- United Kingdom

- /

- Software

- /

- AIM:SWG

UK Penny Stocks To Watch In February 2025

Reviewed by Simply Wall St

The UK market has been grappling with challenges as the FTSE 100 index recently closed lower, influenced by weak trade data from China, which has impacted several sectors reliant on Chinese demand. In such a fluctuating environment, investors often look towards penny stocks—traditionally smaller or newer companies—as potential avenues for growth. While the term "penny stocks" might seem outdated, these investments can still offer significant opportunities when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.94 | £149.81M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.965 | £478.61M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.08 | £329.61M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.38 | £336.16M | ★★★★☆☆ |

| Foresight Group Holdings (LSE:FSG) | £4.05 | £460.22M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.285 | £861.02M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.23 | £159.09M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £4.70 | £89.64M | ★★★★☆☆ |

| Van Elle Holdings (AIM:VANL) | £0.38 | £41.12M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.50 | £231.34M | ★★★★★☆ |

Click here to see the full list of 443 stocks from our UK Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Itaconix (AIM:ITX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Itaconix plc, with a market cap of £17.87 million, develops plant-based polymers for home and personal care applications in North America and Europe.

Operations: The company's revenue is derived from two main segments: Formulation Solutions, which contributes $1.51 million, and Performance Ingredients, generating $5.10 million.

Market Cap: £17.87M

Itaconix plc, with a market cap of £17.87 million, focuses on plant-based polymers and generates revenue from Formulation Solutions (US$1.51 million) and Performance Ingredients (US$5.10 million). Despite being unprofitable, the company has reduced its losses by 16% annually over five years and maintains a sufficient cash runway for more than a year based on current free cash flow. It is debt-free with short-term assets covering both short- and long-term liabilities. However, the board's average tenure suggests inexperience, potentially impacting strategic decisions as profitability remains elusive in the near term.

- Click here to discover the nuances of Itaconix with our detailed analytical financial health report.

- Learn about Itaconix's future growth trajectory here.

Norman Broadbent (AIM:NBB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Norman Broadbent plc, with a market cap of £2.08 million, offers professional services both in the United Kingdom and internationally through its subsidiaries.

Operations: The company generates revenue of £8.50 million from the United Kingdom and £2.80 million from international markets.

Market Cap: £2.08M

Norman Broadbent plc, with a market cap of £2.08 million, has recently become profitable and is actively seeking acquisitions to drive growth. The company's debt is well covered by operating cash flow and interest payments are adequately managed, though its net debt to equity ratio remains high at 48.5%. Despite stable weekly volatility over the past year, the share price has been highly volatile recently. Short-term assets match short-term liabilities but exceed long-term obligations. The management team and board are experienced, yet the stock trades significantly below estimated fair value with a low return on equity of 16.5%.

- Get an in-depth perspective on Norman Broadbent's performance by reading our balance sheet health report here.

- Gain insights into Norman Broadbent's historical outcomes by reviewing our past performance report.

Shearwater Group (AIM:SWG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Shearwater Group plc, with a market cap of £8.58 million, offers cyber security, managed security, and professional advisory solutions to corporate clients across the United Kingdom, Europe, North America, and other international markets.

Operations: The company's revenue is derived from two main segments: Services, contributing £21.17 million, and Software, accounting for £2.27 million.

Market Cap: £8.58M

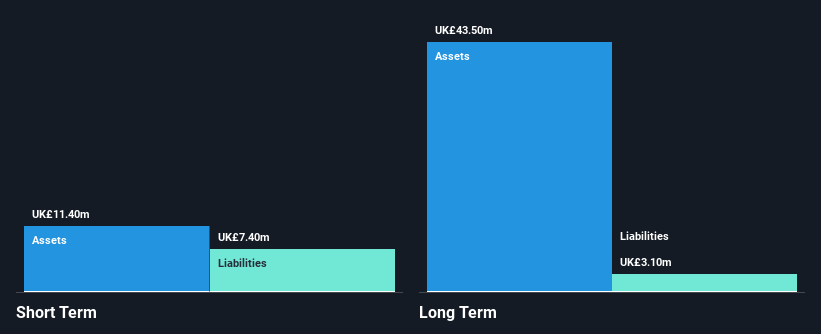

Shearwater Group plc, with a market cap of £8.58 million, remains unprofitable despite stable weekly volatility and a positive cash runway exceeding three years due to growing free cash flow. The company recently secured new contracts totaling £2.3 million, including a significant £1.5 million deal for its Brookcourt Solutions subsidiary, enhancing its cybersecurity offerings. While trading at good value compared to peers and industry standards, Shearwater's revenue growth forecast of 19.4% per year is promising but tempered by past increasing losses and negative return on equity (-6.46%). Short-term assets comfortably cover both short- and long-term liabilities.

- Navigate through the intricacies of Shearwater Group with our comprehensive balance sheet health report here.

- Examine Shearwater Group's earnings growth report to understand how analysts expect it to perform.

Turning Ideas Into Actions

- Take a closer look at our UK Penny Stocks list of 443 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:SWG

Shearwater Group

Provides cyber security, managed security, and professional advisory solutions for corporate clients in the United Kingdom, rest of Europe, North America, and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives