- United Kingdom

- /

- Consumer Durables

- /

- LSE:CRST

UK Stocks Priced Below Estimated Value In May 2025

Reviewed by Simply Wall St

In recent months, the UK market has faced challenges as the FTSE 100 index experienced declines, influenced by weak trade data from China and global economic uncertainties. Amidst these conditions, identifying stocks that are priced below their estimated value can offer potential opportunities for investors seeking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Begbies Traynor Group (AIM:BEG) | £0.924 | £1.68 | 45.1% |

| Aptitude Software Group (LSE:APTD) | £2.78 | £5.12 | 45.7% |

| Gooch & Housego (AIM:GHH) | £3.95 | £7.18 | 45% |

| On the Beach Group (LSE:OTB) | £2.645 | £4.96 | 46.6% |

| Trainline (LSE:TRN) | £3.02 | £5.39 | 44% |

| Entain (LSE:ENT) | £6.53 | £12.69 | 48.5% |

| ECO Animal Health Group (AIM:EAH) | £0.695 | £1.28 | 45.6% |

| Mpac Group (AIM:MPAC) | £3.75 | £7.38 | 49.2% |

| Kromek Group (AIM:KMK) | £0.051 | £0.10 | 49.7% |

| Crest Nicholson Holdings (LSE:CRST) | £1.853 | £3.66 | 49.3% |

Let's review some notable picks from our screened stocks.

Fintel (AIM:FNTL)

Overview: Fintel Plc provides intermediary services and distribution channels to the retail financial services sector in the United Kingdom, with a market cap of £251.11 million.

Operations: The company's revenue is derived from three primary segments: Research & Fintech (£25.40 million), Distribution Channels (£23.80 million), and Intermediary Services (£29.10 million).

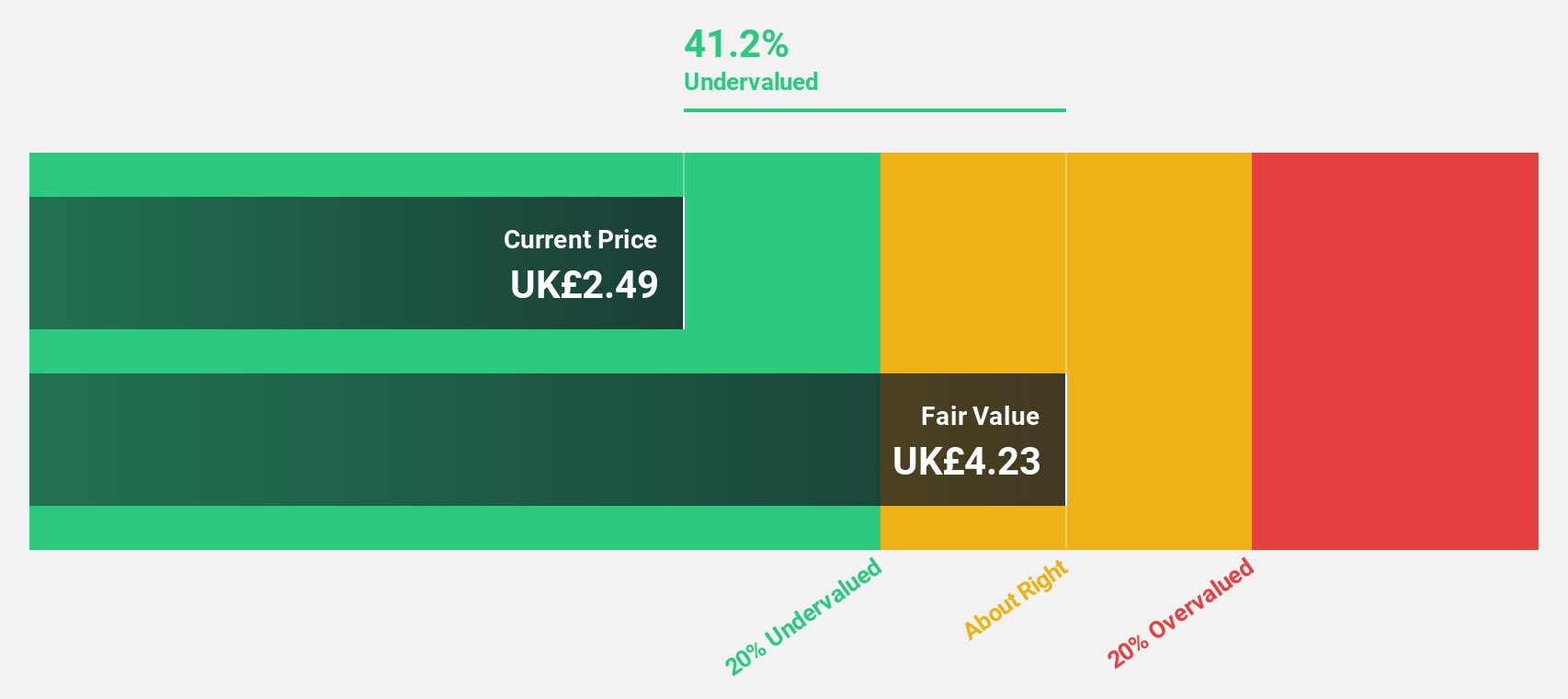

Estimated Discount To Fair Value: 42.8%

Fintel is trading at £2.41, significantly below its estimated fair value of £4.21, suggesting it may be undervalued based on cash flows. Despite a decrease in net profit margin from 10.9% to 7.5%, earnings are forecast to grow substantially at 30.2% annually, outpacing the UK market's 14%. Revenue growth is expected at 7% per year, faster than the UK's average of 3.7%. Recent executive changes include Matt Timmins assuming sole CEO responsibilities post-AGM in May 2025.

