Exploring European Undervalued Small Caps With Insider Action In May 2025

Reviewed by Simply Wall St

In May 2025, European markets have shown resilience, with the STOXX Europe 600 Index rising by 2.10% following a positive shift in global trade sentiment due to a temporary de-escalation of U.S.-China tariffs. This improved economic environment, coupled with strong industrial output and rising exports in the eurozone, provides a fertile ground for exploring small-cap stocks that may be undervalued yet poised for potential growth. Identifying such stocks often involves looking at companies with solid fundamentals and insider activity as indicators of confidence amidst these favorable conditions.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Morgan Advanced Materials | 12.3x | 0.6x | 33.77% | ★★★★★☆ |

| AKVA group | 15.2x | 0.7x | 48.02% | ★★★★★☆ |

| Savills | 24.8x | 0.6x | 41.10% | ★★★★☆☆ |

| Tristel | 29.9x | 4.2x | 19.75% | ★★★★☆☆ |

| Cloetta | 15.6x | 1.1x | 46.05% | ★★★★☆☆ |

| SmartCraft | 42.2x | 7.5x | 33.70% | ★★★★☆☆ |

| Close Brothers Group | NA | 0.6x | 44.49% | ★★★★☆☆ |

| Absolent Air Care Group | 22.6x | 1.8x | 48.73% | ★★★☆☆☆ |

| Eastnine | 18.3x | 8.8x | 39.84% | ★★★☆☆☆ |

| Seeing Machines | NA | 2.5x | 44.30% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

