- United Kingdom

- /

- Commercial Services

- /

- AIM:HSP

Concurrent Technologies And 2 Other Undiscovered Gems In The United Kingdom

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 and FTSE 250 indices experience downward pressure due to weak trade data from China, investors are increasingly cautious about the global economic landscape. In such an environment, identifying promising small-cap stocks like Concurrent Technologies can offer opportunities for those looking to navigate market volatility with a focus on companies that demonstrate resilience and potential for growth despite broader challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| B.P. Marsh & Partners | NA | 42.17% | 45.70% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.01% | 5.12% | ★★★★★★ |

| BioPharma Credit | NA | 7.73% | 7.94% | ★★★★★★ |

| Georgia Capital | NA | 2.23% | 16.34% | ★★★★★★ |

| MS INTERNATIONAL | NA | 15.73% | 53.22% | ★★★★★★ |

| Vectron Systems | NA | 2.48% | 28.82% | ★★★★★★ |

| Nationwide Building Society | 282.42% | 9.69% | 21.24% | ★★★★★☆ |

| FW Thorpe | 2.12% | 10.94% | 13.25% | ★★★★★☆ |

| Distribution Finance Capital Holdings | 9.37% | 48.09% | 66.49% | ★★★★★☆ |

| Foresight Environmental Infrastructure | NA | -24.80% | -27.25% | ★★★★★☆ |

Let's dive into some prime choices out of from the screener.

Concurrent Technologies (AIM:CNC)

Simply Wall St Value Rating: ★★★★★★

Overview: Concurrent Technologies Plc, with a market cap of £198.66 million, specializes in designing, developing, manufacturing, and marketing single board computers for system integrators and original equipment manufacturers.