- Our growth report here indicates Fintel may be poised for an improving outlook.

- Navigate through the intricacies of Fintel with our comprehensive financial health report here.

NIOX Group (AIM:NIOX)

Overview: NIOX Group Plc focuses on designing, developing, and commercializing medical devices for asthma diagnosis, monitoring, and management globally with a market cap of £258.92 million.

Operations: The company generates revenue of £41.80 million from its NIOX® segment, which involves medical devices for asthma-related applications.

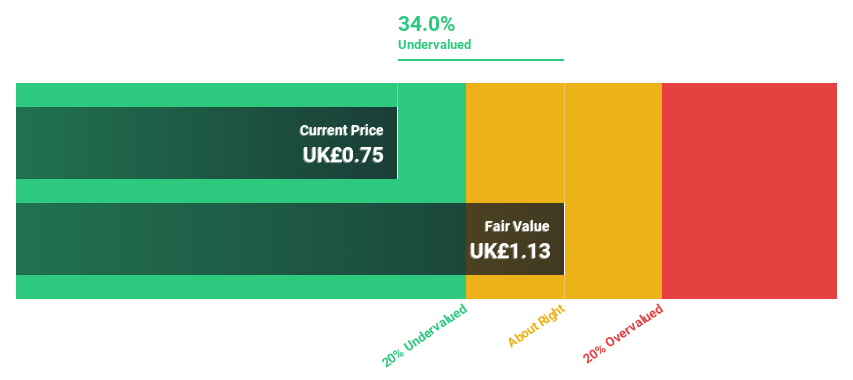

Estimated Discount To Fair Value: 40.8%

NIOX Group, trading at £0.65, is priced significantly below its estimated fair value of £1.1, indicating potential undervaluation based on cash flows. Despite a decline in net profit margin from 25.8% to 8.1%, earnings are forecast to grow substantially at 36.8% annually, surpassing the UK market's growth rate of 14%. However, revenue growth is slower at 10.7% per year compared to a higher benchmark of 20%. Recent acquisition talks with Keensight Capital were canceled due to macroeconomic conditions.

- According our earnings growth report, there's an indication that NIOX Group might be ready to expand.

- Take a closer look at NIOX Group's balance sheet health here in our report.

Crest Nicholson Holdings (LSE:CRST)

Overview: Crest Nicholson Holdings plc is a company that builds residential homes in the United Kingdom, with a market cap of £475 million.

Operations: The company's revenue is primarily derived from its Home Builders - Residential / Commercial segment, which generated £618.20 million.

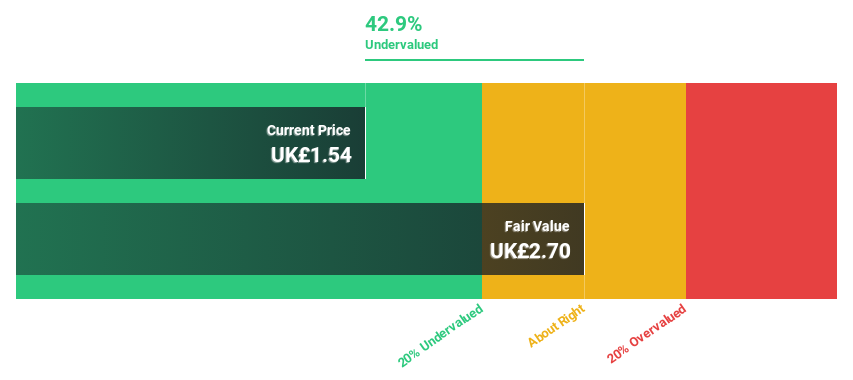

Estimated Discount To Fair Value: 49.3%

Crest Nicholson Holdings, trading at £1.85, is significantly below its estimated fair value of £3.66, suggesting it is undervalued based on cash flows. Despite a net loss of £103.5 million for the year ending October 31, 2024, revenue growth is projected to outpace the UK market at 6.1% annually. However, auditor concerns about its going concern status highlight financial stability issues that could impact future performance despite expected profitability in three years.

- Upon reviewing our latest growth report, Crest Nicholson Holdings' projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Crest Nicholson Holdings.

Make It Happen

- Click here to access our complete index of 52 Undervalued UK Stocks Based On Cash Flows.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Crest Nicholson Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CRST

Crest Nicholson Holdings

Engages in building residential homes in the United Kingdom.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives