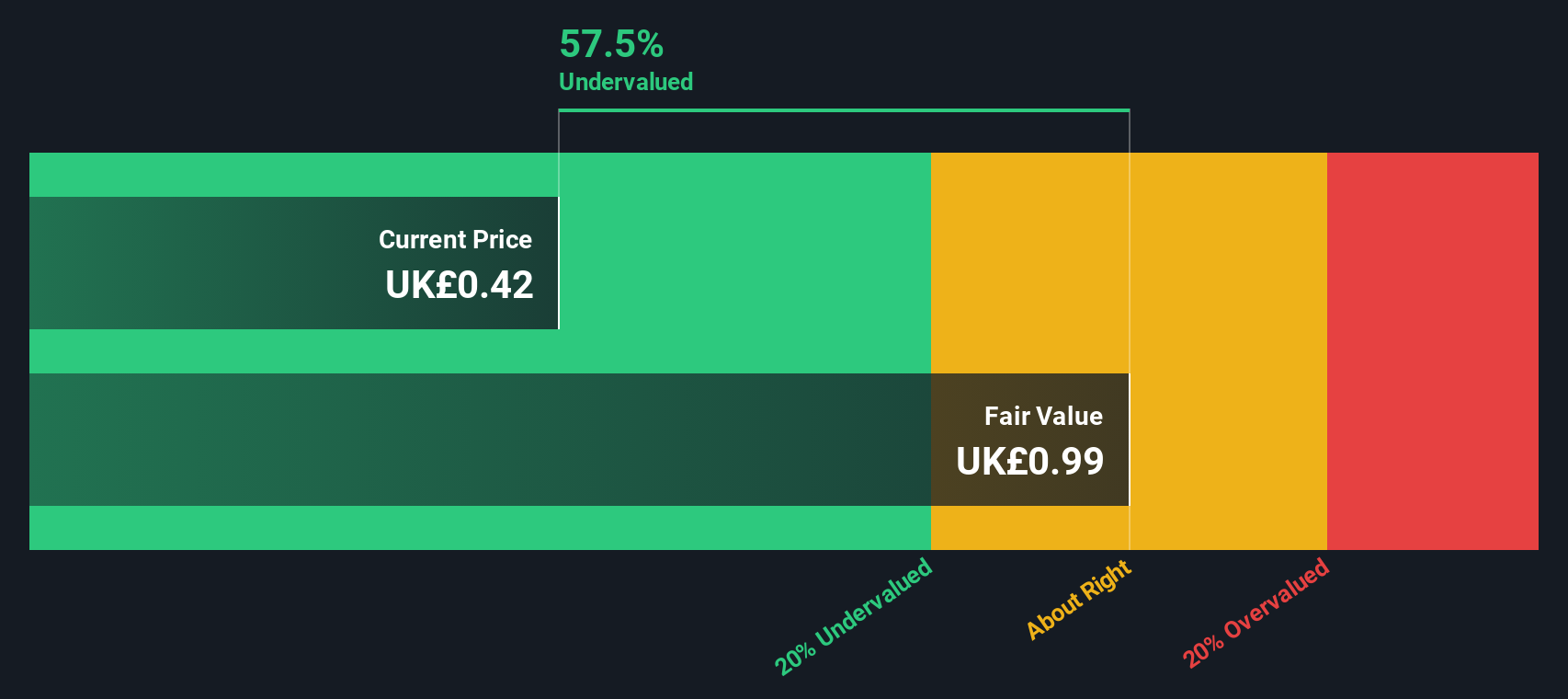

Marston's (LSE:MARS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Marston's is a UK-based pub and brewing company that operates a portfolio of pubs, bars, and lodges across the country with a market capitalisation of £0.37 billion.

Operations: Marston's revenue streams primarily involve sales, with recent figures showing £898.6 million in revenue. The cost of goods sold (COGS) has been significant, recently reported at £746.9 million, impacting the gross profit margin which was noted at 16.88%. Operating expenses have varied, with some periods reporting no operating expenses recorded. Net income has fluctuated over time, reflecting changes in non-operating expenses and other financial factors affecting profitability.

PE: 15.8x

Marston's, a UK pub operator, showcases potential as an undervalued stock with its recent financial performance and insider confidence. Despite reporting a net loss of £18.5 million for the year ending September 2024, sales rose to £898.6 million from the previous year's £872.3 million. Notably, like-for-like sales increased by 4.8% over 52 weeks, outperforming the market despite challenging weather conditions late in the period. Insider confidence is evident through recent share purchases between October and December 2024, suggesting belief in future growth prospects as earnings are projected to grow by over 36% annually despite higher risk funding sources primarily from external borrowing rather than customer deposits.

- Get an in-depth perspective on Marston's performance by reading our valuation report here.

Gain insights into Marston's historical performance by reviewing our past performance report.

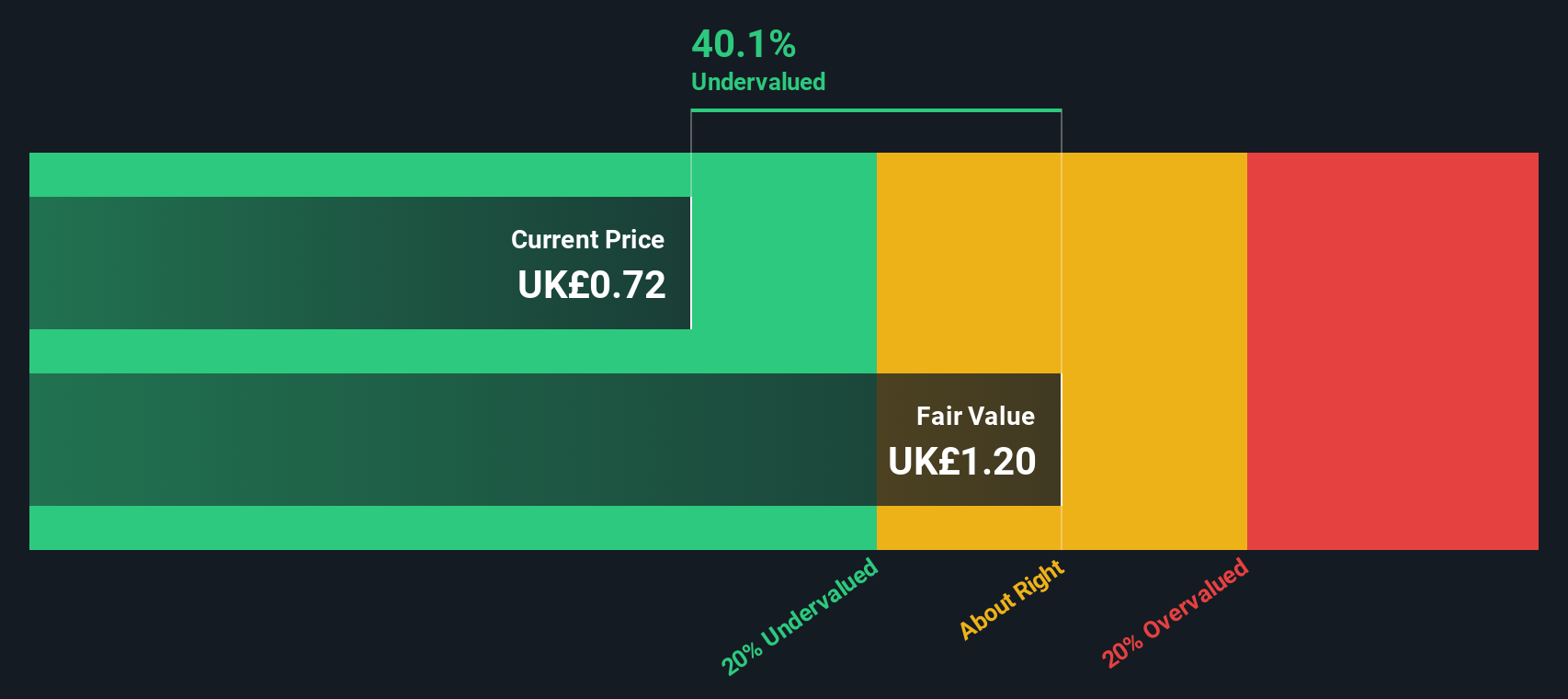

NewRiver REIT (LSE:NRR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: NewRiver REIT is a UK-based real estate investment trust specializing in the acquisition, management, and development of retail and leisure properties with a market capitalization of approximately £0.24 billion.

Operations: NewRiver REIT's revenue is primarily derived from its gross profit, which has shown fluctuations with a recent gross profit margin of 71.58%. The company faces significant non-operating expenses that impact its net income, evidenced by a net income margin that has varied widely over the years, reaching -36.78% at one point and more recently improving to 21.43%. Operating expenses have remained relatively stable around £12-14 million in recent periods.

PE: 21.8x

NewRiver REIT, a UK-based property company, is navigating its small cap landscape with strategic moves despite challenges. Recently reporting £31.8 million in sales for the half year ended September 2024, it turned a net income of £8.2 million from a prior loss. The company's focus on mergers and acquisitions aligns with its strategy to enhance capital allocation, as stated by leadership on December 12, 2024. Although Growthpoint Properties may divest its stake due to strategic realignment, NewRiver's commitment to potential growth remains evident through these initiatives.

- Click here to discover the nuances of NewRiver REIT with our detailed analytical valuation report.

Evaluate NewRiver REIT's historical performance by accessing our past performance report.

Where To Now?

- Dive into all 31 of the Undervalued UK Small Caps With Insider Buying we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:MARS

Marston's

Operates managed, franchised, tenanted, partnership, and leased pubs in the United Kingdom.

Undervalued with moderate growth potential.