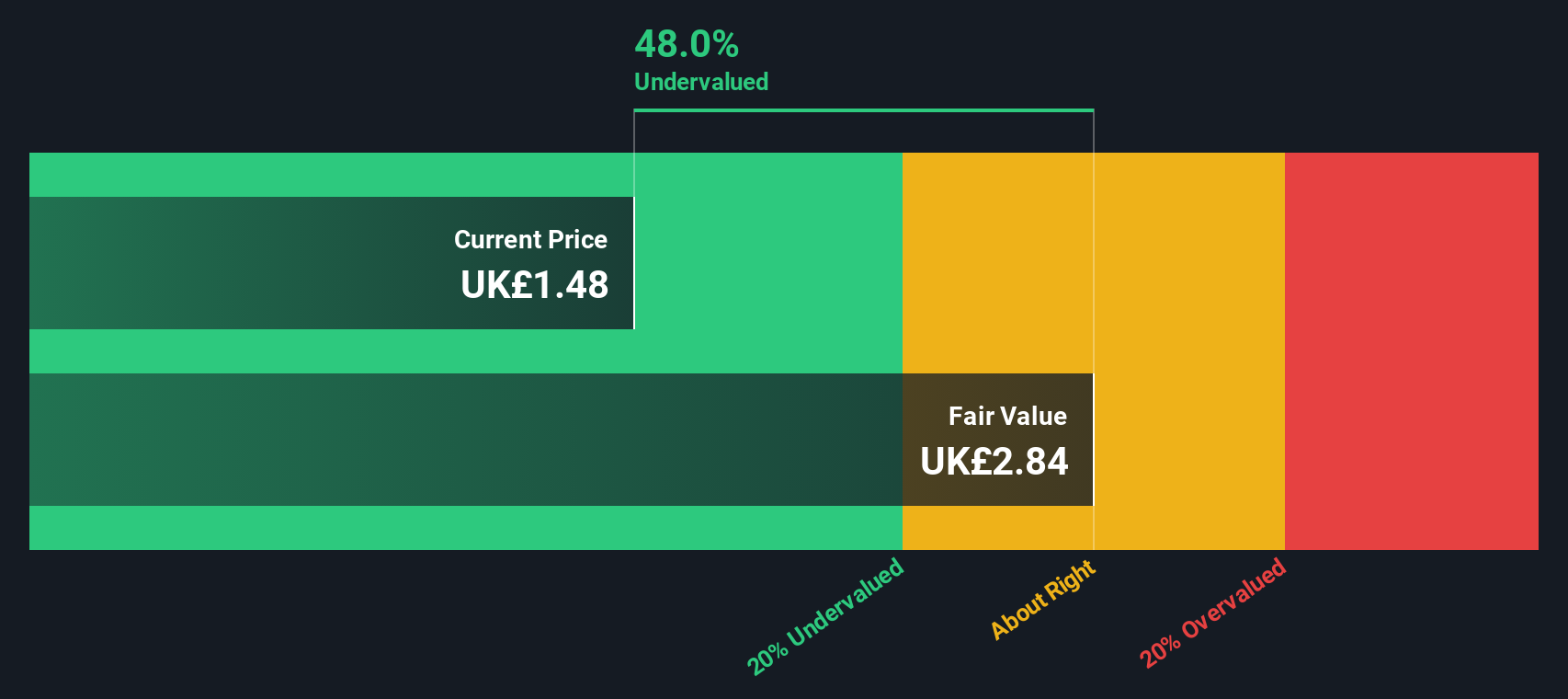

Fintel (AIM:FNTL)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Fintel is a company that provides research, fintech solutions, distribution channels, and intermediary services with a market cap of £1.42 billion.

Operations: The company's revenue is primarily generated from Intermediary Services (£29.1 million), Research & Fintech (£25.4 million), and Distribution Channels (£23.8 million). Over recent periods, the gross profit margin has shown a trend of fluctuation, reaching 26.04% by the end of 2023 and decreasing to 23.88% in early 2025. Operating expenses have been relatively stable at around £2-£3 million, while non-operating expenses have increased over time, impacting net income margins which stood at approximately 7.54% in early 2025.

PE: 48.4x

Fintel, a smaller European company, is experiencing insider confidence with Neil Stevens purchasing 130,000 shares recently. Despite lower profit margins at 7.5% compared to last year's 10.9%, earnings are projected to grow by over 30% annually. The company's sales rose to £78.3 million in 2024 from £64.9 million the previous year, although net income decreased slightly to £5.9 million from £7.1 million due to one-off items impacting results and reliance on external borrowing for funding adds risk but also potential upside if managed well amidst executive changes and restructuring efforts.