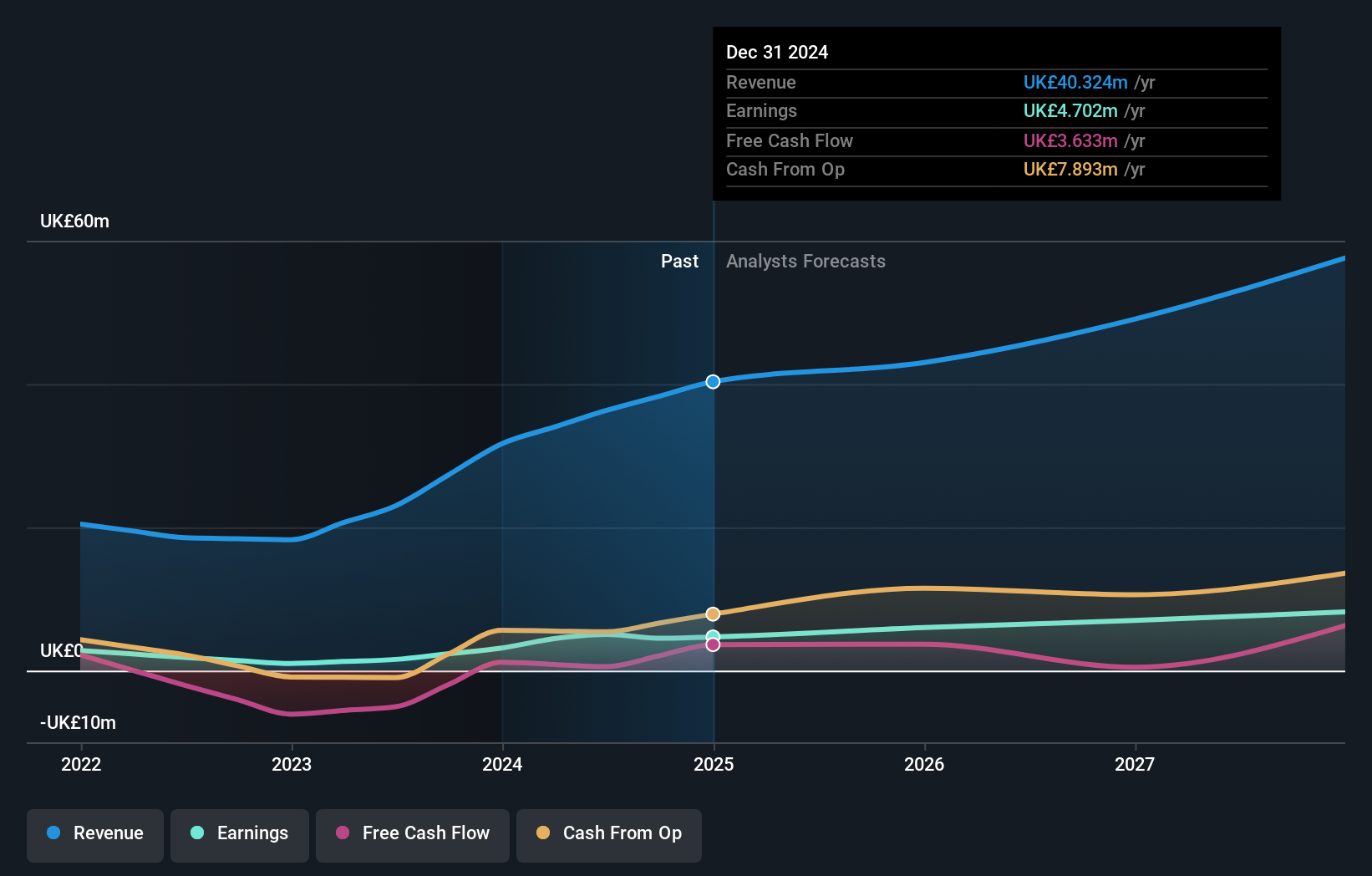

Operations: Concurrent Technologies generates revenue primarily through the design, manufacture, and supply of high-end embedded computer products, amounting to £44.57 million.

Concurrent Technologies has been making waves with its recent $5.25 million contract to design computing solutions for a US defense contractor, marking a first in outsourcing for the client. This move underscores its prowess in high-performance Intel-based products and aligns with industry trends towards open standards. Financially, the company shines with earnings growth of 10.9% over the past year, surpassing the tech industry's -11.8%. Being debt-free for five years and maintaining positive free cash flow further bolster its financial health, while projected earnings growth of 17.92% per year suggests promising future prospects.

- Unlock comprehensive insights into our analysis of Concurrent Technologies stock in this health report.

Evaluate Concurrent Technologies' historical performance by accessing our past performance report.

Hargreaves Services (AIM:HSP)

Simply Wall St Value Rating: ★★★★★★

Overview: Hargreaves Services Plc offers environmental and industrial services across the United Kingdom, Europe, Hong Kong, and internationally with a market cap of £220.82 million.

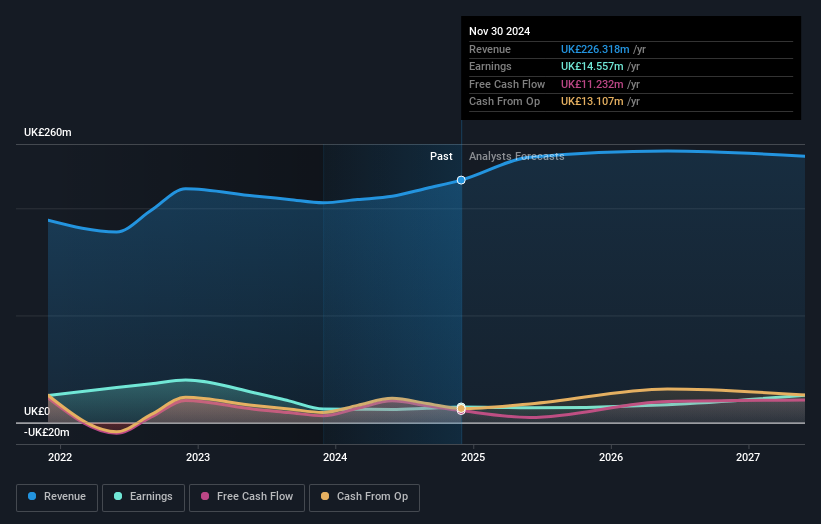

Operations: The company's revenue primarily comes from its Services segment, generating £247.69 million, with additional contributions from Hargreaves Land at £20.08 million.

Hargreaves Services, a UK-based company, stands out with its earnings growth of 20% over the past year, surpassing the industry average of 10.5%. The price-to-earnings ratio at 15x is attractive compared to the broader UK market's 15.9x. Impressively, this firm is debt-free now, having reduced its debt from a ratio of 24.6% five years ago. With strong free cash flow and high-quality earnings reported consistently, Hargreaves seems well-positioned for continued success as indicated by recent guidance forecasting robust revenue and profit growth for the six months ending November 2025.

- Take a closer look at Hargreaves Services' potential here in our health report.

Explore historical data to track Hargreaves Services' performance over time in our Past section.

