- United Kingdom

- /

- Professional Services

- /

- AIM:FNTL

UK Stock Market's October 2025 Picks For Estimated Value Opportunities

Reviewed by Simply Wall St

As the UK stock market grapples with global economic pressures, notably the faltering trade data from China impacting indices like the FTSE 100 and FTSE 250, investors are keenly observing for potential value opportunities amidst these fluctuations. In such a climate, identifying undervalued stocks becomes crucial as they may present promising prospects for those looking to navigate through current market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vistry Group (LSE:VTY) | £6.304 | £12.20 | 48.3% |

| On the Beach Group (LSE:OTB) | £2.215 | £4.40 | 49.6% |

| Norcros (LSE:NXR) | £2.89 | £5.49 | 47.4% |

| Nichols (AIM:NICL) | £10.75 | £18.66 | 42.4% |

| Fintel (AIM:FNTL) | £2.17 | £3.85 | 43.6% |

| Fevertree Drinks (AIM:FEVR) | £8.67 | £15.72 | 44.8% |

| Essentra (LSE:ESNT) | £1.078 | £1.98 | 45.6% |

| DFS Furniture (LSE:DFS) | £1.56 | £2.77 | 43.8% |

| AstraZeneca (LSE:AZN) | £125.64 | £239.28 | 47.5% |

| Advanced Medical Solutions Group (AIM:AMS) | £2.235 | £4.36 | 48.8% |

Let's explore several standout options from the results in the screener.

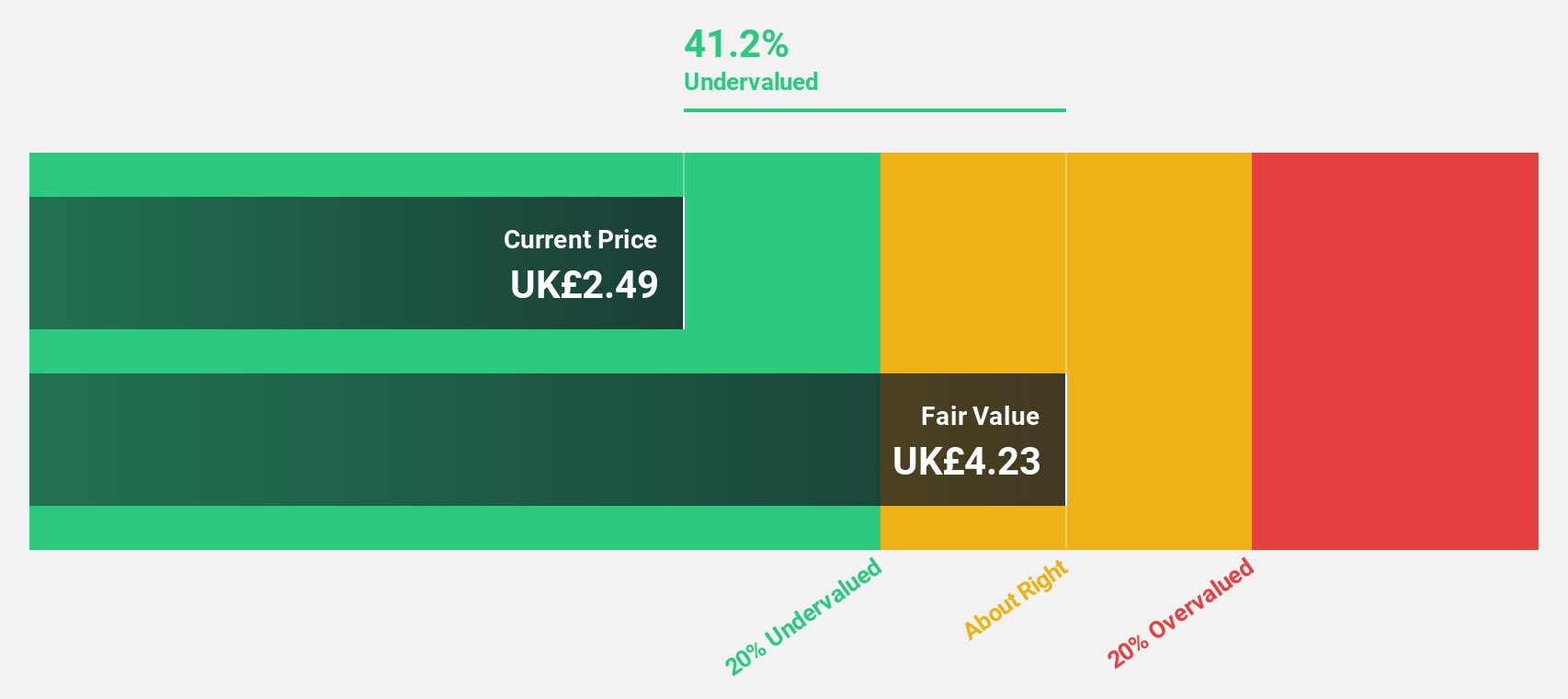

Fintel (AIM:FNTL)

Overview: Fintel Plc provides intermediary services and distribution channels to the retail financial services sector in the United Kingdom, with a market cap of £226.10 million.

Operations: Fintel Plc generates revenue through its intermediary services and distribution channels within the UK's retail financial services sector.

Estimated Discount To Fair Value: 43.6%

Fintel Plc is trading at £2.17, significantly below its estimated fair value of £3.85, indicating it is undervalued based on discounted cash flow analysis. Recent earnings reports show a sales increase to £42.4 million and net income growth to £2.4 million for H1 2025, reflecting solid financial performance despite large one-off items impacting results. Analysts project Fintel's earnings will grow at 31.2% annually over the next three years, outpacing the UK market's average growth rate.

- Insights from our recent growth report point to a promising forecast for Fintel's business outlook.

- Navigate through the intricacies of Fintel with our comprehensive financial health report here.

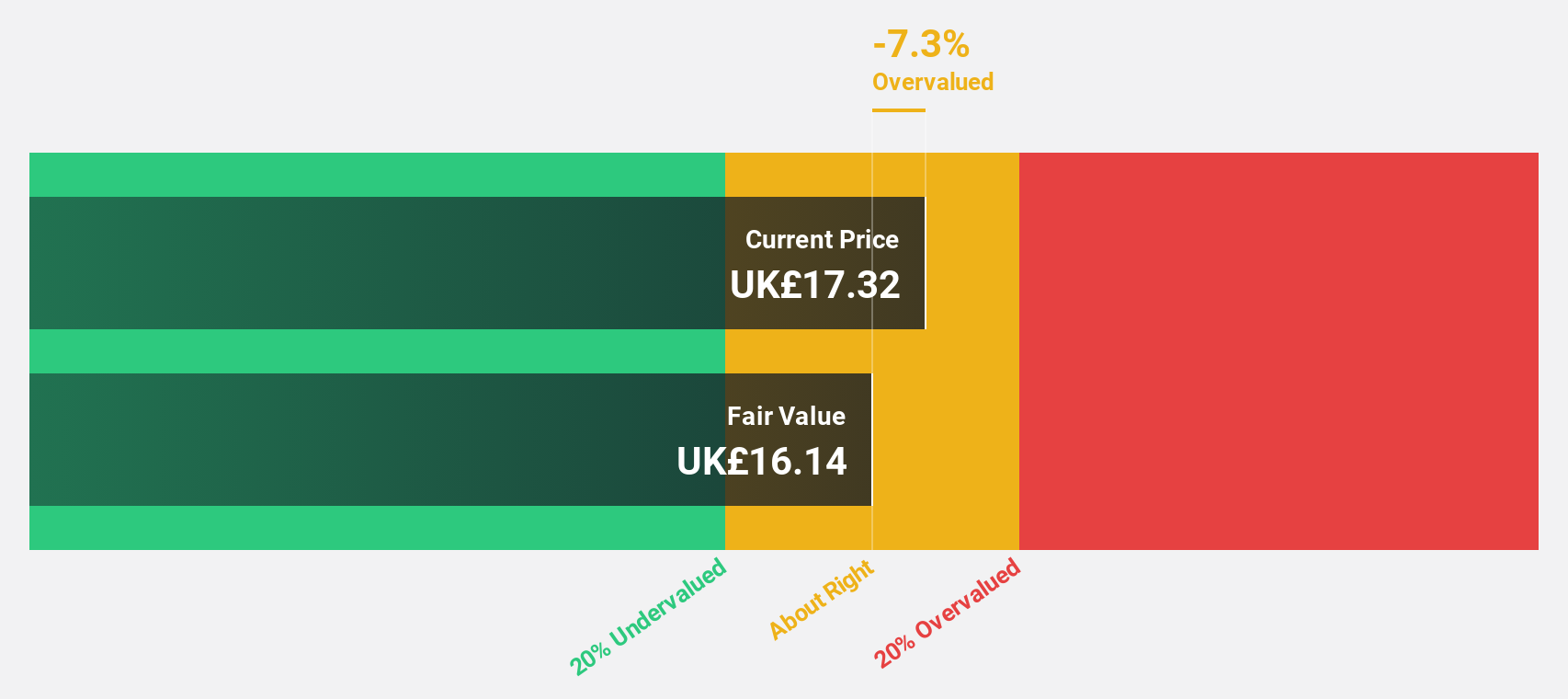

Avon Technologies (LSE:AVON)

Overview: Avon Technologies Plc, with a market cap of £563.72 million, specializes in providing respiratory and head protection products for military and first responder markets in Europe and the United States.

Operations: The company's revenue is derived from Team Wendy, contributing $142.80 million, and Avon Protection, which accounts for $153.80 million.

Estimated Discount To Fair Value: 10.4%

Avon Technologies, trading at £19.02, is undervalued with an estimated fair value of £21.24 based on discounted cash flow analysis. The company recently became profitable and its earnings are forecast to grow significantly at 58% annually, surpassing the UK market's 14.4% growth rate over the next three years. However, revenue growth is expected to be moderate at 6.2% per year and one-off items have impacted financial results.

- The analysis detailed in our Avon Technologies growth report hints at robust future financial performance.

- Dive into the specifics of Avon Technologies here with our thorough financial health report.

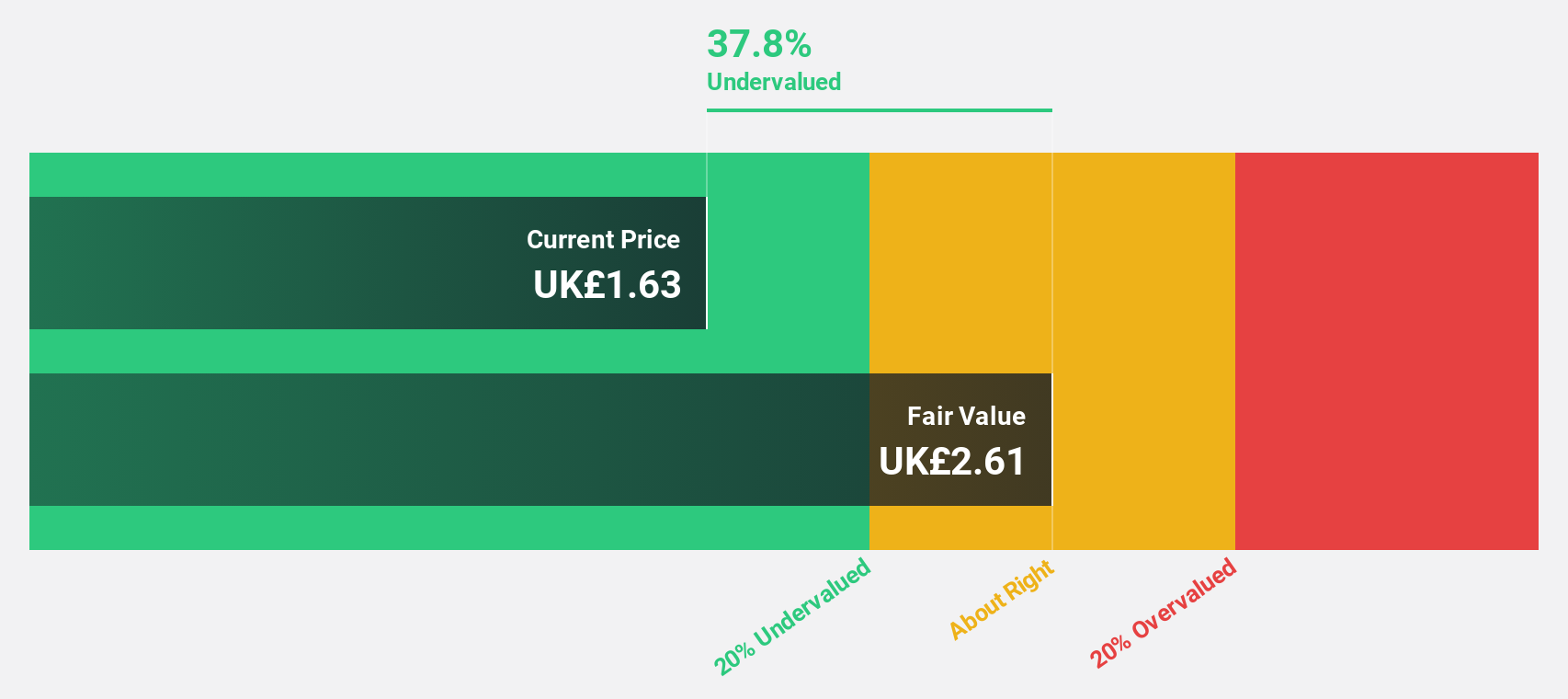

Stelrad Group (LSE:SRAD)

Overview: Stelrad Group PLC manufactures and distributes radiators across the United Kingdom, Ireland, Europe, Turkey, and internationally with a market cap of £203.76 million.

Operations: The company's revenue from the manufacture and distribution of radiators amounts to £283.94 million.

Estimated Discount To Fair Value: 38.2%

Stelrad Group is trading at £1.60, significantly below its estimated fair value of £2.59 according to discounted cash flow analysis, making it highly undervalued. Despite a net loss of £3.45 million in H1 2025 and declining profit margins, earnings are projected to grow substantially at 37.52% annually over the next three years, outpacing the UK market's growth rate. However, revenue growth remains modest and high debt levels pose financial risks.

- Upon reviewing our latest growth report, Stelrad Group's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Stelrad Group stock in this financial health report.

Make It Happen

- Unlock our comprehensive list of 48 Undervalued UK Stocks Based On Cash Flows by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FNTL

Fintel

Engages in the provision of intermediary services and distribution channels to the retail financial services sector in the United Kingdom.

Good value with reasonable growth potential.

Market Insights

Community Narratives