- United Kingdom

- /

- Professional Services

- /

- AIM:FNTL

Cora Gold And 2 More UK Penny Stocks To Watch

Reviewed by Simply Wall St

The recent performance of the FTSE 100 and FTSE 250 indices reflects the broader challenges facing global markets, with weak trade data from China impacting investor sentiment in London. Despite these headwinds, certain investment opportunities remain attractive, particularly within the realm of penny stocks. While once considered a niche area, penny stocks continue to offer potential growth by focusing on smaller or newer companies with strong financial health and solid fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| DSW Capital (AIM:DSW) | £0.50 | £12.57M | ✅ 3 ⚠️ 4 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.56 | £520.28M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £1.99 | £160.77M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £1.02 | £15.4M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.13 | £27.03M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.675 | $392.4M | ✅ 4 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.35 | £237.74M | ✅ 4 ⚠️ 1 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.28 | £61.82M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.145 | £182.74M | ✅ 4 ⚠️ 2 View Analysis > |

| ME Group International (LSE:MEGP) | £1.502 | £567.34M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 298 stocks from our UK Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Cora Gold (AIM:CORA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cora Gold Limited, with a market cap of £28.48 million, explores and develops mineral projects in West Africa through its subsidiaries.

Operations: Cora Gold Limited currently has no reported revenue segments.

Market Cap: £28.48M

Cora Gold Limited, with a market cap of £28.48 million, is currently pre-revenue and debt-free, focusing on mineral exploration in West Africa. Recent updates highlight significant progress at the Madina Foulbe Exploration Project in Senegal and an updated Definitive Feasibility Study for the Sanankoro Gold Project in Mali. The Sanankoro project shows promising potential with an increased probable reserve of 531 koz gold and a projected 10-year mine life. However, Cora faces challenges such as high share price volatility and less than a year of cash runway if current spending continues without revenue generation.

- Dive into the specifics of Cora Gold here with our thorough balance sheet health report.

- Understand Cora Gold's earnings outlook by examining our growth report.

Fintel (AIM:FNTL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Fintel Plc provides intermediary services and distribution channels to the retail financial services sector in the United Kingdom, with a market cap of £222.97 million.

Operations: The company generates £85 million in revenue from its operations within the United Kingdom.