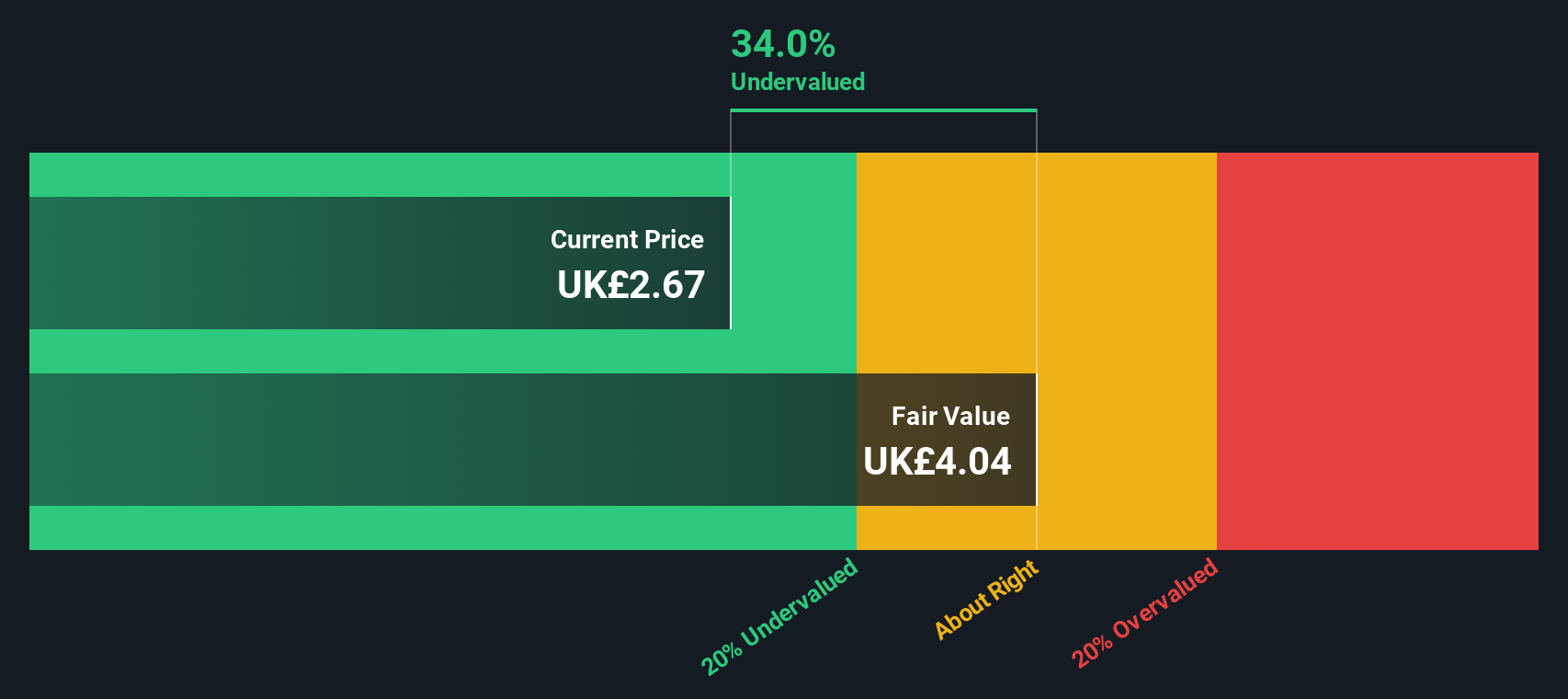

Luceco (LSE:LUCE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Luceco is a company specializing in the design, manufacture, and distribution of LED lighting, portable power products, and wiring accessories with a market capitalization of £0.16 billion.

Operations: The company's revenue streams are primarily derived from LED Lighting (£78.40 million), Portable Power (£55.20 million), and Wiring Accessories (£108.90 million). The gross profit margin has shown a notable trend, reaching 41.52% as of June 2024, reflecting an increase over the years from earlier figures such as 29.05% in March 2017. Operating expenses have been significant, with general and administrative expenses being a major component, recorded at £63.0 million by December 2024.

PE: 16.0x

Luceco, a European small cap in the electrical products sector, has shown insider confidence with Jonathan Hornby purchasing 2.4 million shares valued at £3.8 million, reflecting a 10% increase in their stake. Despite high external debt levels and no customer deposits, Luceco's earnings are projected to grow by 12.9% annually. Recent financials indicate sales rose to £242.5 million from £209 million year-on-year, though net income slightly declined to £14.6 million from £16.7 million, suggesting potential for improvement amidst dividend hikes and strategic growth plans.

- Click here to discover the nuances of Luceco with our detailed analytical valuation report.

Evaluate Luceco's historical performance by accessing our past performance report.