Sylvania Platinum (AIM:SLP)

Simply Wall St Value Rating: ★★★★★★

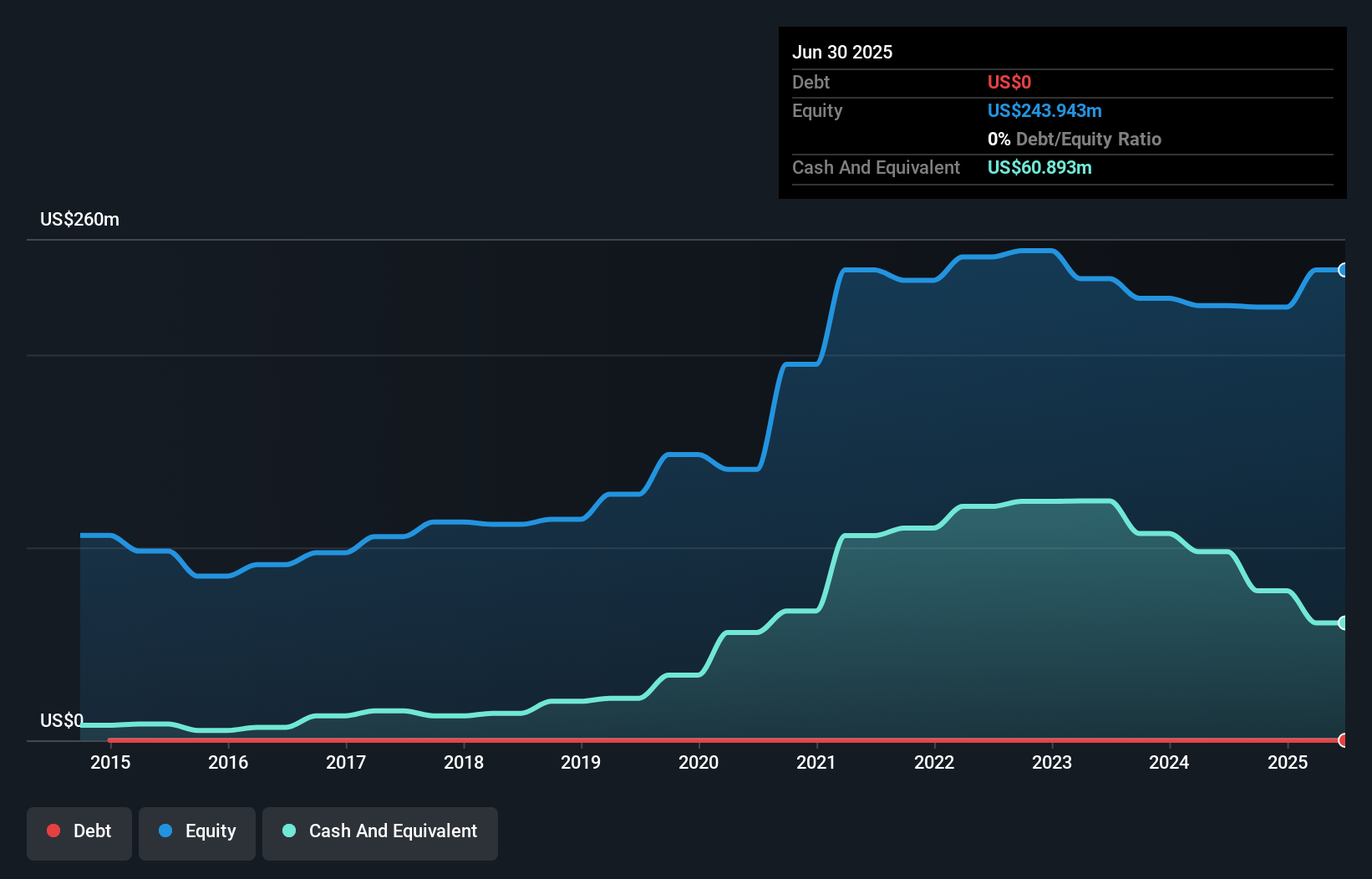

Overview: Sylvania Platinum Limited, along with its subsidiaries, focuses on the retreatment of platinum group metals (PGM) bearing chrome tailings materials in South Africa and has a market capitalization of £247.13 million.

Operations: Sylvania Platinum generates revenue primarily through its Sylvania Dump Operations (SDO), which reported $104.23 million.

Sylvania Platinum, a smaller player in the metals and mining sector, is making strides with its Thaba joint venture, which aims to boost both PGM and chrome revenues. The company has experienced a 17% improvement in PGM feed grades, enhancing production efficiency. Despite being debt-free for five years and trading at 86.4% below estimated fair value, SLP faces challenges from rising costs due to third-party material reliance and regulatory changes in South Africa. Analysts forecast earnings growth of 27% annually, with current net profit margins at 12.5%, suggesting potential for future expansion as margins improve.

Where To Now?

- Dive into all 57 of the UK Undiscovered Gems With Strong Fundamentals we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hargreaves Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:HSP

Hargreaves Services

Provides environmental and industrial services in the United Kingdom, Europe, Hong Kong, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)