Market Cap: £222.97M

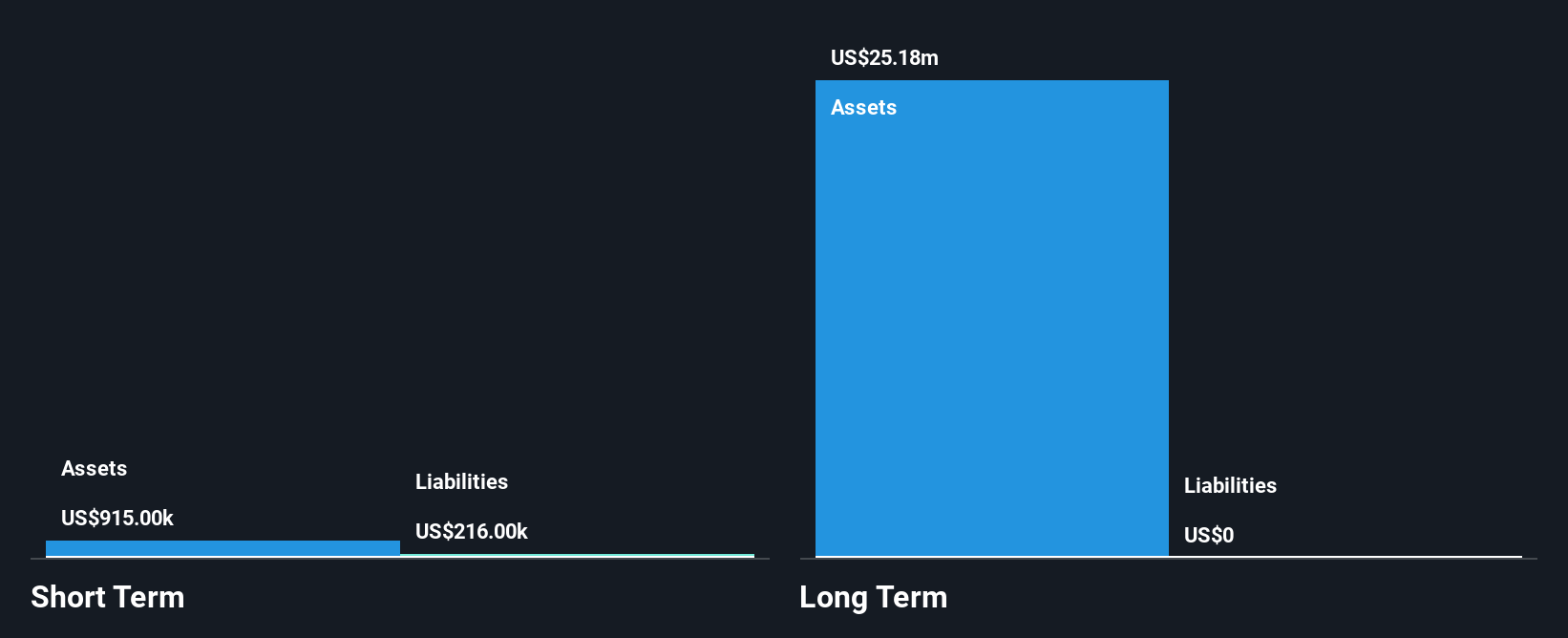

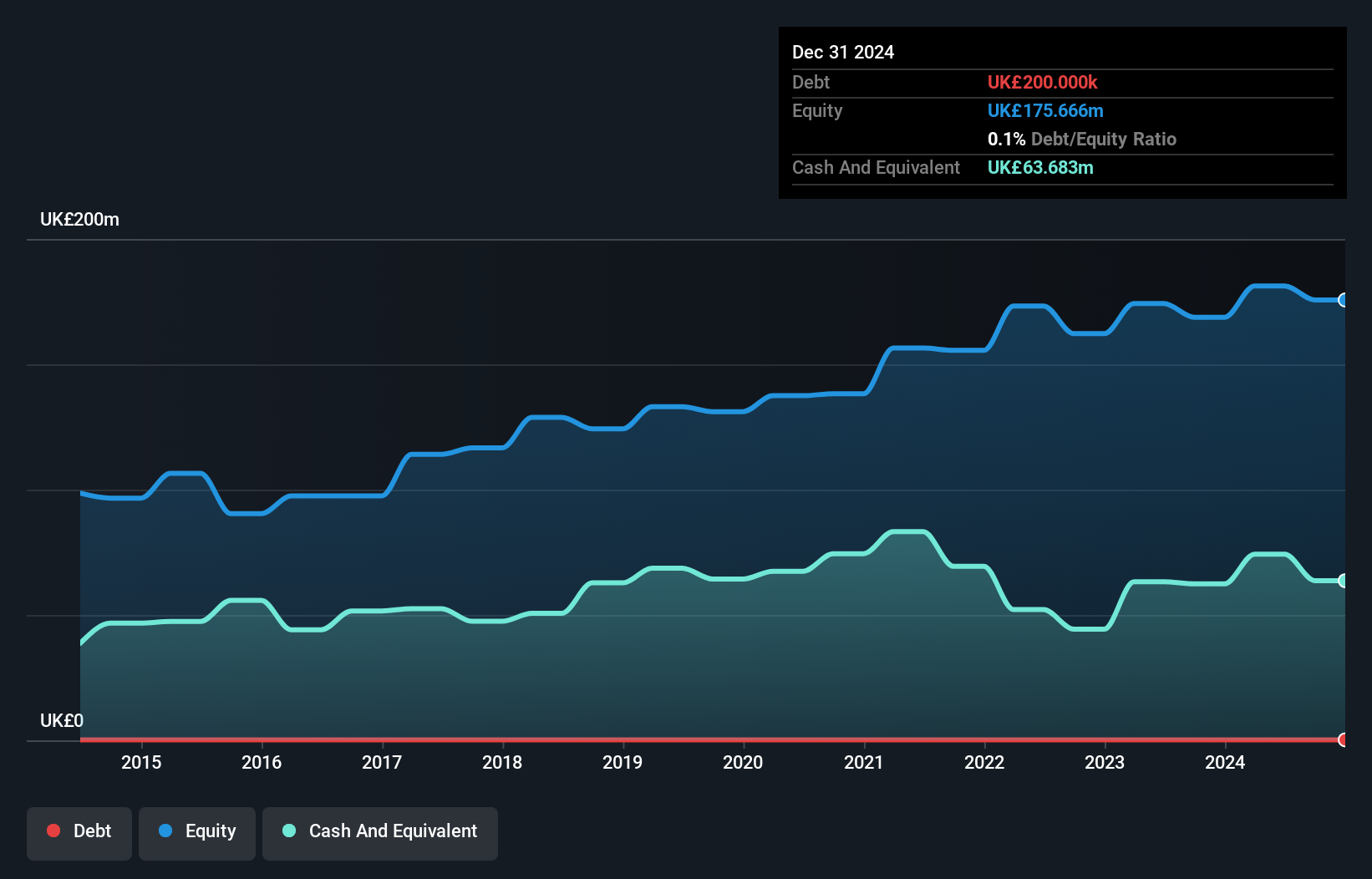

Fintel Plc, with a market cap of £222.97 million, is navigating the penny stock landscape by reducing its debt to equity ratio from 65% to 37.6% over five years and improving earnings growth by 5.1% in the past year, surpassing industry averages. Despite a one-off £6.5 million loss impacting recent results, Fintel's interest payments are well covered by EBIT at 6.4 times coverage, and operating cash flow effectively covers its debt obligations at 25.7%. Recent half-year earnings showed an increase in sales to £42.4 million and net income of £2.4 million with a slight dividend increase reflecting financial resilience despite short-term liabilities exceeding assets.

- Click to explore a detailed breakdown of our findings in Fintel's financial health report.

- Examine Fintel's earnings growth report to understand how analysts expect it to perform.

James Halstead (AIM:JHD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: James Halstead plc is a manufacturer and supplier of flooring products for both commercial and domestic uses across the UK, Europe, Scandinavia, Australasia, Asia, and other international markets with a market cap of £564.75 million.

Operations: The company generates £261.97 million in revenue from its flooring products manufacturing and distribution operations.

Market Cap: £564.75M

James Halstead plc, with a market cap of £564.75 million, demonstrates financial stability amid the penny stock sector through its strong balance sheet where short-term assets (£195.7M) surpass both short and long-term liabilities (£52.0M and £6.3M respectively). Despite a slight decline in sales to £261.97 million for the year ending June 2025, net income remained steady at £40.61 million, supporting a record 49th consecutive year of increased dividends now totaling 8.80 pence annually. The company's high return on equity (22.3%) and substantial cash coverage over debt underscore its robust financial health despite recent negative earnings growth (-2.2%).

- Unlock comprehensive insights into our analysis of James Halstead stock in this financial health report.

- Gain insights into James Halstead's future direction by reviewing our growth report.

Taking Advantage

- Click this link to deep-dive into the 298 companies within our UK Penny Stocks screener.

- Curious About Other Options? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FNTL

Fintel

Engages in the provision of intermediary services and distribution channels to the retail financial services sector in the United Kingdom.

Good value with reasonable growth potential.

Market Insights

Community Narratives