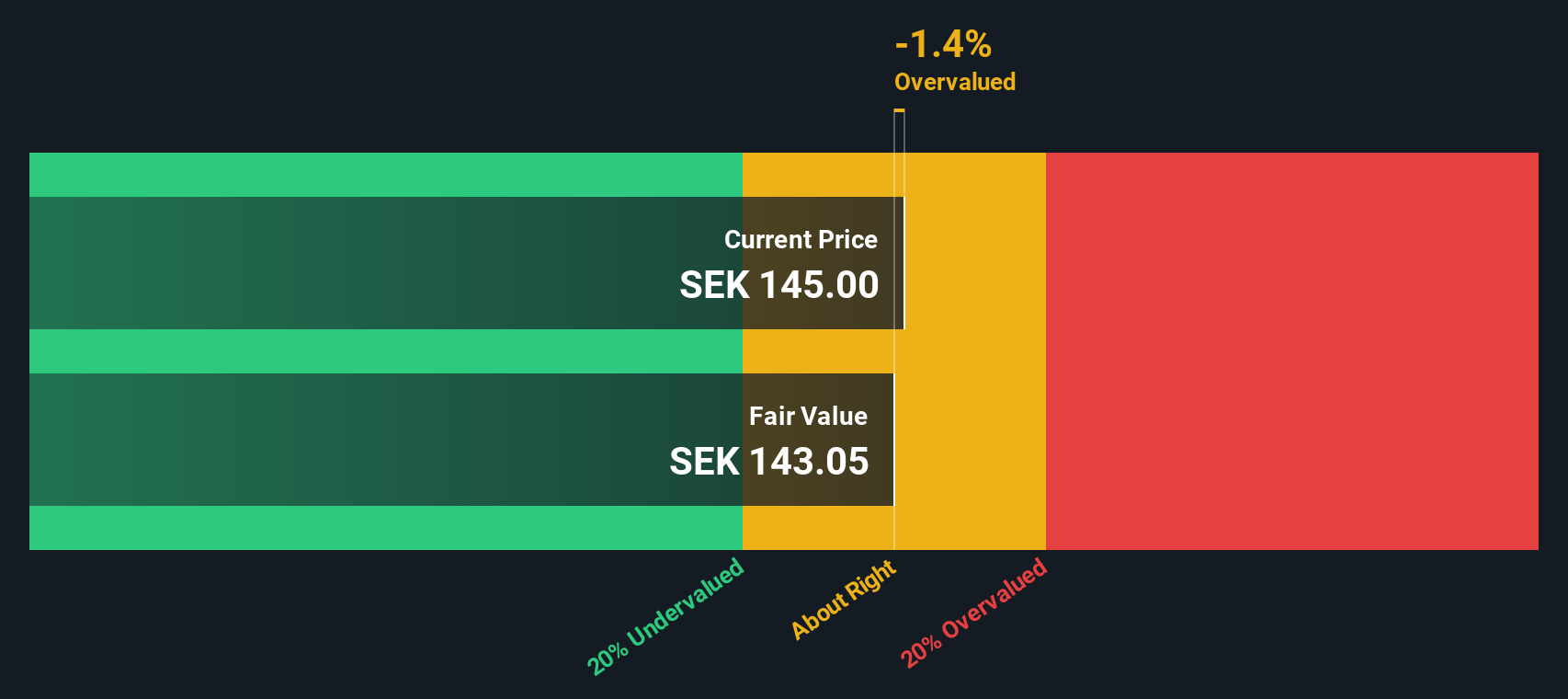

Yubico (OM:YUBICO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Yubico is a company specializing in providing hardware authentication security solutions, known for its YubiKey devices, with a market capitalization of approximately SEK 9.45 billion.

Operations: Yubico's revenue has shown consistent growth, reaching SEK 2.45 billion by March 2025, driven by a significant increase in gross profit margin from 30.85% in December 2022 to over 80% in the subsequent periods. The company incurs substantial operating expenses, with sales and marketing being a major component alongside research and development costs. Despite fluctuations in net income margin, Yubico achieved a notable net income of SEK 349.2 million by March 2025.

PE: 37.6x

Yubico, a player in the cybersecurity sector, is expanding its YubiKey services across Europe and globally, enhancing its market presence. Despite a dip in net income to SEK 51.3 million for Q1 2025 from SEK 73.8 million last year, sales rose to SEK 623.1 million from SEK 498.9 million, indicating potential growth momentum. Insider confidence is evident with recent share purchases by executives this year, signaling belief in long-term prospects despite reliance on external borrowing for funding stability.

- Click here and access our complete valuation analysis report to understand the dynamics of Yubico.

Assess Yubico's past performance with our detailed historical performance reports.

Seize The Opportunity

- Investigate our full lineup of 70 Undervalued European Small Caps With Insider Buying right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:YUBICO

Yubico

Provides authentication solutions for use in computers, networks, and online services.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives